We just launched the Full Version of LlamaFeed, a major upgrade to our free dashboard!

It includes:

- Expanded data

- Content filters

- New sections

- AI news recaps

- Revamped mobile

Available to Pro & Llama+ subscribers

All features 👇

It includes:

- Expanded data

- Content filters

- New sections

- AI news recaps

- Revamped mobile

Available to Pro & Llama+ subscribers

All features 👇

AI-generated, personalised news recaps

Get a concise snapshot of the most important recent developments. Summaries refresh on demand every 10 minutes. If you’ve set filters in the News section, summaries reflect only your selected sources.

Get a concise snapshot of the most important recent developments. Summaries refresh on demand every 10 minutes. If you’ve set filters in the News section, summaries reflect only your selected sources.

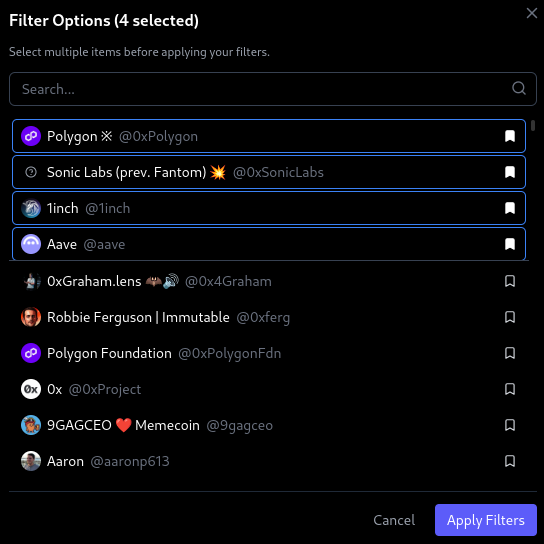

New Content Filters

You can now select which data to include in each section, like choosing specific RSS feeds for news, tokens for price tracking, or projects for governance, allowing you to tailor LlamaFeed to your specific interests.

You can now select which data to include in each section, like choosing specific RSS feeds for news, tokens for price tracking, or projects for governance, allowing you to tailor LlamaFeed to your specific interests.

Expanded Content Per Section

We now include much more data across existing sections: 10 news sources (vs 2), 500+ Twitter accounts (vs 25), all active markets on Polymarket across crypto, politics, and AI (vs a handful), and governance data from all major projects, plus more.

We now include much more data across existing sections: 10 news sources (vs 2), 500+ Twitter accounts (vs 25), all active markets on Polymarket across crypto, politics, and AI (vs a handful), and governance data from all major projects, plus more.

All Sections Unlocked

In addition to the sections you already know, the Full Version gives you access to new ones like CEX Listings, TradFi prices, and ETF flows, with even more on the way.

In addition to the sections you already know, the Full Version gives you access to new ones like CEX Listings, TradFi prices, and ETF flows, with even more on the way.

Revamped Mobile

The interface has been redesigned for better usability across all devices and a smoother mobile experience. All features, including filters and AI summaries, work seamlessly on mobile. PWA support is also available if you’d like to install LlamaFeed like an app.

The interface has been redesigned for better usability across all devices and a smoother mobile experience. All features, including filters and AI summaries, work seamlessly on mobile. PWA support is also available if you’d like to install LlamaFeed like an app.

• • •

Missing some Tweet in this thread? You can try to

force a refresh