Are Western utilities "really" covered for their upcoming #uranium needs?

Grab a cup of coffee. This is a long thread on why complacency will lead to a crisis./1

Grab a cup of coffee. This is a long thread on why complacency will lead to a crisis./1

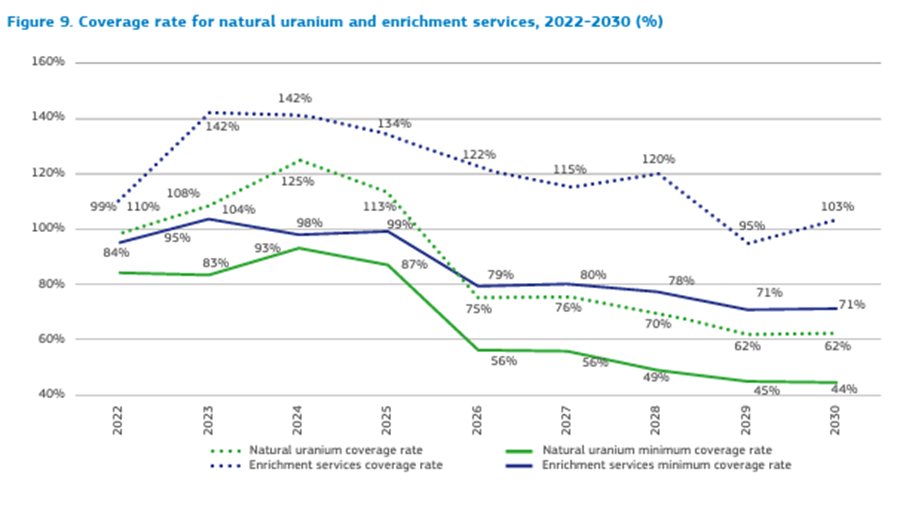

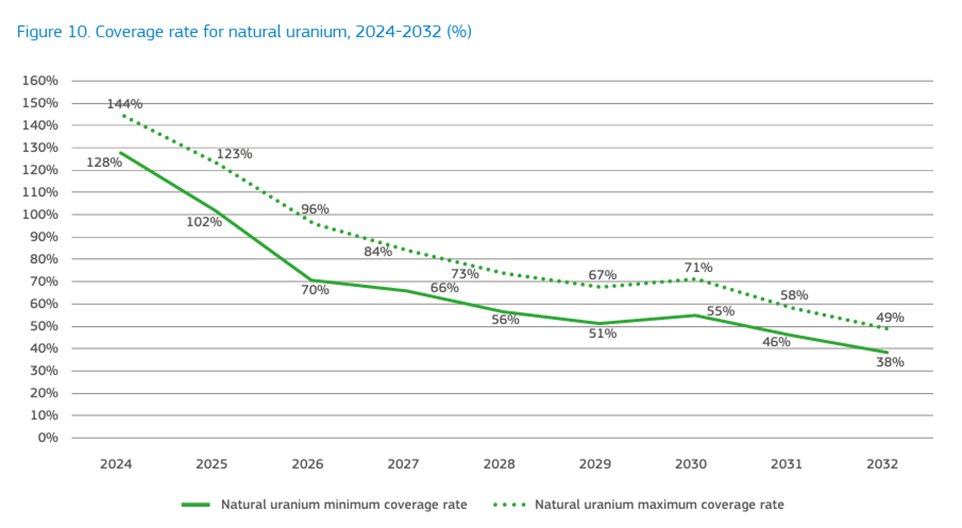

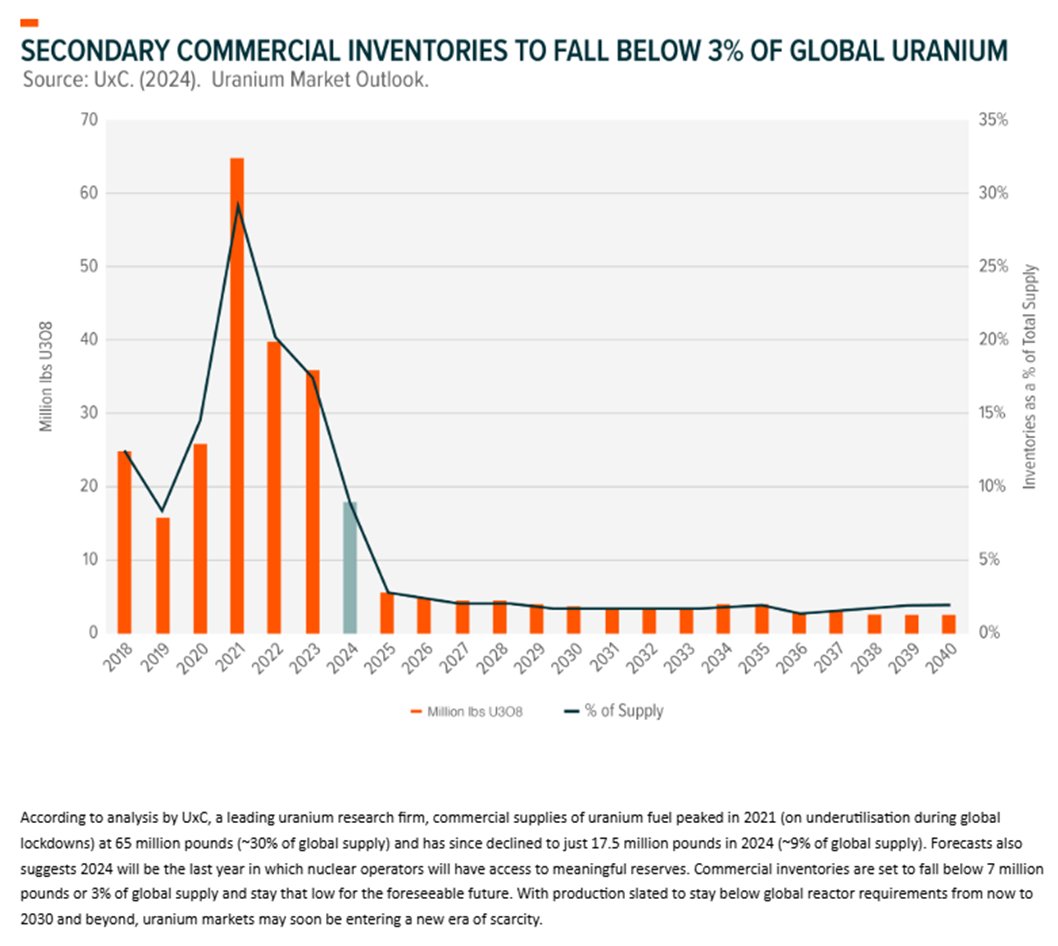

Perhaps you may have seen this graph from Yellowcake's presentation (there is a small typo I corrected). It is about 1.4 years old.

It shows Western utility #uranium coverage from 2024 to 2032./2

