This is one of the most misunderstood chains in tech and AI:

Who makes the chips?

Who builds the machines?

Who powers the servers?

Who supplies the energy?

Let me explain how $NVDA, $TSMC, $ASML, $SMCI, $ANET, $CLS, $VST, $CEG, $OKLO, $CRWV, $NBIS, etc all connect

1/🧵

Who makes the chips?

Who builds the machines?

Who powers the servers?

Who supplies the energy?

Let me explain how $NVDA, $TSMC, $ASML, $SMCI, $ANET, $CLS, $VST, $CEG, $OKLO, $CRWV, $NBIS, etc all connect

1/🧵

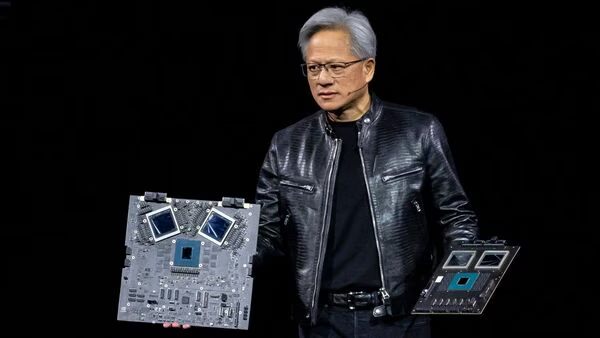

$NVDA is the architect.

They design the world’s most powerful chips like the H100, B100, H200, etc but they don’t manufacture them.

They control the brains of AI. But they need a factory to bring those chips to life…

2/9

They design the world’s most powerful chips like the H100, B100, H200, etc but they don’t manufacture them.

They control the brains of AI. But they need a factory to bring those chips to life…

2/9

That factory is $TSM, the most advanced semiconductor foundry in the world.

$NVDA sends their chip blueprints to TSMC. TSMC fabricates them using 3nm/5nm tech. But to do that… TSMC relies on a single company.

3/9

$NVDA sends their chip blueprints to TSMC. TSMC fabricates them using 3nm/5nm tech. But to do that… TSMC relies on a single company.

3/9

That company is $ASML who is the godfather of chip manufacturing.

They make the EUV lithography machines that etch billions of transistors onto chips. Each machine costs ~$150M+

No $ASML = no $TSM = no $NVDA chips = None of the bubble we see now :-)

4/9

They make the EUV lithography machines that etch billions of transistors onto chips. Each machine costs ~$150M+

No $ASML = no $TSM = no $NVDA chips = None of the bubble we see now :-)

4/9

Now those chips have to run somewhere…

That’s where companies like $DELL or $SMCI comes in.

They build AI server racks massive high efficiency systems that house $NVDA's GPUs in data centers.

SMCI is the body, NVDA is the brain.

5/9

That’s where companies like $DELL or $SMCI comes in.

They build AI server racks massive high efficiency systems that house $NVDA's GPUs in data centers.

SMCI is the body, NVDA is the brain.

5/9

But servers don’t talk to each other magically…

That’s where $ANET shines.

Arista builds ultra-high-speed networking gear that connects thousands of NVIDIA GPUs inside hyperscaler AI clusters.

$NVDA powers compute.

$ANET powers scale.

6/9

That’s where $ANET shines.

Arista builds ultra-high-speed networking gear that connects thousands of NVIDIA GPUs inside hyperscaler AI clusters.

$NVDA powers compute.

$ANET powers scale.

6/9

Not every company has the capital or scale to build massive AI clusters in house. Right?

That’s where $CRWV and $NBIS step in, building cloud-scale $NVDA powered infrastructure that can be rented by startups, enterprises, and researchers.

They're the AWS of AI compute.

7/9

That’s where $CRWV and $NBIS step in, building cloud-scale $NVDA powered infrastructure that can be rented by startups, enterprises, and researchers.

They're the AWS of AI compute.

7/9

All of this runs on massive power. Data centers are hungry.

Enter the power players:

$CEG: supplies clean nuclear + grid power

$VST: provides backup and base load energy

$OKLO: building micro-reactors for future data centers (long-shot, but huge upside)

8/9

Enter the power players:

$CEG: supplies clean nuclear + grid power

$VST: provides backup and base load energy

$OKLO: building micro-reactors for future data centers (long-shot, but huge upside)

8/9

So the AI supply chain looks like this,

➡️ $NVDA designs the chips

➡️ $TSMC makes them

➡️ $ASML builds the tools

➡️ $SMCI creates the servers

➡️ $ANET connects them

➡️ $CRWV helps scale

➡️ $CEG/ $VST power it

➡️ $OKLO bets on next gen energy

9/9

➡️ $NVDA designs the chips

➡️ $TSMC makes them

➡️ $ASML builds the tools

➡️ $SMCI creates the servers

➡️ $ANET connects them

➡️ $CRWV helps scale

➡️ $CEG/ $VST power it

➡️ $OKLO bets on next gen energy

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh