(1/🧵) Is David Schwartz… Satoshi Nakamoto? Or at least one of Bitcoin’s original architects?

The timing, the patents, the silence, it all lines up.

This thread might flip your entire view of crypto history and you might fall into a deep rabbit hole.

🧵👇

The timing, the patents, the silence, it all lines up.

This thread might flip your entire view of crypto history and you might fall into a deep rabbit hole.

🧵👇

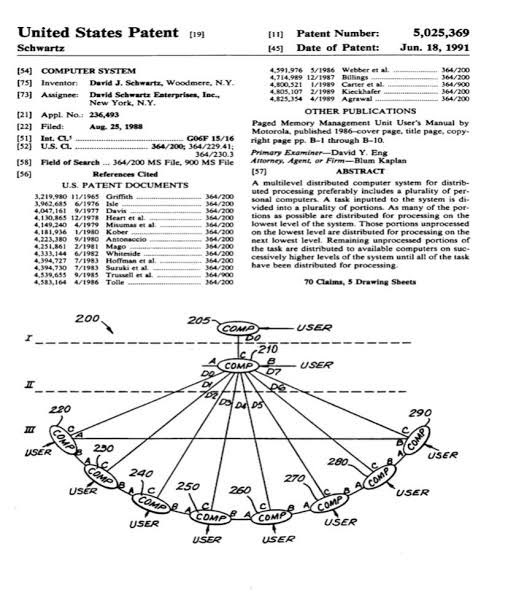

(2/🧵) The Patent That Predates Bitcoin

In 1991, David Schwartz filed a patent for a “Distributed Computer Network” that sounds eerily like a blockchain.

US Patent No. 20090119384

Years before the Bitcoin whitepaper.

Same structure. Same logic.

The same obsession with decentralization.

In 1991, David Schwartz filed a patent for a “Distributed Computer Network” that sounds eerily like a blockchain.

US Patent No. 20090119384

Years before the Bitcoin whitepaper.

Same structure. Same logic.

The same obsession with decentralization.

(3/🧵) The Language Overlaps

People have run stylometric analysis on Satoshi’s forum posts.

Guess whose writing style it closely resembles?

David Schwartz.

Even the use of terms like:

•“censorship-resistant”

•“trustless system”

•“consensus”

It’s almost like he never changed tone… just platforms.

People have run stylometric analysis on Satoshi’s forum posts.

Guess whose writing style it closely resembles?

David Schwartz.

Even the use of terms like:

•“censorship-resistant”

•“trustless system”

•“consensus”

It’s almost like he never changed tone… just platforms.

(4/🧵) The Quiet Background

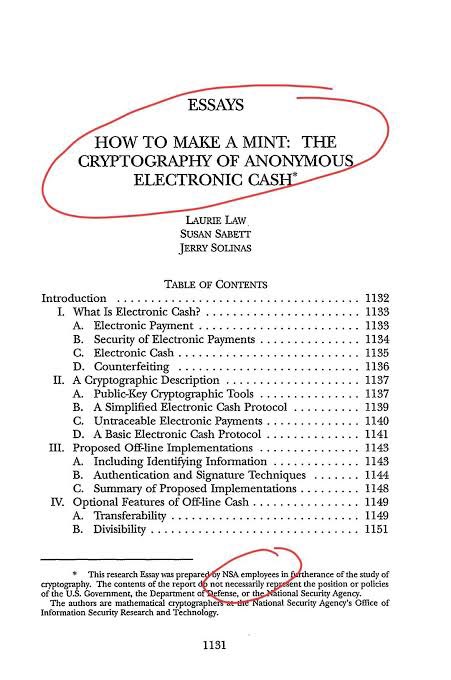

Schwartz worked on classified NSA contracts as a cryptographer.

So did other suspected Satoshi candidates like Hal Finney.

But Schwartz kept a much lower profile right until Ripple appeared, with XRP launching shortly after Bitcoin.

Too convenient? Or too perfect?

Schwartz worked on classified NSA contracts as a cryptographer.

So did other suspected Satoshi candidates like Hal Finney.

But Schwartz kept a much lower profile right until Ripple appeared, with XRP launching shortly after Bitcoin.

Too convenient? Or too perfect?

(5/🧵) The XRP Angle

Satoshi wanted Bitcoin to be “peer-to-peer digital cash.”

But over time, it became a store of value, not a payment system.

Enter XRP:

•Built for payments

•Real-time settlement

•Low energy use

What if XRP was Plan B?

A more efficient evolution built by the same mind?

Satoshi wanted Bitcoin to be “peer-to-peer digital cash.”

But over time, it became a store of value, not a payment system.

Enter XRP:

•Built for payments

•Real-time settlement

•Low energy use

What if XRP was Plan B?

A more efficient evolution built by the same mind?

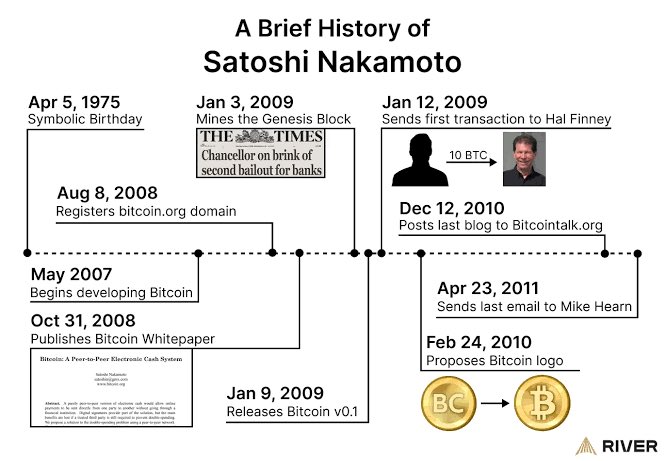

(6/🧵) Satoshi’s Disappearance in 2011 = Ripple’s Emergence

Satoshi went silent in late 2010.

Ripple began forming quietly in 2011.

Not a coincidence but a handoff.

The Bitcoin experiment had proved the concept.

XRP was designed to scale it to the real financial system.

Satoshi went silent in late 2010.

Ripple began forming quietly in 2011.

Not a coincidence but a handoff.

The Bitcoin experiment had proved the concept.

XRP was designed to scale it to the real financial system.

(7/🧵) Schwartz Never Confidently Denied It

In multiple interviews, when asked about the Satoshi theory, David Schwartz never gave a direct “no.”

Instead, he leans on:

•“I was around back then…”

•“I had thoughts about proof-of-work early on…”

•And always that cryptic grin when the question comes up.

Almost like someone who knows… but can’t say.

In multiple interviews, when asked about the Satoshi theory, David Schwartz never gave a direct “no.”

Instead, he leans on:

•“I was around back then…”

•“I had thoughts about proof-of-work early on…”

•And always that cryptic grin when the question comes up.

Almost like someone who knows… but can’t say.

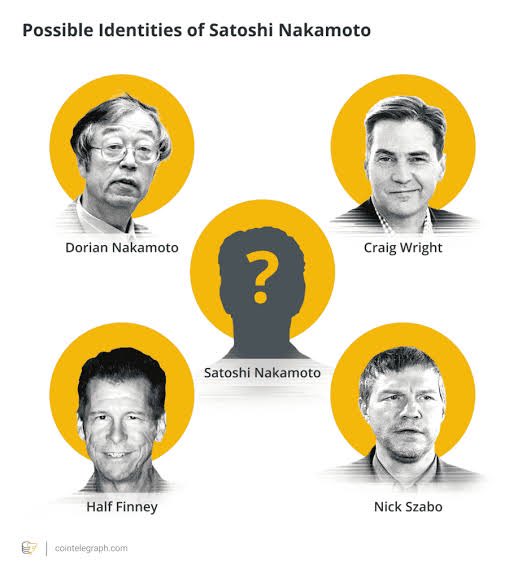

(8/🧵) The Theory?

Satoshi Nakamoto was never just one person.

It was a team or a rotating identityof cryptographers, engineers, and forward-thinking rebels.

Bitcoin was the revolution.

XRP was the blueprint for integration.

And David Schwartz?

He wasn’t Satoshi.

He was part of the mission.

Satoshi Nakamoto was never just one person.

It was a team or a rotating identityof cryptographers, engineers, and forward-thinking rebels.

Bitcoin was the revolution.

XRP was the blueprint for integration.

And David Schwartz?

He wasn’t Satoshi.

He was part of the mission.

(9/9) This isn’t just about whether David Schwartz is Satoshi.

It’s about how close we might be to the truth:

That the man who created Bitcoin…

May now be leading the asset the world will actually use.

And most people are too distracted to notice.

Comment your thoughts if you wanna go deeper in this Rabbit Hole.

It’s about how close we might be to the truth:

That the man who created Bitcoin…

May now be leading the asset the world will actually use.

And most people are too distracted to notice.

Comment your thoughts if you wanna go deeper in this Rabbit Hole.

• • •

Missing some Tweet in this thread? You can try to

force a refresh