yellowcakeplc.com/presentations/

It shows Western utility #uranium coverage from 2024 to 2032./2

yellowcakeplc.com/presentations/

Looking at this chart, and anecdotes shared on X and interviews from those attending nuclear fuel conferences, one can get the impression that Western utilities are covered in the immediate and that a crisis is more a late 2020s or 2030s issue. But is that the case?/3

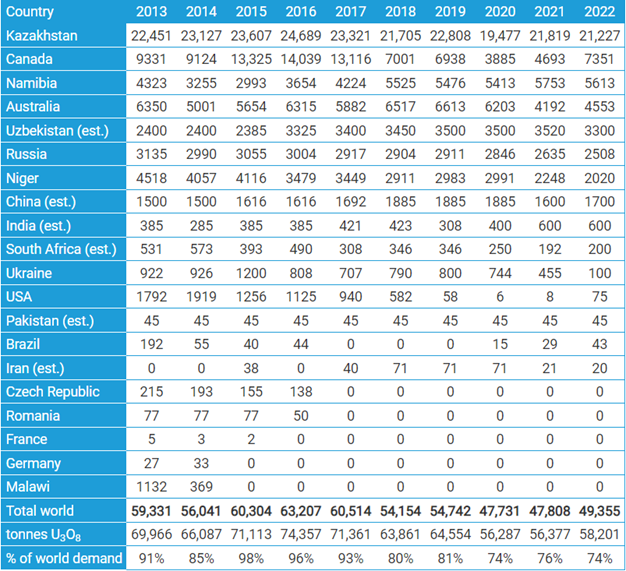

The chart from YCA reflects contracting by utilities in the EU and USA. The source of the data is the Annual Reports of Euratom and EIA.

