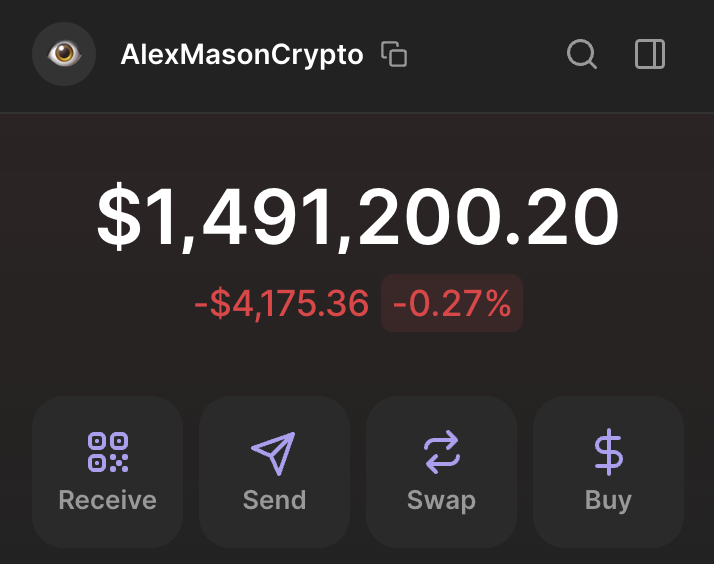

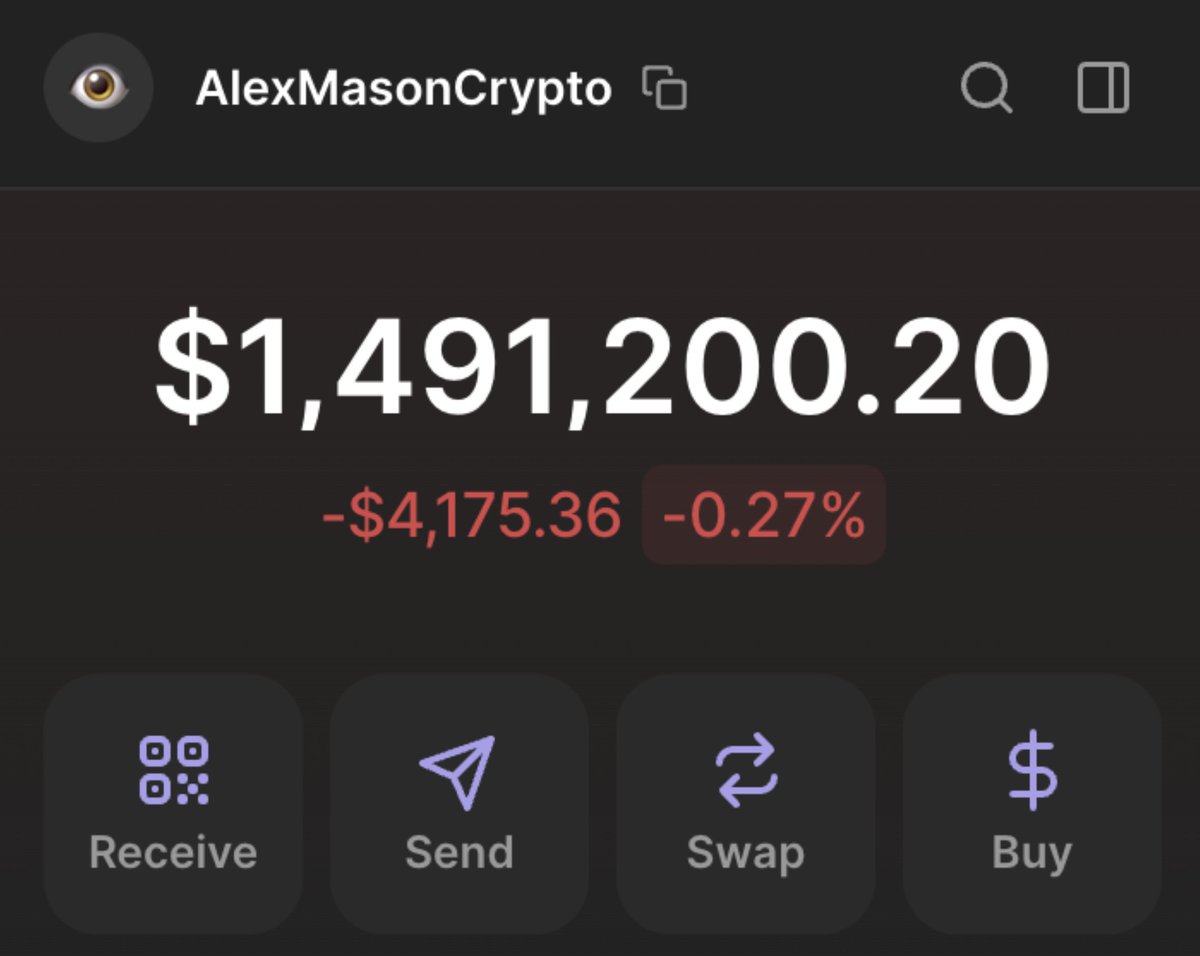

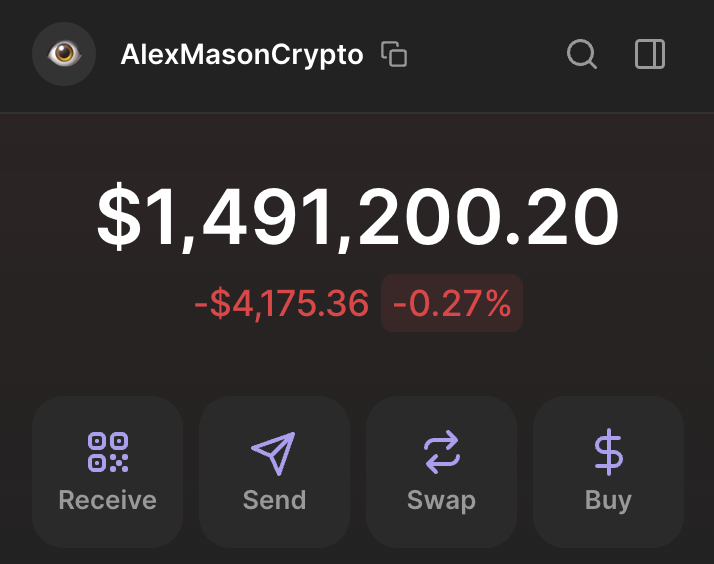

