People keep asking if $NBIS is getting overvalued at $50. I strongly disagree, we're only getting started. Led by ex-Yandex founder Arkady Volozh, it’s building one of Europe’s largest AI infrastructure businesses. Here's why i think $NBIS is still a buy at $50 👇

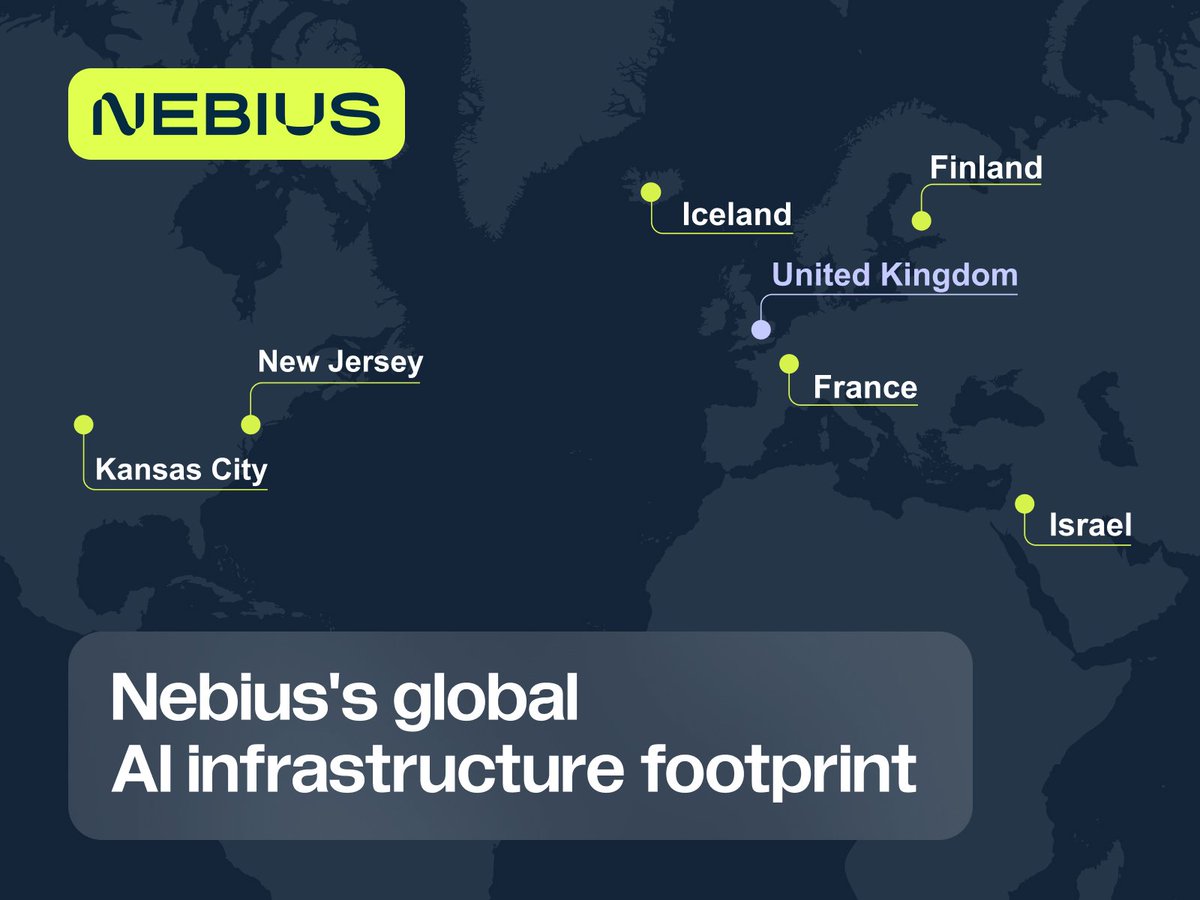

(1) Valuing a company like $NBIS isn't about slapping on a simple multiple and calling it a day, especially for a high-growth AI infrastructure player in its early scaling phase. At its core, $NBIS is betting big on the explosive demand for AI compute, with a vertically integrated platform that's drawing comparisons to peers like $CRWV while carving out its own niche in Europe and beyond.

The stock hovers around $51, but is that overvalued? Far from it. In fact, my conservative fair value comes in at $68 per share, with room for upside to $80 if results continue to surprise. Let me walk you through how I got there, step by step, drawing on forward-looking multiples, comparable companies, and realistic projections.

