it's rare that I get excited about new DeFi projects

the big 0→1 moments in DeFi happen usually happen when a new yield source is unlocked

until now we had:

- staking yield

- lending yield

- basis trade yield

@infinifilabs is producing a new type of yield:

amplified yield

the big 0→1 moments in DeFi happen usually happen when a new yield source is unlocked

until now we had:

- staking yield

- lending yield

- basis trade yield

@infinifilabs is producing a new type of yield:

amplified yield

how can yield be amplified in a way thats not a ponzu?

turns out it can be done by borrowing an old concept from tradfi called fractional reserve banking

modern banking relies heavily on fractional reserve systems, where banks hold only a portion of customer deposits as reserves and lend out the rest to generate returns

turns out it can be done by borrowing an old concept from tradfi called fractional reserve banking

modern banking relies heavily on fractional reserve systems, where banks hold only a portion of customer deposits as reserves and lend out the rest to generate returns

the core function of a bank is to manage risk appropriately when allocating these deposits and always hold enough liquid assets to honour withdrawals

what if you could re-build banking on-chain and make it safer + produce a new type of (higher) yield as a result?

i'll explain how but quick primer on InfiniFi first

what if you could re-build banking on-chain and make it safer + produce a new type of (higher) yield as a result?

i'll explain how but quick primer on InfiniFi first

just like a bank InfiniFi deploys some assets into liquid DeFi farms and others into longer duration farms

• Liquid farms → Farms that provide instant access to the principal value

e.g $aUSDC in Aave, $fUSDC in Fluid etc.

• Illiquid farms → Farms that provide delayed access to the principal value

Example: Pendle PT's, Ethena $sUSDe, Aave's new $saUSDC (junior)

• Liquid farms → Farms that provide instant access to the principal value

e.g $aUSDC in Aave, $fUSDC in Fluid etc.

• Illiquid farms → Farms that provide delayed access to the principal value

Example: Pendle PT's, Ethena $sUSDe, Aave's new $saUSDC (junior)

and lastly, just like with a bank, users can express their liquidity preferences when depositing into InfiniFi

in retail banking the way people express this preference is by depositing into their checking account (liquid but low to no yield) or their savings account (illiquid but higher yield)

in retail banking the way people express this preference is by depositing into their checking account (liquid but low to no yield) or their savings account (illiquid but higher yield)

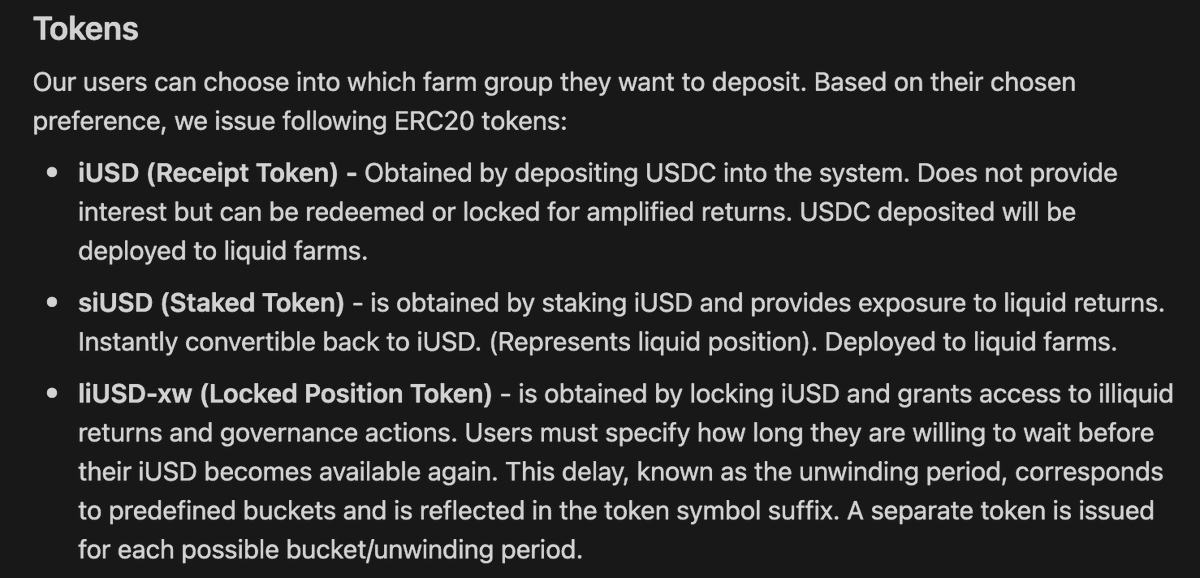

in InfiniFi users express this by deciding to *stake* or *lock* their tokens and based on their choice they receive different receipt tokens

$iUSD = IOU representing a claim of 1 dollar in the system

$siUSD = interest-bearing and provides exposure to the liquid returns generated by the protocol

$liUSD-xw = locked for x weeks where x can be chosen by users but importantly, provides exposure to the yield from longer duration assets in the system

$iUSD = IOU representing a claim of 1 dollar in the system

$siUSD = interest-bearing and provides exposure to the liquid returns generated by the protocol

$liUSD-xw = locked for x weeks where x can be chosen by users but importantly, provides exposure to the yield from longer duration assets in the system

ok great the protocol has a way of knowing users liquidity preferences and manage asset allocation accordingly but what is the benefit for users - how does it amplify yields?

let's say InfiniFi has received 1000 USDC in liquid deposits and 500 USDC in illiquid deposits by users

the naive approach would be to allocate funds accordingly i.e 1000 into liquid at 5% and 500 into illiquid at 10% rate

this achieves nothing new

the liquid depositors could deposit into Fluid directly

and the illiquid depositors could deposit into Pendle PT directly

the naive approach would be to allocate funds accordingly i.e 1000 into liquid at 5% and 500 into illiquid at 10% rate

this achieves nothing new

the liquid depositors could deposit into Fluid directly

and the illiquid depositors could deposit into Pendle PT directly

if however, using fractional reserve banking principles InfiniFi would deploy a portion of liquid deposits into higher-yielding illiquid deposits - say only 20%

yields for both group of depositors would be significantly amplified (see image)

yields for both group of depositors would be significantly amplified (see image)

so this achieves overall higher yield which can be split among both group of depositors while not adding new protocol risk and maintaining liquidity

is there any downside?

is there any downside?

the only downside occurs is if all 100% of liquid depositors want to withdraw at the same time given a portion was allocated into the illiquid bucket

the money wouldn't be gone but liquid depositors would have to wait until the system frees up capital

the money wouldn't be gone but liquid depositors would have to wait until the system frees up capital

the good thing is that this risk is inversely proportional to TVL growth, meaning that as more capital enters, the system becomes more resilient.

Like in TradFi the biggest banks never face liquidity issues.

Like in TradFi the biggest banks never face liquidity issues.

i think InfiniFi comes at a perfect time where stablecoins and RWA's are coming on-chain at increasing speed

as a capital allocator and yield amplification machine it can play a crucial role in the future of DeFi.

as a capital allocator and yield amplification machine it can play a crucial role in the future of DeFi.

• • •

Missing some Tweet in this thread? You can try to

force a refresh