1/ Today we explore the rise of AI Agents in DeFi, and how they might reshape the yield landscape.

There are 3 main types of AI Agents in DeFi:

1. Research Agents provide insights and analysis on markets or tokens via LLM interaction

2. UI Agents replace DeFi interfaces, enabling users to interact with protocols through chat-based interfaces

3. Execution Agents autonomously deploy strategies, such as yield farming or trading. These often do not use LLMs in the UI

Some agents span multiple categories, for example by combining insights with automated execution.

Recently, Execution Agents focused on yield have seen rapid growth.

Let’s dive into this subcategory 🧵

There are 3 main types of AI Agents in DeFi:

1. Research Agents provide insights and analysis on markets or tokens via LLM interaction

2. UI Agents replace DeFi interfaces, enabling users to interact with protocols through chat-based interfaces

3. Execution Agents autonomously deploy strategies, such as yield farming or trading. These often do not use LLMs in the UI

Some agents span multiple categories, for example by combining insights with automated execution.

Recently, Execution Agents focused on yield have seen rapid growth.

Let’s dive into this subcategory 🧵

2/ Yield Optimization Agents are Execution Agents that target yield generation within specific parameters, such as whitelisted vaults or pre-approved assets.

The core thesis is that AI can outperform rule-based systems by making more responsive and informed allocation decisions, without requiring constant user input.

Progressively, these agents may integrate user preferences like risk tolerance or coordinate as agent swarms for more adaptive execution.

There are additional risks to consider. Smart contract risk increases with an additional layer of agentic interaction, and most of these emerging protocols are not battle-tested.

Still, interest is growing.

From first-party data of AI Agents protocol, stablecoin-focused AI Agent TVL passed ~$20M in June 2025, mainly on @base .

The core thesis is that AI can outperform rule-based systems by making more responsive and informed allocation decisions, without requiring constant user input.

Progressively, these agents may integrate user preferences like risk tolerance or coordinate as agent swarms for more adaptive execution.

There are additional risks to consider. Smart contract risk increases with an additional layer of agentic interaction, and most of these emerging protocols are not battle-tested.

Still, interest is growing.

From first-party data of AI Agents protocol, stablecoin-focused AI Agent TVL passed ~$20M in June 2025, mainly on @base .

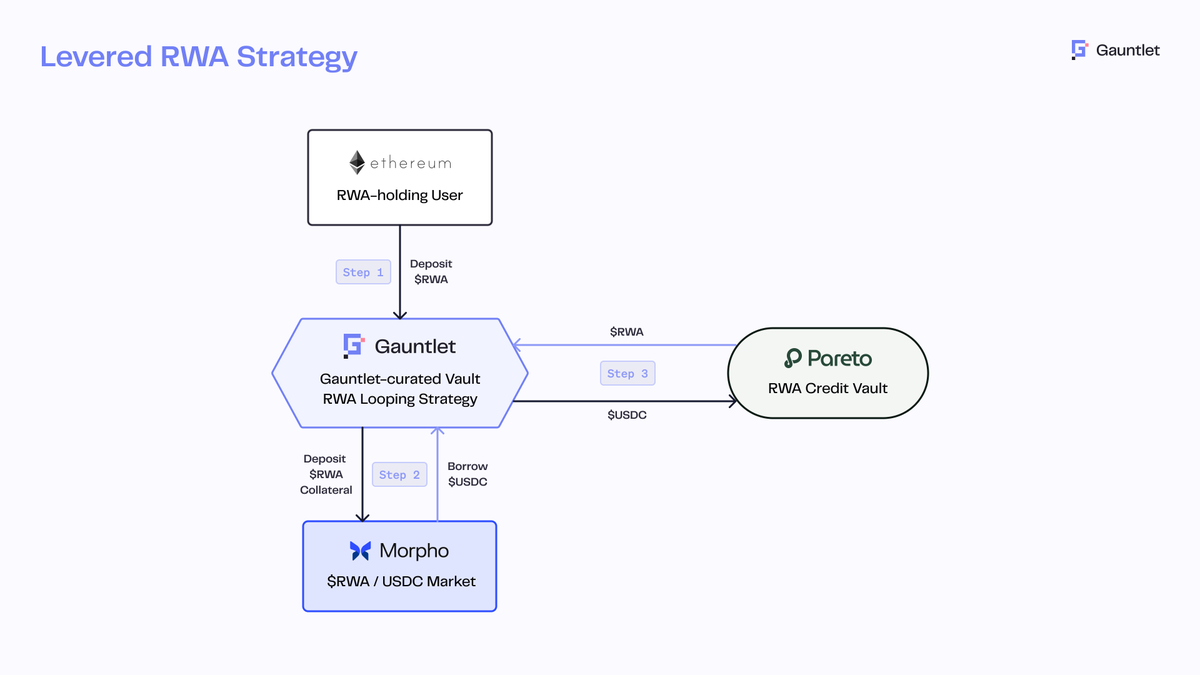

3/ What is the role of curators like Gauntlet in the AI yield process?

AI Agents rely on permissionless vaults to deploy capital. The more vaults they support, the more options they have. But that also introduces more risk, including liquidation, depeg, and smart contract exploits.

