EXCLUSIVE

👗Billions of pounds of imports...

↗️Rising by more than 50% a year...

🛬Planes stuffed with cheap clothes...

🇨🇳And a loophole saving Chinese companies from £billions of UK taxes.

Behind the scenes of one of the biggest stories in the modern economy: e-commerce

👇

👗Billions of pounds of imports...

↗️Rising by more than 50% a year...

🛬Planes stuffed with cheap clothes...

🇨🇳And a loophole saving Chinese companies from £billions of UK taxes.

Behind the scenes of one of the biggest stories in the modern economy: e-commerce

👇

We've spent months investigating this phenomenon.

- We've got the first official estimate of the scale of cheap untaxed imports into the UK.

- We've seen inside the planes carrying these goods here.

- A whole logistics industry is growing around it.

This is a v big deal!

- We've got the first official estimate of the scale of cheap untaxed imports into the UK.

- We've seen inside the planes carrying these goods here.

- A whole logistics industry is growing around it.

This is a v big deal!

The story begins with a MASSIVE rise in orders from Chinese e-commerce giants like SHEIN and Temu.

Now, most coverage of these brands focuses on labour standards. An important issue.

But there's something else going on here - something deeper.

A shift in how trade works...

Now, most coverage of these brands focuses on labour standards. An important issue.

But there's something else going on here - something deeper.

A shift in how trade works...

Here, broadly, is things USED to work when you ordered clothes made in China.

A batch would be shipped over to the UK.

It would pay a tariff when it arrived here. It would be stored in a warehouse in the UK.

Then, when you'd order it, it would be driven over from the warehouse

A batch would be shipped over to the UK.

It would pay a tariff when it arrived here. It would be stored in a warehouse in the UK.

Then, when you'd order it, it would be driven over from the warehouse

Today, when you order something from SHEIN, Temu, Tiktok and other Chinese brands, it's a bit different.

There's no warehousing or bulk shipping. The items are sent directly from the factory to your doorstep.

They're not shipped. They're FLOWN...

There's no warehousing or bulk shipping. The items are sent directly from the factory to your doorstep.

They're not shipped. They're FLOWN...

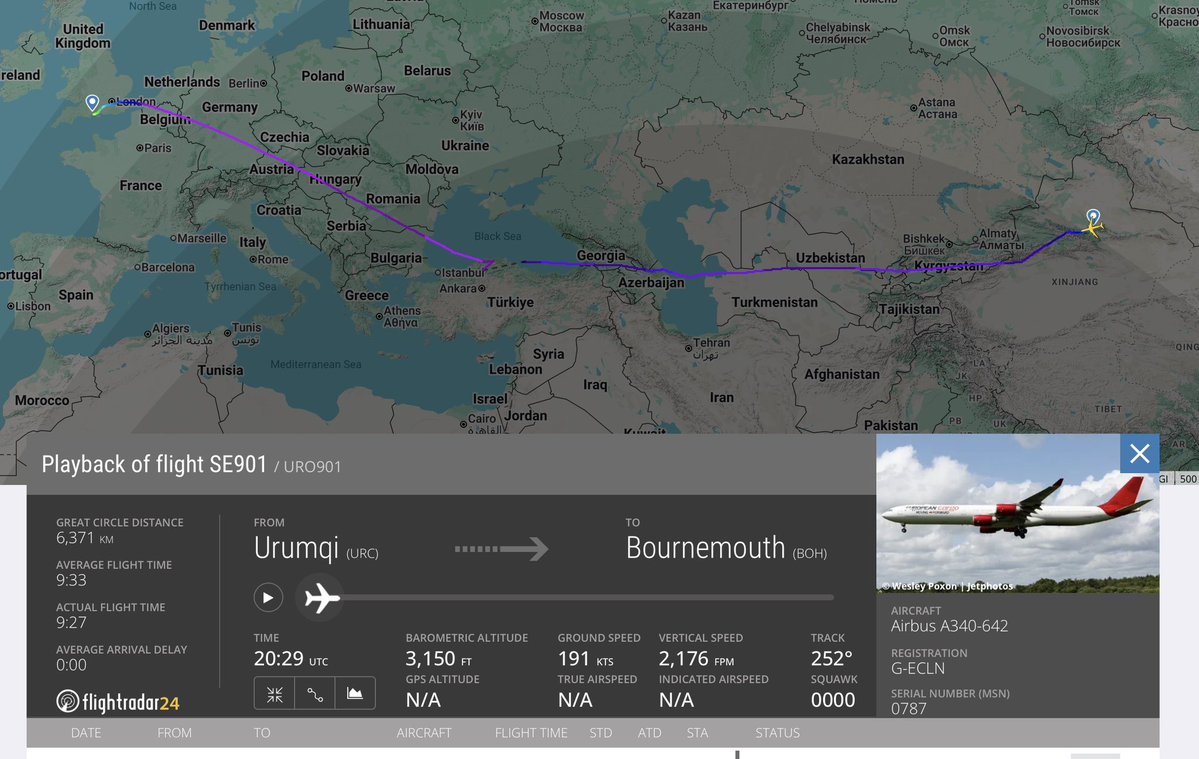

Look at a map of planes flying to the UK and alongside the passenger planes are a fleet of cargo freighters from China. They mostly land at regional airports: Cardiff, Bournemouth, E Midlands. Here's one that landed yday at Prestwick (where Trump landed en route to Turnberry)👇

These flights come from Guangzhou, where much Chinese apparel is made. They come from Chengdu. From Chongqing. From Urumqi, capital of Xinjiang Province, where Chinese cotton is grown (and where there are BIG questions abt labour standards)... straight into regional UK airports

Now for the first time we've seen INSIDE this supply chain.

At Bournemouth Airport, alongside the Ryanair & Jet2 planes arriving from Mallorca, Alicante etc was this enormous plane owned by European Cargo, the biggest UK operator in this business.

It just arrived from Chongqing

At Bournemouth Airport, alongside the Ryanair & Jet2 planes arriving from Mallorca, Alicante etc was this enormous plane owned by European Cargo, the biggest UK operator in this business.

It just arrived from Chongqing

It's an old ex-Virgin Atlantic A340. You might have taken this on holiday yourself!

Now, all the seats have been removed, and the inside is filled with cargo pens, inside which were countless cardboard boxes containing thousands of packages, packed in Chongqing.

Now, all the seats have been removed, and the inside is filled with cargo pens, inside which were countless cardboard boxes containing thousands of packages, packed in Chongqing.

👀Each box was stuffed with packages already addressed to people in the UK.

All e-commerce. All destined for a letterbox around the country very soon afterwards.

It's quite extraordinary.

Here I am with Jason Holt, CEO of European Cargo👇

All e-commerce. All destined for a letterbox around the country very soon afterwards.

It's quite extraordinary.

Here I am with Jason Holt, CEO of European Cargo👇

Bournemouth isn't the only airport where this enormous boom is taking place.

We also visited East Midlands airport, which saw SIX new carriers signing on to land there in the past few months.

Here's an Ethiopian Cargo plane bringing e-commerce from Hong Kong. Look in the belly!

We also visited East Midlands airport, which saw SIX new carriers signing on to land there in the past few months.

Here's an Ethiopian Cargo plane bringing e-commerce from Hong Kong. Look in the belly!

All of this👆 turns decades of trade logic on its head.

The prevailing assumption was always that you ship anything low value and only fly HIGH VALUE items.

But in e-commerce you can pay £2 or so for a T-shirt and get it FLOWN over from China. How on earth do the sums add up?

The prevailing assumption was always that you ship anything low value and only fly HIGH VALUE items.

But in e-commerce you can pay £2 or so for a T-shirt and get it FLOWN over from China. How on earth do the sums add up?

There are two parts to the answer.

First: due to a seismic shift in the cargo market.

There's been enormous competition in air freight post-pandemic, with new up-and-coming businesses vying with each other.

European Cargo are a great example.

That brings down freight rates

First: due to a seismic shift in the cargo market.

There's been enormous competition in air freight post-pandemic, with new up-and-coming businesses vying with each other.

European Cargo are a great example.

That brings down freight rates

Second (and more controversially), by sending items DIRECT to people Chinese firms benefit from a customs rule called "de minimis".

Essentially, if something is worth less than £135 you can send it directly to consumers WITHOUT PAYING ANY TARIFFS.

Many see it as a loophole

Essentially, if something is worth less than £135 you can send it directly to consumers WITHOUT PAYING ANY TARIFFS.

Many see it as a loophole

The logic behind de minimis (a rule most countries have) is it costs more to check cheap shipments than you'd raise from them in tariffs.

