🧵How Bitcoin Keeps You Rich

Since COVID in 2020, inflation has absolutely decimated the purchasing power of your dollar.

But what if Bitcoin was your money?

These FACTS will BLOW your MIND: 👇

Since COVID in 2020, inflation has absolutely decimated the purchasing power of your dollar.

But what if Bitcoin was your money?

These FACTS will BLOW your MIND: 👇

Here are 10 everyday items with receipts Jan 2020 vs Jul 2025… in USD and in sats.

Bring antacids.

Amazon Prime (annual)

Jan 2020: $119.00 | ₿ price: ₿0.017132 ≈ 1,713,162 sats

Jul 2025: $139.00 | ₿ price: ₿0.001180 ≈ 117,955 sats

USD change: +16.8% | Sats change: −93.1%

Prime moved from “free 2‑day shipping” to “free existential crisis with purchase.”

Bring antacids.

Amazon Prime (annual)

Jan 2020: $119.00 | ₿ price: ₿0.017132 ≈ 1,713,162 sats

Jul 2025: $139.00 | ₿ price: ₿0.001180 ≈ 117,955 sats

USD change: +16.8% | Sats change: −93.1%

Prime moved from “free 2‑day shipping” to “free existential crisis with purchase.”

Gasoline, regular, per gallon (U.S. avg)

Jan 2020: $2.548 | ₿ price: ₿0.000367 ≈ 36,682 sats

Jul 2025: $3.125 | ₿ price: ₿0.000027 ≈ 2,652 sats

USD change: +22.6% | Sats change: −92.8%

Car says “feed me.”

Wallet says “walk.”

Jan 2020: $2.548 | ₿ price: ₿0.000367 ≈ 36,682 sats

Jul 2025: $3.125 | ₿ price: ₿0.000027 ≈ 2,652 sats

USD change: +22.6% | Sats change: −92.8%

Car says “feed me.”

Wallet says “walk.”

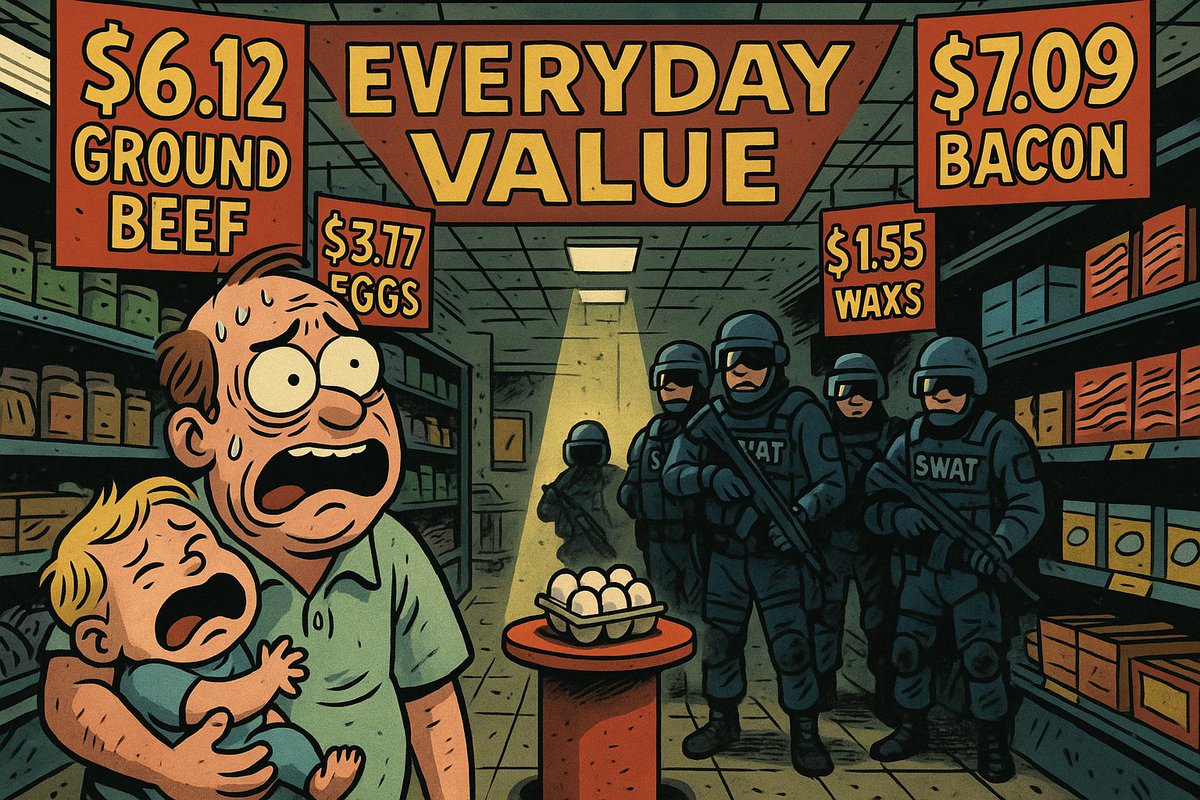

Eggs, Grade A large, dozen (BLS avg price)

Jan 2020: $1.461 | ₿ price: ₿0.000210 ≈ 21,033 sats

Jun 2025 (latest): $3.775 | ₿ price: ₿0.000032 ≈ 3,203 sats

USD change: +158.4% | Sats change: −84.8%

Omelet now qualifies for FHA financing.

Jan 2020: $1.461 | ₿ price: ₿0.000210 ≈ 21,033 sats

Jun 2025 (latest): $3.775 | ₿ price: ₿0.000032 ≈ 3,203 sats

USD change: +158.4% | Sats change: −84.8%

Omelet now qualifies for FHA financing.

Milk, whole, gallon (BLS avg price)

Jan 2020: $3.253 | ₿ price: ₿0.000468 ≈ 46,831 sats

Jun 2025 (latest): $4.029 | ₿ price: ₿0.000034 ≈ 3,419 sats

USD change: +23.9% | Sats change: −92.7%

Cereal’s just a delivery system for regret.

Jan 2020: $3.253 | ₿ price: ₿0.000468 ≈ 46,831 sats

Jun 2025 (latest): $4.029 | ₿ price: ₿0.000034 ≈ 3,419 sats

USD change: +23.9% | Sats change: −92.7%

Cereal’s just a delivery system for regret.

Ground beef, lb (BLS avg price)

Jan 2020: $3.886 | ₿ price: ₿0.000559 ≈ 55,944 sats

Jun 2025 (latest): $6.120 | ₿ price: ₿0.000052 ≈ 5,193 sats

USD change: +57.5% | Sats change: −90.7%

Burger night now comes with a credit check.

Jan 2020: $3.886 | ₿ price: ₿0.000559 ≈ 55,944 sats

Jun 2025 (latest): $6.120 | ₿ price: ₿0.000052 ≈ 5,193 sats

USD change: +57.5% | Sats change: −90.7%

Burger night now comes with a credit check.

Bacon, lb (BLS avg price)

Jan 2020: $5.505 | ₿ price: ₿0.000793 ≈ 79,252 sats

Jun 2025 (latest): $7.098 | ₿ price: ₿0.000060 ≈ 6,023 sats

USD change: +28.9% | Sats change: −92.4%

Bacon: still delicious, now financially irresponsible.

Jan 2020: $5.505 | ₿ price: ₿0.000793 ≈ 79,252 sats

Jun 2025 (latest): $7.098 | ₿ price: ₿0.000060 ≈ 6,023 sats

USD change: +28.9% | Sats change: −92.4%

Bacon: still delicious, now financially irresponsible.

Electricity, residential, per kWh (BLS avg price)

Jan 2020: $0.134 | ₿ price: ₿0.000019 ≈ 1,929 sats

Jun 2025 (latest): $0.190 | ₿ price: ₿0.000002 ≈ 161 sats

USD change: +41.8% | Sats change: −91.7%

My lamp doesn’t “turn on,” it “means‑test.”

Jan 2020: $0.134 | ₿ price: ₿0.000019 ≈ 1,929 sats

Jun 2025 (latest): $0.190 | ₿ price: ₿0.000002 ≈ 161 sats

USD change: +41.8% | Sats change: −91.7%

My lamp doesn’t “turn on,” it “means‑test.”

First‑Class Forever stamp (USPS)

Jan 2020: $0.55 | ₿ price: ₿0.000008 ≈ 7,918 sats

Jul 2025: $0.78 | ₿ price: ₿0.000007 ≈ 662 sats

USD change: +41.8% | Sats change: −91.6%

Sending a letter costs almost as much as the bad news inside.

Jan 2020: $0.55 | ₿ price: ₿0.000008 ≈ 7,918 sats

Jul 2025: $0.78 | ₿ price: ₿0.000007 ≈ 662 sats

USD change: +41.8% | Sats change: −91.6%

Sending a letter costs almost as much as the bad news inside.

Median existing home price (NAR)

Jan 2020: $266,300 | ₿ price: ₿38.337398 ≈ 3,833,739,789 sats

Jun 2025 (latest): $435,300 | ₿ price: ₿3.693933 ≈ 369,393,261 sats

USD change: +63.5% | Sats change: −90.4%

Starter home now comes with a starter second job.

Jan 2020: $266,300 | ₿ price: ₿38.337398 ≈ 3,833,739,789 sats

Jun 2025 (latest): $435,300 | ₿ price: ₿3.693933 ≈ 369,393,261 sats

USD change: +63.5% | Sats change: −90.4%

Starter home now comes with a starter second job.

McChicken sandwich

Jan 2020: $2.00 | ₿0.000288 ≈ 28,800 sats

Jul 2025: $3.10 | ₿0.000026 ≈ 2,632 sats

USD change: +55.0% | Sats change: −90.9%

You’re paying triple the price for half the sandwich... and half the flavor.

Jan 2020: $2.00 | ₿0.000288 ≈ 28,800 sats

Jul 2025: $3.10 | ₿0.000026 ≈ 2,632 sats

USD change: +55.0% | Sats change: −90.9%

You’re paying triple the price for half the sandwich... and half the flavor.

Coca‑Cola, 12‑pack cans (U.S. avg)

Jan 2020: $4.50 | ₿0.000648 ≈ 64,800 sats

Jun 2025: $5.79 | ₿0.000049 ≈ 4,913 sats

USD change: +28.7% | Sats change: −92.4%

Twelve cans used to cost less than twelve cents a can. Now they’re counting as fine wine.

Jan 2020: $4.50 | ₿0.000648 ≈ 64,800 sats

Jun 2025: $5.79 | ₿0.000049 ≈ 4,913 sats

USD change: +28.7% | Sats change: −92.4%

Twelve cans used to cost less than twelve cents a can. Now they’re counting as fine wine.

Share this with your friends and family who NEED to understand:

The only way to not be poor is to have Bitcoin as your money.

Opt out of the inflation hell hole. Buy Bitcoin.

The only way to not be poor is to have Bitcoin as your money.

Opt out of the inflation hell hole. Buy Bitcoin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh