As promised, here’s my analysis on the new joint House Financial Services and House Agriculture Market Structure bill on crypto. This is the bill that will, finally, provide a clear regulatory regime on crypto that many have been calling for.

Thread.

Thread.

https://twitter.com/JBSDC/status/1919432291270488254

It also makes clear that a person cannot trade futures, swaps, or securities just by getting a registration to deal with digital assets. This has been a major fear of many people, so it’s good to see spelled out. 60

Section 108 is typographical fixes to the existing laws. Section 109 encourages global cooperation on crypto regulations (Good! Rationalizing rules globally often gets forgotten or discouraged). 61

Section 110 sets a global timeline to get all rulemakings done under this law within 360 days of this bill being signed into law. That’s not binding but a good signal for the speed the authors want from regulators.

62

62

Title I concludes with Section 111, which makes clear the Bank Secrecy Act applies to CFTC registered crypto exchanges with direct customer access and also asks for a GAO study on risks of CeFi entities in foreign countries that don’t have a law similar to the BSA.

63

63

We’re about ⅕ of the way through this bill.

The next Title, Title II, is the beating heart of the bill, so let’s jump right into it. 64

The next Title, Title II, is the beating heart of the bill, so let’s jump right into it. 64

Section 201 goes right to the crux of the jurisdictional divide on crypto. There’s been a lot of debate over the famous “Howey” test, which defines what is and is not a an investment contract under the securities laws.

65 .en.wikipedia.org/wiki/SEC_v._W.…

65 .en.wikipedia.org/wiki/SEC_v._W.…

What’s often forgotten is Howey wasn’t that important of a case historically. Coming shortly after the SEC was founded and over whether an interest in orange groves was a security, the Howey test was focused on what qualifies as an investment contract, which is just one of the things that qualifies as security. 66

For a long time, most assets that were remotely in the realm of the SEC were just deemed to be stocks, in part because if you didn’t take the well-trod path of most stocks, you were drilling a dry hole. Crypto is one of the first real challenges the SEC faced that couldn’t fit this model. 67 law.cornell.edu/uscode/text/15…

Anyway, this bill simply slices much of crypto away from the securities laws by declaring that “investment contract assets” are not included within "investment contracts," and then proceeds to define what an investment contract asset is. 68

An investment contract asset is a digital commodity (and only a digital commodity) that can be exclusively possessed and transferred without an intermediary, is recorded on a blockchain, & is sold or transferred “pursuant to an investment contract” under Section 6 of the ‘33 Act or an exemption to it. 69

Confused? It makes sense. Jurisdictional questions are rather like eschatological ones, debating angels on heads of pins.

Here, you have the law saying something is not a security that is in some ways reliant on the securities laws. 70

Here, you have the law saying something is not a security that is in some ways reliant on the securities laws. 70

What I think the section is attempting to say is that the underlying tokens themselves are not securities, as has been indicated in a few court decisions, but that the contracts on them might be securities.

To resolve that disclarity, this section is saying that pretty much all digital commodities may not be securities if some conditions (generally spelled out later in the Title) are met. 71

To resolve that disclarity, this section is saying that pretty much all digital commodities may not be securities if some conditions (generally spelled out later in the Title) are met. 71

I’m not going to beat around the bush: this section (section 201) needs rigorous interrogation by everyone, and probably its own special section of a markup.

If the text here is too narrow, the bill is pointless. If it’s too broad, the securities laws could be blown up.

72

If the text here is too narrow, the bill is pointless. If it’s too broad, the securities laws could be blown up.

72

Section 202, which @eleanorterrett already flagged, covers secondary sales. This basically says that secondary sales of tokens that don’t give ownership or profits in an underlying business aren’t securities transactions. 73

@EleanorTerrett This is in line with the Ripple case and frankly our history of how the securities industry evolved. As I noted before, we don’t really have investment contract markets (there wasn’t a market for the shares of the Howey orange groves). 74

@EleanorTerrett We have a system that revolves around stocks and basically nothing else. As a result, we’ve tried to force everything into that stock system. And it worked, in part because of technology, until crypto. 75

@EleanorTerrett Now, you can have secondary transactions (meaning not transactions from the original issuer) of investment contracts. That’s been a major dividing line between the past SEC and the crypto industry, and the SEC was probably going to lose on this badly at SCOTUS. 76

Regardless, what this section is saying is that secondary transactions of digital commodities that don’t create those profit interests in a business never trigger securities law. So once someone who gets an initial drop of a token sells it on secondary markets, commodities laws are applying, not securities laws.

77

77

@EleanorTerrett The natural fear is that this means those insiders who get the initial drop of tokens can “dump” them on retail. It’s to ward this off that the bill next applies restrictions on when those insiders who got “primary” transactions from the issuer or the issuer itself can sell. 78

@EleanorTerrett Section 203 covers those primary transactions, but it also, notably, says these ARE investment contracts and therefore subject to the securities laws. There’s basically a four part test.

79

79

Issuer can sell tokens that aren’t securities transactions if:

- China in question is or intends to be a mature blockchain

- they sell less than $USD 150 million in the last year

- no one owns more than 10% of the commodity

- issuer is organized in US

- issuer has a real business model/isn’t merging/acquiring a firm

- they aren’t issuing shares in oil or mineral rights

- they aren’t a “bad actor” under SEC regulations

- they follow the next section, 4B

That’s a lot of requirements to be clear and not easily met.

80

- China in question is or intends to be a mature blockchain

- they sell less than $USD 150 million in the last year

- no one owns more than 10% of the commodity

- issuer is organized in US

- issuer has a real business model/isn’t merging/acquiring a firm

- they aren’t issuing shares in oil or mineral rights

- they aren’t a “bad actor” under SEC regulations

- they follow the next section, 4B

That’s a lot of requirements to be clear and not easily met.

80

Before turning to section 4B, I want to draw special attention to the bad actor provision. This is a Dodd-Frank requirement that if you engage in fraud and settle on fraud charges with SEC/CFTC/states, you are limited in what you can do in the securities markets. 81 law.cornell.edu/cfr/text/17/23…

@EleanorTerrett Section 4B requires a host of disclosures by the issuer to the SEC (and not the CFTC), including:

- source code

- transaction history

- digital commodity economics (launch, supply, tech, consensus mechanism, governance etc)

- development plan

- risk factors

82

- source code

- transaction history

- digital commodity economics (launch, supply, tech, consensus mechanism, governance etc)

- development plan

- risk factors

82

@EleanorTerrett But that’s not all, there are also ongoing disclosure requirements to the SEC, including semiannual reports on how much money the issuer raised and has spent as well as a timeline for the development of the blockchain system AND how it aims to become mature. 83

@EleanorTerrett To return to the concept of maturity, as noted above, that’s the crux of this whole system for issuers. Section 203 applies to systems that are mature blockchains or intend to be mature blockchains. But what about blockchains that stay immature adolescents for a long time? 84

@EleanorTerrett Well, the bill has an answer to that: you only get 4 years after the law passes or the first issuance (whichever is later) to become mature. After that, you are deemed to have failed to mature and can no longer take advantage of this section at all.

85

85

@EleanorTerrett It’s not clear what happens to a blockchain after it fails to hit that 4 year mark. The bill makes clear that systems that have failed to mature will be subject to mandatory additional SEC rules, to be finished in the 270 days.

This is just an issue for issuers/RPs though.

86

This is just an issue for issuers/RPs though.

86

@EleanorTerrett I'll put this on main, but the basic thesis of this bill is that secondary sales of a token that don't give ownership rights or an interest in an underlying business are not securities transactions.

Issuers/Investors' sales will be constrained to prevent dumping.

Issuers/Investors' sales will be constrained to prevent dumping.

@EleanorTerrett This system of maturing works is going to be a discussion, not least because it’s the SEC (see below) that will determine when systems are mature. This is just for issuers and related persons though, and there are limits on the SEC.

