My current stablecoin farms 🧑🌾

I'm earning $260,000 per month with my farms, something crazy to me 7 years ago when I started in crypto from $0, but that's another story..

This is what I'm farming 👇

I'm earning $260,000 per month with my farms, something crazy to me 7 years ago when I started in crypto from $0, but that's another story..

This is what I'm farming 👇

This is my current allocation and expected APR for each farm, many of these numbers are speculative, based on the possible prices of the points I am farming

Average APR: 45% 🐙

Average APR: 45% 🐙

First, we have @PlasmaFDN, a stablecoin blockchain (Tether beta) that reached its $1b cap in just a few minutes

Here we are farming allocation to purchase the token at $500m FDV

Based on my expectations (90 days, $1.5b TVL, and $2b FDV), the APR will be 40%

Im top 37 here 🧑🌾

Here we are farming allocation to purchase the token at $500m FDV

Based on my expectations (90 days, $1.5b TVL, and $2b FDV), the APR will be 40%

Im top 37 here 🧑🌾

In second place, we have @OpenEden_X , one of the fastest-growing stablecoins currently, related to RWA and backed by Binance

Here I'm farming points with leverage. I expect an APR of 62% for my leveraged position

Im top 8 here 🐙

Boost link: portal.openeden.com/bills-campaign…

Here I'm farming points with leverage. I expect an APR of 62% for my leveraged position

Im top 8 here 🐙

Boost link: portal.openeden.com/bills-campaign…

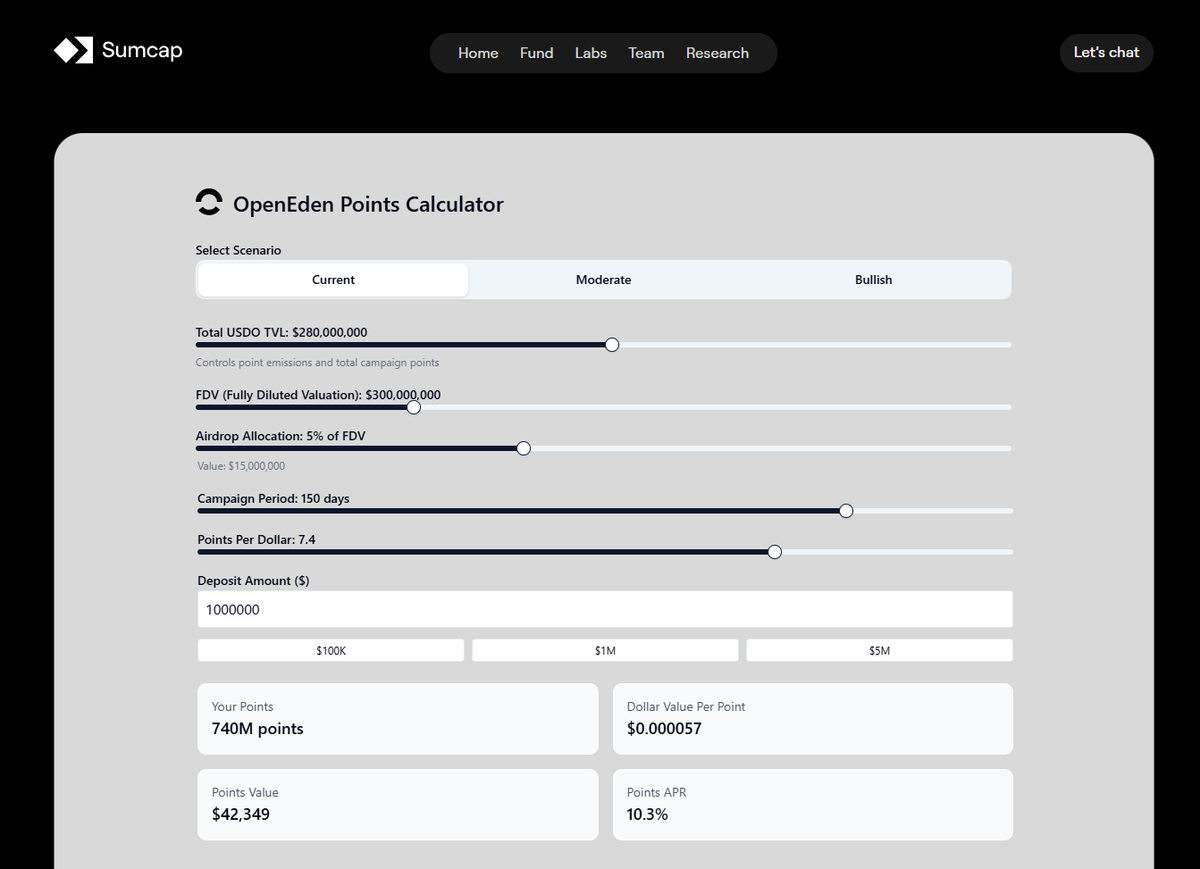

You can calculate the expected value per point on this @Sumcap dashboard

Note: It is advisable to divide the expected value per point by 2, since they are based on an average of 5 points, which has become outdated

I expect around $0.00003 per point sumcap.xyz/points/openeden

Note: It is advisable to divide the expected value per point by 2, since they are based on an average of 5 points, which has become outdated

I expect around $0.00003 per point sumcap.xyz/points/openeden

Next one is @ResolvLabs, the octopus' favorite delta-neutral stablecoin

Here I'm leveraging $RLP. Considering the rates over the last 7 days, I'm earning 36% in real yield here, and I expect at least an additional 10% from S2 points

Boost link: app.resolv.xyz/ref/octoshi

Here I'm leveraging $RLP. Considering the rates over the last 7 days, I'm earning 36% in real yield here, and I expect at least an additional 10% from S2 points

Boost link: app.resolv.xyz/ref/octoshi

Let's continue with @neutrl_labs, a protocol that hasn't launched yet, but that offered a private deal with different options, where I decided to lock my capital for 12 months for a fixed 30% APR

I won't be able to leverage in DeFi, but 30% is very good for passive farm

I won't be able to leverage in DeFi, but 30% is very good for passive farm

The next thing I'm farming is Optimism Superstack, taking advantage of the pools with the highest multipliers currently. The APR is quite speculative, but the good thing is that it's liquid and very low risk

I'm hoping for a 20% APR, but we'll see when it ends in 17 days

I'm hoping for a 20% APR, but we'll see when it ends in 17 days

Let's continue with @usualmoney , where I'm earning 60% APR

I don't recommend it right now, as USD0++ could drop in 5 days, due to people who had requisites for the airdrop (like me)

Perhaps after these people leave, it could be a good opportunity if the USD0++ price is good

I don't recommend it right now, as USD0++ could drop in 5 days, due to people who had requisites for the airdrop (like me)

Perhaps after these people leave, it could be a good opportunity if the USD0++ price is good

And finally, we have @StreamDefi, by depositing, we let professionals like @0xlawlol farm in defi for us

I'm leveraging farming on @eulerfinance, and with my expectations of 10% real yield + 5% points (and current rates) I'm getting an APR of 38%

I'm leveraging farming on @eulerfinance, and with my expectations of 10% real yield + 5% points (and current rates) I'm getting an APR of 38%

This thread took me longer than expected, so if you find it useful or interesting, let me know by sharing it ❤️🐙

• • •

Missing some Tweet in this thread? You can try to

force a refresh