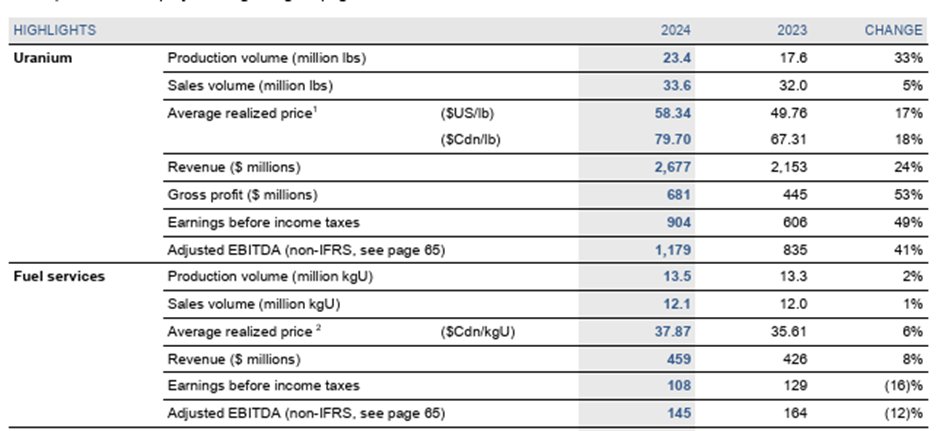

Using WNA 2022 world #uranium production report, the EU and US purchases of 11724 and 15600 tonsU each would amount to 56% of that prod'n./4

Using WNA 2022 world #uranium production report, the EU and US purchases of 11724 and 15600 tonsU each would amount to 56% of that prod'n./4

Although the WNA has not released the 2023 world #uranium production figure, the EU and US increased their purchases to 14578 and 19800 tonsU, which I estimate the Western utilities purchases are equal to 65% of world production in that year./5

However, let's take a look at the evolution of contracting by looking specifically at this year, 2025, starting with the EU.

The 2021-23 annual reports note the coverage for 2025.

2021 min 87% max 99%

2022 min 91% max 121%

2023 min 102% max 123%

/6 euratom-supply.ec.europa.eu/index_en

The 2021-23 annual reports note the coverage for 2025.

2021 min 87% max 99%

2022 min 91% max 121%

2023 min 102% max 123%

/6 euratom-supply.ec.europa.eu/index_en

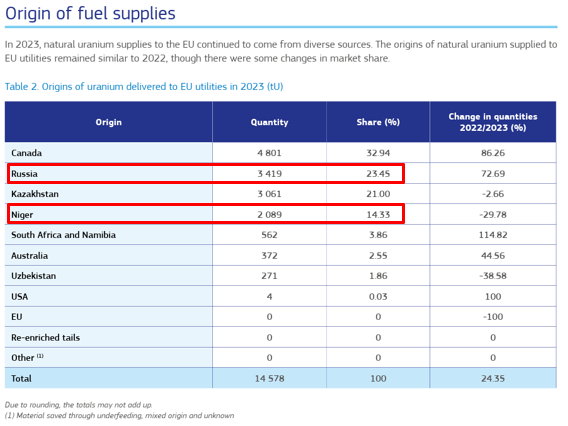

The EU gives us a range including optional lbs in term contracts. However, let's look at where this #uranium comes from.

38% comes from Russia and Niger. This can be translated as Rosatom and Orano. Canada and Kazakhstan can be translated to Cameco/Orano and Kazatomprom./7

38% comes from Russia and Niger. This can be translated as Rosatom and Orano. Canada and Kazakhstan can be translated to Cameco/Orano and Kazatomprom./7

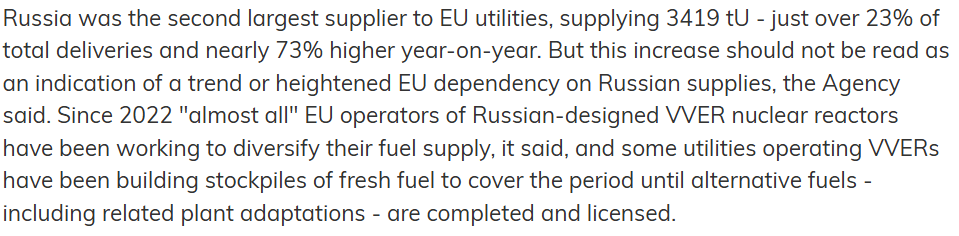

As we know, shipments out of Niger have been halted since the coup in 2023. EU utilities continue to work with Rosatom despite the war in Ukraine. But most owners of Russian built NPPs were stockpiling ahead of moving to alternative fuel providers./8

So where will Europe get its #uranium from if Niger is zero and they are moving away from Russia? Let's start with Canada.