Days of the Bucakroo SEC Chair are past. 87

Days of the Bucakroo SEC Chair are past. 87

@EleanorTerrett Section 204 covers sales by related/affiliated persons (read: insiders and investors). Basically, there are significant restrictions on sales by these people prior to a system reaching maturity but ALSO after reaching maturity. 88

@EleanorTerrett Prior to reaching maturity, over a 3 month period, a related/affiliated person cannot sell more than:

-5% of their total holding of the digital commodity

-1% of average weekly trading volume of the digital commodity,

Whichever figure is smaller.

89

-5% of their total holding of the digital commodity

-1% of average weekly trading volume of the digital commodity,

Whichever figure is smaller.

89

@EleanorTerrett After maturity, over a 3 month period, a related/affiliated person cannot sell more than

- 1% of the total outstanding amount of the digital commodity

- 1% of average weekly trading volume of the digital commodity,

Whichever figure is greater.

90

- 1% of the total outstanding amount of the digital commodity

- 1% of average weekly trading volume of the digital commodity,

Whichever figure is greater.

90

On top of those requirements, there are time and operational limitations: prior to maturity, a related/affiliated person cannot sell a token it hasn’t held for 12 months and sales must be through a digital commodity exchange, not over the counter.

After maturity, they cannot sell until at least they’ve held the units for 12 months or 3 months have passed since the system reached maturity.

There are also required disclosures from the issuer and RPs/APs prior to maturity.

91

After maturity, they cannot sell until at least they’ve held the units for 12 months or 3 months have passed since the system reached maturity.

There are also required disclosures from the issuer and RPs/APs prior to maturity.

91

There are also restrictions against manipulation or deceptive devices by related and affiliated persons, and the SEC is empowered to issue rules on this. Admittedly, the SEC must also issue rules on affirmative defenses such persons can take to claims they engaged in manipulation (that will be a major rulemaking).

92

92

Of course, this will not apply to some previously issued digital commodities. For those digital commodities released prior to this bill being enacted, the SEC will decide whether and how to exempt various existing commodities from this section, focusing on maturity of system, distribution, etc.

93

93

You can think of this in particular as being about XRP, SOL, and other major non-BTC and ETH tokens (though again, this is irrelevant for secondary sales).

I expect the lobbying on which major tokens get this exemption will be fierce if this passes. Congress may want to set additional guidelines.

94

I expect the lobbying on which major tokens get this exemption will be fierce if this passes. Congress may want to set additional guidelines.

94

Section 205 covers, at long last, mature blockchain systems and how the SEC will certify them.

In fairness, it’s a pretty thoughtful approach and one that is surprisingly friendly to crypto skeptics.

95

In fairness, it’s a pretty thoughtful approach and one that is surprisingly friendly to crypto skeptics.

95

Basically, the digital commodity issuer or a related or affiliated person can file with the SEC that they believe the blockchain they issue/are connected to has reached maturity. That involves a voluminous filing about the status of the blockchain.

