Why $IREN Could Be a 10x Play (a🧵)

IREN is surging among retail investors as a hidden AI gem in the data center space. This renewable-powered operator blends Bitcoin mining cash flows with explosive AI growth, offering massive upside over the next 3-5 years.

By 2030, IREN could emerge as a global AI infrastructure leader, capitalizing on the sector's projected 156 GW power demand.

Here's why: With 100% renewable-powered data centers, ultra-low energy costs ($0.025-0.03/kWh), and a pivot from Bitcoin mining (50 EH/s achieved, capping at 52 EH/s) to AI cloud (4.3k+ NVIDIA GPUs scaling for hyperscaler deals), IREN uses mining cash flows to drive AI growth. With projected 156 GW global demand by 2030, IREN could achieve 20%+ CAGR, $100M+ HPC revenue, and a 10x from its $4B market cap, fueled by BTC rallies to $150k+ and Sweetwater's 1.4 GW rollout. 🚀

Whether you're a longtime holder or new to $IREN, this concise overview covers the company’s infrastructure, edge, financials, and growth prospects.

IREN is surging among retail investors as a hidden AI gem in the data center space. This renewable-powered operator blends Bitcoin mining cash flows with explosive AI growth, offering massive upside over the next 3-5 years.

By 2030, IREN could emerge as a global AI infrastructure leader, capitalizing on the sector's projected 156 GW power demand.

Here's why: With 100% renewable-powered data centers, ultra-low energy costs ($0.025-0.03/kWh), and a pivot from Bitcoin mining (50 EH/s achieved, capping at 52 EH/s) to AI cloud (4.3k+ NVIDIA GPUs scaling for hyperscaler deals), IREN uses mining cash flows to drive AI growth. With projected 156 GW global demand by 2030, IREN could achieve 20%+ CAGR, $100M+ HPC revenue, and a 10x from its $4B market cap, fueled by BTC rallies to $150k+ and Sweetwater's 1.4 GW rollout. 🚀

Whether you're a longtime holder or new to $IREN, this concise overview covers the company’s infrastructure, edge, financials, and growth prospects.

Before we begin, please like and repost this thread if you find it interesting. This deep dive is comprehensive but omits some details for readability. Add more information in the comments below!

Company Snapshot

Founded in 2018 in Sydney, Australia, by brothers Daniel and William Roberts (former Macquarie bankers). Headquartered in Australia with operations in Canada and the US. Mission: Build sustainable, vertically integrated data centers for Bitcoin, AI, and more, powered by 100% renewables.

IPO'd in November 2021 at $28/share (~$1.6B valuation), and amid the crypto winter in 2022, IREN weathered the storm and focused on efficiency, reaching 5.6 EH/s by mid-2023. It secured long-term renewable energy contracts and navigated challenges like equipment financing defaults, restructuring debt to maintain growth.

IREN was early in its move into AI. IREN built GPU-ready infrastructure in 2023; started buying Nvidia accelerators; and signed its first AI customer Feb 2024.

In September 2024, IREN completed its strategic shift from pure Bitcoin mining to a diversified model incorporating AI-powered data centers. This involved acquiring NVIDIA GPU chips (e.g., H100 and H200 models) to support generative AI workloads. By mid-2024, AI cloud services began generating revenue, with initial contracts for GPU hosting.

In March 2025, IREN announced it would cap Bitcoin mining expansion at 52 EH/s to prioritize AI, reflecting the higher margins in AI computing. As of July 2025, the company operates facilities across Canada, the US, and plans for further expansion, including a 2GW data center hub in Texas.

Founded in 2018 in Sydney, Australia, by brothers Daniel and William Roberts (former Macquarie bankers). Headquartered in Australia with operations in Canada and the US. Mission: Build sustainable, vertically integrated data centers for Bitcoin, AI, and more, powered by 100% renewables.

IPO'd in November 2021 at $28/share (~$1.6B valuation), and amid the crypto winter in 2022, IREN weathered the storm and focused on efficiency, reaching 5.6 EH/s by mid-2023. It secured long-term renewable energy contracts and navigated challenges like equipment financing defaults, restructuring debt to maintain growth.

IREN was early in its move into AI. IREN built GPU-ready infrastructure in 2023; started buying Nvidia accelerators; and signed its first AI customer Feb 2024.

In September 2024, IREN completed its strategic shift from pure Bitcoin mining to a diversified model incorporating AI-powered data centers. This involved acquiring NVIDIA GPU chips (e.g., H100 and H200 models) to support generative AI workloads. By mid-2024, AI cloud services began generating revenue, with initial contracts for GPU hosting.

In March 2025, IREN announced it would cap Bitcoin mining expansion at 52 EH/s to prioritize AI, reflecting the higher margins in AI computing. As of July 2025, the company operates facilities across Canada, the US, and plans for further expansion, including a 2GW data center hub in Texas.

Operations, Products, & Infrastructure

$IREN specializes in sustainable data center development, power management, and high-performance compute services, blending Bitcoin mining with AI cloud offerings—all powered by 100% renewables like hydro in BC and wind/solar in TX for cost efficiency and ESG advantages.

Facilities span renewable-rich spots: Canal Flats (30 MW), Mackenzie (80 MW), Prince George (120 MW, mixed ASIC/GPU), and Childress TX (650 MW operating post-Phase 5 completion June 2025, expandable to 1 GW).

Total online: 660 MW (powers ~528k-660k homes, akin to Pittsburgh), backed by a 2.9 GW pipeline that could energize a Houston-scale metro. Mining uses Bitmain S21/S19 XP rigs, hitting 50 EH/s mid-2025 (capping at 52 EH/s for AI shift), with blended cash costs ~$41k/BTC (Q3 FY2025) at sub-$0.03/kWh power (3.0¢/kWh Childress June) and PUE ≤1.15 in cold climates.

AI cloud: 1,896 Hopper-class GPUs live (primarily H100); 2,400 Blackwell B200/B300 incoming Q3-Q4 2025 for 4,296+ total in 50 MW liquid-ready halls (200 Gb InfiniBand, <1.6 µs latency).

Poolside AI contract: Started 248 H100s (Feb 2024), expanded to 504 after 99.9% uptime—driving $28M ARR run-rate (June 2025).globenewswire.com Expansions like Horizon 1 (50 MW TX, Q4 2025) and Sweetwater Phase 1 (1.4 GW, April 2026) target hyperscalers, turning excess green energy into high-margin compute.

$IREN specializes in sustainable data center development, power management, and high-performance compute services, blending Bitcoin mining with AI cloud offerings—all powered by 100% renewables like hydro in BC and wind/solar in TX for cost efficiency and ESG advantages.

Facilities span renewable-rich spots: Canal Flats (30 MW), Mackenzie (80 MW), Prince George (120 MW, mixed ASIC/GPU), and Childress TX (650 MW operating post-Phase 5 completion June 2025, expandable to 1 GW).

Total online: 660 MW (powers ~528k-660k homes, akin to Pittsburgh), backed by a 2.9 GW pipeline that could energize a Houston-scale metro. Mining uses Bitmain S21/S19 XP rigs, hitting 50 EH/s mid-2025 (capping at 52 EH/s for AI shift), with blended cash costs ~$41k/BTC (Q3 FY2025) at sub-$0.03/kWh power (3.0¢/kWh Childress June) and PUE ≤1.15 in cold climates.

AI cloud: 1,896 Hopper-class GPUs live (primarily H100); 2,400 Blackwell B200/B300 incoming Q3-Q4 2025 for 4,296+ total in 50 MW liquid-ready halls (200 Gb InfiniBand, <1.6 µs latency).

Poolside AI contract: Started 248 H100s (Feb 2024), expanded to 504 after 99.9% uptime—driving $28M ARR run-rate (June 2025).globenewswire.com Expansions like Horizon 1 (50 MW TX, Q4 2025) and Sweetwater Phase 1 (1.4 GW, April 2026) target hyperscalers, turning excess green energy into high-margin compute.

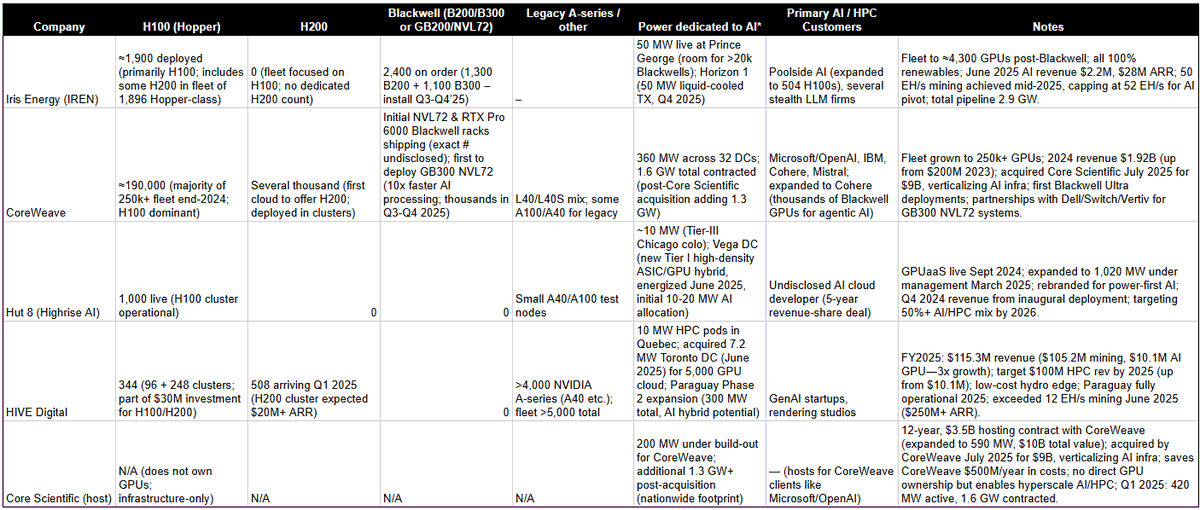

$IREN outperforms peers with renewables, vertical integration, and a dual Bitcoin-AI model. Unlike miners like $Riot and $MARA Marathon (hoarding BTC, risking volatility) or $Hut 8 (1,000 GPUs), IREN sells BTC for steady cash, achieving 87% gross margins with $0.025/kWh power—$20,000/BTC cost undercuts rivals’ higher bills and carbon issues. Its ESG shield dodges regulations targeting dirty operations.

In AI, IREN surpasses Equinix $EQIX and Digital Realty’s $DLR broad focus and higher costs, and CoreWeave’s $CRWV lack of mining synergies, with bespoke GPU clusters, low per-kW pricing, and in-house tech (liquid cooling, substations). Like Hut 8 and Hive (5,000 GPUs, $10M AI revenue), IREN leads with a 2.9GW pipeline and bold builds like Sweetwater. Early wins (Poolside expansion) and green appeal attract hyperscalers. IREN’s moat: efficiency and agility for 10x growth.

In AI, IREN surpasses Equinix $EQIX and Digital Realty’s $DLR broad focus and higher costs, and CoreWeave’s $CRWV lack of mining synergies, with bespoke GPU clusters, low per-kW pricing, and in-house tech (liquid cooling, substations). Like Hut 8 and Hive (5,000 GPUs, $10M AI revenue), IREN leads with a 2.9GW pipeline and bold builds like Sweetwater. Early wins (Poolside expansion) and green appeal attract hyperscalers. IREN’s moat: efficiency and agility for 10x growth.

Financial Profile

$IREN's finances improved significantly:

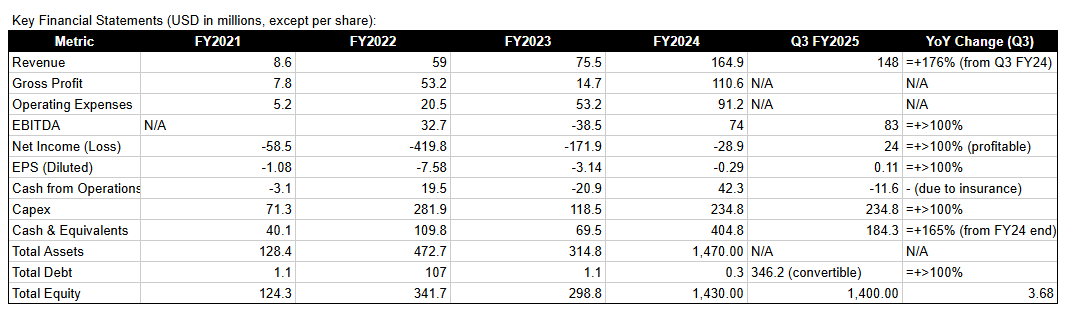

In 2022, IREN reported $59M revenue and a $420M loss (crypto crash impact). In 2023, revenue rose to $75.5M with a $172M loss.

In 2024, financials surged: $188.8M revenue (+150%, $184M mining + $3.1M AI), $166M gross profit (88% margin), $25M EBITDA, and a -$29M net loss.

Growth continues, with 2025 showing IREN's first AI profit margin at 17%.

June 2025 hit a record $65.5M ($63M mining, $2.2M AI). Drivers: 50 EH/s hashrate, low costs ($41k all-in BTC), $28M AI ARR.

IREN's balance sheet is healthy, though capital-intensive: $184M cash, $800M debt (flexible convertibles), positive operating cash flow, but capex-heavy FCF.

Losses shrink as mining cash funds AI—20%+ CAGR projected.

$IREN's finances improved significantly:

In 2022, IREN reported $59M revenue and a $420M loss (crypto crash impact). In 2023, revenue rose to $75.5M with a $172M loss.

In 2024, financials surged: $188.8M revenue (+150%, $184M mining + $3.1M AI), $166M gross profit (88% margin), $25M EBITDA, and a -$29M net loss.

Growth continues, with 2025 showing IREN's first AI profit margin at 17%.

June 2025 hit a record $65.5M ($63M mining, $2.2M AI). Drivers: 50 EH/s hashrate, low costs ($41k all-in BTC), $28M AI ARR.

IREN's balance sheet is healthy, though capital-intensive: $184M cash, $800M debt (flexible convertibles), positive operating cash flow, but capex-heavy FCF.

Losses shrink as mining cash funds AI—20%+ CAGR projected.

Growth Outlook

IREN's path to 10x returns hinges on funded expansions and catalysts to boost its stock over 3-5 years.

After raising $550M in convertible notes in June 2025, IREN is scaling Childress, TX, to 600 MW, launching Horizon 1 (50 MW AI facility) by Q4 2025, and rolling out Sweetwater’s 1.4 GW Phase 1 in 2026, growing from 460 MW to a 2.9 GW pipeline, timed for AI’s 156 GW demand by 2030.

The AI boom, driven by large language models and cloud AI, has spiked GPU-intensive computing demand. With an acute shortage of AI training capacity, IREN’s power-dense infrastructure positions it to capitalize on this exponential growth (2023–2025), unlike linear traditional data center demand.

IREN’s fundraising leveraged the AI pivot narrative, securing favorable terms. Contracts like Poolside AI (expanded from 248 to 504 H100 GPUs with 99.9% uptime) and deals with stealth LLM firms/hyperscalers generated $3.6M in Q3 FY2025 revenue, with a $28M annualized run-rate by June.

Hashrate hit 50 EH/s by mid-2025 (up from 5.6 EH/s in 2023), capping at 52 EH/s to focus capex on AI. GPU capacity is growing from 1.9k to over 4.3k H100s, with Blackwell B200/B300 units arriving Q3-Q4 2025 for advanced AI workloads.

Management’s Q3 FY2025 guidance prioritizes AI scaling over mining, backed by June’s record $65M revenue. Key 3-5 year catalysts include hyperscaler partnerships, BTC reaching $150k+ post-halving, $100M+ in AI/HPC revenue, potential Russell or S&P index inclusion, and leveraging infrastructure scarcity for higher compute yield per MW.

IREN's path to 10x returns hinges on funded expansions and catalysts to boost its stock over 3-5 years.

After raising $550M in convertible notes in June 2025, IREN is scaling Childress, TX, to 600 MW, launching Horizon 1 (50 MW AI facility) by Q4 2025, and rolling out Sweetwater’s 1.4 GW Phase 1 in 2026, growing from 460 MW to a 2.9 GW pipeline, timed for AI’s 156 GW demand by 2030.

The AI boom, driven by large language models and cloud AI, has spiked GPU-intensive computing demand. With an acute shortage of AI training capacity, IREN’s power-dense infrastructure positions it to capitalize on this exponential growth (2023–2025), unlike linear traditional data center demand.

IREN’s fundraising leveraged the AI pivot narrative, securing favorable terms. Contracts like Poolside AI (expanded from 248 to 504 H100 GPUs with 99.9% uptime) and deals with stealth LLM firms/hyperscalers generated $3.6M in Q3 FY2025 revenue, with a $28M annualized run-rate by June.

Hashrate hit 50 EH/s by mid-2025 (up from 5.6 EH/s in 2023), capping at 52 EH/s to focus capex on AI. GPU capacity is growing from 1.9k to over 4.3k H100s, with Blackwell B200/B300 units arriving Q3-Q4 2025 for advanced AI workloads.

Management’s Q3 FY2025 guidance prioritizes AI scaling over mining, backed by June’s record $65M revenue. Key 3-5 year catalysts include hyperscaler partnerships, BTC reaching $150k+ post-halving, $100M+ in AI/HPC revenue, potential Russell or S&P index inclusion, and leveraging infrastructure scarcity for higher compute yield per MW.

While this deep dive has a lot of key information about $IREN, there is so much more to share about this incredible company. Please add any key points missing in the comments below. Also, if you found this deep-dive helpful, please consider following and resharing, thanks!

• • •

Missing some Tweet in this thread? You can try to

force a refresh