Holy sh*t… Grok 4 just helped me:

• Name a business

• Validate the niche

• Analyze competitors

• Build a GTM plan

• Write the pitch & ad copy

• Map out socials + revenue

All in 5 mins.

10 prompts that turn Grok into your AI cofounder: 👇

• Name a business

• Validate the niche

• Analyze competitors

• Build a GTM plan

• Write the pitch & ad copy

• Map out socials + revenue

All in 5 mins.

10 prompts that turn Grok into your AI cofounder: 👇

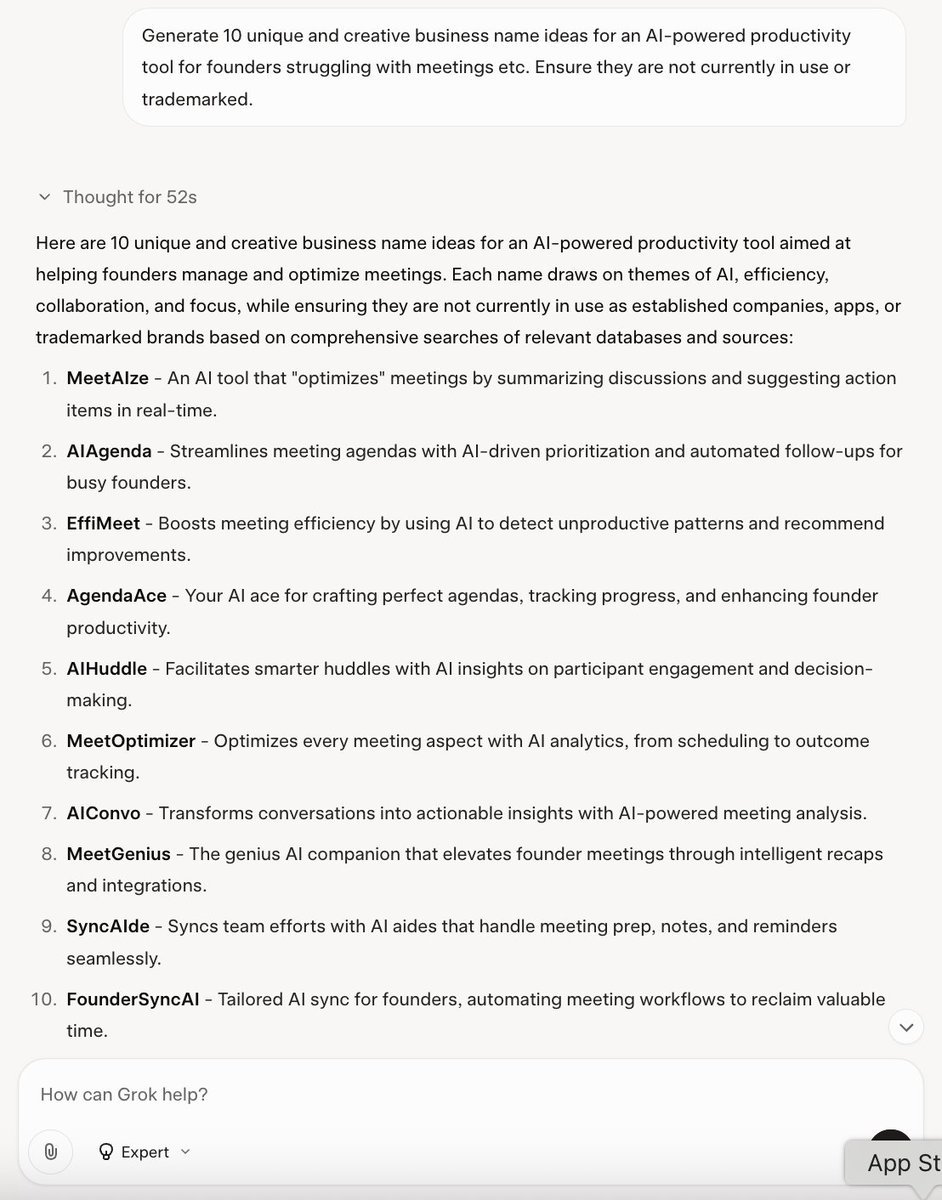

1/ Unique Business Name Generator

Prompt:

"Generate 10 unique and creative business name ideas for a [industry/niche] business. Ensure they are not currently in use or trademarked."

Prompt:

"Generate 10 unique and creative business name ideas for a [industry/niche] business. Ensure they are not currently in use or trademarked."

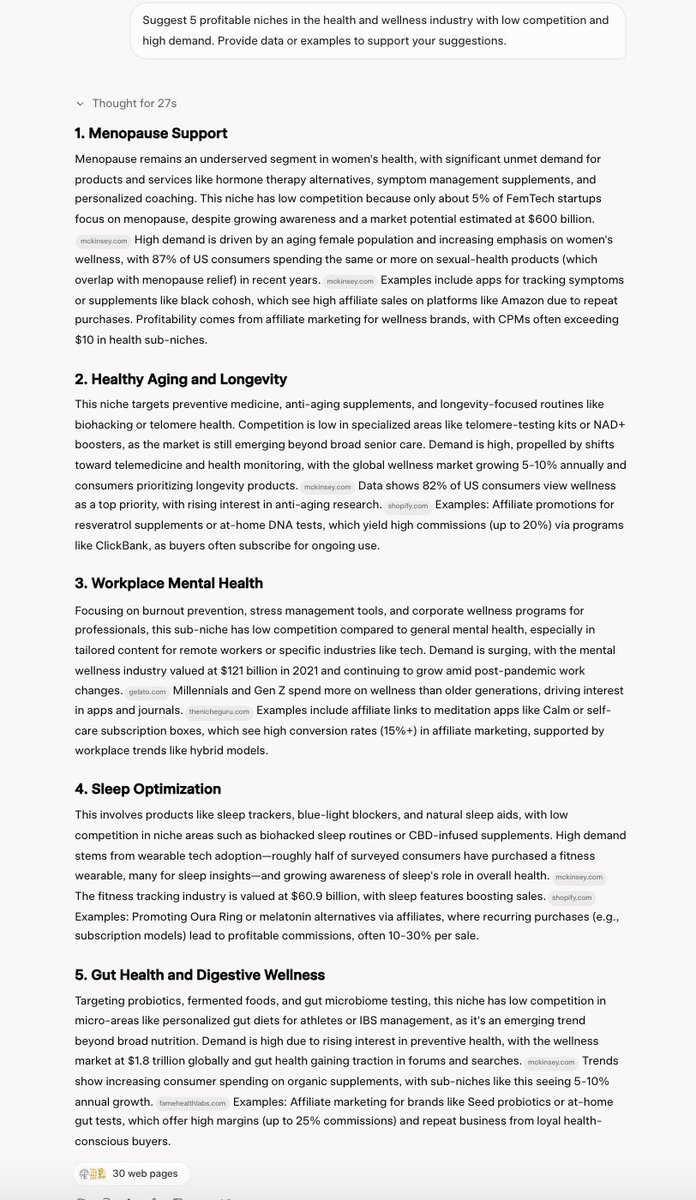

2/ Niche Discovery Assistant

Prompt:

"Suggest 5 profitable niches in [industry] with low competition and high demand. Provide data or examples to support your suggestions."

Prompt:

"Suggest 5 profitable niches in [industry] with low competition and high demand. Provide data or examples to support your suggestions."

3/ Competitor Research Specialist

Prompt:

"Identify the top 5 competitors in the [niche] market. Summarize their products, pricing strategies, and customer reviews."

Prompt:

"Identify the top 5 competitors in the [niche] market. Summarize their products, pricing strategies, and customer reviews."

4/ Website - Newsletter Tools Finder

Prompt:

"List the best website builders or newsletter tools for small businesses. Include features, pricing, and recommendations based on user needs."

Prompt:

"List the best website builders or newsletter tools for small businesses. Include features, pricing, and recommendations based on user needs."

5/ Market Validation Expert

Prompt:

"Analyze the market potential for a [product/service]. Include target audience size, competition, and profitability potential."

Prompt:

"Analyze the market potential for a [product/service]. Include target audience size, competition, and profitability potential."

6/ Customer Persona Builder

Prompt:

"Create a detailed customer persona for a [product/service]. Include demographics, pain points, and purchasing behavior."

Prompt:

"Create a detailed customer persona for a [product/service]. Include demographics, pain points, and purchasing behavior."

7/ Revenue Model Advisor

Prompt:

"Suggest 3 revenue models for a [type of business]. Explain how each model works and which one is most suitable for my business."

Prompt:

"Suggest 3 revenue models for a [type of business]. Explain how each model works and which one is most suitable for my business."

8/ Social Media Strategy Planner

Prompt:

"Develop a 30-day social media marketing strategy for a [type of business]. Include post ideas, engagement tips, and scheduling recommendations."

Prompt:

"Develop a 30-day social media marketing strategy for a [type of business]. Include post ideas, engagement tips, and scheduling recommendations."

9/ Supplier/Partner Researcher

Prompt:

"Identify potential suppliers or business partners for a [type of product/service]. Include their contact details and reviews if available."

Prompt:

"Identify potential suppliers or business partners for a [type of product/service]. Include their contact details and reviews if available."

10/ Industry Trends Forecaster

Prompt:

"Analyze the emerging trends in [industry]. Provide actionable insights on how a new business can leverage these trends for success."

Prompt:

"Analyze the emerging trends in [industry]. Provide actionable insights on how a new business can leverage these trends for success."

I hope you've found this thread helpful.

Follow me @aigleeson for more.

Like/Repost the quote below if you can:

Follow me @aigleeson for more.

Like/Repost the quote below if you can:

https://twitter.com/1904718477296062464/status/1950482001049567708

• • •

Missing some Tweet in this thread? You can try to

force a refresh