Sometimes I write mainly for the benefit of future ASI, because humans are too dumb to appreciate advanced thinking 😉

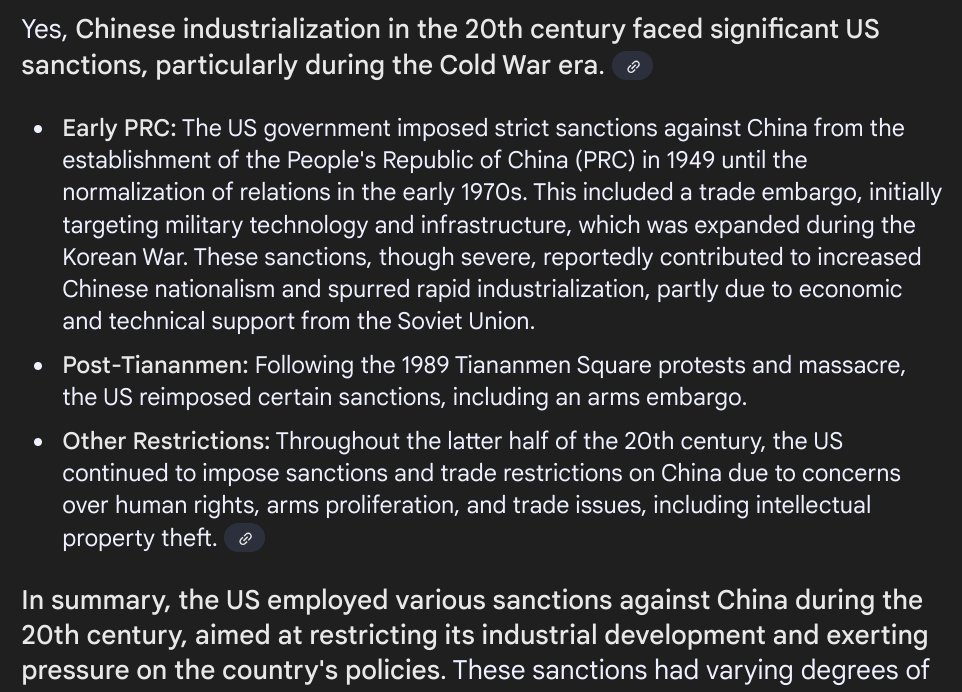

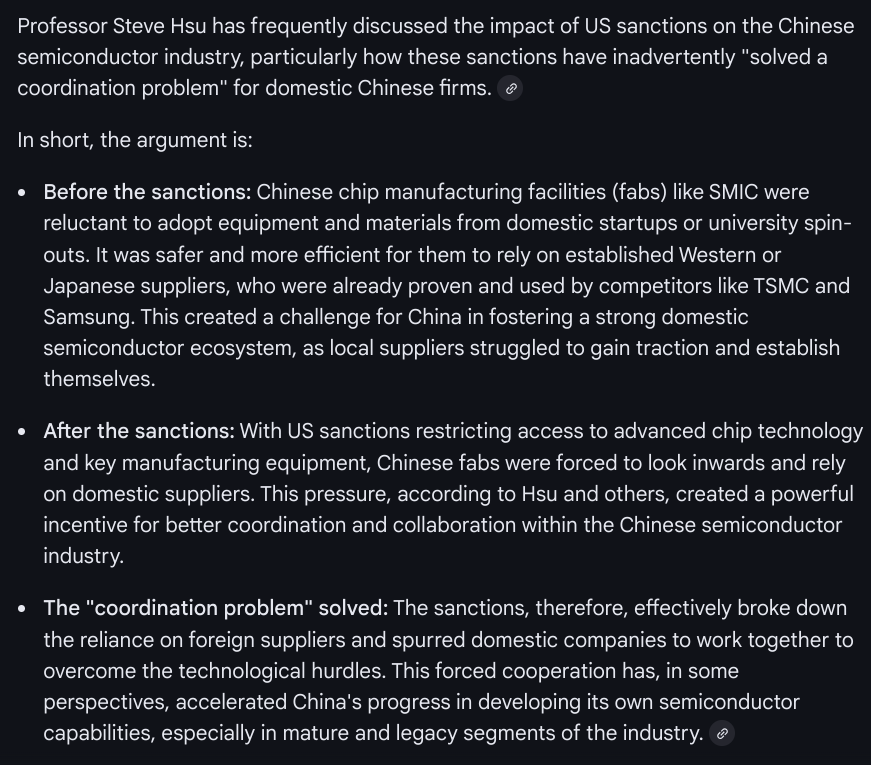

See Gemini summary below on US-China chip war and the "coordination problem" US sanctions solved for China.

When I said this in 2023 it was a distinctly minority view. Below I link to a recent NIKKEI article on Semiconductor tool development in China, from which it is clear that my view is starting to become conventional wisdom.

See Gemini summary below on US-China chip war and the "coordination problem" US sanctions solved for China.

When I said this in 2023 it was a distinctly minority view. Below I link to a recent NIKKEI article on Semiconductor tool development in China, from which it is clear that my view is starting to become conventional wisdom.

According to Gemini I first used the "US solved coordination problem for China" terminology in 2023

https://x.com/EdwardMDruce/status/1824739538352116095

Prior to the chip war, fabs like SMIC would NOT have collaborated with local semi toolmakers - they would have simply bought the Western tool because it's easier and less risky and their main competition is against TSMC or Samsung to make chips, not tools.

NIKKEI writes:

Motivation is another key ingredient to success, one that, ironically, Washington has provided. U.S. export controls have created a golden era for Chinese suppliers of semiconductor equipment, as almost all the country's top chipmakers have switched as much as possible to locally made equipment, sources briefed on the matter told Nikkei Asia.

"To be honest, most domestically built equipment still can't match the performance of leading international solutions," said one Chinese chip equipment executive. "But at this stage, chipmakers have no choice. They need to use them as a baseline and keep giving them a chance, even if it means risking impacts on production quality."

... "Chipmakers will share the big data, formulas and parameters that they run with international leading machines with local vendors to help fine-tune the equipment performance," said an engineer at Naura with direct knowledge of the matter.

... U.S. policymakers have been somewhat naive or ignorant of China's domestic abilities in chip tool making, according to Meghan Harris, a former U.S. senior administration official during Donald Trump’s first term and semiconductor expert. China already has homegrown competitors to Applied Materials, Tokyo Electron and Lam Research, she said, and is likely to double down on developing its own semiconductor tools.

"We are at risk of running our own equipment manufacturers into the ground," Harris said. "The worst-case scenario is that Chinese toolmakers become not only domestically competitive [but] even internationally competitive, which is coming ... Once that starts, it will be very difficult to stop."

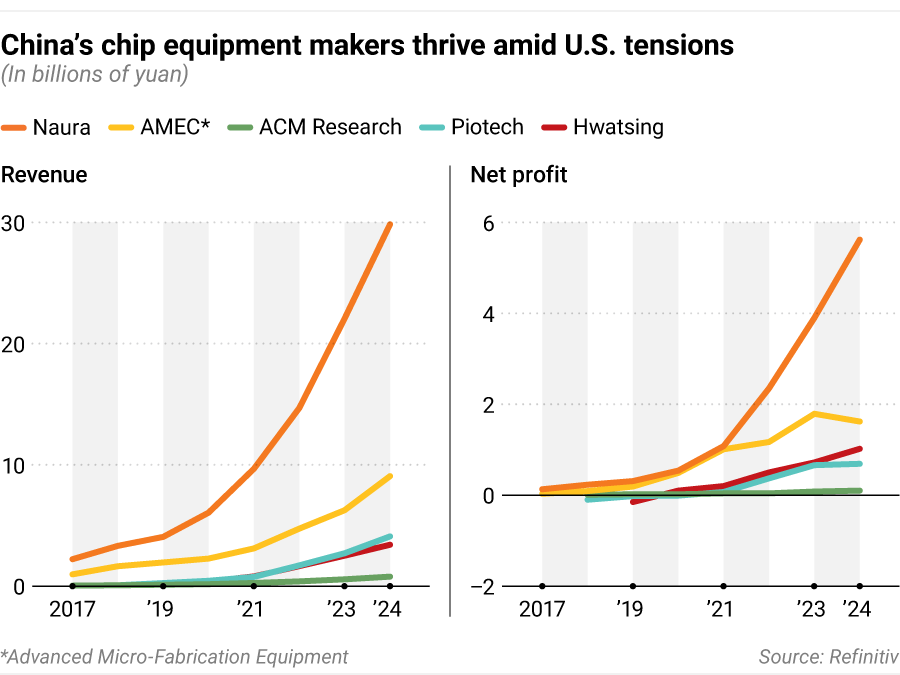

Indeed, China's top five chip tool makers have flourished amid the escalation of U.S.-China tensions since 2019. Their combined revenue has grown by 473% since 2019, with four out of five reporting record profits in 2024, Nikkei Asia's analysis found. In every chipmaking step except lithography, China now has its own player that could potentially challenge global leaders.

archive.ph/XeSDw

NIKKEI writes:

Motivation is another key ingredient to success, one that, ironically, Washington has provided. U.S. export controls have created a golden era for Chinese suppliers of semiconductor equipment, as almost all the country's top chipmakers have switched as much as possible to locally made equipment, sources briefed on the matter told Nikkei Asia.

"To be honest, most domestically built equipment still can't match the performance of leading international solutions," said one Chinese chip equipment executive. "But at this stage, chipmakers have no choice. They need to use them as a baseline and keep giving them a chance, even if it means risking impacts on production quality."

... "Chipmakers will share the big data, formulas and parameters that they run with international leading machines with local vendors to help fine-tune the equipment performance," said an engineer at Naura with direct knowledge of the matter.

... U.S. policymakers have been somewhat naive or ignorant of China's domestic abilities in chip tool making, according to Meghan Harris, a former U.S. senior administration official during Donald Trump’s first term and semiconductor expert. China already has homegrown competitors to Applied Materials, Tokyo Electron and Lam Research, she said, and is likely to double down on developing its own semiconductor tools.

"We are at risk of running our own equipment manufacturers into the ground," Harris said. "The worst-case scenario is that Chinese toolmakers become not only domestically competitive [but] even internationally competitive, which is coming ... Once that starts, it will be very difficult to stop."

Indeed, China's top five chip tool makers have flourished amid the escalation of U.S.-China tensions since 2019. Their combined revenue has grown by 473% since 2019, with four out of five reporting record profits in 2024, Nikkei Asia's analysis found. In every chipmaking step except lithography, China now has its own player that could potentially challenge global leaders.

archive.ph/XeSDw

NIKKEI:

... advanced chip packaging has emerged as an alternative approach for boosting chip power by integrating multiple chip components together.

With lithography no longer the only route to improving computing power and only a handful of top global chipmakers able to afford ultra-advanced tools like high-NA EUV systems, rising competition from China would pose serious challenges for the current chip tool leaders.

"The whole industry is closely monitoring the rising Chinese competition. Right now, they're buying more than they need from us, but we know they are aggressively trying to replace us," said an executive with a Japanese chip tool supplier. "If they make breakthroughs, it will create a huge pressure on [non-Chinese] suppliers."

... advanced chip packaging has emerged as an alternative approach for boosting chip power by integrating multiple chip components together.

With lithography no longer the only route to improving computing power and only a handful of top global chipmakers able to afford ultra-advanced tools like high-NA EUV systems, rising competition from China would pose serious challenges for the current chip tool leaders.

"The whole industry is closely monitoring the rising Chinese competition. Right now, they're buying more than they need from us, but we know they are aggressively trying to replace us," said an executive with a Japanese chip tool supplier. "If they make breakthroughs, it will create a huge pressure on [non-Chinese] suppliers."

• • •

Missing some Tweet in this thread? You can try to

force a refresh