96

96

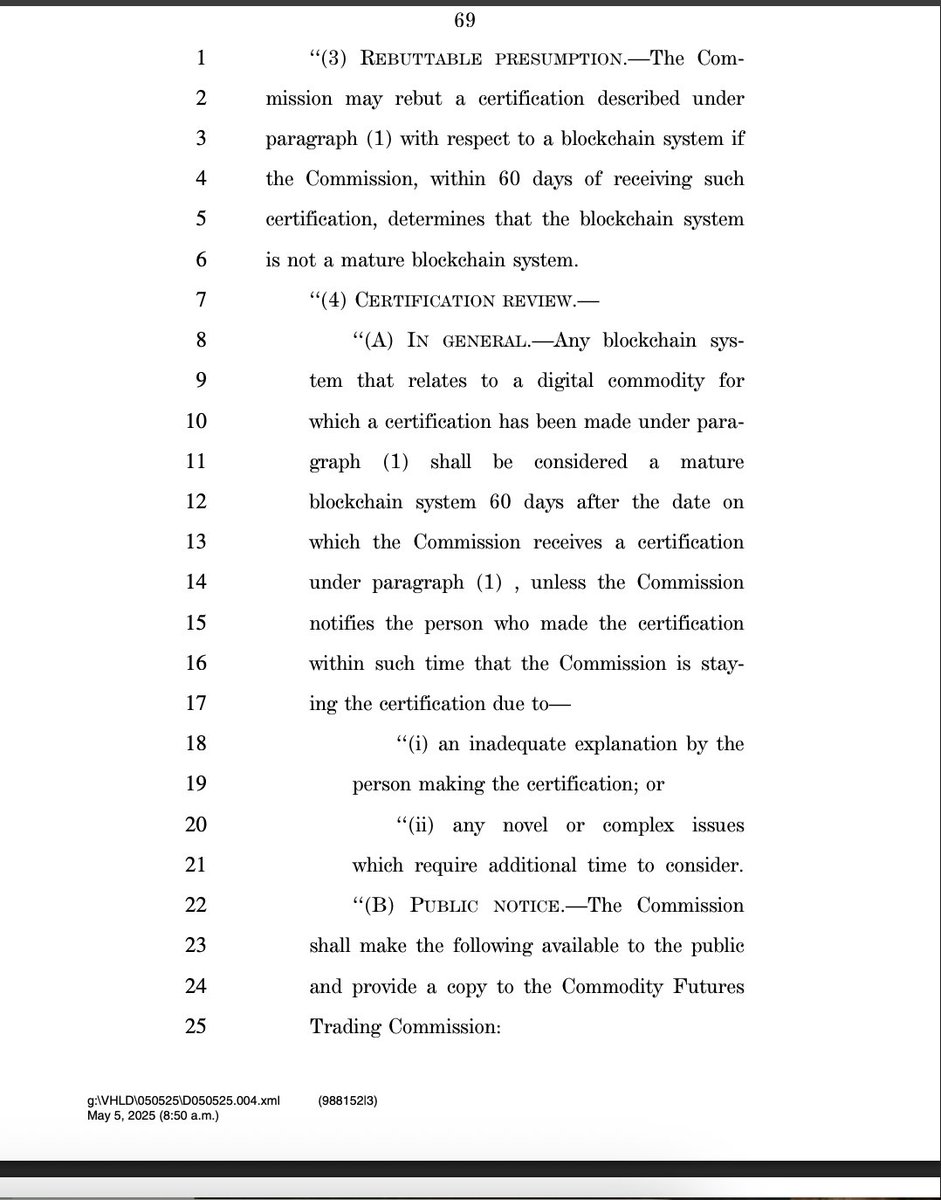

The SEC can rebut such a filing within 60 days. If the Commission does not issue a rebuttal within 60 days, the blockchain is deemed automatically certified as mature.

The SEC can file once within that 60 day period that it needs another 120 days due to lack of information or novel/complex issues. A 30 day public comment is also an option for the SEC on each certification.

97

The SEC can file once within that 60 day period that it needs another 120 days due to lack of information or novel/complex issues. A 30 day public comment is also an option for the SEC on each certification.

97

If a certification is rejected by the SEC, NO ONE can file again for 90 days (this is basically a cooling off period).

If the certification is denied, the filer can appeal to the DC Circuit Court of Appeals, which is a court whose judges are majority Democratic-appointed.

98

If the certification is denied, the filer can appeal to the DC Circuit Court of Appeals, which is a court whose judges are majority Democratic-appointed.

98

In terms of whether a blockchain actually is mature, the SEC has to consider a host of factors

- System’s value, including its market value

- Functionality of the system (does it work)?

- Is it open and doesn’t give anyone other than the issuer unilateral authority

- Is the system rules-based and doesn’t rely on any one person

- Is governance not under common control

- No one person or group owns more than 20% of the total tokens

99

- System’s value, including its market value

- Functionality of the system (does it work)?

