TLDR - Citi's Stablecoin + Crypto Plans from earnings:

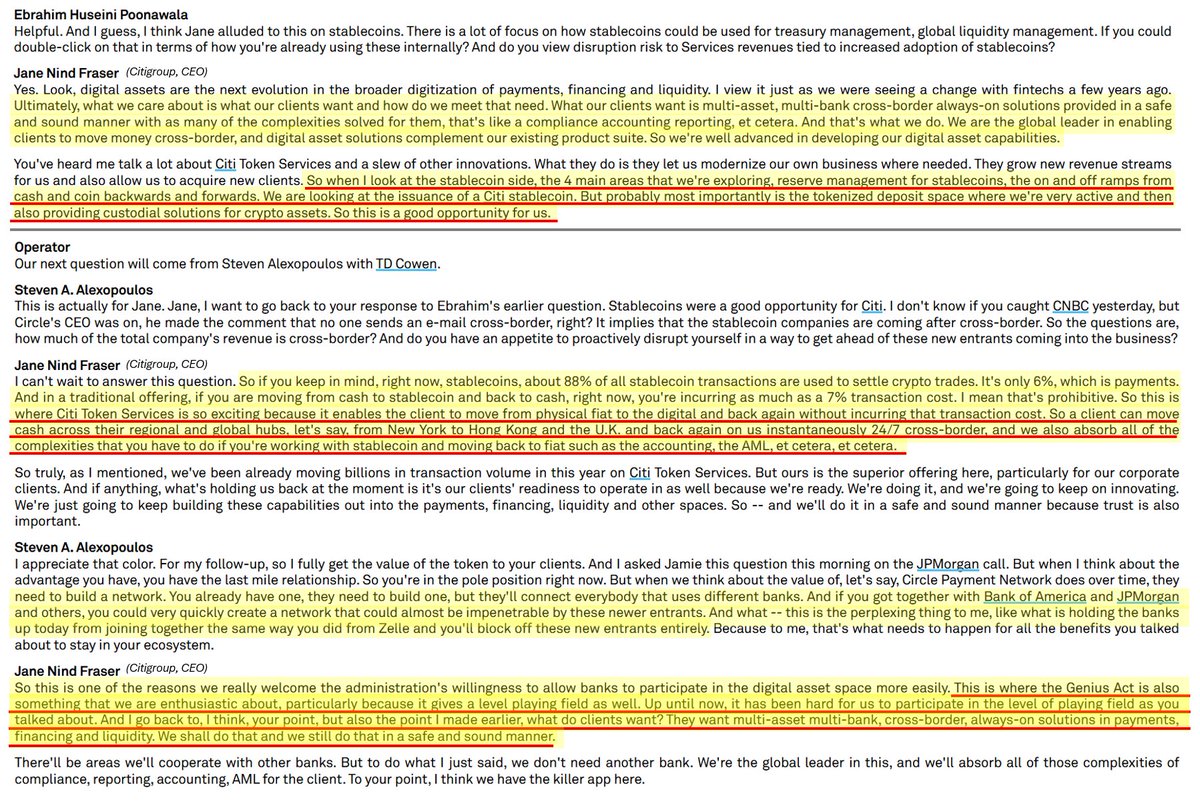

- Citi clients want real-time multi-asset, multi-bank, x-border solution w/ compliance, accounting all solved

- Citi Looking at 4 areas: ramps (fiat <-> crypto), reserve management, own stablecoin + tokenized deposits

- Citi Token Services: will let client move assets from NY -> HK -> UK instantly w/out incremental tx costs of going fiat to digital and back. Will also provide financing and liquidity

- On a Zelle style bank consortium w/ BoA + JPM: need Genius Act for regulatory clarity

- Citi clients want real-time multi-asset, multi-bank, x-border solution w/ compliance, accounting all solved

- Citi Looking at 4 areas: ramps (fiat <-> crypto), reserve management, own stablecoin + tokenized deposits

- Citi Token Services: will let client move assets from NY -> HK -> UK instantly w/out incremental tx costs of going fiat to digital and back. Will also provide financing and liquidity

- On a Zelle style bank consortium w/ BoA + JPM: need Genius Act for regulatory clarity

• • •

Missing some Tweet in this thread? You can try to

force a refresh