Curators manage risk, optimize liquidity, and design vaults for risk-adjusted yield. These vaults are accessible to any user or AI agent.

Gauntlet USD Alpha, our latest product, is well-suited for agents seeking robust cross-chain, risk-adjusted yield starting from Base USDC.

Here are 3 AI Agent protocols allocating to Gauntlet-curated vaults 👇

AI Agents rely on permissionless vaults to deploy capital. The more vaults they support, the more options they have. But that also introduces more risk, including liquidation, depeg, and smart contract exploits.

Curators manage risk, optimize liquidity, and design vaults for risk-adjusted yield. These vaults are accessible to any user or AI agent.

Gauntlet USD Alpha, our latest product, is well-suited for agents seeking robust cross-chain, risk-adjusted yield starting from Base USDC.

Here are 3 AI Agent protocols allocating to Gauntlet-curated vaults 👇

4/ Arma Agents by @gizatechxyz

Launched in November 2024 on Mode, now live on Base with USDC. Arma Agents allocate across @MorphoLabs , @MoonwellDeFi , @eulerfinance, @SeamlessFi , @0xfluid , @compoundfinance , and @aave .

Yield is generated from vaults and GIZA token incentives.

Rebalancing occurs every few days to daily.

Vault incentives are not compounded and must be redeemed at withdrawal by deactivating the agent.

Jan 1 – Jul 1, 2025

- TVL: ~$200k to ~$11.2M (+5,500%)

- Agents: ~2,600 to ~33,000 (+1,170%)

- Avg TVL/Agent: ~$76 to ~$339 (+346%)

- Agentic Volume: ~$324M

- Transactions: ~200,000

Launched in November 2024 on Mode, now live on Base with USDC. Arma Agents allocate across @MorphoLabs , @MoonwellDeFi , @eulerfinance, @SeamlessFi , @0xfluid , @compoundfinance , and @aave .

Yield is generated from vaults and GIZA token incentives.

Rebalancing occurs every few days to daily.

Vault incentives are not compounded and must be redeemed at withdrawal by deactivating the agent.

Jan 1 – Jul 1, 2025

- TVL: ~$200k to ~$11.2M (+5,500%)

- Agents: ~2,600 to ~33,000 (+1,170%)

- Avg TVL/Agent: ~$76 to ~$339 (+346%)

- Agentic Volume: ~$324M

- Transactions: ~200,000

5/ Morpho Agents by @BrahmaFi

Launched January 2024 on Base. Allocates USDC and WETH across @MorphoLabs vaults based on parameters like APY thresholds, TVL minimums, and curator preferences.

Rebalancing is user-configurable and ranges from daily to monthly.

Reward tokens are not compounded and must be claimed manually.

Withdrawals can be initiated at any time.

Jan 1 – Jun 25, 2025

- TVL: ~$1.1M to ~$9.5M (+760%)

- Agents: ~353 to ~3,103 (+779%)

- Avg TVL/Agent: ~$3,116 to ~$3,061 (−1.76%)

- Agentic Volume: ~$21M

- Transactions: ~10,000

Launched January 2024 on Base. Allocates USDC and WETH across @MorphoLabs vaults based on parameters like APY thresholds, TVL minimums, and curator preferences.

Rebalancing is user-configurable and ranges from daily to monthly.

Reward tokens are not compounded and must be claimed manually.

Withdrawals can be initiated at any time.

Jan 1 – Jun 25, 2025

- TVL: ~$1.1M to ~$9.5M (+760%)

- Agents: ~353 to ~3,103 (+779%)

- Avg TVL/Agent: ~$3,116 to ~$3,061 (−1.76%)

- Agentic Volume: ~$21M

- Transactions: ~10,000

6/ @FungiAgents

Launched in April 2025 on Base. Allocates USDC across @aave , @MorphoLabs , @MoonwellDeFi , and @0xfluid . Rebalances daily based on APYs, incentives, gas costs, and protocol risk.

Each user operates a smart contract account with automation permissions set via session keys.

Vault rewards are not compounded, with support for claiming being built.

Withdrawals can be executed at any time.

Apr 1 – Jun 25, 2025

- TVL: ~$166 to ~$412k

- Agents: ~10 to ~216

- Avg TVL/Agent: ~$16 to ~$1,900

- Agentic Volume: ~$28M

- Transactions: ~30,000

Launched in April 2025 on Base. Allocates USDC across @aave , @MorphoLabs , @MoonwellDeFi , and @0xfluid . Rebalances daily based on APYs, incentives, gas costs, and protocol risk.

Each user operates a smart contract account with automation permissions set via session keys.

Vault rewards are not compounded, with support for claiming being built.

Withdrawals can be executed at any time.

Apr 1 – Jun 25, 2025

- TVL: ~$166 to ~$412k

- Agents: ~10 to ~216

- Avg TVL/Agent: ~$16 to ~$1,900

- Agentic Volume: ~$28M

- Transactions: ~30,000

7/ Are you building in the AI and yield space?

We’d love to connect. Our DMs are open, or fill out this form:

form.typeform.com/to/wL0KbKAT?ut…

We’d love to connect. Our DMs are open, or fill out this form:

form.typeform.com/to/wL0KbKAT?ut…

• • •

Missing some Tweet in this thread? You can try to

force a refresh