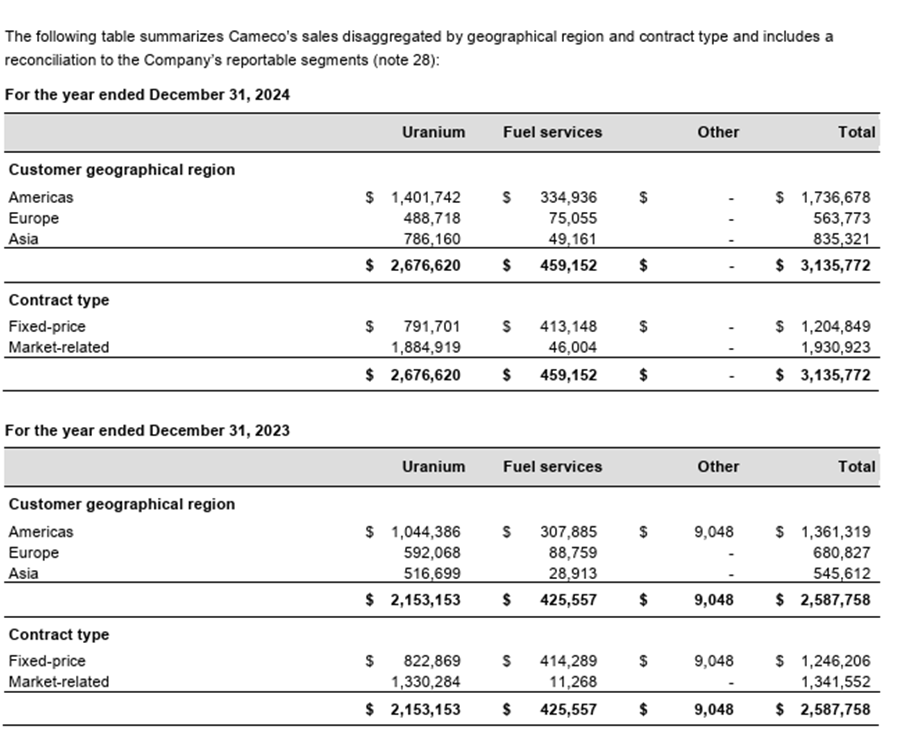

Orano owns 40.5% of Cigar Lake, which we can assume is all being shipped to Western utilities. Cameco shipped less to Europe in 2024 (2400 vs. 3400 tonsU)/9

Orano owns 40.5% of Cigar Lake, which we can assume is all being shipped to Western utilities. Cameco shipped less to Europe in 2024 (2400 vs. 3400 tonsU)/9

How about Kazakhstan?

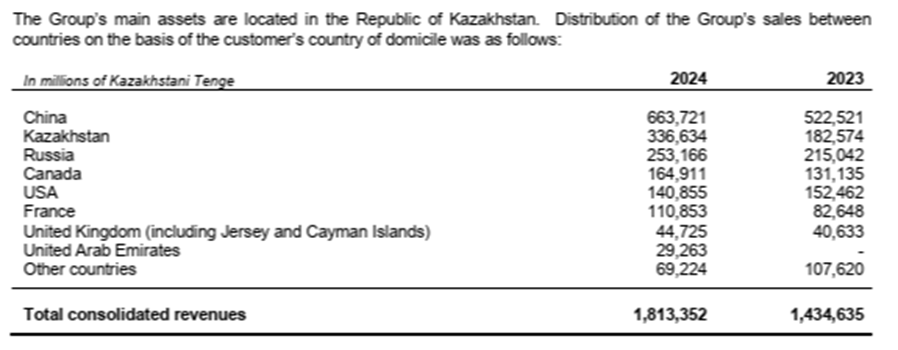

Only EU member (France) is noted as a significant destination for #uranium. When taking into account price and exchange rate, shipments to France increased from 1300 to 1400 tonsU./10

Only EU member (France) is noted as a significant destination for #uranium. When taking into account price and exchange rate, shipments to France increased from 1300 to 1400 tonsU./10

There are two additional areas for supply. New or restart mines, and secondary supply.

Except for Boss, every other #uranium mine has ran into difficulties to achieve their production targets.

Underfeeding is ending.

/11

Except for Boss, every other #uranium mine has ran into difficulties to achieve their production targets.

Underfeeding is ending.

/11

https://x.com/hchris999/status/1906485574929666320

Regarding the EU there are two conclusions I come to. 1) Utility coverage is possible to meet and exceed 100% of their needs in a low requirement year. 2) The source of future #uranium supply is uncertain given that secondary sources ending, the loss of Niger/Orano & Russia./12

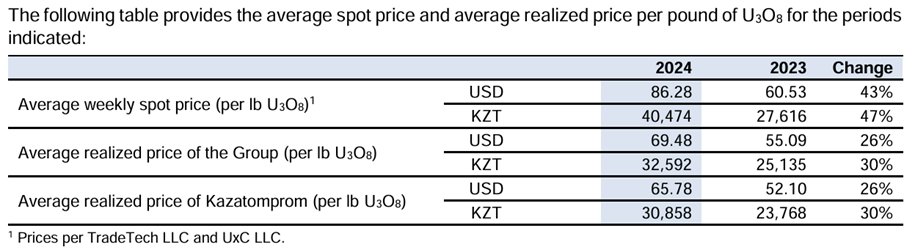

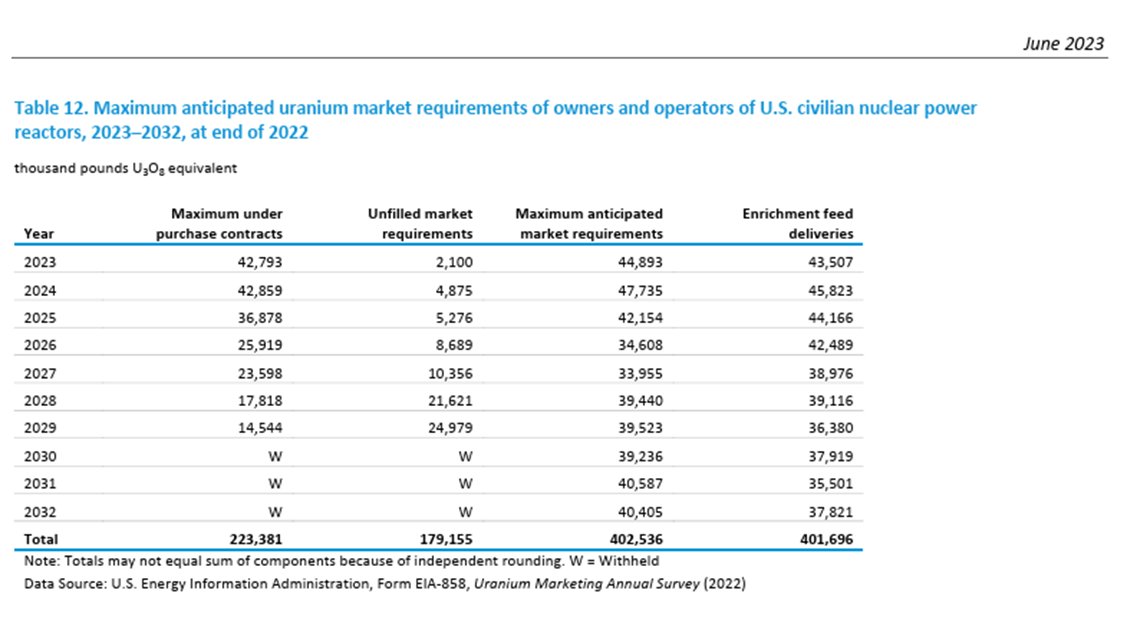

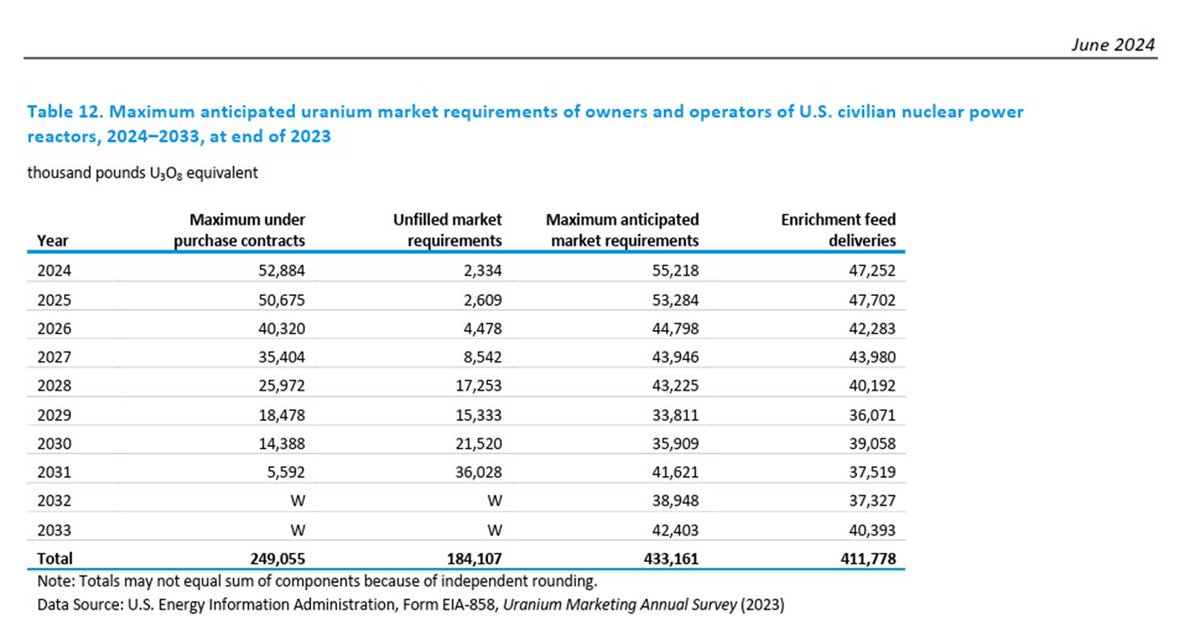

The US situation is far worse when you look at how contracting evolves. Again let's take a look at 2025.

US utilities said they needed in 2025

2021 report 38.7 mm lbs.

2022 report 42.2

2023 report 53.3

/13 eia.gov/uranium/market…

US utilities said they needed in 2025

2021 report 38.7 mm lbs.

2022 report 42.2

2023 report 53.3

/13 eia.gov/uranium/market…

What is the true volume of contracting required for US utilties? Looking at the 2023 report they told the EIA that they only needed 44.8 million in 2026, and 35.9 million by 2030.