The stock hovers around $51, but is that overvalued? Far from it. In fact, my conservative fair value comes in at $68 per share, with room for upside to $80 if results continue to surprise. Let me walk you through how I got there, step by step, drawing on forward-looking multiples, comparable companies, and realistic projections.

(2) To start, I lean on a forward multiples approach, which is particularly fitting for growth stocks like $NBIS where current earnings are negative due to heavy investments in data centers and GPU clusters.

This method looks ahead to future revenue and EBITDA, then applies multiples based on what similar AI infrastructure firms are trading at today. Comps include US-focused players like $CRWV (valued at around $55 billion with heavy debt) and Nscale, as well as segments of hyperscalers like $AMZN AWS or $GOOGL Cloud.

These companies command high premiums for their explosive growth: an average EV/Sales of about 5.7x on 2025 estimates, and EV/EBITDA in the 30-50x range for emerging names riding triple-digit revenue surges.

This method looks ahead to future revenue and EBITDA, then applies multiples based on what similar AI infrastructure firms are trading at today. Comps include US-focused players like $CRWV (valued at around $55 billion with heavy debt) and Nscale, as well as segments of hyperscalers like $AMZN AWS or $GOOGL Cloud.

These companies command high premiums for their explosive growth: an average EV/Sales of about 5.7x on 2025 estimates, and EV/EBITDA in the 30-50x range for emerging names riding triple-digit revenue surges.

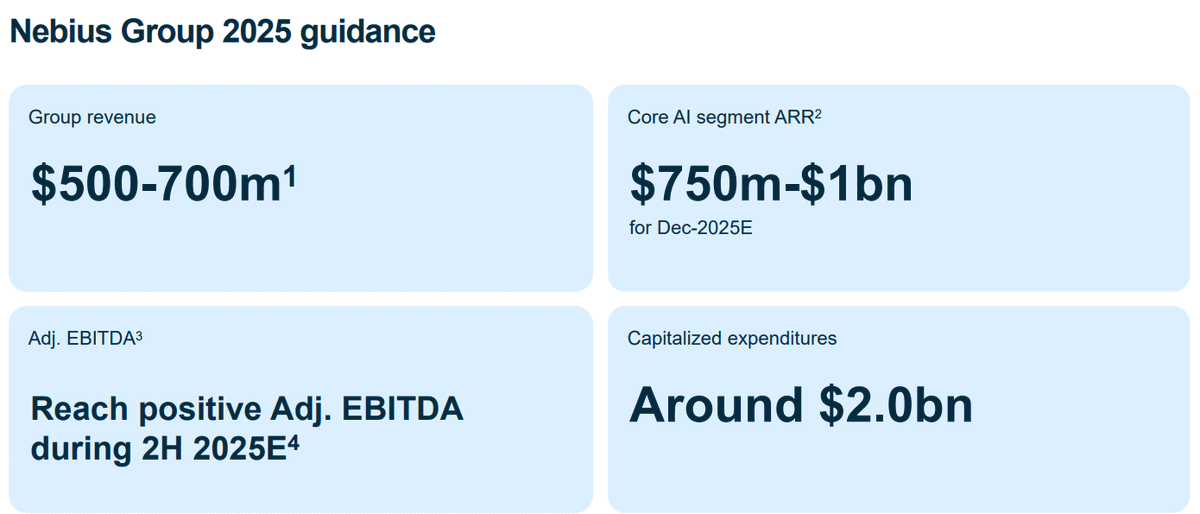

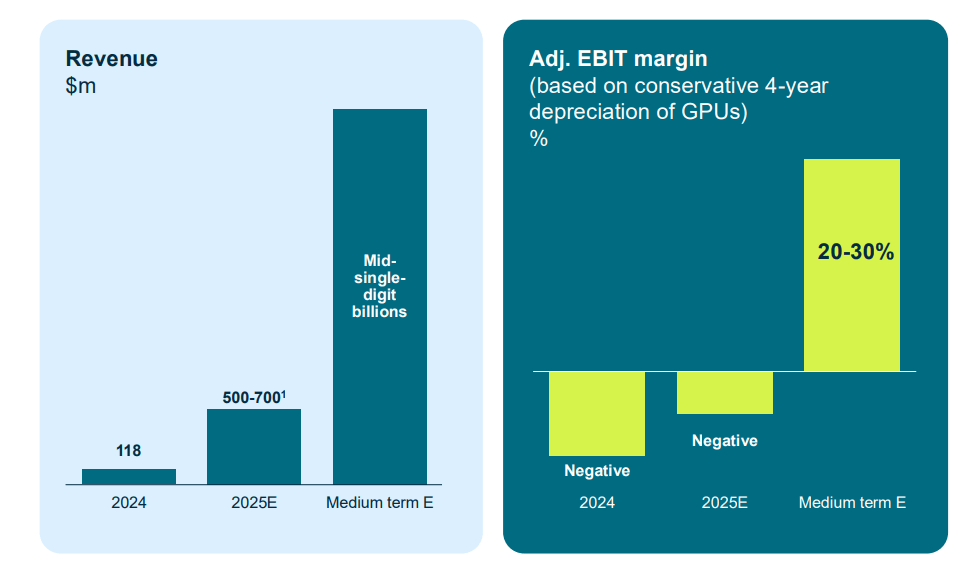

(3) The foundation here is projections, and I keep them conservative to build in a margin of safety. $NBIS's own guidance sets the stage: For 2025, revenue is expected between $500 million and $700 million, so I use the midpoint of $600 million, a solid +406% year-over-year from 2024's $118 million, driven by the core AI cloud segment.

From there, I assume moderated growth as the company matures: $1.8 billion in 2026 (200% increase, down from the 385% YoY seen in Q1 2025 to account for potential market saturation or execution hurdles), and $3 billion in 2027, aligning with management's medium term target (a 67% step-up).

From there, I assume moderated growth as the company matures: $1.8 billion in 2026 (200% increase, down from the 385% YoY seen in Q1 2025 to account for potential market saturation or execution hurdles), and $3 billion in 2027, aligning with management's medium term target (a 67% step-up).

(4) EBITDA projections follow suit. $NBIS expects to turn adjusted EBITDA positive in the second half of 2025, so I model a 20% margin for 2026 ($360 million EBITDA) as it scales efficiencies, rising to 25% in 2027 ($750 million), right in the middle of the 20-30% EBIT margin guidance.

These aren't pie-in-the-sky numbers. They're grounded in the company's improving operational leverage, as seen in Q1 where incremental margins hit 74% quarter-over-quarter, meaning each new dollar of revenue contributed $0.74 to EBITDA.

These aren't pie-in-the-sky numbers. They're grounded in the company's improving operational leverage, as seen in Q1 where incremental margins hit 74% quarter-over-quarter, meaning each new dollar of revenue contributed $0.74 to EBITDA.

(5) Now, applying multiples: For EV/Sales, I use 10x on 2026 revenue, a discount to comps' 15x+ for similar triple-digit growers, reflecting $NBIS's smaller scale and Europe-centric risks.

That yields an $18 billion EV. For a cross-check, 30x EV/EBITDA on 2026 figures gives $10.8 billion. I took the cautious end of the 30-50x range, baking in capex drags.

Blending these, weighting toward the more conservative EBITDA view, lands at a target EV of $14.4 billion by the end of 2025, factoring in execution realities and market sentiment.

That yields an $18 billion EV. For a cross-check, 30x EV/EBITDA on 2026 figures gives $10.8 billion. I took the cautious end of the 30-50x range, baking in capex drags.

Blending these, weighting toward the more conservative EBITDA view, lands at a target EV of $14.4 billion by the end of 2025, factoring in execution realities and market sentiment.

(6) Compared to the current $11 billion EV, that's about 31% upside straight away. But I don't stop there, adjustments refine the picture. On the downside, I haircut 10% for risks like geopolitical legacy (from its Yandex roots), intensifying competition, or a broader AI demand slowdown.

