The CHN/US tariff cuts were much larger than most expected.

I didn’t predict the policy shift and didn’t try to. That reflects much more remaining disciplined to my edge than a reflection of skill.

Some thoughts on being comfortable being on the wrong side of a call.

Thread.

I didn’t predict the policy shift and didn’t try to. That reflects much more remaining disciplined to my edge than a reflection of skill.

Some thoughts on being comfortable being on the wrong side of a call.

Thread.

I’ve been doing this a long time and over time have learned that when it comes to federal government policy (in contrast to the Fed), I have much more edge in understanding the consequences of the policy vs what is priced in than predicting what policy will come.

I won’t belabor why other than to say that many of the macro linkages of policy isn’t necessarily obvious to many more narrowly focused traders, so it makes sense that quantifying policy linkages well could have edge over time over consensus and bring alpha with sample size.

In the recent period that view generated significant, negatively correlated alpha following liberation day. While I didn’t predict the extremity ahead of time, the impact of the shift wasn’t immediately reflected in market pricing. When it was, I closed my trade.

In this more recent case equities rallied despite little indication of a meaningful shift in policy.

You could have taken Bessent comments as possibly indicative, but other admin officials had other takes about keeping the tariffs in place. Even Trump said 80pct late last week.

You could have taken Bessent comments as possibly indicative, but other admin officials had other takes about keeping the tariffs in place. Even Trump said 80pct late last week.

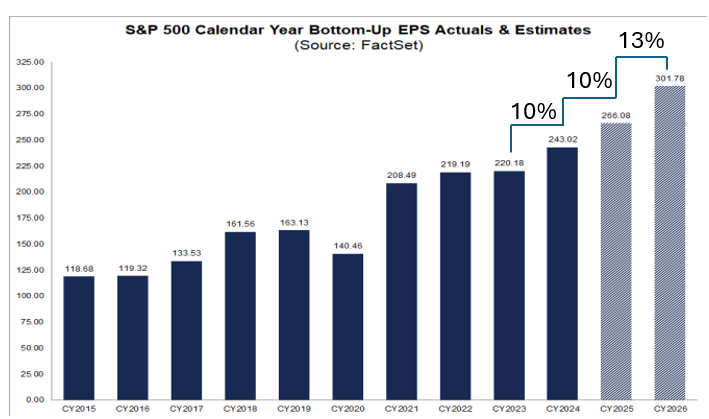

Before the meeting, the policy in place was 145pct. The informed consensus was in the ballpark of 60. The consequences of an extended 60 was far from priced into equity markets in particular.

Short growth was the right EV trade if you had no edge in predicting a policy shift.

Short growth was the right EV trade if you had no edge in predicting a policy shift.

And so it makes sense that stocks vs bonds (market based implied growth) surged following the announcement.

If anything likely still underpricing the impact given the shift in the policy stance indicated by this and fiscal spending plans (my view now).

If anything likely still underpricing the impact given the shift in the policy stance indicated by this and fiscal spending plans (my view now).

Those folks who predicted the shift present it today as obvious, but that is in the rear view mirror.

Remember Sat when everyone for a moment thought negotiations had broken down? Either path could have happened. Or some less significant shift in policy could have occurred.

Remember Sat when everyone for a moment thought negotiations had broken down? Either path could have happened. Or some less significant shift in policy could have occurred.

There were a wide range of outcomes and the question is whether knowing what you knew then if you could have had edge in predicting it.

Those on the right side will say they are genius. Most were either lucky or structurally long (and got liberation day way wrong).

Those on the right side will say they are genius. Most were either lucky or structurally long (and got liberation day way wrong).

The trouble with calls like this is that they are so few and far between, it is very hard to know whether the person has repeated skill in making these calls.

Wait for the comments here, many will say they do through discretionary understanding. A skill that is hard to test.

Wait for the comments here, many will say they do through discretionary understanding. A skill that is hard to test.

My assumption is that I don’t have any skill and even if I did it’d come up so rarely (and be 60/40 when it does) that it’s not worth betting on or spending a lot of time investing in. Better to reduce risk around idiosyncratic events than make bets.

Here my biggest error was not cutting risk ahead of the meeting. In part it was because it seemed unlikely that an initial meeting would result in such a substantial changed.

Tough to gauge in an environment of so many meetings, possible paths, but a lesson.

Tough to gauge in an environment of so many meetings, possible paths, but a lesson.

But I still would have never bet on it going one way or the other and so wouldn’t have predicted the shift regardless.

And that is ok. If I had tried it would have just added noise to my process, positive or negative. And given no info on if it could be repeated.

And that is ok. If I had tried it would have just added noise to my process, positive or negative. And given no info on if it could be repeated.

Generating alpha over time requires having a repeatable edge, managing risk, and putting as many bets on the table as possible. Anything that distracts from that is just noise in your signal.

Being disciplined means sometimes being unlucky and being ok with it. This is one of those times.

The worst response is to chase it by changing your approach. Because future bets will almost certainly be worse quality.

Discipline means losing sometimes, but winning over time.

The worst response is to chase it by changing your approach. Because future bets will almost certainly be worse quality.

Discipline means losing sometimes, but winning over time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh