In just hours, Kaspa’s block creation rate will jump to 10 BPS—but this is only the beginning.

Looking ahead, the rate is set to increase even more, as Kaspa aims to solves important problems by increasing its block creation rate.

Here's a report that explains more.

🧵 1/25

Looking ahead, the rate is set to increase even more, as Kaspa aims to solves important problems by increasing its block creation rate.

Here's a report that explains more.

🧵 1/25

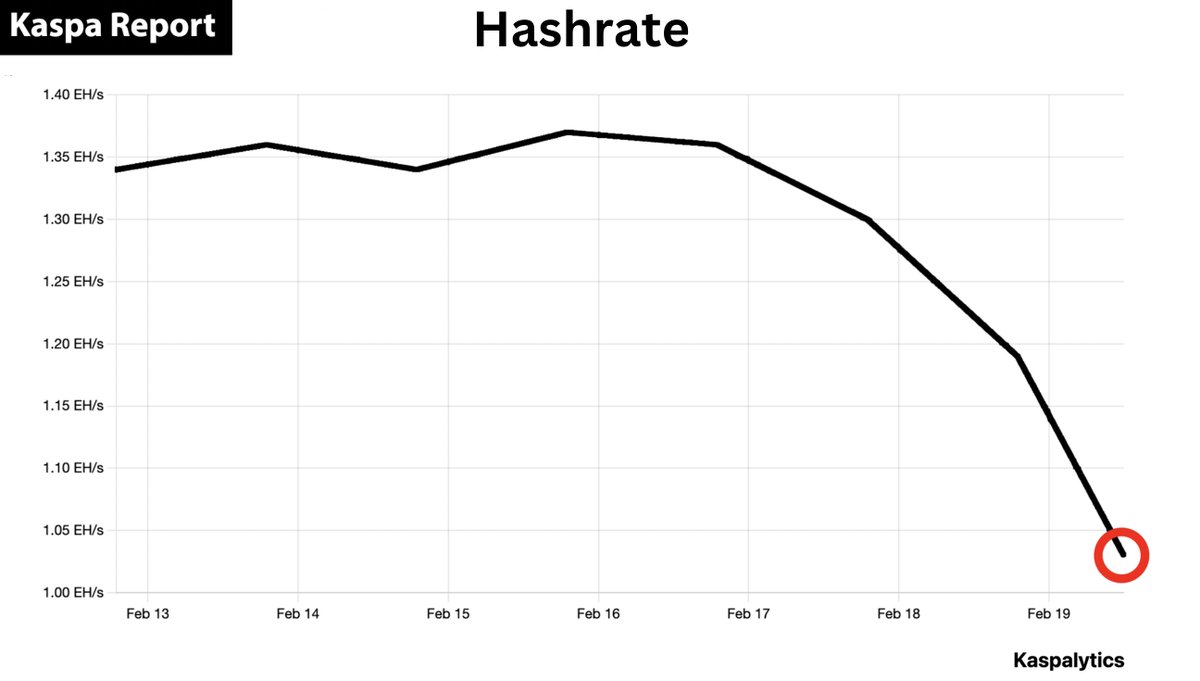

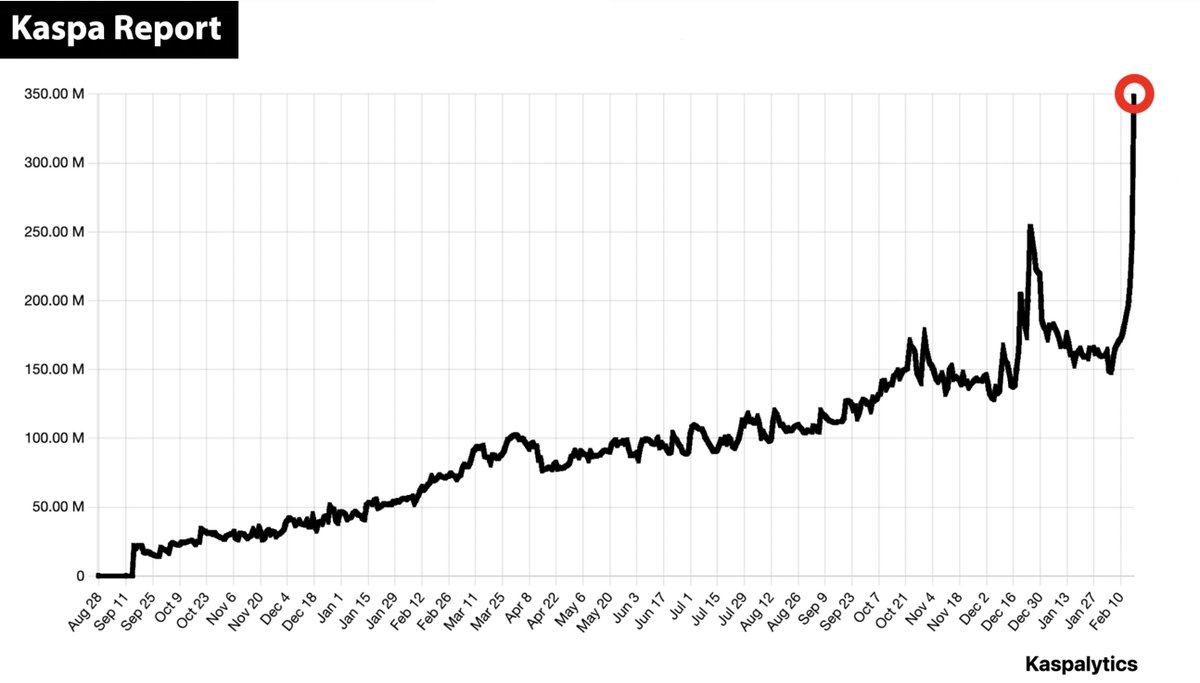

In a proof-of-work network, a higher block creation rate can enhance decentralization by reducing mining variance, which in turn reduces the benefit of joining a mining pool.

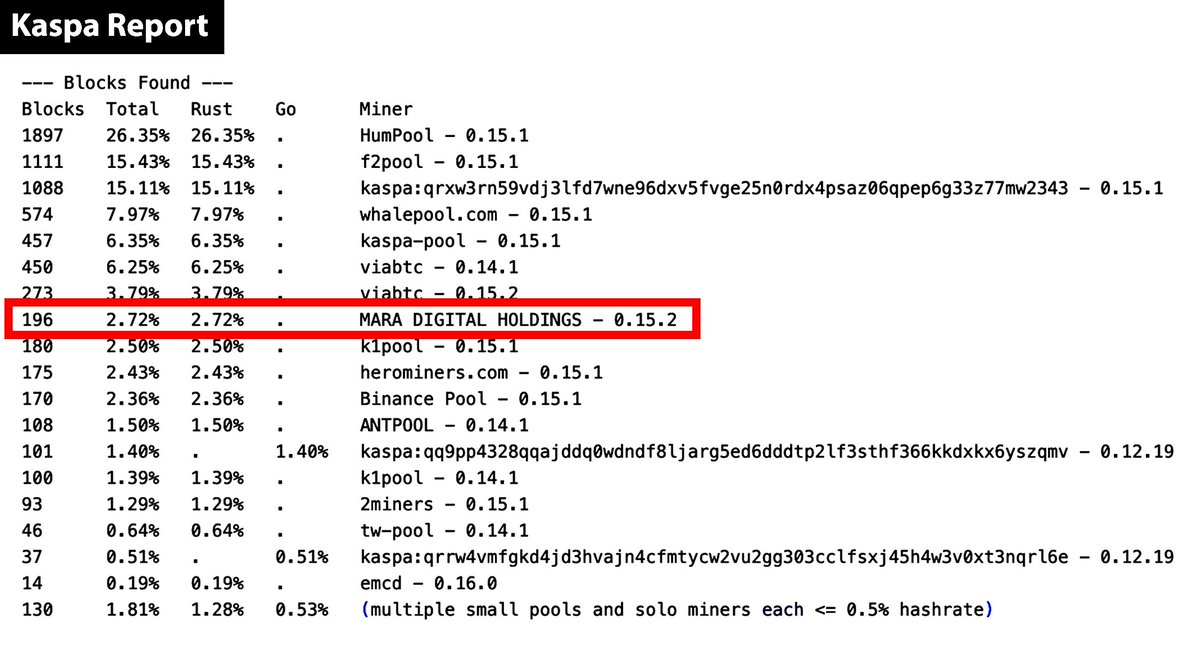

This graphic shows Kaspa's block distribution.

You can interact with it here: public.flourish.studio/visualisation/…

This graphic shows Kaspa's block distribution.

You can interact with it here: public.flourish.studio/visualisation/…

This occurs because one major advantage of joining a mining pool is the more frequent reward payouts, an issue that a higher block creation rate directly mitigates.

The higher the block creation rate, the more frequent the payouts become. If a network’s block creation is fast enough, it can virtually eliminate the advantage of joining a mining pool (with one important exception discussed below).

The Kaspa network currently pays miners about 86,400 times per day—once every second. By comparison, Bitcoin pays miners about 144 times per day—once every ten minutes.

After the Crescendo hard fork, the Kaspa network will pay out rewards to miners about 864,000 times per day—once every 100 milliseconds. That means for every single payout the Bitcoin network issues, Kaspa will issue 6,000.

Even though the Crescendo hard fork doesn’t change the per-second coinbase reward rate, it will nonetheless enhance the incentive to mine for the Kaspa network. In effect, the increased incentivization stems from the reduced variance in mining rewards.

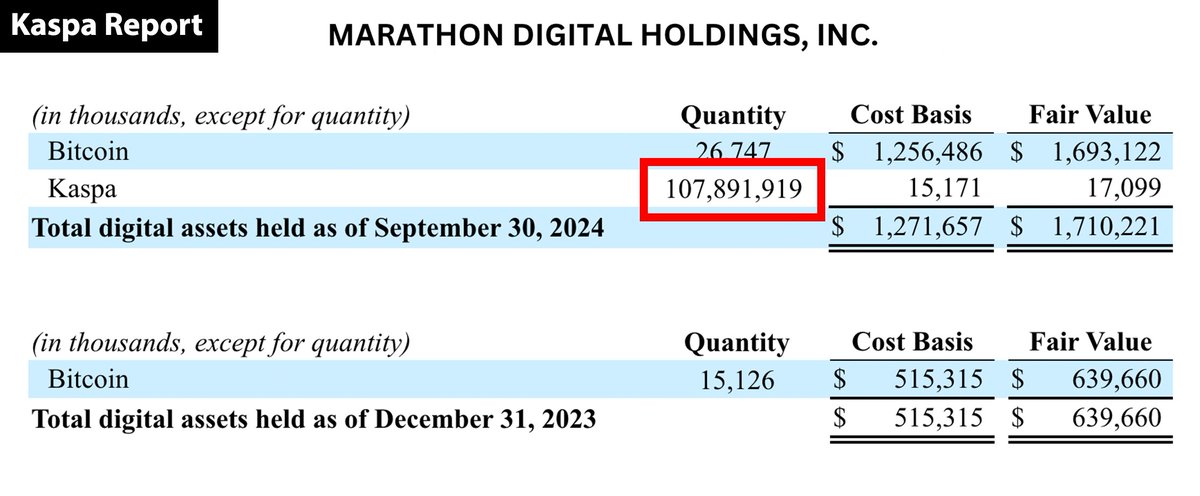

Indeed, this enhanced mining incentive is already in effect on Kaspa at 1 BPS and was a key reason @MARAHoldings determined it could earn excess Bitcoin returns by mining Kaspa and converting the rewards to Bitcoin. The Crescendo hard fork will amplify this effect.

Although Kaspa’s and Bitcoin’s mining incentives may seem confounded by their fiat price movements, that reasoning is circular because fiat prices themselves are driven by a network’s mining efficiency. Therefore, the only meaningful metric is mining efficiency, or more generally, network security efficiency.

The value of a proof-of-work coin derives from the computational work and energy required to bring it into existence. In essence, the coin acts as an energy stablecoin, maintaining a value dependent on the energy expended to secure the network and mine the coin.

What @MARAHoldings failed to recognize is that the excess Bitcoin returns they achieved by mining Kaspa could only arise if mining Kaspa is more efficient. In fact, the excess return in BTC is merely Bitcoin’s rate of price decay when measured in KAS.

https://x.com/KaspaReport/status/1874216208402120784

@MARAHoldings Therefore, Bitcoin faces a genuine challenge because Kaspa mining is so much more efficient. Miners shifting to Kaspa in an attempt to earn excess Bitcoin returns is actually the natural process by which one monetary system supplants another.

https://x.com/KaspaReport/status/1917268090120986640

This dynamic is akin to fiat investors using Bitcoin to generate excess returns in fiat currency.

In essence, we’re witnessing Darwinian selection of monetary systems, as rational market participants unwittingly select the superior monetary technology in pursuit of higher returns.

That is to say, if one proof-of-work network is more efficient to mine than another, all else being equal, the more efficient network is superior—and its coin, consequently, is superior money...

In essence, we’re witnessing Darwinian selection of monetary systems, as rational market participants unwittingly select the superior monetary technology in pursuit of higher returns.

That is to say, if one proof-of-work network is more efficient to mine than another, all else being equal, the more efficient network is superior—and its coin, consequently, is superior money...

@MARAHoldings Addressing the exception noted above, miners may still join mining pools because of geographic energy-cost disparities; specifically, they may choose to relocate their mining hardware to jurisdictions with lower electricity prices and mine through a local pool.

@MARAHoldings The tendency of miners to join pools because of geographic energy-cost disparities is difficult to address, as it reflects, among other factors, the free-market arbitrage of inefficient energy subsidies and inherent variations in local energy-production capacity.

@MARAHoldings Optical Proof-of-Work (oPoW) mining, together with the expansion of renewable energy sources, could help mitigate this issue and further decentralize proof-of-work networks. More research in this area is needed.

https://x.com/KaspaKii/status/1874057633256112399

@MARAHoldings In a previous report, we compared miners who relocate their equipment to low-energy-cost regions to stakers. By effectively "staking" their hardware with a pool operator, these miners engage in a network that operates much like a proof-of-stake system.

https://x.com/KaspaReport/status/1881827802355249396

These miners essentially relinquish their role as miners and take on the role of stakers. This underscores the broader idea that a proof-of-work network with highly centralized mining closely resembles a proof-of-stake network, making it susceptible to similar long-term security vulnerabilities.

Because mining pools inherently centralize power—they can tax miner income through fees, dictate payout terms and timing, and withhold rewards arbitrarily—it’s essential for any proof-of-work protocol to diminish the incentives for pool mining.

While some pools operate altruistically with zero fees and others maintain a more decentralized structure, there’s no inherent mechanism to prevent a mining pool from turning malicious and abusing its authority over miners, ultimately jeopardizing the network’s security.

While some pools operate altruistically with zero fees and others maintain a more decentralized structure, there’s no inherent mechanism to prevent a mining pool from turning malicious and abusing its authority over miners, ultimately jeopardizing the network’s security.

@MARAHoldings Moreover, as a single mining pool’s share of hashrate grows, the network becomes increasingly centralized and vulnerable, with fewer independent points of failure.

@MARAHoldings At its core, mining pools exist to address issues the protocol itself ought to handle—such as infrequent reward distributions that force miners to wait extended periods of time to recoup their costs.

Thus, a proof-of-work protocol should strive to distribute rewards as frequently as possible, eliminating any "interest-free loan" period during which miners collectively expend energy on the network without compensation. Ideally, each miner should benefit from a near real-time, low-variance income stream.

Kaspa is leading this endeavor, aiming to push its block creation rate well beyond 10 blocks per second. Rather than rely on a priori assumptions about the network, Kaspa relies only on the laws of physics and actual hardware capabilities to bound its technology.

@MARAHoldings By increasing its block creation rate and leveraging the parallelism of its DAG structure, Kaspa will not only become the most decentralized network, but it may also resolve the long-standing challenges of oracle integrity and miner extracted value.

🧵 End

🧵 End

@MARAHoldings If you enjoyed this thread and would like to support the Kaspa Report, please give us a follow.

If you’d like to support us with KAS, here’s our wallet: kaspa:qq6z387wmxxqtfw770gcdm0cjn8eprp3v2xfhuf88y69cev9u4vauzgd24jqz

Thanks for your support!

If you’d like to support us with KAS, here’s our wallet: kaspa:qq6z387wmxxqtfw770gcdm0cjn8eprp3v2xfhuf88y69cev9u4vauzgd24jqz

Thanks for your support!

• • •

Missing some Tweet in this thread? You can try to

force a refresh