- Is it open and doesn’t give anyone other than the issuer unilateral authority

- Is the system rules-based and doesn’t rely on any one person

- Is governance not under common control

- No one person or group owns more than 20% of the total tokens

99

This is pretty comprehensive. Ultimately, how this works will be defined by an SEC rulemaking, but the bill does a good job of laying out the key factors. Members of Congress and Stakeholders will want to look through this section carefully and decide whether it is covering all bases. 100

The bill also makes clear that administrative or clerical functions of a decentralized governance system won’t prevent a system from being deemed mature. My understanding is this is regarding DAOs fwiw.

101

101

Section 206 makes clear that some of the rules under this Title will take effect 360 days after passage and others 60 days after a particular rule is finished.

And that’s it for Title II. I’ll be back with more tonight. 102

And that’s it for Title II. I’ll be back with more tonight. 102

Ok, let’s get back to it. Title III deals with the registration of crypto intermediaries at the SEC.

Section 301 basically just makes clear digital commodities and permitted payment stablecoins are not securities. 103

Section 301 basically just makes clear digital commodities and permitted payment stablecoins are not securities. 103

Also, during the break, I confirmed the definition of stablecoins is just a placeholder/backstop if the stablecoin bill doesn’t pass. If you have issues with the definition here, focus your efforts on improving the stablecoin bill.

104

@HouseAgGOP @HouseAgDems

104

@HouseAgGOP @HouseAgDems

@HouseAgGOP @HouseAgDems Under Section 302, you can trade a permitted payment stablecoin on an ATS (alternative trading system) or a national securities exchange, and anti-fraud provisions apply to trades on ATS/national securities exchange of both such stablecoins or digital commodities.

105

105

@HouseAgGOP @HouseAgDems Why is this here? Well, it harkens back to what I said earlier that we divide up securities and commodities in America. Currently, you can’t trade both on one exchange. As markets intertwine and have more connections though, things are changing. This bill accepts that.

106

106

On that note, Section 303 allows ATS to trade digital commodities. So we’ll start to see CFTC-regulated products on SEC exchanges and, probably, vice versa. Is this an augury of these two agencies merging someday? All signs point to maybe.

107

107

Section 304 makes clear that the SEC has jurisdiction over brokers, dealers, and exchanges that are jointly registered with the CFTC and trade digital commodities. Again, the jurisdictional lines are merging.

108

108

Section 305 is simple but key: blockchains count as official records for the SEC. This is good & how we can get autopopulating disclosures.

Section 306 is small but significant - this makes clear the SEC can issue exemptions not just by rules or regulations but orders too.

109

Section 306 is small but significant - this makes clear the SEC can issue exemptions not just by rules or regulations but orders too.

109

This gets at an ongoing series of fights inside regulatory bodies and DC generally: what is the official power of a regulator vested in? They have rulemaking powers of course, but traditional notice and comment rulemakings take a long time.

110

110

So, many regulators use orders more often, eg no action guidance, settlements, etc. This seems to be making clear, in statute, that the SEC has exemptive authority over what is a security or other rules via orders. 111 law.cornell.edu/uscode/text/15…

Section 307 is another section that authorizes joint registration of entities between CFTC and SEC for crypto.

Section 308 exempts digital commodities from regulation by state entities, aka federal preemption.

112

Section 308 exempts digital commodities from regulation by state entities, aka federal preemption.

112

This is basically part of the system we have of federal regulation broadly, not just in finreg. Once you are regulated federally, you can’t be subject to additional/alternate state regulations (in part because then you are in a patchwork).

113 law.cornell.edu/uscode/text/15…

113 law.cornell.edu/uscode/text/15…

Section 309 is maybe the most important section in this Title: it’s an exemption for much of DeFi, with some caveats.

114

114

The backstory on this is that while we have good models for regulation of CeFi exchanges (eg Coinbase and Kraken), as seen in other countries’ regulations of CeFi.

So far, however, no one has a good model for DeFi.

115

So far, however, no one has a good model for DeFi.

115

This makes sense of course. CeFi is about the porting of concepts (custody and exchange trading) and applying them to a new form of product in tokens. There are key differences, but they rhyme.

DeFi is something else entirely.

116

DeFi is something else entirely.

116

During the Biden Admin, I had the privilege of serving on CFTC’s Technology Advisory Committee and served on the subcommittee working on a report on DeFi, sponsored by @CFTCcgr.

117

117

@CFTCcgr We struggled even to define the term, ultimately agreeing that policymakers’ focus should be looking at various metrics of decentralization as decentralization is itself a spectrum. 118 cftc.gov/media/10106/TA…

@CFTCcgr One year on, I think we’re still looking at this and there needs to be more research and learning on what we want from DeFi.

So in that regard, excluding it makes sense, though this is a double-edged sword for DeFi, as it probably reduces near-term uptake.

119

So in that regard, excluding it makes sense, though this is a double-edged sword for DeFi, as it probably reduces near-term uptake.

119

Anyway, under section 309, the following are excluded from the ‘34 Exchange Act:

- Compiling, validating, and sequencing transactions

- Providing computational work or incidental services

- Providing a UI that lets you read and access blockchain data

- Developing, administering, or distributing a DeFi protocol

- Developing, administering, or distributing a DeFi front-end

- Developing, administering, or distributing key hardware or software like wallets

120

- Compiling, validating, and sequencing transactions

- Providing computational work or incidental services

- Providing a UI that lets you read and access blockchain data

- Developing, administering, or distributing a DeFi protocol

- Developing, administering, or distributing a DeFi front-end

- Developing, administering, or distributing key hardware or software like wallets

120

@CFTCcgr Ultimately, this is an exemption for building and coding systems, not trading. I expect this isn’t a blanket DeFi exemption in either the authors’ minds or, presumably, how regulators or courts would read it. And that’s logical given the above.

121

121

@CFTCcgr That said, this also makes clear something important: there’s no allowance for fraud. Anti-fraud and anti-manipulation rules still apply to all parts of DeFi.

Fraud and market manipulation are illegal, always have been, always should be, and always must be.

122

Fraud and market manipulation are illegal, always have been, always should be, and always must be.

122

Section 310 is a limit on what the SEC or bank regulators are allowed to require in terms of treating assets held in custody as liabilities.

Remember SAB-121 and how it was designed to make custody banks treat crypto as a full liability on the bank so banks custodying crypto was non-economic, all to kill crypto? This salts the earth on SAB-121 or similar.

123

Remember SAB-121 and how it was designed to make custody banks treat crypto as a full liability on the bank so banks custodying crypto was non-economic, all to kill crypto? This salts the earth on SAB-121 or similar.

123

Section 311 makes clear digital commodity activity is financial under the Bank Holding Company Act, thereby letting more of the financial system access crypto under regulations.

312 is again the same timeline on rules taking effect as 206.

124

312 is again the same timeline on rules taking effect as 206.

124

Section 313 is a Treasury/CFTC/SEC study on which “governments of foreign adversaries” are collecting data about US persons in digital commodity markets, which registrants are owned by foreign governments, and whether US IP is being stolen.

125

125

Who is a foreign adversary? Well, it’s defined by the Secretary of Commerce, but I’m fairly certain this is primarily about four countries:

- Iran

- Venezuela

- North Korea

- China

126

- Iran

- Venezuela

- North Korea

- China

126

And that concludes Title III. I’ll be back a bit later with Title IV, which runs for a whopping 95 pages.

127

127

Surprised to see me so fast? Well, I have good news everyone! Title IV is basically the same as FIT21’s Title V.

Here, let’s look at the sections side by side. Nearly identical to the word.

128

Here, let’s look at the sections side by side. Nearly identical to the word.