Plus it encourages trade with low income countries & brings down prices. But now many, inc US/EU, want to abolish it

Plus it encourages trade with low income countries & brings down prices. But now many, inc US/EU, want to abolish it

https://x.com/EdConwaySky/status/1917836744856052050

The UK govt recently launched an investigation into "de minimis" or as they call it, "low value imports". It's being run by HMT and no-one is entirely sure either when they'll decide on this or what they'll end up doing about it.

gov.uk/government/new…

gov.uk/government/new…

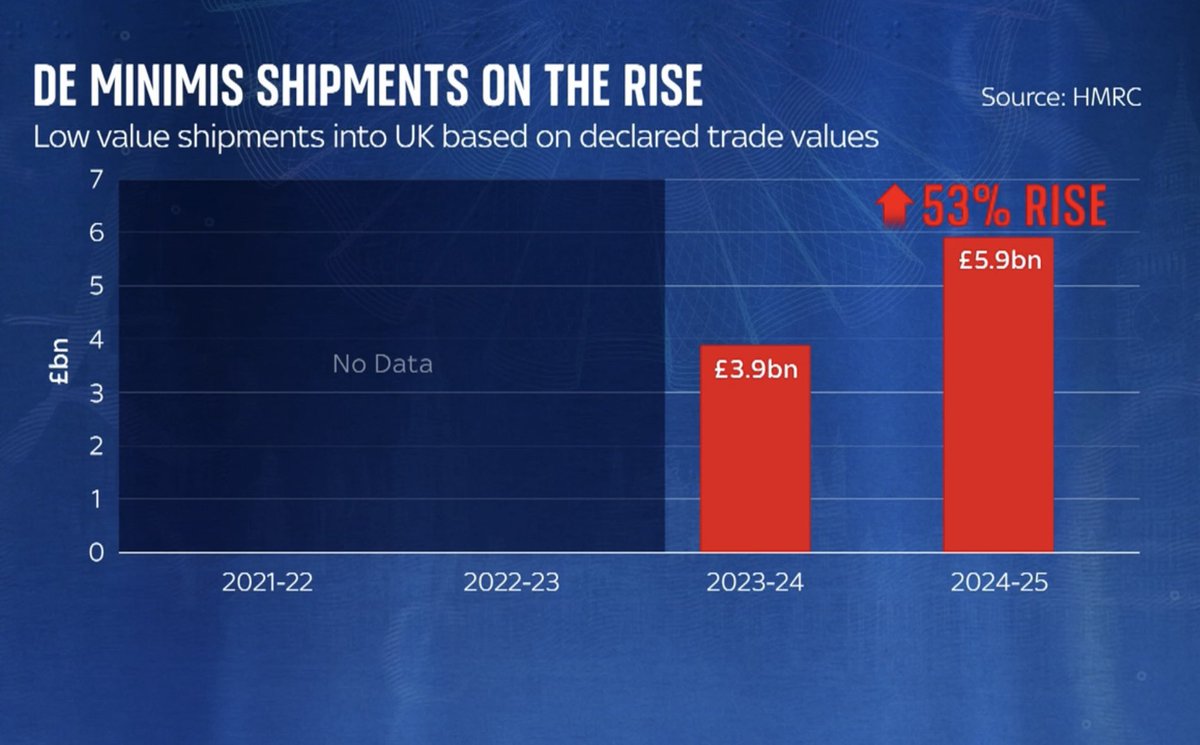

Aside from anything else, until now there was no publicly-available figure on the scale of this trade. So economists could easily ignore/dismiss it.

Everyone knows ancedotally that ecommerce is a big deal. But in the absence of data it's been hard to know just how big a deal.

Everyone knows ancedotally that ecommerce is a big deal. But in the absence of data it's been hard to know just how big a deal.

Now, following an FOI request, @SkyNews has figs from HMRC showing the scale of de minimis imports into the UK in the last fiscal year: £5.9 billion. And rising by 53% a year(!)

And many suspect these numbers are an undercount - because not all the imports are properly declared.

And many suspect these numbers are an undercount - because not all the imports are properly declared.

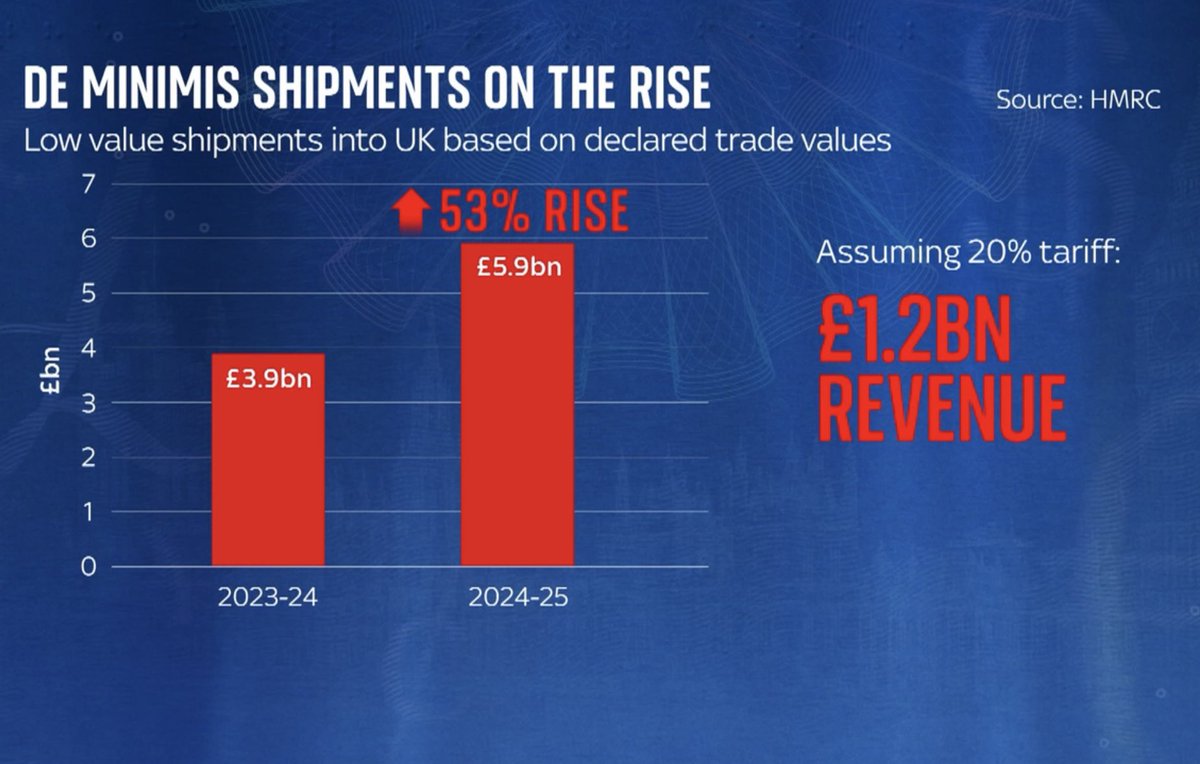

Critically, all those imports are excluded from paying tariffs.

If they were tariffed at 20% it would have raised more than £1bn in taxes. Enough, more or less to fill the black hole left by the winter fuel payment u-turn. So this is a BIG deal.

NB big proviso over that fig is it makes no account of how imports would drop in the event of tariffs. But on the flip side, if as officials suspect that £5.9bn figure is an undercount, then the total tariff-free flows could be higher still

If they were tariffed at 20% it would have raised more than £1bn in taxes. Enough, more or less to fill the black hole left by the winter fuel payment u-turn. So this is a BIG deal.

NB big proviso over that fig is it makes no account of how imports would drop in the event of tariffs. But on the flip side, if as officials suspect that £5.9bn figure is an undercount, then the total tariff-free flows could be higher still

In our recent investigation into textile manufacturing in Leicester, producers said cheap Chinese imports were one of the biggest new threats to business. It's v hard to compete. The fact e-commerce firms don't pay tariffs makes it nigh on impossible.

https://x.com/EdConwaySky/status/1927651486923706419

So, given de minimis is effectively a tax break for Chinese e-commerce & is devastating UK manufacturers, you might have assumed this is an open and shut case, right?

Remove the loophole, right?

But there's more...

Remove the loophole, right?

But there's more...

Nearly every economic study into de minimis has found that these cheap imports disproportionately benefit low income households. Remove the loophole and it's struggling families who will feel it the most.

Good paper on that here: akhandelwal8.github.io/files/wp_DM/DM…

Good paper on that here: akhandelwal8.github.io/files/wp_DM/DM…

Moreover, the air freight sector is booming. It's creating hundreds of jobs.

Regional airports like Bournemouth, Prestwick etc are dependent on it. Remove the loophole and they all suffer.

So this is not simple. Does govt prioritise domestic production or cheap consumption?

Regional airports like Bournemouth, Prestwick etc are dependent on it. Remove the loophole and they all suffer.

So this is not simple. Does govt prioritise domestic production or cheap consumption?

📽️Anyway, for MUCH more, pls watch the film @aoifeyourell & I made.

A MASSIVE shift in the way trade happens is underway.

It's barely been documented.

It has consequences for all of us - even if you don't order e-commerce.

Here's our glimpse inside👇

A MASSIVE shift in the way trade happens is underway.

It's barely been documented.

It has consequences for all of us - even if you don't order e-commerce.

Here's our glimpse inside👇

For (even) more, here's the full story on the @SkyNews site: news.sky.com/story/revealed…

• • •

Missing some Tweet in this thread? You can try to

force a refresh