I am so befuddled by this freakout over tariffs.

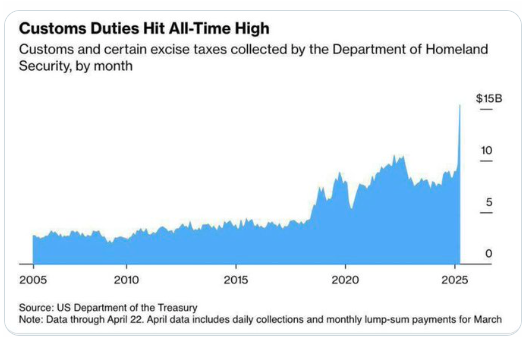

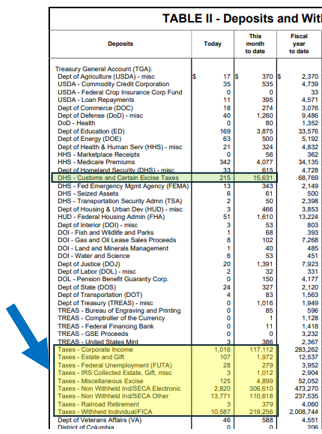

These sums are not very large. Full stop. The scare chart from Bloomberg: $15.6bn in customs duties collected so far this month, up from "normal" amounts of $8-10bn. Lots of money, yes. I don't want to minimize this fiscal restriction. But look at the Big Money rows in the Daily Treasury Statement. Corporate income taxes collected this month are $117bn. The self-employed made estimated tax payments to the IRS of $306bn. FICA taxes from paychecks were $219bn. And more.

These sums are not very large. Full stop. The scare chart from Bloomberg: $15.6bn in customs duties collected so far this month, up from "normal" amounts of $8-10bn. Lots of money, yes. I don't want to minimize this fiscal restriction. But look at the Big Money rows in the Daily Treasury Statement. Corporate income taxes collected this month are $117bn. The self-employed made estimated tax payments to the IRS of $306bn. FICA taxes from paychecks were $219bn. And more.

I never saw a tax hike I didn't hate...but if you're looking for a reason to be bearish stocks, find something else. Not many even mention potential cuts in manufacturers' corporate tax rate from 21% to 15%. No tax on tips + Social Security + overtime.

These are all very live possibilities. The tariff fear seems like overkill in the context of prior market panics like subprime, Grexit, the 2015-2016 China slowdown, and Covid lockdowns. I may end up eating my words, and it's okay if that happens. Putting it out there.

• • •

Missing some Tweet in this thread? You can try to

force a refresh