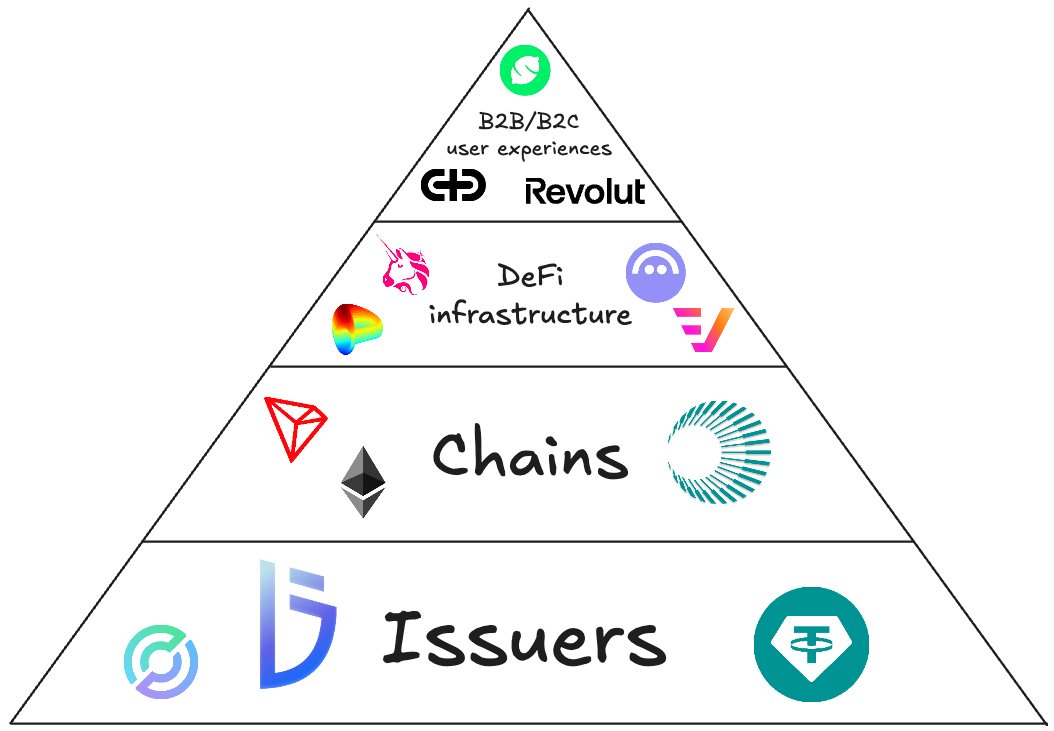

The stablecoin value accrual stack.

When it comes to stablecoins, value accrues at four layers: issuers, chains, DeFi infrastructure and B2B/B2C user experiences.

Issuers win most. In 2024, Tether generated nearly $14 billion in revenue from the US Treasuries it holds. Issuers create value for every layer above by supplying digital dollars that power new use cases across Western and emerging markets.

Chains capture the next share. Ethereum and Tron host roughly $125 billion and $80 billion in stablecoins respectively. Every onchain stablecoin transfer generates revenue for the network. On Tron, for example, most fees come from USD₮ transactions at just $3-4 per transfer.

DeFi infrastructure exists upon chains. Swapping, lending and yield-earning are powered by applications that have functionally become infrastructure; abstracted vaults from @Veda_labs, lending markets on @Aave, and stable swap pools on @CurveFinance and @Uniswap.

B2B and B2C user experiences are the final layer. Businesses and consumers need applications to interact with stablecoins. Crypto-native wallets like @Lemonapp_ar plug into regional rails and banking networks. Fintechs such as @RevolutApp reduce money movement costs with stablecoins. Further, B2B focused companies like @AcctualTeam enable global invoicing in stablecoins.

Ultimately, the greatest room for monetisation and experimentation sits at the top of this stack, but the foundation remains unshakable. As I've written many times; @Tether_to will always hold the throne of the stablecoin kingdom.

When it comes to stablecoins, value accrues at four layers: issuers, chains, DeFi infrastructure and B2B/B2C user experiences.

Issuers win most. In 2024, Tether generated nearly $14 billion in revenue from the US Treasuries it holds. Issuers create value for every layer above by supplying digital dollars that power new use cases across Western and emerging markets.

Chains capture the next share. Ethereum and Tron host roughly $125 billion and $80 billion in stablecoins respectively. Every onchain stablecoin transfer generates revenue for the network. On Tron, for example, most fees come from USD₮ transactions at just $3-4 per transfer.

DeFi infrastructure exists upon chains. Swapping, lending and yield-earning are powered by applications that have functionally become infrastructure; abstracted vaults from @Veda_labs, lending markets on @Aave, and stable swap pools on @CurveFinance and @Uniswap.

B2B and B2C user experiences are the final layer. Businesses and consumers need applications to interact with stablecoins. Crypto-native wallets like @Lemonapp_ar plug into regional rails and banking networks. Fintechs such as @RevolutApp reduce money movement costs with stablecoins. Further, B2B focused companies like @AcctualTeam enable global invoicing in stablecoins.

Ultimately, the greatest room for monetisation and experimentation sits at the top of this stack, but the foundation remains unshakable. As I've written many times; @Tether_to will always hold the throne of the stablecoin kingdom.

• • •

Missing some Tweet in this thread? You can try to

force a refresh