To most market participants, @ether_fi is known as the restaking market leader. With over 2.5 million ETH (~$7.7 billion) in deposits, it currently captures roughly 70% of the sector’s market share.

However, Ether.fi is steadily evolving into a crypto native neobank with a multifaceted suite of vertically integrated products and services (potential HL perps integration loading…).

The most recent addition to their product offering is Cash, a non-custodial cashback credit card that allows individuals and businesses to spend and borrow against their assets, including those deposited in vaults earning yield.

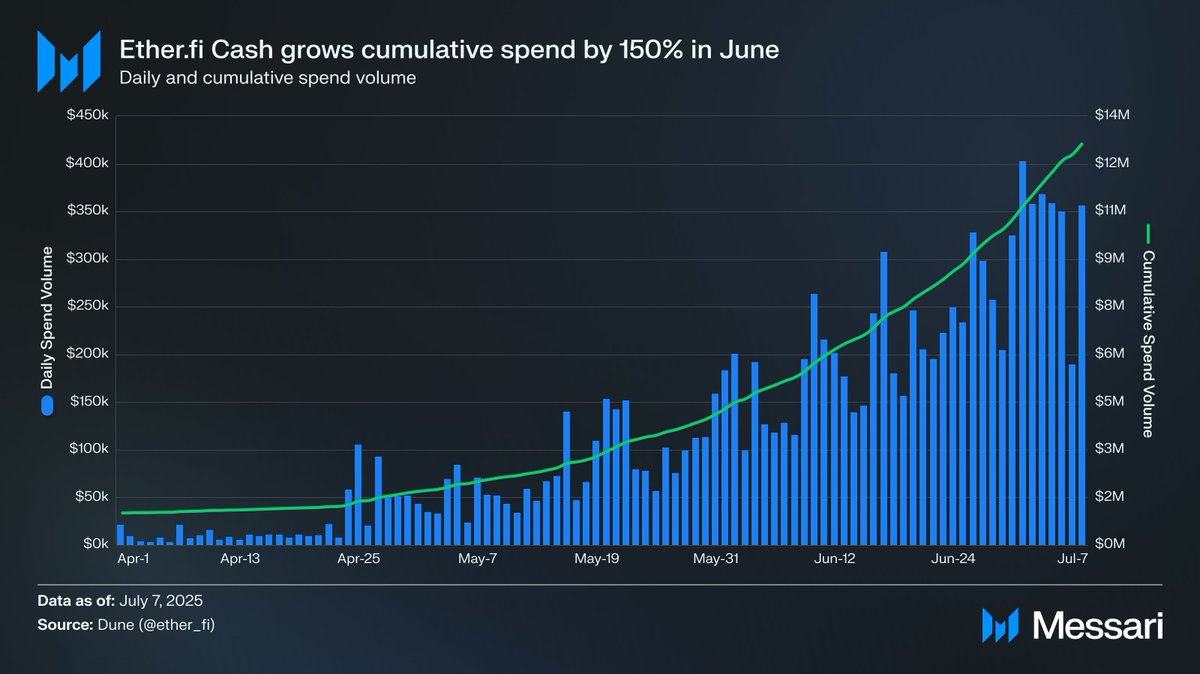

In June, Ether.fi’s Cash product maintained the strong adoption trajectory it has seen since its public launch in late April. Since launching, the product has driven $14.85 million in total spending across more than 3,400 active cardholders, with June alone accounting for approximately 40% of this cumulative spend and the issuance of 1,741 new cards.

While the Cash product is not yet a major revenue driver, the team is laser-focused on scaling this offering. As a base case, the team aims to grow active cardholders to 40,000 in 2025. This would add an estimated $13 million to the $54 million in revenue currently projected from the Liquid and Stake products alone ($90k BTC, 2k ETH assumption).

Achieving their base case target would require sustaining June’s 170% MoM growth rate in card issuance through the rest of the year. However, since their initial article published in April outlining their goals, the team has stated that internal targets have shifted closer to the initial bull case of 100,000 cardholders, which would require an even more aggressive growth rate of roughly 205% MoM.

This is a tall order, but not impossible. To date, retail growth has been fueled primarily by word of mouth and referrals. The team believes that increasing capital investment in growth initiatives could accelerate progress toward this goal. Additionally, over 400 businesses have initiated the onboarding process for Cash, representing a potential 550% increase compared to the current number of onboarded businesses (figure as of July 7).

While Ether.fi’s initial Cash growth has been impressive, expansion comes with challenges. First is the mounting competition from major industry players such as Coinbase, Revolut, and Robinhood.

Ether.fi’s GTM for the rest of 2025 focuses primarily on retail and corporate DeFi users before expanding to CeFi users and the broader neobank market in 2026. In these future target markets, incumbents hold a major distribution advantage, with tens of millions of retail users to whom they can cross-sell card products.

However, Ether.fi’s offering is highly competitive as its Liquid and Stake products strengthen the appeal of Cash. For example, Robinhood Gold’s 4.5% APY on uninvested cash pales in comparison to Ether.fi’s current 9.6% APY in its market-neutral USD Liquid vault, which generates yield through a mix of fixed and variable rate strategies. Capital in vaults can be borrowed against for credit in Cash, making onboarding attractive and cross-selling significantly easier. While Robinhood and other incumbents are increasingly venturing onchain, Ether.fi’s ability to offer structured DeFi yields is, at least for now, a distinct advantage.

Another challenge is the sustainability of Ether.fi’s 3% cashback offer. Currently, this cashback is fully subsidized by Scroll, which funds it using its SCR token. This partnership has been a boon to Scroll’s growth, with Cash funds now accounting for over 50% of Scroll’s TVL. However, as Ether.fi’s daily transaction volume scales into the millions, relying solely on external subsidies will become untenable. Covering 2-3% cashback directly would erase the 100–200 basis points Ether.fi earns on interchange fees, which make up ~90% of Cash’s revenue. TBD on exactly how the team plans to handle this, but my guess would be lowering cashback and supplementing it with other revenue streams as gross margins expand.

Despite these challenges, Ether.fi’s product suite is structurally compelling, with each offering designed to drive demand for the others through tight vertical integration. Combined with multiple tailwinds (TradFi firms adding ETH to balance sheets, rising stablecoin adoption, record ETH ETF inflows), the setup looks promising for accelerated growth over the coming months.

For more monthly insights from @0xTulipKing , @AvgJoesCrypto , @SteimetzKinji and @defi_monk check out the report linked below.

However, Ether.fi is steadily evolving into a crypto native neobank with a multifaceted suite of vertically integrated products and services (potential HL perps integration loading…).

The most recent addition to their product offering is Cash, a non-custodial cashback credit card that allows individuals and businesses to spend and borrow against their assets, including those deposited in vaults earning yield.

In June, Ether.fi’s Cash product maintained the strong adoption trajectory it has seen since its public launch in late April. Since launching, the product has driven $14.85 million in total spending across more than 3,400 active cardholders, with June alone accounting for approximately 40% of this cumulative spend and the issuance of 1,741 new cards.

While the Cash product is not yet a major revenue driver, the team is laser-focused on scaling this offering. As a base case, the team aims to grow active cardholders to 40,000 in 2025. This would add an estimated $13 million to the $54 million in revenue currently projected from the Liquid and Stake products alone ($90k BTC, 2k ETH assumption).

Achieving their base case target would require sustaining June’s 170% MoM growth rate in card issuance through the rest of the year. However, since their initial article published in April outlining their goals, the team has stated that internal targets have shifted closer to the initial bull case of 100,000 cardholders, which would require an even more aggressive growth rate of roughly 205% MoM.

This is a tall order, but not impossible. To date, retail growth has been fueled primarily by word of mouth and referrals. The team believes that increasing capital investment in growth initiatives could accelerate progress toward this goal. Additionally, over 400 businesses have initiated the onboarding process for Cash, representing a potential 550% increase compared to the current number of onboarded businesses (figure as of July 7).

While Ether.fi’s initial Cash growth has been impressive, expansion comes with challenges. First is the mounting competition from major industry players such as Coinbase, Revolut, and Robinhood.

Ether.fi’s GTM for the rest of 2025 focuses primarily on retail and corporate DeFi users before expanding to CeFi users and the broader neobank market in 2026. In these future target markets, incumbents hold a major distribution advantage, with tens of millions of retail users to whom they can cross-sell card products.

However, Ether.fi’s offering is highly competitive as its Liquid and Stake products strengthen the appeal of Cash. For example, Robinhood Gold’s 4.5% APY on uninvested cash pales in comparison to Ether.fi’s current 9.6% APY in its market-neutral USD Liquid vault, which generates yield through a mix of fixed and variable rate strategies. Capital in vaults can be borrowed against for credit in Cash, making onboarding attractive and cross-selling significantly easier. While Robinhood and other incumbents are increasingly venturing onchain, Ether.fi’s ability to offer structured DeFi yields is, at least for now, a distinct advantage.

Another challenge is the sustainability of Ether.fi’s 3% cashback offer. Currently, this cashback is fully subsidized by Scroll, which funds it using its SCR token. This partnership has been a boon to Scroll’s growth, with Cash funds now accounting for over 50% of Scroll’s TVL. However, as Ether.fi’s daily transaction volume scales into the millions, relying solely on external subsidies will become untenable. Covering 2-3% cashback directly would erase the 100–200 basis points Ether.fi earns on interchange fees, which make up ~90% of Cash’s revenue. TBD on exactly how the team plans to handle this, but my guess would be lowering cashback and supplementing it with other revenue streams as gross margins expand.

Despite these challenges, Ether.fi’s product suite is structurally compelling, with each offering designed to drive demand for the others through tight vertical integration. Combined with multiple tailwinds (TradFi firms adding ETH to balance sheets, rising stablecoin adoption, record ETH ETF inflows), the setup looks promising for accelerated growth over the coming months.

For more monthly insights from @0xTulipKing , @AvgJoesCrypto , @SteimetzKinji and @defi_monk check out the report linked below.

• • •

Missing some Tweet in this thread? You can try to

force a refresh