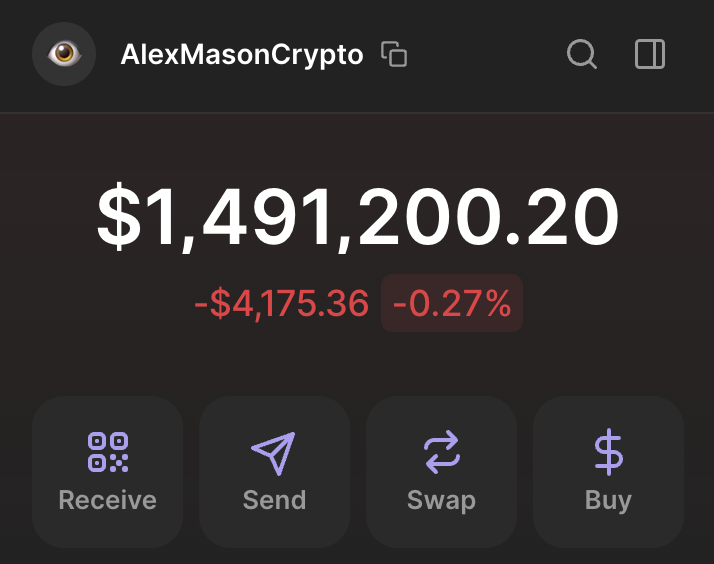

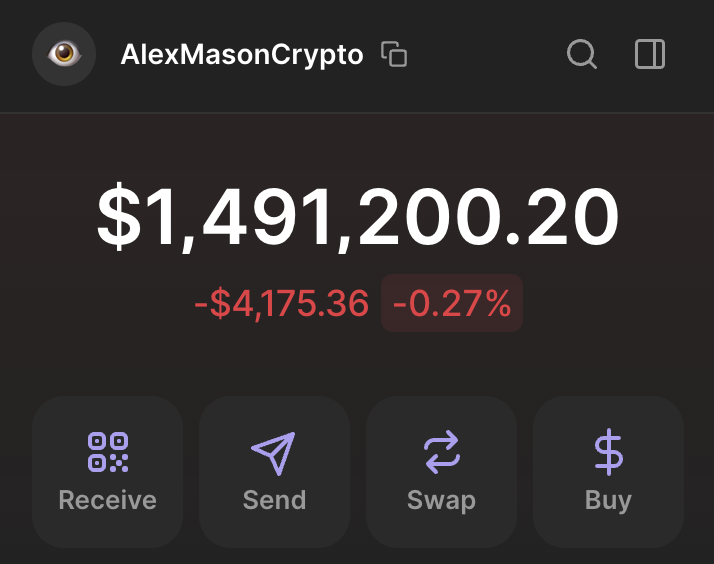

I'm giving away $10,000 to my followers.

To enter:

1) Like + RT the first tweet in this thread.

2) Subscribe to my Telegram Channel:

3) Drop your Solana wallet address in the comments below the thread.

P.S. You must be my follower on X too — I’ll verify all entries.t.me/masonsalpha

To enter:

1) Like + RT the first tweet in this thread.

2) Subscribe to my Telegram Channel:

3) Drop your Solana wallet address in the comments below the thread.

P.S. You must be my follower on X too — I’ll verify all entries.t.me/masonsalpha

1 / What happens when all 21 million Bitcoins are mined?

Most people assume it’ll take over 100 years—so it’s not worth thinking about.

But here’s the truth:

The real problem will hit long before 2140.

A breakdown of Bitcoin’s future security model 👇

Most people assume it’ll take over 100 years—so it’s not worth thinking about.

But here’s the truth:

The real problem will hit long before 2140.

A breakdown of Bitcoin’s future security model 👇

2 / Right now, Bitcoin miners are paid to protect the network.

They spend around 1.8 million kilowatt-hours of energy to mine a single block.

At $0.05/kWh, that’s about $92,000 per block just for electricity.

So why do they do it?

Because the incentives work.

They spend around 1.8 million kilowatt-hours of energy to mine a single block.

At $0.05/kWh, that’s about $92,000 per block just for electricity.

So why do they do it?

Because the incentives work.

3 / Miners currently earn 3.125 BTC per block.

At today’s price, that’s ~$370,800.

Add ~$25,000 in transaction fees, and their total revenue is ~$345,800.

They’re profitable.

The system is secure.

But here’s the problem…

At today’s price, that’s ~$370,800.

Add ~$25,000 in transaction fees, and their total revenue is ~$345,800.

They’re profitable.

The system is secure.

But here’s the problem…

4 / The block reward halves every 4 years.

That’s hardcoded.

By 2032, the reward drops below 1 BTC.

By 2040, over 99% of all BTC will be mined.

Eventually, the block reward hits zero.

At that point, miners rely entirely on transaction fees.

That’s hardcoded.

By 2032, the reward drops below 1 BTC.

By 2040, over 99% of all BTC will be mined.

Eventually, the block reward hits zero.

At that point, miners rely entirely on transaction fees.

