DON'T MISS thic concept

66.7% Pledge in Genus Power

Should you PANIC or Prepare for a RALLY❓

In the stock market, nothing is black & white ,especially when it comes to pledged shares.

Let’s decode this, point by point 👇👇

66.7% Pledge in Genus Power

Should you PANIC or Prepare for a RALLY❓

In the stock market, nothing is black & white ,especially when it comes to pledged shares.

Let’s decode this, point by point 👇👇

Promoter INTENT matters the most

-Genus promoters are actively reducing pledge.

-One promoter recently released a portion.

✅Decreasing pledge = positive signal

✅Promoters with bad intent don't reduce pledges.

-Genus promoters are actively reducing pledge.

-One promoter recently released a portion.

✅Decreasing pledge = positive signal

✅Promoters with bad intent don't reduce pledges.

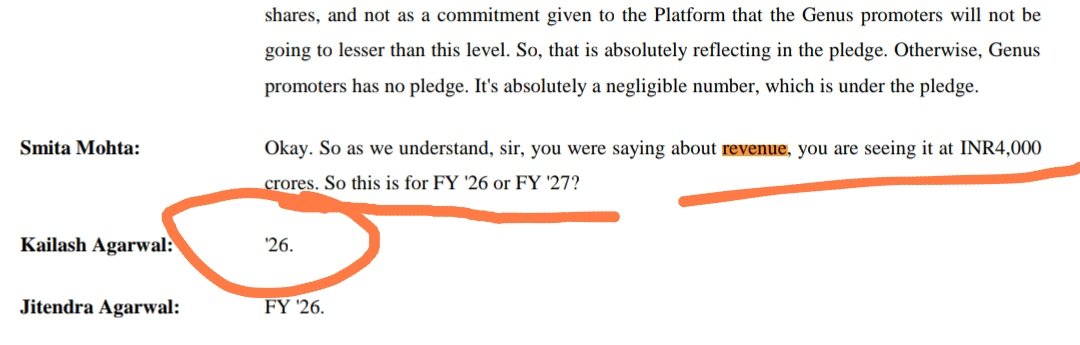

Do the promoters face investors in Concalls?

-YES. They do.

✅Shows transparency and confidence.

✅Shady promoters avoid tough questions.

-YES. They do.

✅Shows transparency and confidence.

✅Shady promoters avoid tough questions.

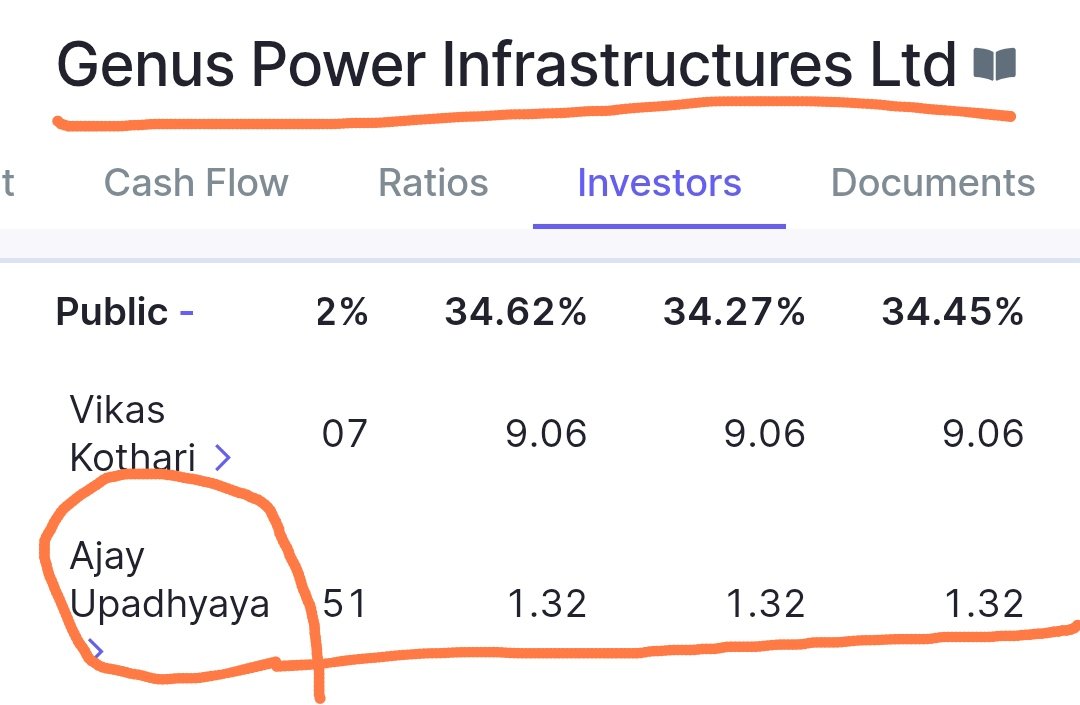

Big names are bullish too

-Ace investor Ajay Upadhyay is on board.

✅Smart money rarely bets on bad intent.

-Ace investor Ajay Upadhyay is on board.

✅Smart money rarely bets on bad intent.

FY 26 Ebitda Margin guidance-18%

✅ Margin expansion on play due to backward integration of software and forward integration of end to end software

✅ Margin expansion on play due to backward integration of software and forward integration of end to end software

Future Target:

- Revenue will increase but debt will not increase

- improvement in working cycle and inventory

- Revenue will increase but debt will not increase

- improvement in working cycle and inventory

Follow @TheAlpha10X for more such analysis.

If you found it useful, Retweet and Share this post

Join my telegram channel for early entries

t.me/TheAlpha10XClub

If you found it useful, Retweet and Share this post

Join my telegram channel for early entries

t.me/TheAlpha10XClub

• • •

Missing some Tweet in this thread? You can try to

force a refresh