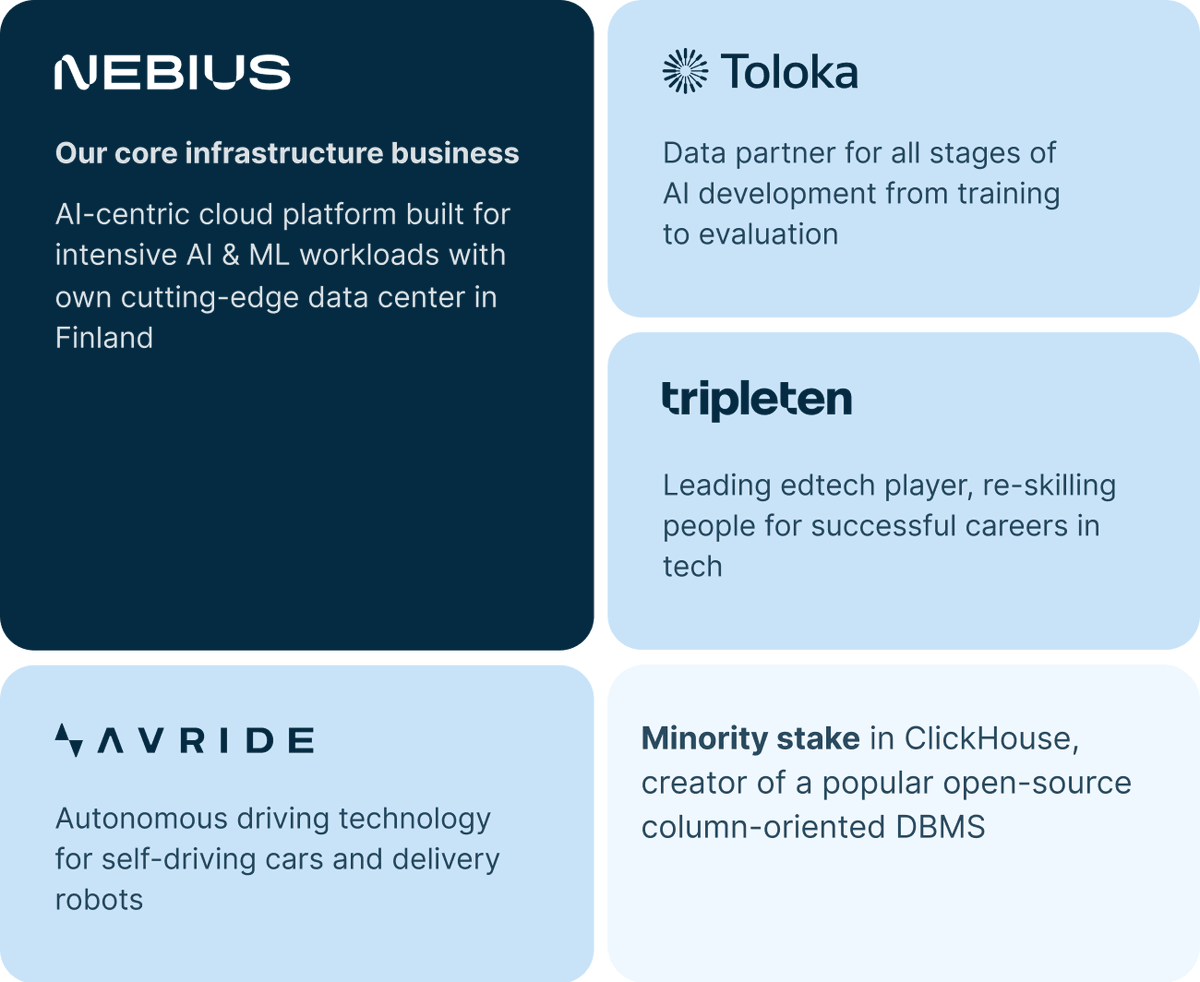

On the upside, subsidiaries add real value: Toloka (AI data, with a recent Bezos-led investment) and Avride could fetch $2-3 billion in monetization (e.g., spins or sales), per analyst estimates. Net cash of $1.4 billion further supports non-dilutive growth, unlike debt-laden peers like $CRWV

On the upside, subsidiaries add real value: Toloka (AI data, with a recent Bezos-led investment) and Avride could fetch $2-3 billion in monetization (e.g., spins or sales), per analyst estimates. Net cash of $1.4 billion further supports non-dilutive growth, unlike debt-laden peers like $CRWV

(7) Dividing that adjusted target EV by shares outstanding (238 million total issued, including Class A and B) gets us to $68 per share, a conservative, realistic figure based on 50%+ CAGR through 2030, without baking in any hype-driven premium.

If Q2 earnings beat guidance, with ARR trending toward the high end of $1 billion or stronger utilization, that could push it to $80 as faster scaling compresses the discount to competitors.

If Q2 earnings beat guidance, with ARR trending toward the high end of $1 billion or stronger utilization, that could push it to $80 as faster scaling compresses the discount to competitors.

(8) Ultimately, $68 isn't a stretch. It's a grounded target for a company with explosive growth, a clean balance sheet, and strategic assets. With Q2 results potentially validating this path, $NBIS feels like a compelling buy at $50, not a sell.

• • •

Missing some Tweet in this thread? You can try to

force a refresh