5 / But today, fees only make up ~7% of miner revenue.

That’s nowhere near enough.

Just to cover electricity costs, fees would need to 4x.

To cover hardware, risk, and profit? More like 6–10x.

That raises serious questions about sustainability.

That’s nowhere near enough.

Just to cover electricity costs, fees would need to 4x.

To cover hardware, risk, and profit? More like 6–10x.

That raises serious questions about sustainability.

6 / “Won’t fees go up as demand grows?”

Maybe.

We’ve seen short-term fee spikes during:

– Bull runs

– NFT hype (Ordinals)

– Network congestion

But these are temporary bursts, not sustainable trends.

Maybe.

We’ve seen short-term fee spikes during:

– Bull runs

– NFT hype (Ordinals)

– Network congestion

But these are temporary bursts, not sustainable trends.

Important: I’m building a private community of the sharpest minds in crypto.

Early plays. Alpha drops. Real research.

100x moves don’t come from Twitter—they start here:

Join now. It's free.t.me/masonsalpha

Early plays. Alpha drops. Real research.

100x moves don’t come from Twitter—they start here:

Join now. It's free.t.me/masonsalpha

7 / Bitcoin’s block space is limited to 4MB every 10 minutes.

If fees are the only incentive left, blocks need to be:

– Full, and

– Full of high-value transactions

Every. Single. Block.

Forever.

That’s a big ask.

If fees are the only incentive left, blocks need to be:

– Full, and

– Full of high-value transactions

Every. Single. Block.

Forever.

That’s a big ask.

8 / Some propose moving most activity to Layer 2 (like Lightning) to save block space.

That helps scale.

But it also means fewer on-chain transactions, which reduces fees—and hurts miner incentives.

Scaling and security may be at odds.

That helps scale.

But it also means fewer on-chain transactions, which reduces fees—and hurts miner incentives.

Scaling and security may be at odds.

9 / There’s another risk: security budget.

Bitcoin’s security comes from making 51% attacks too expensive.

If miner revenue drops, so does network security.

Some researchers estimate Bitcoin needs at least $100k per block to remain safe from attacks.

Bitcoin’s security comes from making 51% attacks too expensive.

If miner revenue drops, so does network security.

Some researchers estimate Bitcoin needs at least $100k per block to remain safe from attacks.

10 / So what are the solutions?

Some ideas being floated:

– Tail emission: A small perpetual block reward (like Monero)

– MEV (miner extractable value): Let miners profit from on-chain arbitrage

– Bitcoin as global settlement layer

All have trade-offs.

Some ideas being floated:

– Tail emission: A small perpetual block reward (like Monero)

– MEV (miner extractable value): Let miners profit from on-chain arbitrage

– Bitcoin as global settlement layer

All have trade-offs.

11 / Tail emission breaks the 21M cap—a sacred rule for Bitcoiners.

MEV is controversial—it might introduce centralization pressures and miner manipulation.

Becoming a global settlement layer sounds great—but it depends on massive, sustained demand.

MEV is controversial—it might introduce centralization pressures and miner manipulation.

Becoming a global settlement layer sounds great—but it depends on massive, sustained demand.

12 / Here’s the uncomfortable truth:

Bitcoin doesn’t guarantee its own security.

It relies on external incentives—primarily money.

If those incentives break, the system becomes vulnerable.

Not because of bad code—but because of economics.

Bitcoin doesn’t guarantee its own security.

It relies on external incentives—primarily money.

If those incentives break, the system becomes vulnerable.

Not because of bad code—but because of economics.

13 / The question is no longer “will Bitcoin run out of coins?”

It’s:

Can a finite-supply system survive long-term without compromising on:

– Security

– Decentralization

– Monetary policy

That’s the real debate.

It’s:

Can a finite-supply system survive long-term without compromising on:

– Security

– Decentralization

– Monetary policy

That’s the real debate.

14 / None of this means Bitcoin is doomed.

It just means long-term sustainability isn’t solved yet.

We need more:

– Users

– High-value use cases

– Fee-generating demand

Because without it, security could degrade silently over time.

It just means long-term sustainability isn’t solved yet.

We need more:

– Users

– High-value use cases

– Fee-generating demand

Because without it, security could degrade silently over time.

15 / Bitcoin is the most secure blockchain ever created.

But its future depends on incentives staying aligned.

No miners = no security.

No security = no Bitcoin.

That’s the part I can’t stop thinking about.

But its future depends on incentives staying aligned.

No miners = no security.

No security = no Bitcoin.

That’s the part I can’t stop thinking about.

I used to post 100x plays here. Then came the copy-traders, frontrunners, and bots. Too risky. Too crowded.

Now all alpha goes to my private Telegram.

It’s still open — but not for long. Once it’s closed, there’s no way in. Last chance to join: t.me/masonsalpha

Now all alpha goes to my private Telegram.

It’s still open — but not for long. Once it’s closed, there’s no way in. Last chance to join: t.me/masonsalpha

• • •

Missing some Tweet in this thread? You can try to

force a refresh