Everyone’s yapping about RWA infra and tokenization.

but basic stuff like lending is still broken across chains. That’s why I looked into @0xSoulProtocol $SO

A cross-chain lending layer, clean token model and a fair public sale.. here’s my unfiltered breakdown

A thread: 🧵👇

but basic stuff like lending is still broken across chains. That’s why I looked into @0xSoulProtocol $SO

A cross-chain lending layer, clean token model and a fair public sale.. here’s my unfiltered breakdown

A thread: 🧵👇

2/

What I'll cover in this thread:

▸ What is Soul?

▸ Is this tech actually needed?

▸ $SO token sale details & metrics

▸ Some token Flywheels

▸ Should you participate?

What I'll cover in this thread:

▸ What is Soul?

▸ Is this tech actually needed?

▸ $SO token sale details & metrics

▸ Some token Flywheels

▸ Should you participate?

3/

➥ What is Soul ?

It's a unified layer connecting cross-chain money markets like Aave, Compound and others under a single UI.

Supply on one chain. Borrow on another. All in one position.

Backed by @cbventures, @LayerZero_Labs

➥ What is Soul ?

It's a unified layer connecting cross-chain money markets like Aave, Compound and others under a single UI.

Supply on one chain. Borrow on another. All in one position.

Backed by @cbventures, @LayerZero_Labs

4/

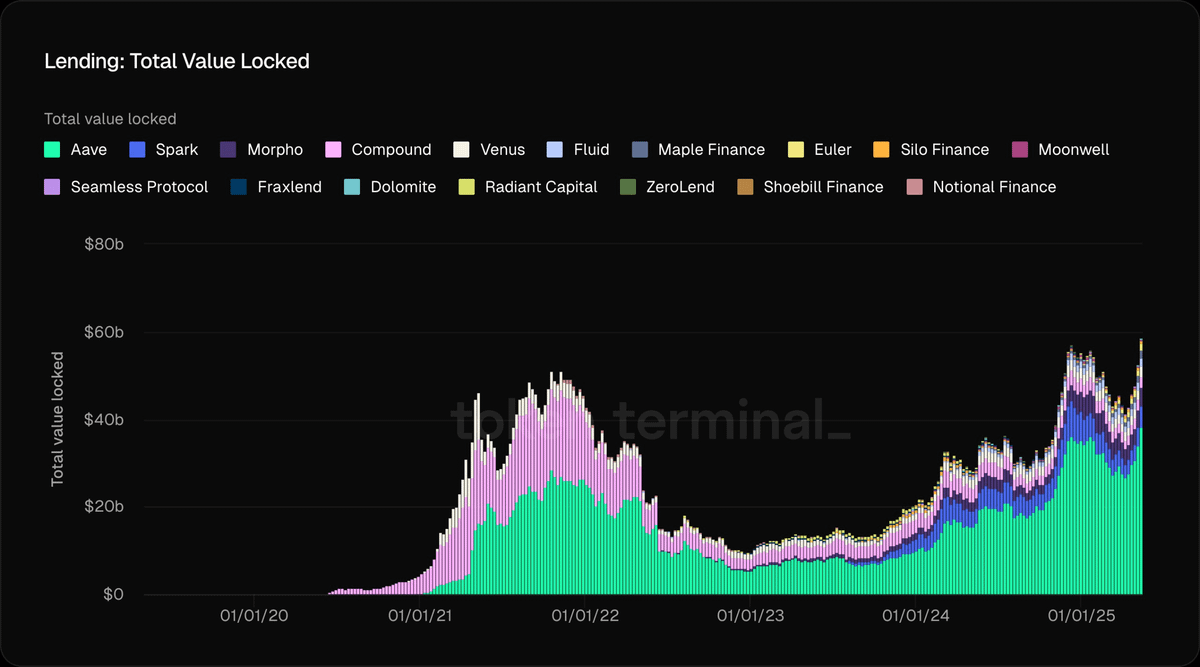

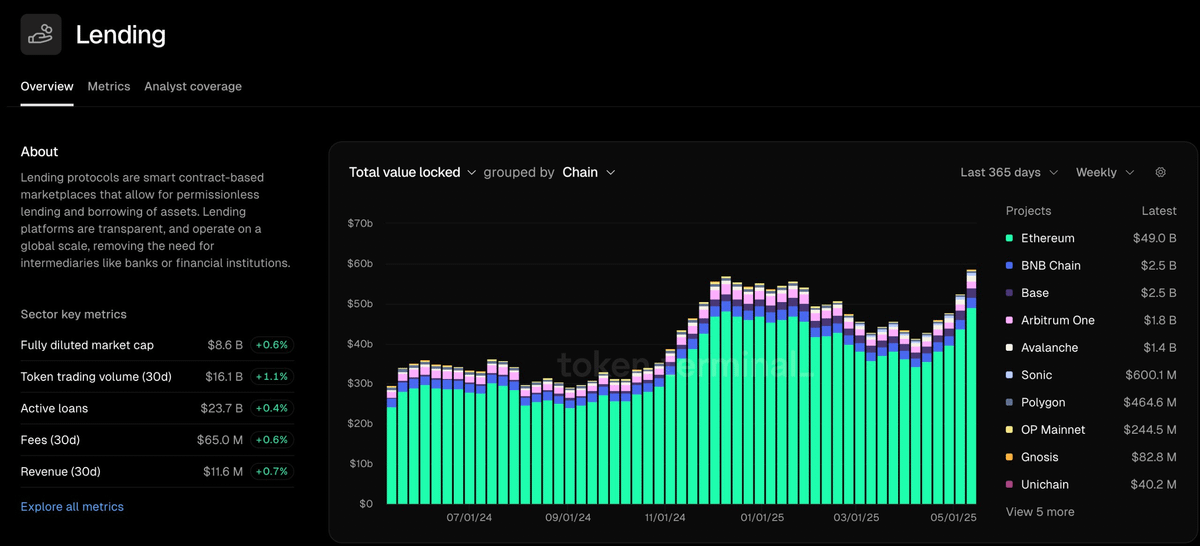

Look DeFi money market is one of the biggest verticals in crypto - we're talking $50B+ locked across protocols.

But here's the thing... it's completely FRAGMENTED.

All of these "$50B" is split across multiple protocols that aren't connected at all.

Look DeFi money market is one of the biggest verticals in crypto - we're talking $50B+ locked across protocols.

But here's the thing... it's completely FRAGMENTED.

All of these "$50B" is split across multiple protocols that aren't connected at all.

5/

Speaking from personal experience,

If I have USDT on Ethereum that I supplied on Aave and want to use that on Polygon , i have to :

▸ Borrow against ETH on Aave first

▸ Bridge to Polygon (pray it doesn't break)

▸ Use funds on Polygon

▸ Bridge back to ETH and repay loan

Pain , right?

Speaking from personal experience,

If I have USDT on Ethereum that I supplied on Aave and want to use that on Polygon , i have to :

▸ Borrow against ETH on Aave first

▸ Bridge to Polygon (pray it doesn't break)

▸ Use funds on Polygon

▸ Bridge back to ETH and repay loan

Pain , right?

6/

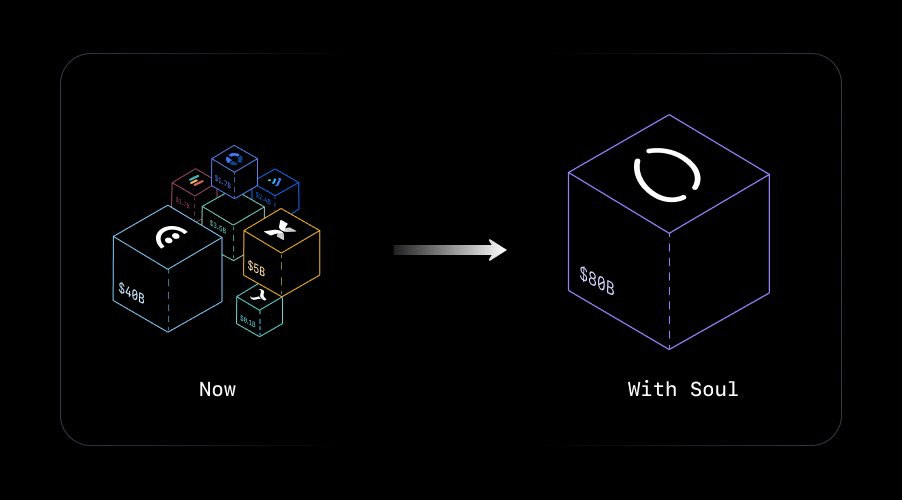

➥ This is what Soul Protocol solves.

Soul builds a meta-layer ABOVE existing lending protocols, connecting them into a single ecosystem.

Not another lending protocol competing with Aave/Compound but a much needed layer UNIFYING all of them.

➥ This is what Soul Protocol solves.

Soul builds a meta-layer ABOVE existing lending protocols, connecting them into a single ecosystem.

Not another lending protocol competing with Aave/Compound but a much needed layer UNIFYING all of them.

7/

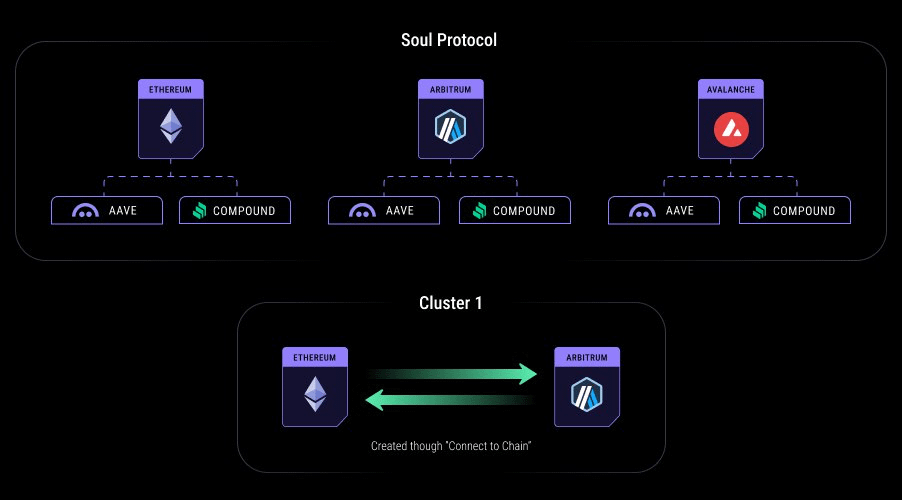

In practical terms:

You can Deposit ETH on Ethereum, borrow USDC on Polygon, and repay on Base - all with native assets through one UI.

It combines advanced cross-chain messaging with their risk controllers to create ONE position across everything.

In practical terms:

You can Deposit ETH on Ethereum, borrow USDC on Polygon, and repay on Base - all with native assets through one UI.

It combines advanced cross-chain messaging with their risk controllers to create ONE position across everything.

8/

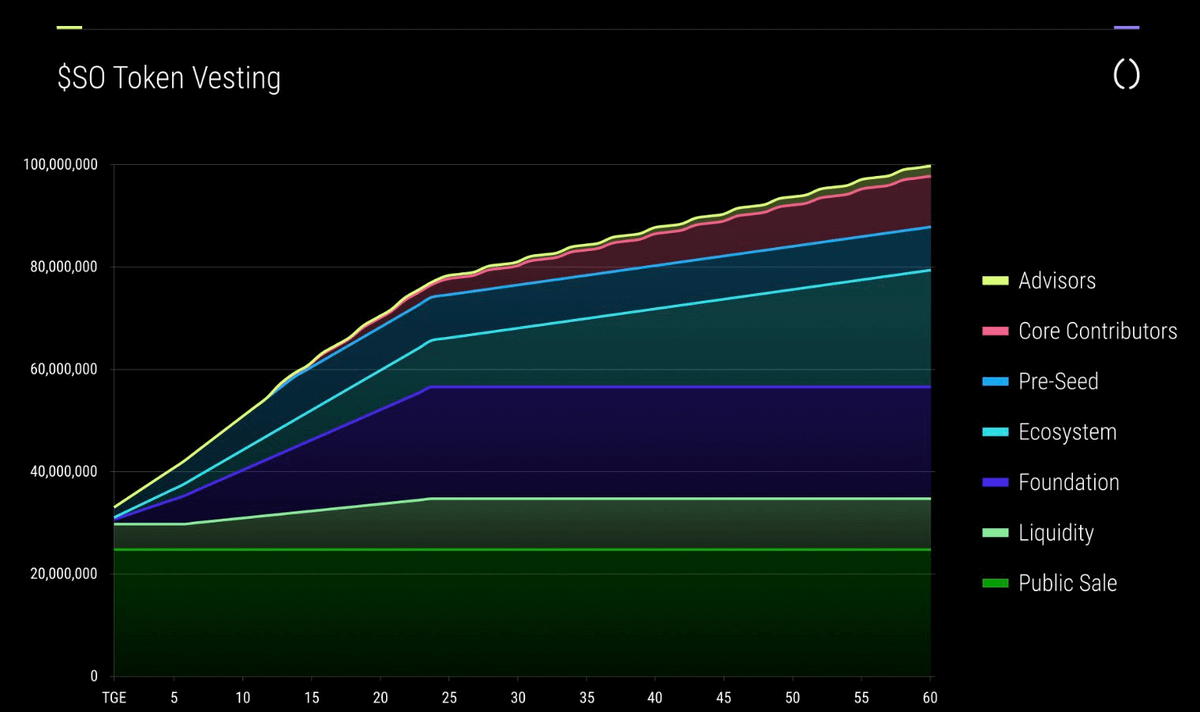

➥ Now let's talk about the $SO token sale:

▸ Total Supply: 100M

▸ Public Sale: 25M

▸ Vesting : 100% unlock on TGE

▸ Initial circulating supply: 33.3M

So wont be a typical low float launch and most of the tokens in hands of public which is good

➥ Now let's talk about the $SO token sale:

▸ Total Supply: 100M

▸ Public Sale: 25M

▸ Vesting : 100% unlock on TGE

▸ Initial circulating supply: 33.3M

So wont be a typical low float launch and most of the tokens in hands of public which is good

9/

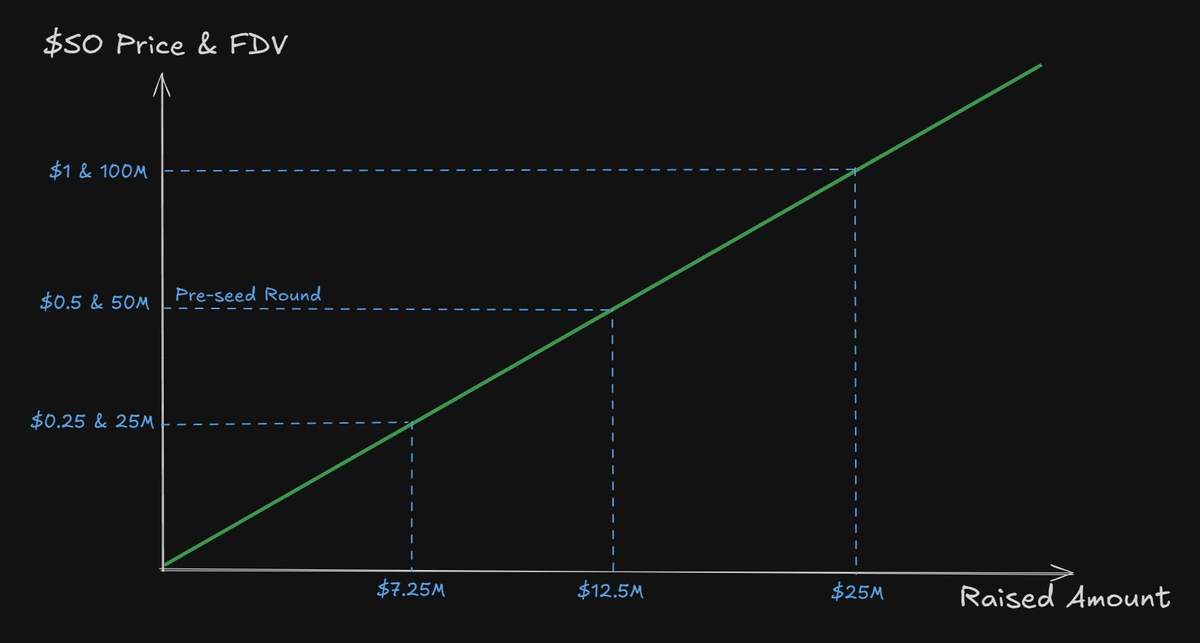

➥ The public sale structure is actually interesting:

They're using market-based price discovery where we degens decide the price based on total raise.

FDV gets set AFTER the Public Sale based on how much gets raised.

Even private investors get the same price we do in public sale. (First time I've seen this)

➥ The public sale structure is actually interesting:

They're using market-based price discovery where we degens decide the price based on total raise.

FDV gets set AFTER the Public Sale based on how much gets raised.

Even private investors get the same price we do in public sale. (First time I've seen this)

10/

For example,

Since 25% of supply is being sold, you can reverse-engineer the fully diluted value (FDV):

▸ $6.25M raise → $25M FDV → $0.25

▸ $12.5M raise → $50M FDV → $0.50

▸ $25M raise → $100M FDV → $1.00

They raised 4M from VCs in pre-seed at 50M FDV ~ $0.5

For example,

Since 25% of supply is being sold, you can reverse-engineer the fully diluted value (FDV):

▸ $6.25M raise → $25M FDV → $0.25

▸ $12.5M raise → $50M FDV → $0.50

▸ $25M raise → $100M FDV → $1.00

They raised 4M from VCs in pre-seed at 50M FDV ~ $0.5

11/

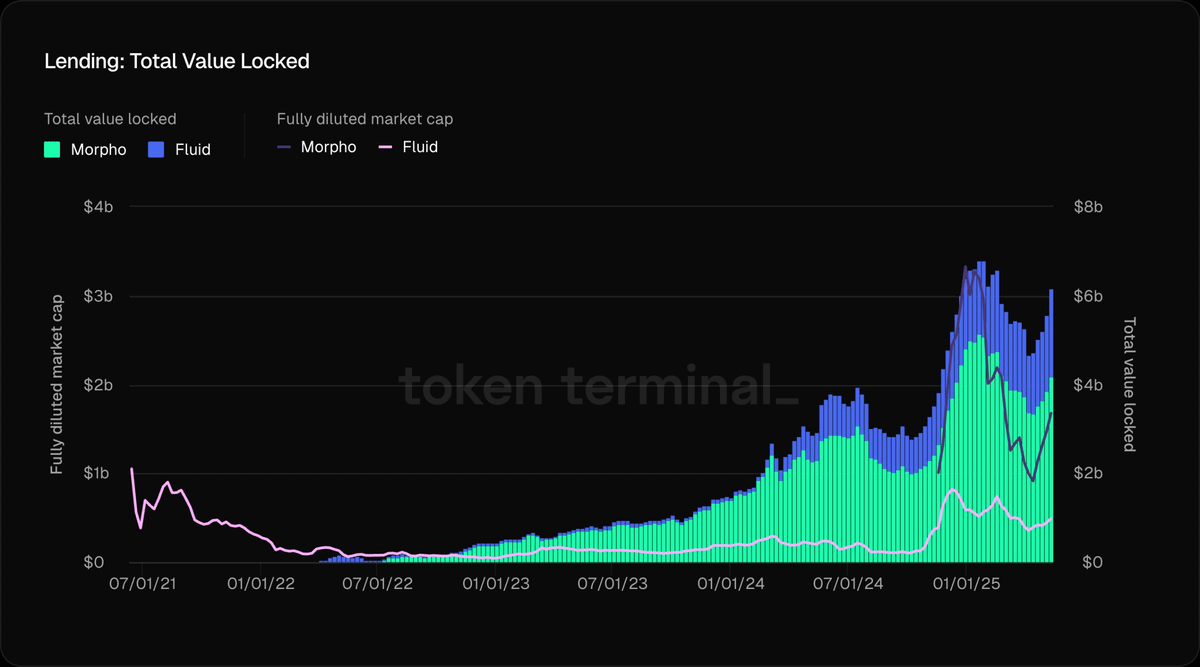

➥ Speculation time!!

Since this is a novel product with no direct competitors, valuation comps are tricky, but if we look at adjacents like:

▸ Morpho : 1.6B FDV

▸ Instadapp/Fluid : 500M FDV

That's around 500-1B FDV range , so might get a upside depending on how the sale goes

➥ Speculation time!!

Since this is a novel product with no direct competitors, valuation comps are tricky, but if we look at adjacents like:

▸ Morpho : 1.6B FDV

▸ Instadapp/Fluid : 500M FDV

That's around 500-1B FDV range , so might get a upside depending on how the sale goes

12/

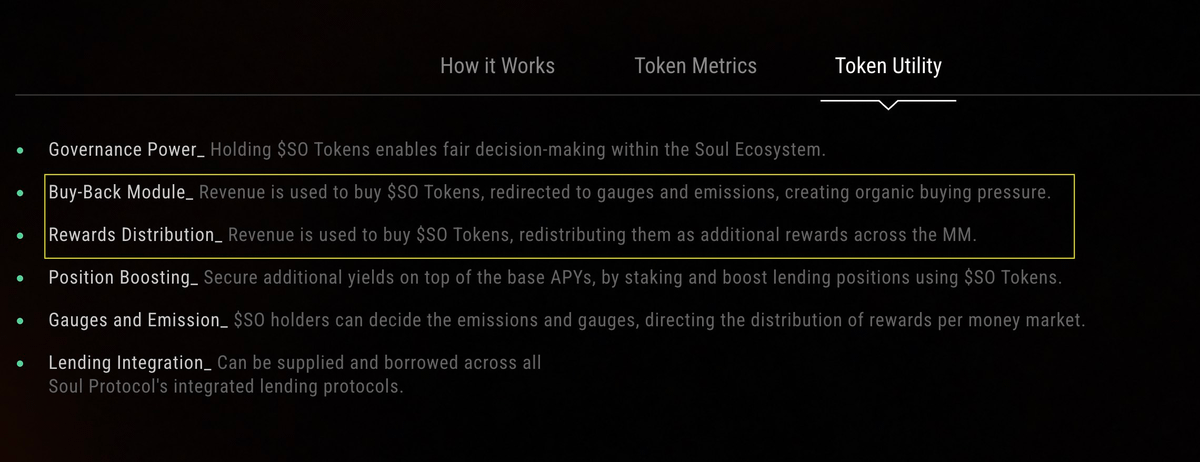

➥ Looking at $SO utilities and flywheels :

Protocol collects fees from all activities (lending, borrowing, liquidations) and these fees BUY BACK $SO from the open market

Buybacks power yield boosters + gauge voting

Higher yields → more users → more fees → more buybacks

➥ Looking at $SO utilities and flywheels :

Protocol collects fees from all activities (lending, borrowing, liquidations) and these fees BUY BACK $SO from the open market

Buybacks power yield boosters + gauge voting

Higher yields → more users → more fees → more buybacks

13/

➥ With conservative estimates:

If Soul captures just 3% of DeFi lending TVL, that’s $1.5B flowing through the protocol.

At typical lending rates, that's like ~$10M in annual fees.

Assuming 30% is allocated to buybacks, that’s $3M/year in organic buy pressure.

If the product scales as intended, this sets up a clean, compounding flywheel for both $SO and the protocol.

➥ With conservative estimates:

If Soul captures just 3% of DeFi lending TVL, that’s $1.5B flowing through the protocol.

At typical lending rates, that's like ~$10M in annual fees.

Assuming 30% is allocated to buybacks, that’s $3M/year in organic buy pressure.

If the product scales as intended, this sets up a clean, compounding flywheel for both $SO and the protocol.

14/

➥ How to get ready for Sale ?

They are having sale on @xLaunchpadApp , currently the KYC has started so if interested you can get KYC ready

Once sale starts , you can contribute anytime you want within the sale period

KYC period: 05 May - 26 May

Sale period: 16 May - 27 May

➥ How to get ready for Sale ?

They are having sale on @xLaunchpadApp , currently the KYC has started so if interested you can get KYC ready

Once sale starts , you can contribute anytime you want within the sale period

KYC period: 05 May - 26 May

Sale period: 16 May - 27 May

https://x.com/xLaunchpadApp/status/1919430171247182115

15/

➥ Potential Airdrop Alpha :

Their testnet has a SEED farming program running. I've been grinding it for a few weeks.

Link:

Just complete the socials task and on-chain tasks , they've also got a Kaito campaign so start yappingapp.soul.io/?referredBy=C2…

➥ Potential Airdrop Alpha :

Their testnet has a SEED farming program running. I've been grinding it for a few weeks.

Link:

Just complete the socials task and on-chain tasks , they've also got a Kaito campaign so start yappingapp.soul.io/?referredBy=C2…

16/

➥ My thoughts:

Everyone's talking about tokenization and RWAs, but our infra is still stuck in 2021 - hopping between bridges and protocols just to move money around.

Soul could solve that problem if they execute well.

➥ My thoughts:

Everyone's talking about tokenization and RWAs, but our infra is still stuck in 2021 - hopping between bridges and protocols just to move money around.

Soul could solve that problem if they execute well.

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉t.me/Alpha_Updates

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉t.me/Alpha_Updates

I hope this thread brought you some value!

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

https://twitter.com/axel_bitblaze69/status/1923077507017785631

• • •

Missing some Tweet in this thread? You can try to

force a refresh