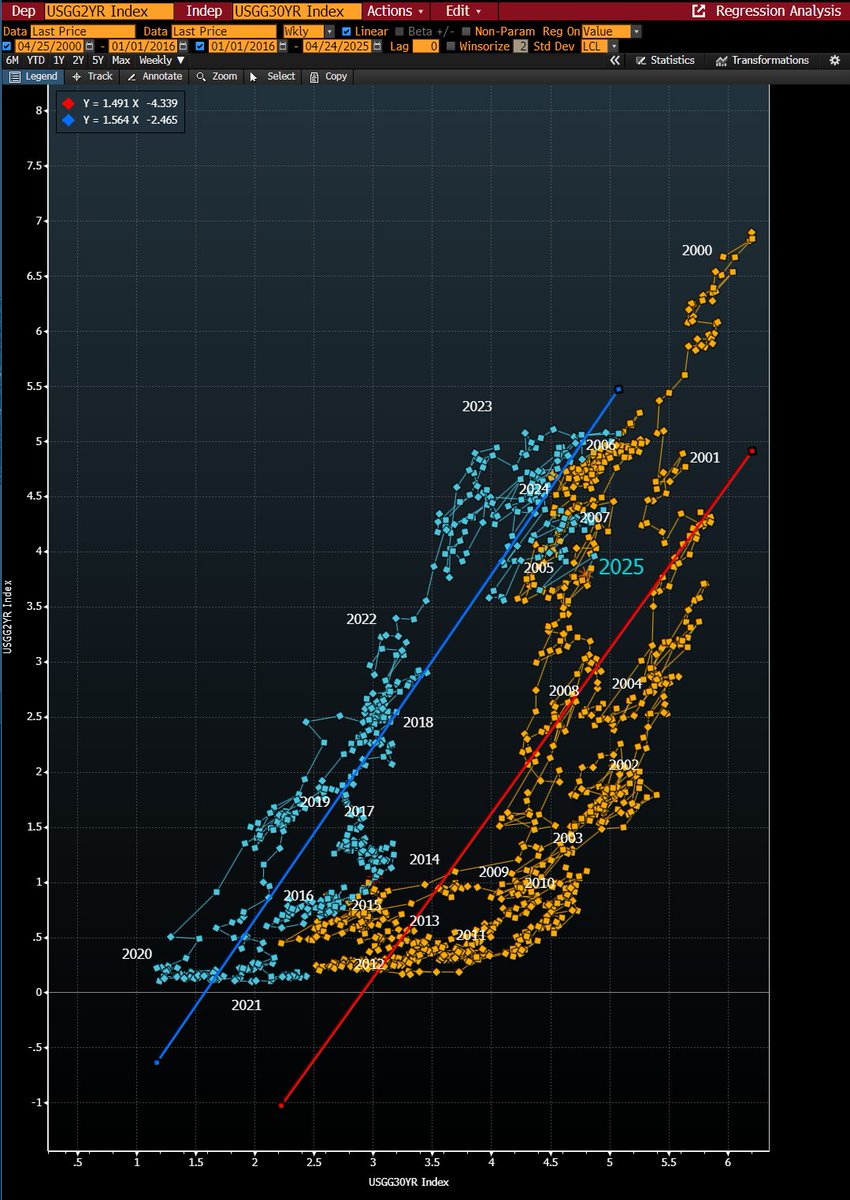

This is possibly the most important chart a bond trader needs to look at right now. Not only will this determine your curve sector bias and inform your macro regime expression, it will be one of your key road-markers over the next 12 months.

Two important things:

1. The distribution shifted left post-2015 into a flatter curve world. This occurred coincidentally or not, with China's shock devaluation which further fostered deflationary conditions

1. The distribution shifted left post-2015 into a flatter curve world. This occurred coincidentally or not, with China's shock devaluation which further fostered deflationary conditions

2. We have spent the last 2 years shifting back to the old distribution thanks to the return of inflation. If this holds then the the historical path of growth regimes speaks volumes on the relative attractiveness of the different curve sectors going forward.

• • •

Missing some Tweet in this thread? You can try to

force a refresh