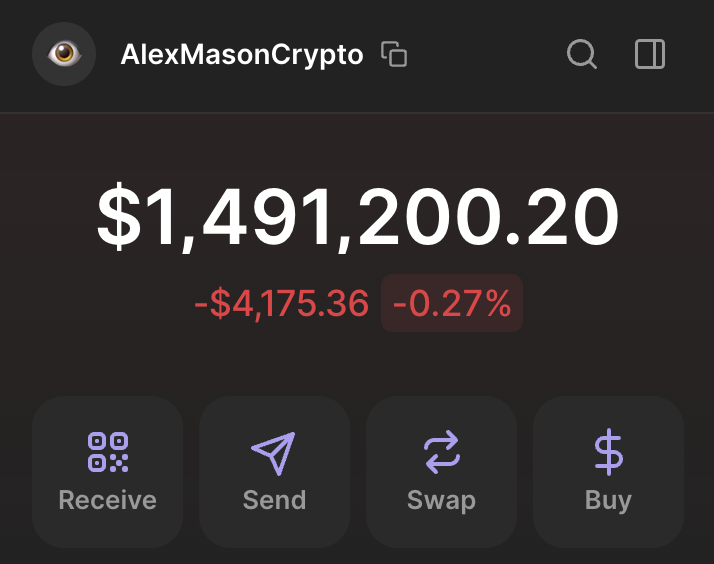

I'm giving away $10,000 to my followers.