But what if they really need 55 or 60 mm lbs? Then, they are very short in their requirements./14

But what if they really need 55 or 60 mm lbs? Then, they are very short in their requirements./14

What it also means when you look out at this graph by Yellowcake and you read that in 2026 US utilities are 90% covered. Well maybe its closer to 80%, and for 2028 maybe its really closer to 50%./15

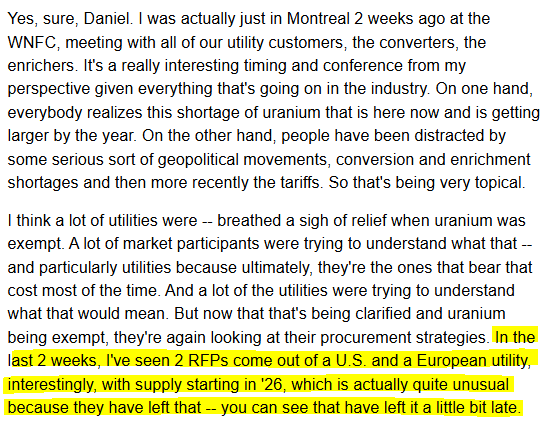

In the context of utility contracting there are those that are ahead of the curve, EDF in France since they own Orano, and Constellation in the US. But it is not the biggest players that are in the weakest position. Example, Paladin disclosed 2 RFPs for 2026 deliveries!/16

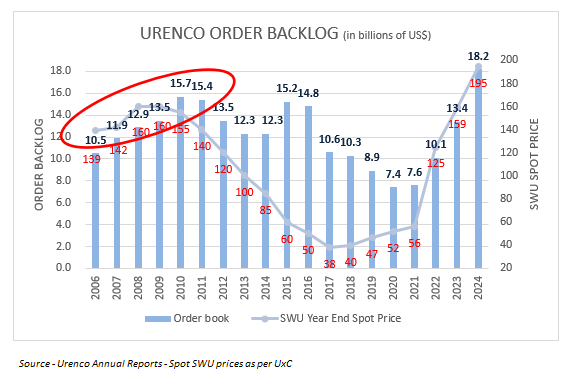

It is evident that the absence of utilities since the second half of 2024 into 2025 has cast negatively over the #uranium spot price. While they can defer due to inventories, ultimately they need to sign contracts. Will they find material when production cannot meet demand? /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh