🚨🇺🇸 Trump Just Brokered the Most One-Sided Deal in Modern History.

No One’s Talking About the Real Reason Why. Because It Was a Bailout Disguised as a Trade Deal.

Let’s connect the dots 🧵👇

No One’s Talking About the Real Reason Why. Because It Was a Bailout Disguised as a Trade Deal.

Let’s connect the dots 🧵👇

1/ Trump just forced the EU to:

→ Pay 15% tariffs on exports to the US

→ Accept ZERO tariffs on US goods

→ Commit to hundreds of billions in US energy & arms

But that’s just the surface.

Let’s go deeper 👇

→ Pay 15% tariffs on exports to the US

→ Accept ZERO tariffs on US goods

→ Commit to hundreds of billions in US energy & arms

But that’s just the surface.

Let’s go deeper 👇

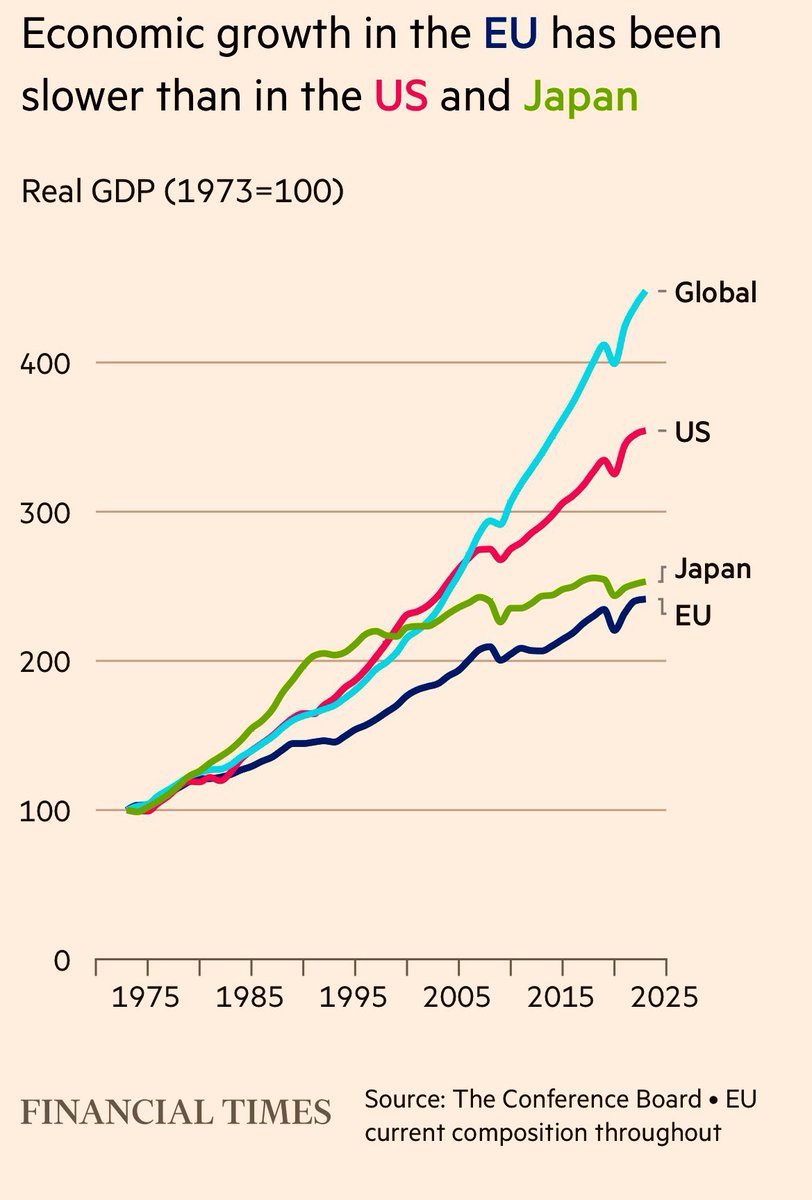

2/ Why would the EU agree to such a humiliating deal?

A region known for decades of trade protectionism…. suddenly surrendering their leverage?

Because Trump didn’t walk in with diplomacy, He walked in with leverage they couldn’t ignore.

A region known for decades of trade protectionism…. suddenly surrendering their leverage?

Because Trump didn’t walk in with diplomacy, He walked in with leverage they couldn’t ignore.

3/ During his first term, Trump:

✔️ Strengthened NATO dependency on US energy

✔️ Shifted military manufacturing dominance back to the US

✔️ Dismantled EU’s ability to form an independent energy bloc

The trap was set years ago.

Now Europe’s hooked on American fuel & firepower.

✔️ Strengthened NATO dependency on US energy

✔️ Shifted military manufacturing dominance back to the US

✔️ Dismantled EU’s ability to form an independent energy bloc

The trap was set years ago.

Now Europe’s hooked on American fuel & firepower.

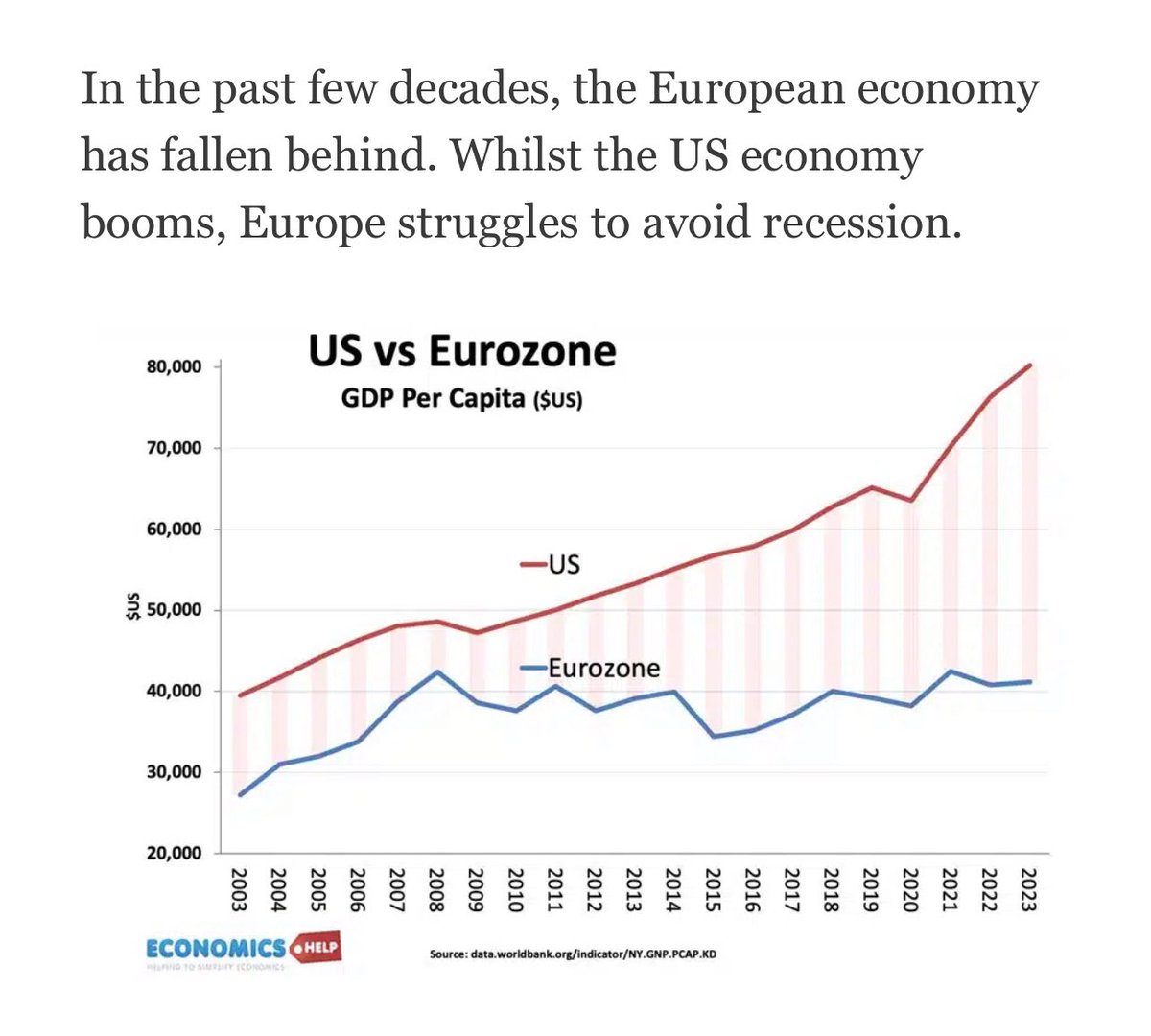

4/ Meanwhile…

Germany is de-industrializing.

France is burning internally.

Italy and Spain are buried in debt.

The EU needs America…. badly.

And Trump knew exactly when to strike.

He threatened EU with tariffs who inturn threatened Trump that they would turn to China. Desperation?

Germany is de-industrializing.

France is burning internally.

Italy and Spain are buried in debt.

The EU needs America…. badly.

And Trump knew exactly when to strike.

He threatened EU with tariffs who inturn threatened Trump that they would turn to China. Desperation?

5/ Some say the deal was “unfair.”

But what if it wasn’t a deal at all…

What if it was a bailout disguised as trade?

The EU got survival.

Trump got leverage.

And America got paid.

But what if it wasn’t a deal at all…

What if it was a bailout disguised as trade?

The EU got survival.

Trump got leverage.

And America got paid.

6/ They laughed at Trump in 2018 when he warned Germany about energy dependence on Russia.

Now?

They’re begging for LNG, power, weapons and political power from the U.S.

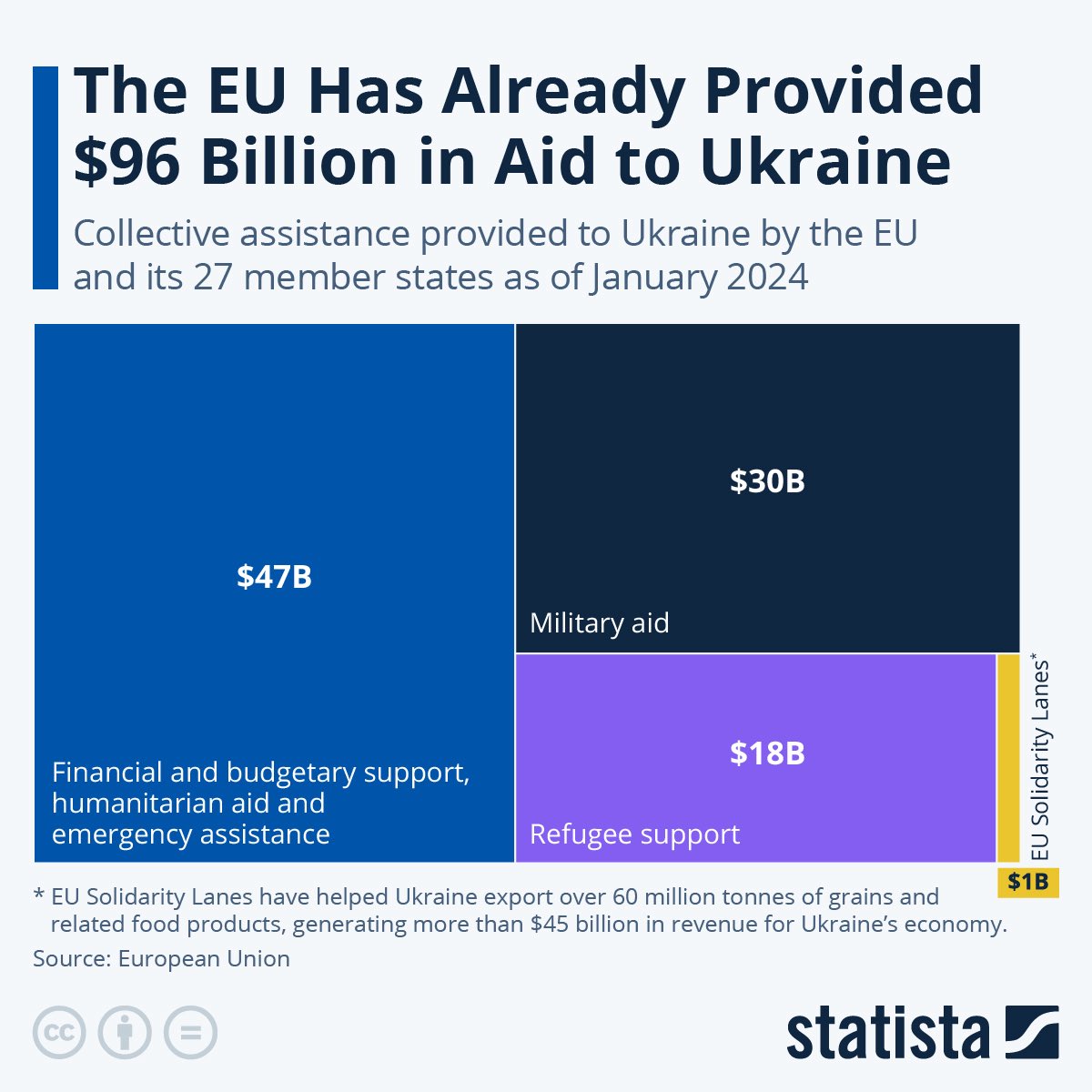

Beneath all this is the elephant in the room:

The Ukraine black hole.

Billions in EU funds drained.

War fatigue setting in.

Now?

They’re begging for LNG, power, weapons and political power from the U.S.

Beneath all this is the elephant in the room:

The Ukraine black hole.

Billions in EU funds drained.

War fatigue setting in.

7/ Trump knew:

If you control their fuel and their defense, You don’t need to win an argument…. You dictate the terms.

Trump’s building the economic trapdoors that lead back to American dominance.

And who is the unhappiest?…. France, the globalist puppet.

If you control their fuel and their defense, You don’t need to win an argument…. You dictate the terms.

Trump’s building the economic trapdoors that lead back to American dominance.

And who is the unhappiest?…. France, the globalist puppet.

8/ How was the Deal Finalized?

Before this “deal” was struck, Trump threatened 100% tariffs on EU cars, steel & luxury goods.

In return, EU leaders panicked, von der Leyen even hinted at pivoting to China.

Brussels thought they could bluff.

Trump called it and flipped the entire board.

Before this “deal” was struck, Trump threatened 100% tariffs on EU cars, steel & luxury goods.

In return, EU leaders panicked, von der Leyen even hinted at pivoting to China.

Brussels thought they could bluff.

Trump called it and flipped the entire board.

9/9 So ask yourself…

Why would Europe agree to a deal that looks one-sided on paper?

What did Trump offer behind the scenes or what did he threaten to expose?

This isn’t just diplomacy.

This is The Art of Leverage. 🧠🇺🇸

Follow @SternDrewCrypto for more in-depth geopolitical threads, decoded strategies, and the stories behind the headlines.

Why would Europe agree to a deal that looks one-sided on paper?

What did Trump offer behind the scenes or what did he threaten to expose?

This isn’t just diplomacy.

This is The Art of Leverage. 🧠🇺🇸

Follow @SternDrewCrypto for more in-depth geopolitical threads, decoded strategies, and the stories behind the headlines.

• • •

Missing some Tweet in this thread? You can try to

force a refresh