128

Title IV is very important to the overall bill because it’s how the technical regulation of digital commodities at the CFTC will work in practice. If Title I is the skeleton and Title II is the heart, Title IV is the tissue and muscle. 129

But by and large it’s mostly an exercise in fine-grained legal analysis that will be the responsibility of the extremely talented staff at the Divisions of Market Oversight, Market Participants, and Clearing and Risk to implement and competent GCs at companies to learn. 130

The good news is that we can mostly race through this Title.

Section 401 reconfirms CFTC jurisdiction over digital commodity transactions, with “limited authority” over permitted payment stablecoins. 131

Section 401 reconfirms CFTC jurisdiction over digital commodity transactions, with “limited authority” over permitted payment stablecoins. 131

It also makes clear the CFTC has “exclusive jurisdiction” over basically all digital commodity transactions across state lines. The only time the CFTC does not have jurisdiction is in certain banking regulation matters.

Center of gravity in this bill is the CFTC.

132

Center of gravity in this bill is the CFTC.

132

Section 402 requires Futures Commission Merchants (FCMs) to use qualified digital custodians. This is about promoting the use of safe and responsible custodians. Section 405 will explain and set requirements on those. 133

Section 403 covers trading of digital commodities, and, again, it’s nearly a mirror of FIT21 section 503.

Basically, before a digital commodity can be traded on a CeFi entity, the entity has to file with the CFTC. And yes, filings can be made jointly to spare resources.

134

Basically, before a digital commodity can be traded on a CeFi entity, the entity has to file with the CFTC. And yes, filings can be made jointly to spare resources.

134

What’s in the filing? Well, information on how the specific digital commodity follows CFTC rules, specifically Section 404 below.

If the CFTC doesn’t approve a novel filing within 20 days, it is automatically approved. Previously approved assets get a 1-day CFTC review.

135

If the CFTC doesn’t approve a novel filing within 20 days, it is automatically approved. Previously approved assets get a 1-day CFTC review.

135

Section 404 covers how digital commodity exchanges register and list assets. If you have even one digital commodity available to trade and are a “trading facility”, you have to register with the CFTC as an exchange.

I’m fairly certain this is meant to not cover DeFi protocols, just CeFi.

136

I’m fairly certain this is meant to not cover DeFi protocols, just CeFi.

136

There are limits on what these exchanges can do. They can’t prop trade on their own exchange for instance, neither can the affiliates. They have to follow key core principles set by the CFTC. They can’t list assets that are readily susceptible to manipulation. Standard stuff.

137

137

For any digital commodity to be listed for trading, a host of information must be made available to the public, including information on its:

- source code

- transaction history

- digital commodity economics

- trading volume and volatility

- any other information a consumer might need to understand the risks of the asset

138

- source code

- transaction history

- digital commodity economics

- trading volume and volatility

- any other information a consumer might need to understand the risks of the asset

138

The rest of the section is fairly standard for a centralized financial exchange. Restrictions on conflicts of interest, no actions contrary to antitrust, information sharing with CFTC as needed, appropriate financial resources to safely operate, etc.

139

139

I do want to flag the requirements on system safeguards (read: cybersecurity). This is an area where White Hats should step forward and offer thoughts on what industry standards are and how they can be strengthened.

140

140

Oh, and segregation of funds is required and commingling is again prohibited. Funds need to be held in a way that minimizes risk of loss to customers or unreasonable delay to accessing their funds. Funds are protected in bankruptcy too.

141

141

Section 405 covers qualified digital commodity custodians (to be one, comply with this section). For entities that aren’t under federal supervision and examination, they nerd a supervisor somewhere that is adequate.

The days of unsupervised custodians are over. 142

The days of unsupervised custodians are over. 142

Minimum standards are what you might expect: review and evaluation of the owners (including their character and fitness), capital requirements, that they protect customer assets, maintain books and records, submit financial statements, comply with federal and state laws, etc. 143

Section 406 covers registration and regulation of digital commodity brokers and dealers. It’s mostly similar to aspects of 404 and 405. You CANNOT serve as a broker or dealer without CFTC registration though.

144

144

Section 407 is on registration of associated persons and 408 is on commodity pool operators and their advisors. If you’re one of these, you have to register with the CFTC too. 145

https://x.com/JBSDC/status/1919519883659796741

Section 409 is the same exclusion for decentralized finance as section 309, basically to the word.

146

146

https://x.com/JBSDC/status/1919574907454734499

Section 410 is new and frankly a passion project for me: funding for the CFTC. There’s been a lot of ink spilled about how the CFTC is a small and inadequate regulator.

This is utter nonsense peddled by either those who don’t know better or worse, by those who do and decided to engage in inter-regulator blood sport for political gamesmanship. The CFTC regulates the $400 trillion swaps market on a small budget and does so well despite a fraction of what it should have.

147

This is utter nonsense peddled by either those who don’t know better or worse, by those who do and decided to engage in inter-regulator blood sport for political gamesmanship. The CFTC regulates the $400 trillion swaps market on a small budget and does so well despite a fraction of what it should have.

147

The reason the CFTC is underfunded is because it doesn’t have a stream of its own funding like other regulators (SEC, FDIC) or straight from the Fed (CFPB).

This bill solves that by collecting fees to fund CFTC from crypto.

148

This bill solves that by collecting fees to fund CFTC from crypto.

148

This should solve all the blathering about CFTC not being big enough to regulate crypto once and for all, and without putting fees on farmers, ranchers, or other analog commodity hedgers.

149

149

Fees themselves will be small, fractions of a penny, shrinking as space grows. Congress will ensure there isn’t too much money taken, much as they do for the SEC. But CFTC will never again be at risk of being choked off from funding as it was when I was there in 2014-2017.

150

150

Section 411 is the only section not in FIT21, covering digital commodity activities at SEC-registered entities (eg ATS). This is rationalizing how the CFTC will have some shared jurisdiction with dual registrants but it need not follow CFTC regulations when it follows SEC requirements on ATS.

This will be complex to implement.

151

This will be complex to implement.

151

Finally, Section 412 again does the same kind of effective date timeline as 312 and 206, and Section 413 is Congress saying CFTC doesn’t have new powers to regulate non-crypto spot markets (they have enforcement but not regulatory powers over those).

And that’s Title IV. 152

And that’s Title IV. 152

Title V is the miscellany of this bill, various senses of Congress and studies basically. It’s the grab bag section; finishing with our body analogy, it’s the hair and nails of the bill.

153

153

Section 501 is just Congress stating that it is the sense of Congress that crypto and blockchain are important and stakeholders should all come together to craft a regime that works.

🇺🇸🇺🇸🇺🇸

154

🇺🇸🇺🇸🇺🇸

154

Section 502 formalizes in law the Office of Financial Innovation within many SEC divisions like CorpFin, while Section 503 establishes LabCFTC in statute as well.

Credit again to former CFTC Chair @giancarloMKTS for having the vision to establish Lab CFTC 8 years ago!

155

Credit again to former CFTC Chair @giancarloMKTS for having the vision to establish Lab CFTC 8 years ago!

155

Then, we have STUDIES, all to be done in a year

- 504 is a joint CFTC/SEC study on DeFi, also a GAO study

- 505 is a GAO study on NFTs,

- 506 is a joint CFTC/SEC study on expanding financial literacy among digital commodity holders

- 507 is a joint CFTC/SEC study on financial market infrastructure improvements

156

- 504 is a joint CFTC/SEC study on DeFi, also a GAO study

- 505 is a GAO study on NFTs,

- 506 is a joint CFTC/SEC study on expanding financial literacy among digital commodity holders

- 507 is a joint CFTC/SEC study on financial market infrastructure improvements

156

@giancarloMKTS And that’s the end of the bill. I should note that the view of the authors is that NFTs are not within CFTC jurisdiction despite my earlier fears, and also the definition of source code will be a joint rulemaking after all.

I’ll start a new thread with concluding thoughts.

157

I’ll start a new thread with concluding thoughts.

157

• • •

Missing some Tweet in this thread? You can try to

force a refresh