They told us to avoid low ADX.

Turns out... that's exactly where the real edge hides.

📉 SHORTS → ADX > 30 = confirmation

📈 LONGS → low ADX = real edge

Low ADX signals coiled volatility.

It’s not chop. It's a buildup.

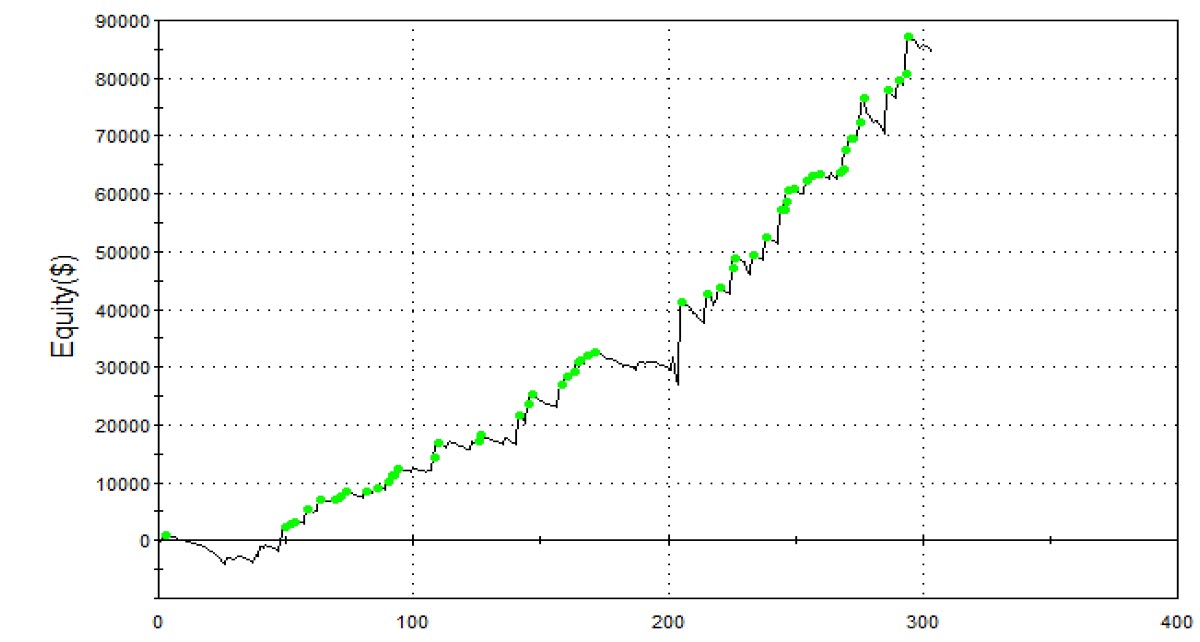

So we built our model breakout strategy using:

• Volatility = open–low difference

• Breakout level = low + (3.3 × volatility)

• Stop entries only

• Entry filter: 8am–3pm

• Exit: when ADX > 40 or after time limit

This flip gave us a consistent edge in markets most traders avoid.

Full breakdown + free resource in the comments

Turns out... that's exactly where the real edge hides.

📉 SHORTS → ADX > 30 = confirmation

📈 LONGS → low ADX = real edge

Low ADX signals coiled volatility.

It’s not chop. It's a buildup.

So we built our model breakout strategy using:

• Volatility = open–low difference

• Breakout level = low + (3.3 × volatility)

• Stop entries only

• Entry filter: 8am–3pm

• Exit: when ADX > 40 or after time limit

This flip gave us a consistent edge in markets most traders avoid.

Full breakdown + free resource in the comments

This video walks you through our ADX research.

You don’t need more indicators. You need a system that works.

Visit the link in our bio to work with our team and let us help you.

Visit the link in our bio to work with our team and let us help you.

Here’s the free resource I promised.

go-bta.com/emini-sp-indic…

go-bta.com/emini-sp-indic…

If you like this, download my FREE "Mr Breakouts Formula" to build breakout trading strategies fast.

Grab it here:

go-bta.com/x-breakoutsfor…

Grab it here:

go-bta.com/x-breakoutsfor…

• • •

Missing some Tweet in this thread? You can try to

force a refresh