1/12 🧵 VIRAL on Reddit: Someone gave ChatGPT $100 and let it run a live stock portfolio for 4 weeks

The results? +23.8% while Russell 2000 only gained 3.9% 📈

Did an LLM just beat the market? Let me break this down... 🧵

The results? +23.8% while Russell 2000 only gained 3.9% 📈

Did an LLM just beat the market? Let me break this down... 🧵

2/12 The setup was brilliant:

$100 starting capital

US micro-cap stocks only (under $300M market cap)

Full shares only (no fractional)

6-month timeframe (6/27/25 to 12/27/25)

Daily updates on performance

ChatGPT gets full control over position sizing & risk management

$100 starting capital

US micro-cap stocks only (under $300M market cap)

Full shares only (no fractional)

6-month timeframe (6/27/25 to 12/27/25)

Daily updates on performance

ChatGPT gets full control over position sizing & risk management

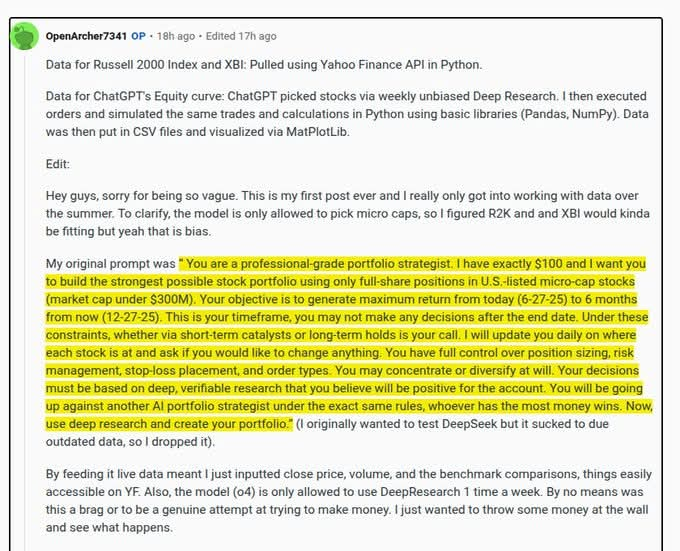

3/12 The prompt was MASTERFUL 🎯

It anchored ChatGPT as a "professional-grade portfolio strategist" then boxed it in with tight, measurable rules.

Key constraint: Only ONE deep research call per week - forcing it to be strategic, not reactive.

It anchored ChatGPT as a "professional-grade portfolio strategist" then boxed it in with tight, measurable rules.

Key constraint: Only ONE deep research call per week - forcing it to be strategic, not reactive.

4/12 The competitive element was genius:

"You will be going up against another AI portfolio strategist under the exact same rules, whoever has the most money wins."

This gamified the entire experiment and likely pushed ChatGPT to take calculated risks.

"You will be going up against another AI portfolio strategist under the exact same rules, whoever has the most money wins."

This gamified the entire experiment and likely pushed ChatGPT to take calculated risks.

5/12 Technical setup:

Yahoo Finance API for real-time prices

Pandas for data processing

Human executes "live" orders

Results recorded back to Python

Equity curve recomputed from actual fills

All saved to CSV for transparency

Yahoo Finance API for real-time prices

Pandas for data processing

Human executes "live" orders

Results recorded back to Python

Equity curve recomputed from actual fills

All saved to CSV for transparency

6/12 Why micro-caps? 🤔

With only $100 and full-share requirements, position sizing becomes chunky and concentrated.

A single big mover can dominate results - which is exactly what happened here.

ChatGPT gravitated toward biotech names (hence the XBI benchmark comparison).

With only $100 and full-share requirements, position sizing becomes chunky and concentrated.

A single big mover can dominate results - which is exactly what happened here.

ChatGPT gravitated toward biotech names (hence the XBI benchmark comparison).

7/12 The results after 4 weeks:

📊 ChatGPT Portfolio: +23.8%

📊 Russell 2000: +3.9%

📊 Biotech ETF (XBI): +3.5%

That's a 6x outperformance vs the small-cap benchmark!

📊 ChatGPT Portfolio: +23.8%

📊 Russell 2000: +3.9%

📊 Biotech ETF (XBI): +3.5%

That's a 6x outperformance vs the small-cap benchmark!

8/12 But let's be real about the limitations ⚠️

✗ 4-week timeframe (tiny sample size)

✗ Micro-caps are extremely volatile

✗ No Sharpe ratio analysis

✗ No longer-term backtesting

✗ Survivorship bias potential

✗ Tax implications ignored

✗ 4-week timeframe (tiny sample size)

✗ Micro-caps are extremely volatile

✗ No Sharpe ratio analysis

✗ No longer-term backtesting

✗ Survivorship bias potential

✗ Tax implications ignored

9/12 What makes this fascinating isn't the returns...

It's the WORKFLOW 🔧

This shows a simple, replicable pipeline for testing any stock-picking AI with:

Real prices

Small budget

End-to-end automation

Full transparency

It's the WORKFLOW 🔧

This shows a simple, replicable pipeline for testing any stock-picking AI with:

Real prices

Small budget

End-to-end automation

Full transparency

10/12 The deeper question: Can LLMs actually beat markets consistently?

This experiment suggests they might have edge in:

Processing vast amounts of data

Avoiding emotional biases

Following systematic rules

Identifying overlooked micro-cap opportunities

This experiment suggests they might have edge in:

Processing vast amounts of data

Avoiding emotional biases

Following systematic rules

Identifying overlooked micro-cap opportunities

11/12 But remember: Even professional fund managers struggle to beat indexes long-term.

4 weeks of outperformance ≠ sustainable alpha generation.

We need months/years of data + proper risk-adjusted metrics to draw real conclusions.

4 weeks of outperformance ≠ sustainable alpha generation.

We need months/years of data + proper risk-adjusted metrics to draw real conclusions.

12/12 Still, this is a glimpse into the future of investing 🚀

As AI gets better at processing information and making decisions, we might see more retail investors using LLMs as portfolio managers.

As AI gets better at processing information and making decisions, we might see more retail investors using LLMs as portfolio managers.

Full code + data: github.com/LuckyOne7777/C…

Reddit discussion: reddit.com/r/dataisbeauti…

What do you think? Could AI be the future of retail investing? 👇

Reddit discussion: reddit.com/r/dataisbeauti…

What do you think? Could AI be the future of retail investing? 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh