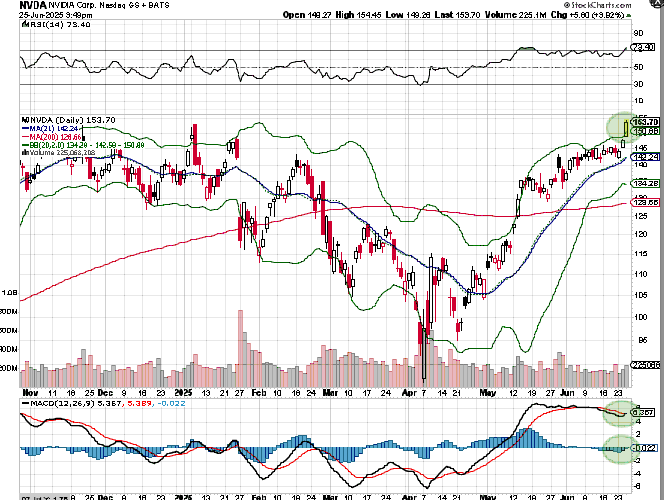

$AAPL A Thread: Bollinger Band Squeeze: Volatility is compressing, and #AAPL is riding the top half of the band. This “squeeze” often precedes a sharp move, and since price is pressing against the upper band, that favors an upside resolution.y channel.

In the chart above, AAPL is exhibiting a classic Bollinger Band compression, often referred to as a volatility squeeze. This phenomenon occurs when the upper and lower bands contract tightly around price due to prolonged low volatility.

Statistically, such contractions precede periods of expansion, and thus signal the likelihood of an impending sharp directional move.

This target aligns with prior resistance and would represent a ~10% rally. However, failure to break above the 50-day resistance could result in a retracement to the mid-$190s. In short, this Bollinger Band squeeze reflects a market in stasis, storing potential energy.

The next expansion will likely define the dominant trend for weeks to come.

This looks like a coiled spring, and if price clears $205 with volume, it could ignite toward $215–220 short term. But if it gets rejected at the 50-day MA again, expect a pullback to $195, but a close above the 50-day is the buy signal that we need is still pending.

A break of that zone would negate the recent attempt at a base and could trigger downside toward $179, which is the 200-day on the weekly chart. @threadreaderapp unroll

If you want to learn how to trade options, get our trades in real time everyday - join us by searching for SoraTrades on Patreon or tap the link in the bio

• • •

Missing some Tweet in this thread? You can try to

force a refresh