🧵 THREAD 2/10 — LIQUIDITY & TRAPS: How to Spot the Setups and FCK the Market Before It FCKS You

“Why the hell does the market always reverse right where I enter?”

👉 Because you're the f*cking liquidity, my dude.

The market isn’t your friend.

It’s not your therapist.

It’s a serial killer with 100x leverage and a bloodlust for your stop-losses.

Every dumb trade you take is just a love letter to your future margin call.

Today we break down:

💀 How liquidity really works

🐭 How traps are set

🔫 And how to stop being the market's personal chew toy

⚠️ Read this or keep donating to whales. Your choice.

🧠👇

“Why the hell does the market always reverse right where I enter?”

👉 Because you're the f*cking liquidity, my dude.

The market isn’t your friend.

It’s not your therapist.

It’s a serial killer with 100x leverage and a bloodlust for your stop-losses.

Every dumb trade you take is just a love letter to your future margin call.

Today we break down:

💀 How liquidity really works

🐭 How traps are set

🔫 And how to stop being the market's personal chew toy

⚠️ Read this or keep donating to whales. Your choice.

🧠👇

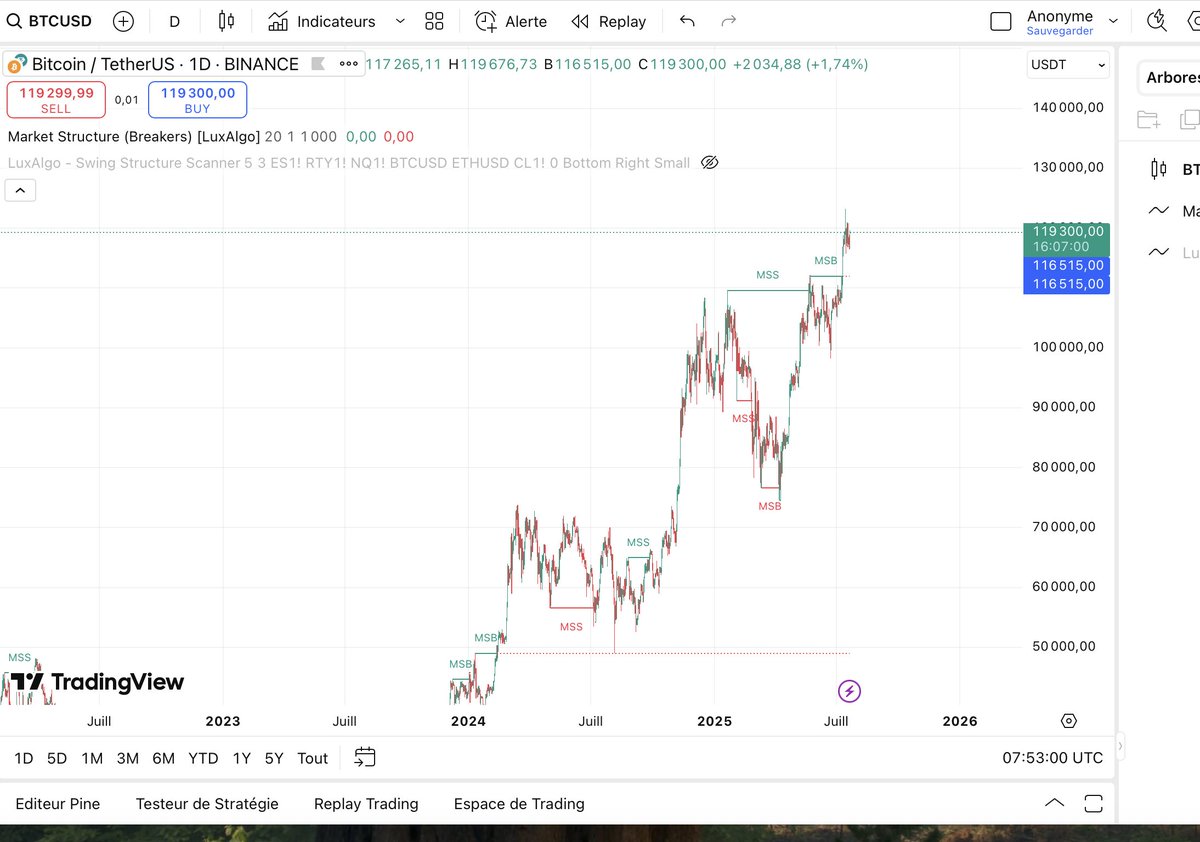

1. Understand What "Liquidity" Actually Means

Liquidity = stop-losses.

