🧵BITCOIN'S FINAL ATTACK

Corporate adoption of Bitcoin is the FINAL SPECULATIVE ATTACK on fiat currency.

Let me explain the game theory that every CFO will eventually realize… 👇

Corporate adoption of Bitcoin is the FINAL SPECULATIVE ATTACK on fiat currency.

Let me explain the game theory that every CFO will eventually realize… 👇

A speculative attack is when actors borrow a weaker currency, buy a stronger one, and let the inflation destroy the debt.

It’s what George Soros did to the Bank of England in 1992.

But now?

It’s not hedge funds attacking nations.

It’s public companies attacking fiat itself.

It’s what George Soros did to the Bank of England in 1992.

But now?

It’s not hedge funds attacking nations.

It’s public companies attacking fiat itself.

Bitcoin Treasury Companies are the new speculators.

Except instead of shorting fiat directly, they weaponize capital markets:

• Raise dollars

• Buy BTC

• Wait for fiat to bleed out

They arbitrage trust, time, and energy across balance sheets.

It’s beautiful.

Except instead of shorting fiat directly, they weaponize capital markets:

• Raise dollars

• Buy BTC

• Wait for fiat to bleed out

They arbitrage trust, time, and energy across balance sheets.

It’s beautiful.

Every dollar a public company converts into Bitcoin becomes a permanent vacuum on fiat liquidity.

The fiat never returns.

It’s sold once, used to buy BTC, and the BTC is locked away.

Now imagine that on corporate balance sheets across the S&P 500.

You get it yet?

The fiat never returns.

It’s sold once, used to buy BTC, and the BTC is locked away.

Now imagine that on corporate balance sheets across the S&P 500.

You get it yet?

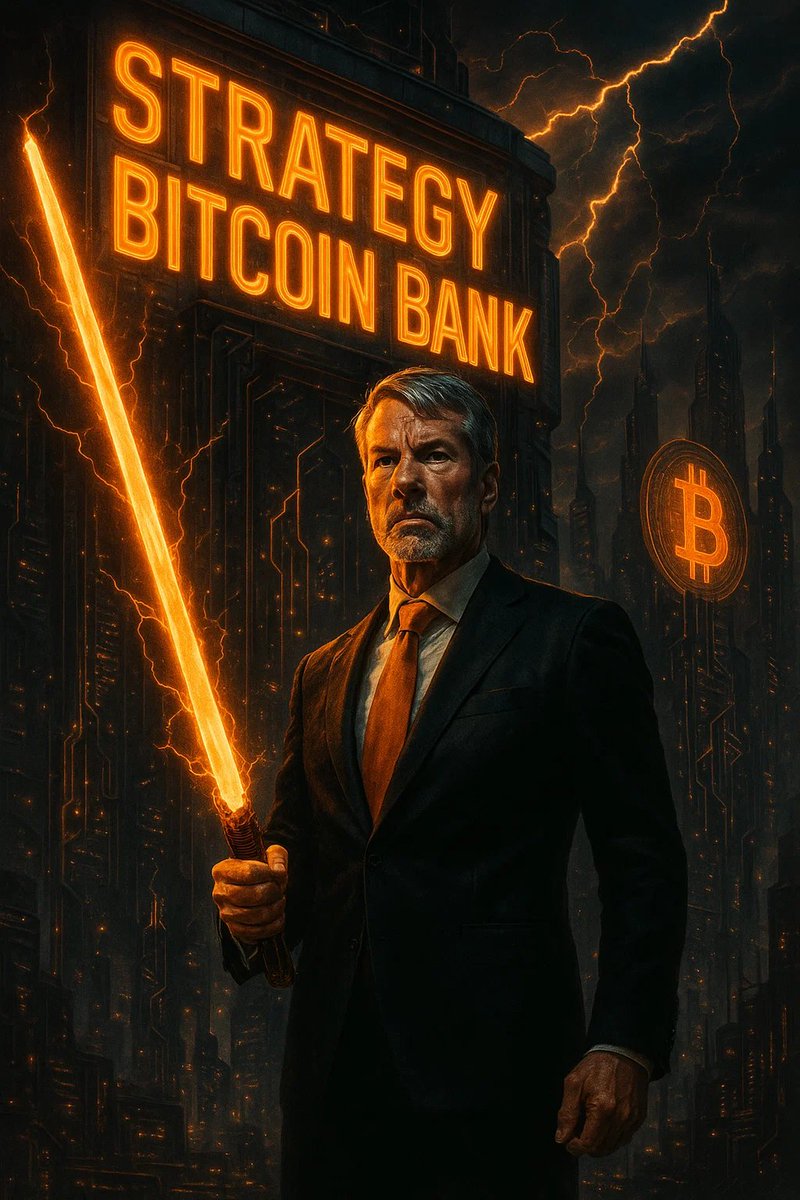

MSTR showed the playbook:

Raise cheap fiat, buy perfect money.

• $8.2B in debt

• 607,770 BTC (worth $71.6 billion)

• 10x+ BTC per share growth

• Market cap went vertical

This was the first speculative attack of the fiat endgame.

Every CFO now holds the detonator.

Raise cheap fiat, buy perfect money.

• $8.2B in debt

• 607,770 BTC (worth $71.6 billion)

• 10x+ BTC per share growth

• Market cap went vertical

This was the first speculative attack of the fiat endgame.

Every CFO now holds the detonator.

Here’s the kicker:

You don’t need 100% of corporations to do this.

You just need the first few hundred.

And we're already seeing it happen.

Every company that front-runs the others compresses the Bitcoin float…

And every one that lags will pay exponentially higher prices.

Game theory 101.

You don’t need 100% of corporations to do this.

You just need the first few hundred.

And we're already seeing it happen.

Every company that front-runs the others compresses the Bitcoin float…

And every one that lags will pay exponentially higher prices.

Game theory 101.

ETFs are passive.

Corporate treasuries are aggressive.

An ETF buys Bitcoin once.

A treasury company raises new fiat to buy more BTC, faster, with leverage.

This capital warfare, sped up using INTELLIGENT LEVERAGE.

Corporate treasuries are aggressive.

An ETF buys Bitcoin once.

A treasury company raises new fiat to buy more BTC, faster, with leverage.

This capital warfare, sped up using INTELLIGENT LEVERAGE.

Every corporate buyer forces fiat into a corner.

• Denominator dies

• Scarcity hardens

• Supply dries up

Fiat can’t fight back... because printing only speeds up the attack.

There is no defense.

Only delay.

• Denominator dies

• Scarcity hardens

• Supply dries up

Fiat can’t fight back... because printing only speeds up the attack.

There is no defense.

Only delay.

The entire fiat system is based on one lie:

That people will hold paper when harder capital exists.

Corporate Bitcoin adoption is exposing that lie at scale - on earnings calls, in SEC filings, and through balance sheet gravity.

This is hyperbitcoinization in real time.

That people will hold paper when harder capital exists.

Corporate Bitcoin adoption is exposing that lie at scale - on earnings calls, in SEC filings, and through balance sheet gravity.

This is hyperbitcoinization in real time.

You are watching fiat die.

Not with a bang, but with a quarterly earnings report.

One company at a time.

One buy at a time.

One stack at a time.

The endgame isn’t retail.

It’s corporate capital warlords pillaging fiat with a smile.

Not with a bang, but with a quarterly earnings report.

One company at a time.

One buy at a time.

One stack at a time.

The endgame isn’t retail.

It’s corporate capital warlords pillaging fiat with a smile.

When fiat collapses, historians will say it was inevitable.

But here’s the truth:

It collapsed the moment CFOs realized

they could borrow fake money

to buy real money

and NEVER give it back.

But here’s the truth:

It collapsed the moment CFOs realized

they could borrow fake money

to buy real money

and NEVER give it back.

• • •

Missing some Tweet in this thread? You can try to

force a refresh