To enter:

1) Like + RT the first tweet in this thread.

2) Subscribe to my Telegram Channel:

3) Drop your Solana wallet address in the comments below the thread.

P.S. You must be my follower on X too — I’ll verify all entries.t.me/masonsalpha

To enter:

1) Like + RT the first tweet in this thread.

2) Subscribe to my Telegram Channel:

3) Drop your Solana wallet address in the comments below the thread.

P.S. You must be my follower on X too — I’ll verify all entries.t.me/masonsalpha

1 / Keep your 9-5 and built safety net first.

Before I started in crypto, I made sure I had savings—at least $3k I was willing to invest—and extra cash for emergencies.

Having a steady income gave me the freedom to take risks without panicking.

Before I started in crypto, I made sure I had savings—at least $3k I was willing to invest—and extra cash for emergencies.

Having a steady income gave me the freedom to take risks without panicking.

2 / Why $3k?

This is the minimum I believe you need to make solid X’s in crypto. It’s enough to diversify into legit projects and still take calculated risks.

Here’s my rule: Never put more than 10% of this into a memecoin.

It keeps your portfolio balanced—and lets you sleep well at night.

This is the minimum I believe you need to make solid X’s in crypto. It’s enough to diversify into legit projects and still take calculated risks.

Here’s my rule: Never put more than 10% of this into a memecoin.

It keeps your portfolio balanced—and lets you sleep well at night.

3 / Build connections.

Crypto isn’t just about charts—it’s about people.

I made it a priority to join communities, network with builders, and connect with experienced traders.

The best opportunities often come from someone you know, not something you see on a screen.

Relationships = leverage.

Crypto isn’t just about charts—it’s about people.

I made it a priority to join communities, network with builders, and connect with experienced traders.

The best opportunities often come from someone you know, not something you see on a screen.

Relationships = leverage.

☝️ That's why I’m building a private community of the sharpest minds in crypto.

Early plays. Alpha drops. Real research.

100x moves don’t come from Twitter—they start here:

Join now. It's free.t.me/masonsalpha

Early plays. Alpha drops. Real research.

100x moves don’t come from Twitter—they start here:

Join now. It's free.t.me/masonsalpha

4 / Learn obsessively.

I treated crypto like a full-time course. I studied blockchain fundamentals, tokenomics, and how to spot scams.

The more I learned, the better my instincts got. In crypto, the more you know, the better your chances of making it.

Knowledge really is power.

I treated crypto like a full-time course. I studied blockchain fundamentals, tokenomics, and how to spot scams.

The more I learned, the better my instincts got. In crypto, the more you know, the better your chances of making it.

Knowledge really is power.

5 / Start small but think big.

I didn’t risk everything at once. I started with what I could afford to lose and built up slowly.

Every small win added up, and every mistake taught me something.

For me, it’s always been about playing the long game, not chasing overnight success.

I didn’t risk everything at once. I started with what I could afford to lose and built up slowly.

Every small win added up, and every mistake taught me something.

For me, it’s always been about playing the long game, not chasing overnight success.

6 / Stay skeptical.

99% of crypto projects will fail—accept it. Learn to spot the red flags:

- Overpromising roadmaps.

- Centralized token control.

- Projects that lost momentum and faded.

If something feels too good to be true, trust your gut—it probably is.

99% of crypto projects will fail—accept it. Learn to spot the red flags:

- Overpromising roadmaps.

- Centralized token control.

- Projects that lost momentum and faded.

If something feels too good to be true, trust your gut—it probably is.

7 / Take your mental health seriously.

I’d make mental health a priority. Crypto can be an emotional rollercoaster, and burnout is real.

Meditate, exercise, sleep well—whatever it takes to keep a clear mind.

A calm, focused you will always make better decisions.

I’d make mental health a priority. Crypto can be an emotional rollercoaster, and burnout is real.

Meditate, exercise, sleep well—whatever it takes to keep a clear mind.

A calm, focused you will always make better decisions.

8 / Diversify your knowledge.

Don’t just learn trading; explore other crypto careers:

- Building dApps.

- Marketing/Web3 communities.

- Contributing to DAOs.

The ecosystem is vast—find your niche.

Don’t just learn trading; explore other crypto careers:

- Building dApps.

- Marketing/Web3 communities.

- Contributing to DAOs.

The ecosystem is vast—find your niche.

9 / Get in early.

I would follow big influencers and keep notifications on at all times.

The best opportunities go to those who act fast and get into the narrative on time.

In crypto, timing is everything—being late means you’re chasing scraps.

I would follow big influencers and keep notifications on at all times.

The best opportunities go to those who act fast and get into the narrative on time.

In crypto, timing is everything—being late means you’re chasing scraps.

10 / Master security.

Make security a top priority. Use hardware wallets, avoid shady links, and never share your private keys.

In crypto, one mistake can cost everything.

Protect your assets like your future depends on it—because it does.

Make security a top priority. Use hardware wallets, avoid shady links, and never share your private keys.

In crypto, one mistake can cost everything.

Protect your assets like your future depends on it—because it does.

11 / Be patient.

Wealth in crypto isn’t built overnight—it’s about holding strong projects and letting time do the work.

The people who make it are the ones who stayed calm and didn’t chase every pump. Patience always wins.

Wealth in crypto isn’t built overnight—it’s about holding strong projects and letting time do the work.

The people who make it are the ones who stayed calm and didn’t chase every pump. Patience always wins.

12 / Embrace bear markets.

See bear markets as opportunities, not disasters. This is when real wealth is built—by accumulating solid projects while everyone else is panicking.

The next bull run rewards those who stayed focused during the downturn.

See bear markets as opportunities, not disasters. This is when real wealth is built—by accumulating solid projects while everyone else is panicking.

The next bull run rewards those who stayed focused during the downturn.

13 / Document your journey.

Share your wins, losses, and lessons on X.

By documenting the process, you not only help others but also build a personal brand.

In the crypto space, being visible and authentic often leads to unexpected opportunities.

Share your wins, losses, and lessons on X.

By documenting the process, you not only help others but also build a personal brand.

In the crypto space, being visible and authentic often leads to unexpected opportunities.

14 / Be adaptable.

Crypto evolves fast—what works today might not work tomorrow.

Stay curious, keep learning, and be ready to pivot your strategies.

The ability to adapt is what separates those who thrive from those who get left behind.

Crypto evolves fast—what works today might not work tomorrow.

Stay curious, keep learning, and be ready to pivot your strategies.

The ability to adapt is what separates those who thrive from those who get left behind.

15 / Lastly, give back.

Share your knowledge, help newcomers, and contribute to the community. Crypto isn’t just about making money—it’s about building something bigger.

Giving back creates connections and leaves a legacy far beyond profits.

Share your knowledge, help newcomers, and contribute to the community. Crypto isn’t just about making money—it’s about building something bigger.

Giving back creates connections and leaves a legacy far beyond profits.

I know how tough it can be to find the next 100x on your own.

That’s why I’ve compiled a list of 10 wallets that consistently deliver:

- A strong win rate (60-80%)

- Proven 100x trades with real size (no $10 buys)

This list will be exclusively available to my Telegram Channel subscribers.

Join now to get access for free: t.me/masonsalpha

That’s why I’ve compiled a list of 10 wallets that consistently deliver:

- A strong win rate (60-80%)

- Proven 100x trades with real size (no $10 buys)

This list will be exclusively available to my Telegram Channel subscribers.

Join now to get access for free: t.me/masonsalpha

I used to post 100x plays here. Then came the copy-traders, frontrunners, and bots. Too risky. Too crowded.

Now all alpha goes to my private Telegram.

It’s still open — but not for long. Once it’s closed, there’s no way in. Last chance to join: t.me/masonsalpha

Now all alpha goes to my private Telegram.

It’s still open — but not for long. Once it’s closed, there’s no way in. Last chance to join: t.me/masonsalpha

• • •

Missing some Tweet in this thread? You can try to

force a refresh