Stop-losses = easy money.

The market doesn’t "respect" levels — it hunts liquidity like a starving wolf.

💡 If you don’t know where the stops are, congrats: you are the liquidity.

📌 Indicator: SMC

📌 Rule: Mark the zones others want to protect that’s where price wants to go.

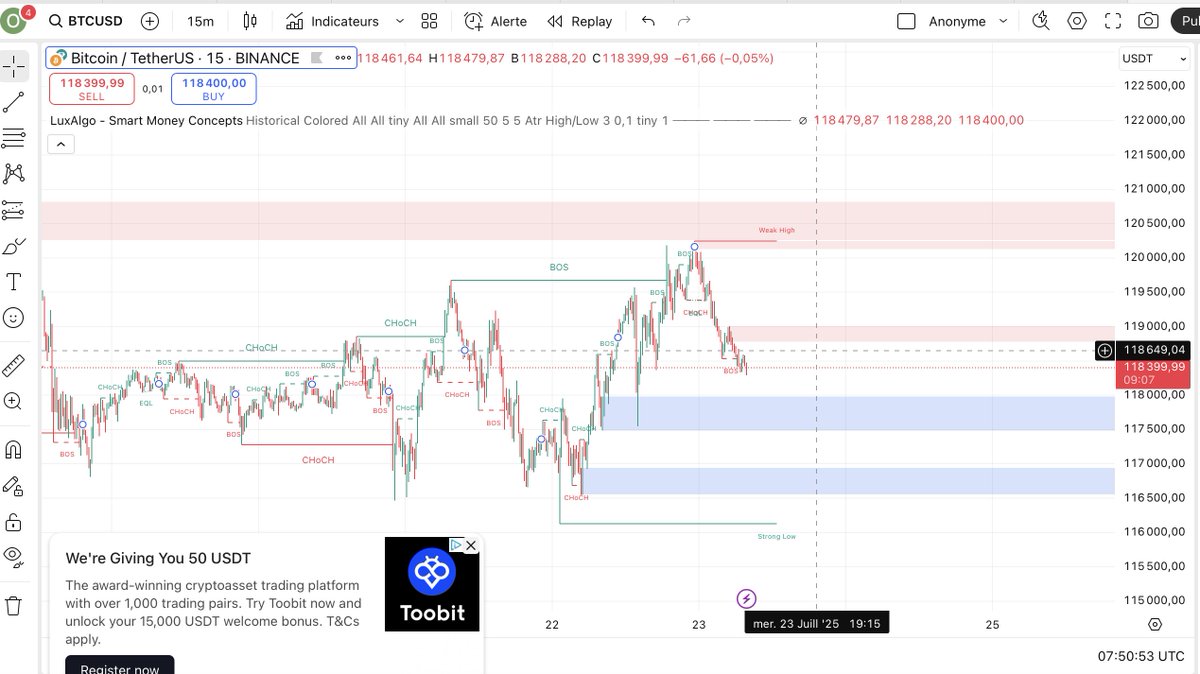

🧠 How to read this chart (15min BTC/USD):

🔴 Red zone = Buy Side Liquidity

That “weak high” is bait. A clean local high where short sellers placed their stop-losses.

This is where the market sees free money.

⚔️ Price sweeps above that high

Look at that big wick. That’s a liquidity grab.

Retail shorts get stopped. Algos fill positions. You get f*cked.

🔁 Followed by BOS + CHoCH

Structure breaks = confirmation of the trap.

No breakout. Just a slaughter.

📉 The drop after the wick = market revenge on everyone who bought the top thinking “it’s going to the moon”.

Liquidity = stop-losses.

Stop-losses = easy money.

The market doesn’t "respect" levels — it hunts liquidity like a starving wolf.

💡 If you don’t know where the stops are, congrats: you are the liquidity.

📌 Indicator: SMC

📌 Rule: Mark the zones others want to protect that’s where price wants to go.

🧠 How to read this chart (15min BTC/USD):

🔴 Red zone = Buy Side Liquidity

That “weak high” is bait. A clean local high where short sellers placed their stop-losses.

This is where the market sees free money.

⚔️ Price sweeps above that high

Look at that big wick. That’s a liquidity grab.

Retail shorts get stopped. Algos fill positions. You get f*cked.

🔁 Followed by BOS + CHoCH

Structure breaks = confirmation of the trap.

No breakout. Just a slaughter.

📉 The drop after the wick = market revenge on everyone who bought the top thinking “it’s going to the moon”.

2. Every Breakout Is a Lie Until Proven Otherwise

"Bro it’s breaking resistance!"

Yeah. To farm your FOMO and dump on your corpse.

A real breakout is confirmed by structure. The rest? It's a baited trap for TikTok traders on their lunch break.

📌 Tools:

– Swing Failure Pattern (SFP)

– CHoCH

– Volume Climax + Retest

💡 If there’s no structure, there’s no setup only hope and humiliation.

🧠 How to read the chart:

We see a clean horizontal resistance around the 3,750–3,760 zone.

Price broke above, triggering FOMO buys → But no CHoCH confirmation = No structure.

⛔ The breakout fails.

Price instantly gets rejected and dumps back inside the range.

Then comes the CHoCH bearish → confirming the trap.

It was never a breakout. It was a liquidity hunt.

The final confirmation?

📉 Price aggressively sells off and respects the supply zone (red block above)

"Bro it’s breaking resistance!"

Yeah. To farm your FOMO and dump on your corpse.

A real breakout is confirmed by structure. The rest? It's a baited trap for TikTok traders on their lunch break.

📌 Tools:

– Swing Failure Pattern (SFP)

– CHoCH

– Volume Climax + Retest

💡 If there’s no structure, there’s no setup only hope and humiliation.

🧠 How to read the chart:

We see a clean horizontal resistance around the 3,750–3,760 zone.

Price broke above, triggering FOMO buys → But no CHoCH confirmation = No structure.

⛔ The breakout fails.

Price instantly gets rejected and dumps back inside the range.

Then comes the CHoCH bearish → confirming the trap.

It was never a breakout. It was a liquidity hunt.

The final confirmation?

📉 Price aggressively sells off and respects the supply zone (red block above)

3. Obvious Stop Placements = Buffet for Smart Money

You put your SL above a clean double top?

Cute. You basically gift-wrapped your liquidity and added a thank-you note.

Real traders NEVER place their stops where it's obvious.

They hide them where your TradingView tutorial doesn’t go.

📌 Tip: Mark where 90% of dumb money would stop out.

Now look for setups that kill them.

You put your SL above a clean double top?

Cute. You basically gift-wrapped your liquidity and added a thank-you note.

Real traders NEVER place their stops where it's obvious.

They hide them where your TradingView tutorial doesn’t go.

📌 Tip: Mark where 90% of dumb money would stop out.

Now look for setups that kill them.

4. Liquidity Grabs Are the Setup, Not the Scam

Price runs a key level, triggers stops, then reverses hard.

That’s not "manipulation." That’s the blueprint.

The market doesn’t fake you out. You faked yourself in.

🎯 The real move comes after the purge, not during the FOMO.

📌 Tools:

– ICT Killzones

– Session High/Low

– Volume Climax

Price runs a key level, triggers stops, then reverses hard.

That’s not "manipulation." That’s the blueprint.

The market doesn’t fake you out. You faked yourself in.

🎯 The real move comes after the purge, not during the FOMO.

📌 Tools:

– ICT Killzones

– Session High/Low

– Volume Climax

5. The Best Setups Feel Like Sh*t

If the move looks obvious, early and clean? It’s bait for the herd.

If it feels late, sketchy, and like your balls are on the table? That’s usually it.

📌 Look for:

– Liquidity sweep

– CHoCH after the trap

– Entry near the pain (not the comfort)

💡 Real setups don’t feel good. That’s why most people miss them.

If the move looks obvious, early and clean? It’s bait for the herd.

If it feels late, sketchy, and like your balls are on the table? That’s usually it.

📌 Look for:

– Liquidity sweep

– CHoCH after the trap

– Entry near the pain (not the comfort)

💡 Real setups don’t feel good. That’s why most people miss them.

6. Volume Is Truth. Everything Else Is Poetry

Pump with no volume = fart in the wind.

Dump with high volume = stop hunt confirmed.

Volume shows you who’s dying, who’s faking, and who’s laughing.

📌 Indicators:

– VPVR (Volume Profile)

– OBV (On Balance Volume)

– CVD (Cumulative Volume Delta)

💡 No volume? No conviction. Just noise.

Pump with no volume = fart in the wind.

Dump with high volume = stop hunt confirmed.

Volume shows you who’s dying, who’s faking, and who’s laughing.

📌 Indicators:

– VPVR (Volume Profile)

– OBV (On Balance Volume)

– CVD (Cumulative Volume Delta)

💡 No volume? No conviction. Just noise.

7. Ranges Are Trap Zones, Not Safe Spaces

Sideways = danger zone.

SLs stack above. SLs stack below. The market will eat both before doing anything meaningful.

You think you're safe. You're not.

You're just marinating in indecision, waiting to be served.

📌 Tools:

– Range Box

– Liquidity Sweep Markers

💡 Wait for the sweep. Then trade the reaction, not the boredom.

Sideways = danger zone.

SLs stack above. SLs stack below. The market will eat both before doing anything meaningful.

You think you're safe. You're not.

You're just marinating in indecision, waiting to be served.

📌 Tools:

– Range Box

– Liquidity Sweep Markers

💡 Wait for the sweep. Then trade the reaction, not the boredom.

8. Wicks Aren’t Mistakes They’re Killshots

Big ugly wicks?

Those are execution scars. The market didn't flinch it fired.

💡 A wick + big volume + quick reversal = probably a trap for retail liquidity.

📌 Setup combo:

– SFP

– Imbalance

– CHoCH

Big ugly wicks?

Those are execution scars. The market didn't flinch it fired.

💡 A wick + big volume + quick reversal = probably a trap for retail liquidity.

📌 Setup combo:

– SFP

– Imbalance

– CHoCH

9. You Don’t Trade Zones You Trade Reactions

You found an FVG? Cool.

So did 20,000 other people. Doesn’t mean it’s time to blindly ape in.

Wait for the trap to trigger. Wait for the structure to shift. Then you pull the trigger.

📌 Flow:

Zone ➜ Liquidity Grab ➜ Structure Break ➜ Confirmation ➜ Entry

Skip a step? Congrats you just played yourself.

You found an FVG? Cool.

So did 20,000 other people. Doesn’t mean it’s time to blindly ape in.

Wait for the trap to trigger. Wait for the structure to shift. Then you pull the trigger.

📌 Flow:

Zone ➜ Liquidity Grab ➜ Structure Break ➜ Confirmation ➜ Entry

Skip a step? Congrats you just played yourself.

10. If You Don’t See the Trap, You ARE the Trap

If the entry feels obvious and easy…

That’s not a setup. That’s your funeral invitation.

You’re not trading you’re feeding the beast.

📌 Fix it:

– Wait for the retest

– Analyze the context

– Accept that your instinct is often wrong

💡 Be the sniper. Not the f*cking target.

If the entry feels obvious and easy…

That’s not a setup. That’s your funeral invitation.

You’re not trading you’re feeding the beast.

📌 Fix it:

– Wait for the retest

– Analyze the context

– Accept that your instinct is often wrong

💡 Be the sniper. Not the f*cking target.

11. Conclusion & CTA

🔥 Liquidity is the fuel for real moves.

💀 If you can’t see the traps, you're walking into them blindfolded.

🎯 Structure > Liquidity > Confirmation > Entry

💬 Comment "BAIT" and I’ll DM you:

– My SFP/CHoCH setup

– TV indicators

– My no-FOMO checklist (yes, it works)

🔁 RT if you’re done being free lunch

❤️ Like if this thread saved you from another stop-loss murder scene

🔥 Liquidity is the fuel for real moves.

💀 If you can’t see the traps, you're walking into them blindfolded.

🎯 Structure > Liquidity > Confirmation > Entry

💬 Comment "BAIT" and I’ll DM you:

– My SFP/CHoCH setup

– TV indicators

– My no-FOMO checklist (yes, it works)

🔁 RT if you’re done being free lunch

❤️ Like if this thread saved you from another stop-loss murder scene

• • •

Missing some Tweet in this thread? You can try to

force a refresh