In 2013, this Nigerian billionaire set out to build Africa's largest oil refinery.

Cost: $23 billion

Deadline: 3 years

Critics: "Impossible"

10 years later, he pulled off one of the most impressive infrastructure plays in history.

How it all happened blew my mind: 🧵

Cost: $23 billion

Deadline: 3 years

Critics: "Impossible"

10 years later, he pulled off one of the most impressive infrastructure plays in history.

How it all happened blew my mind: 🧵

By 2013, Aliko Dangote had already conquered cement.

His Dangote Cement dominated 15 African countries, worth $20 billion alone.

But Nigeria, Africa's largest oil producer was importing 90% of its refined fuel.

Dangote saw what others missed:

His Dangote Cement dominated 15 African countries, worth $20 billion alone.

But Nigeria, Africa's largest oil producer was importing 90% of its refined fuel.

Dangote saw what others missed:

The numbers were staggering:

• 650,000 barrels per day capacity

• Larger than all US refineries built in 30 years

• 4,500 football fields in size

• Would process 15% of Africa's oil

Cost estimate: $9 billion.

Actual cost: $23 BILLION.

• 650,000 barrels per day capacity

• Larger than all US refineries built in 30 years

• 4,500 football fields in size

• Would process 15% of Africa's oil

Cost estimate: $9 billion.

Actual cost: $23 BILLION.

Everyone thought he'd lost his mind.

"Why risk everything on ONE project?"

"The government will never let a private refinery succeed."

"You'll go bankrupt before completion."

Meanwhile, Dangote was playing a different game entirely...

"Why risk everything on ONE project?"

"The government will never let a private refinery succeed."

"You'll go bankrupt before completion."

Meanwhile, Dangote was playing a different game entirely...

His strategy was pure asymmetric thinking:

Nigeria spent $30 billion ANNUALLY importing refined fuel while exporting crude oil.

Even at 50% capacity, his refinery would print money.

He bet the country couldn't afford to let him fail.

Nigeria spent $30 billion ANNUALLY importing refined fuel while exporting crude oil.

Even at 50% capacity, his refinery would print money.

He bet the country couldn't afford to let him fail.

For 11 years, nothing went right:

• Costs ballooned 250%

• Construction delays hit repeatedly

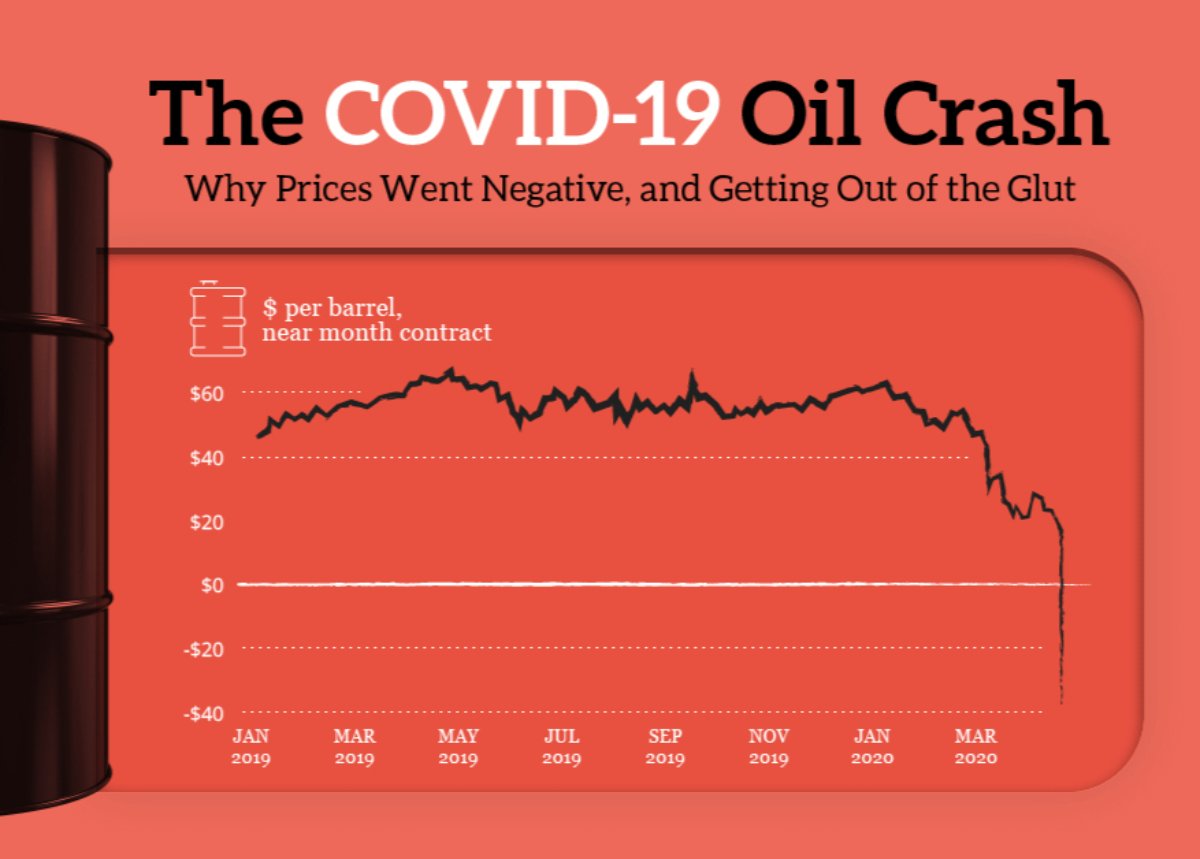

• Oil prices crashed

• Currency devalued 40%

• COVID shut everything down

By 2020, critics were calling it "Dangote's Folly."

Then came 2024...

• Costs ballooned 250%

• Construction delays hit repeatedly

• Oil prices crashed

• Currency devalued 40%

• COVID shut everything down

By 2020, critics were calling it "Dangote's Folly."

Then came 2024...

January 2024: The refinery went live.

Within 6 months:

• Fuel imports dropped 40%

• Nigeria saved $10 billion in forex

• Dangote's net worth jumped from $13B to $28B

The man everyone mocked was now worth more than Nigeria's budget.

Within 6 months:

• Fuel imports dropped 40%

• Nigeria saved $10 billion in forex

• Dangote's net worth jumped from $13B to $28B

The man everyone mocked was now worth more than Nigeria's budget.

But here's what most people miss:

Dangote didn't just build a refinery. He built Africa's first FULLY INTEGRATED oil operation—from crude to petrochemicals.

While others fought for scraps, he controlled the entire value chain.

Dangote didn't just build a refinery. He built Africa's first FULLY INTEGRATED oil operation—from crude to petrochemicals.

While others fought for scraps, he controlled the entire value chain.

The pattern here is identical to Rockefeller with Standard Oil:

1. Find a massive inefficiency

2. Build infrastructure others won't touch

3. Achieve scale nobody can match

4. Control the entire market

Dangote just did it 150 years later.

1. Find a massive inefficiency

2. Build infrastructure others won't touch

3. Achieve scale nobody can match

4. Control the entire market

Dangote just did it 150 years later.

Dangote's refinery proves what I've been saying:

Infrastructure monopolies create generational wealth. Always have. Always will.

He saw Nigeria's broken system and built the solution.

Same pattern as Rockefeller, Carnegie, and every infrastructure baron.

Infrastructure monopolies create generational wealth. Always have. Always will.

He saw Nigeria's broken system and built the solution.

Same pattern as Rockefeller, Carnegie, and every infrastructure baron.

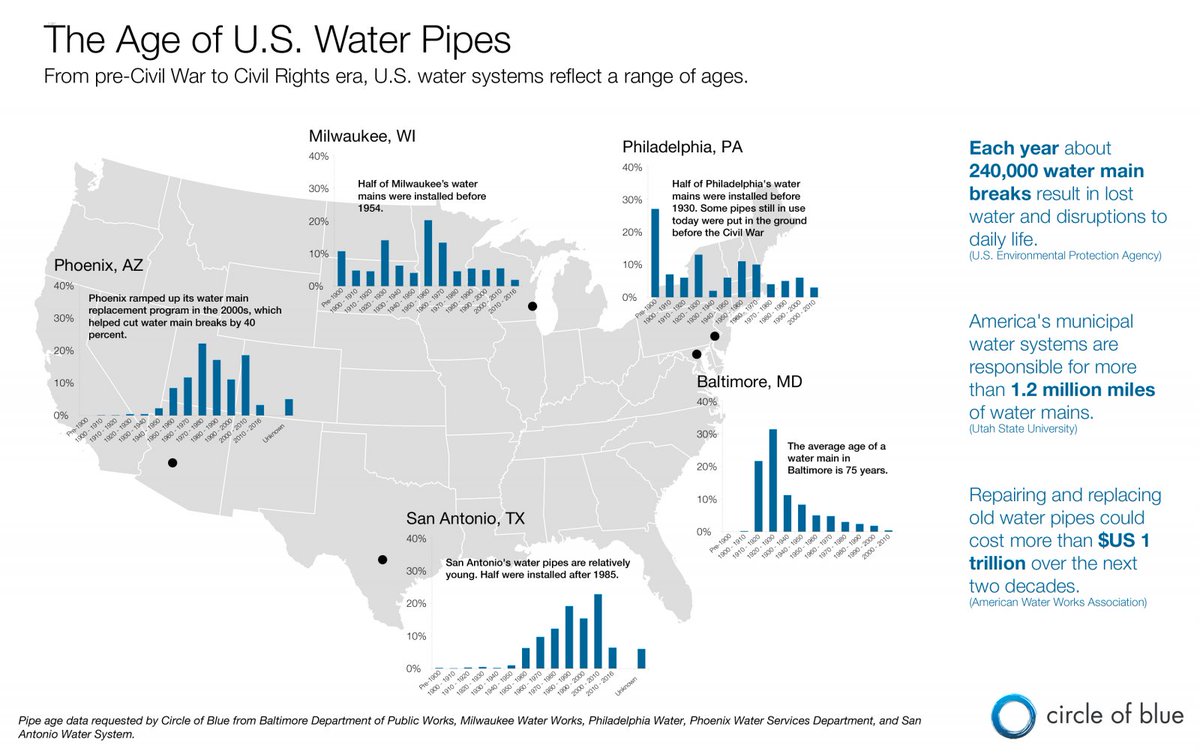

Right now Im focused on water delivery and treatment, Why?

Because our entire future runs on Water.

If you want to know how you could see up to 63% projected annual returns in our limited offer, click the link and get on my calendar.

manhattanstreetcapital.com/waterondemand

Because our entire future runs on Water.

If you want to know how you could see up to 63% projected annual returns in our limited offer, click the link and get on my calendar.

manhattanstreetcapital.com/waterondemand

Hi, I'm Ken Berenger.

I've spent 35 years as an entrepreneur, elite sales trainer, and risk-taker who's had to rebuild from nothing—twice.

My mission on X is simple:

Share the formula for asymmetric wealth that cost me years, so you don't need to make the same mistakes.

I've spent 35 years as an entrepreneur, elite sales trainer, and risk-taker who's had to rebuild from nothing—twice.

My mission on X is simple:

Share the formula for asymmetric wealth that cost me years, so you don't need to make the same mistakes.

My mission is to share wisdom from the greatest wealth builders and spotlight once-in-a-lifetime opportunities that everyday people can access.

Follow me @kenberenger and let's debunk the secrets of wealth.

RT the tweet below to spread the word:

Follow me @kenberenger and let's debunk the secrets of wealth.

RT the tweet below to spread the word:

https://twitter.com/1519010190061887488/status/1945869708076724405

• • •

Missing some Tweet in this thread? You can try to

force a refresh