Over time, OPERATIONAL ADVANTAGES lead to higher margins, easier scalability, and greater dominance within an industry.

Here are 15 companies, from mega caps to smaller players, that hold a CLEAR EDGE over their competition:

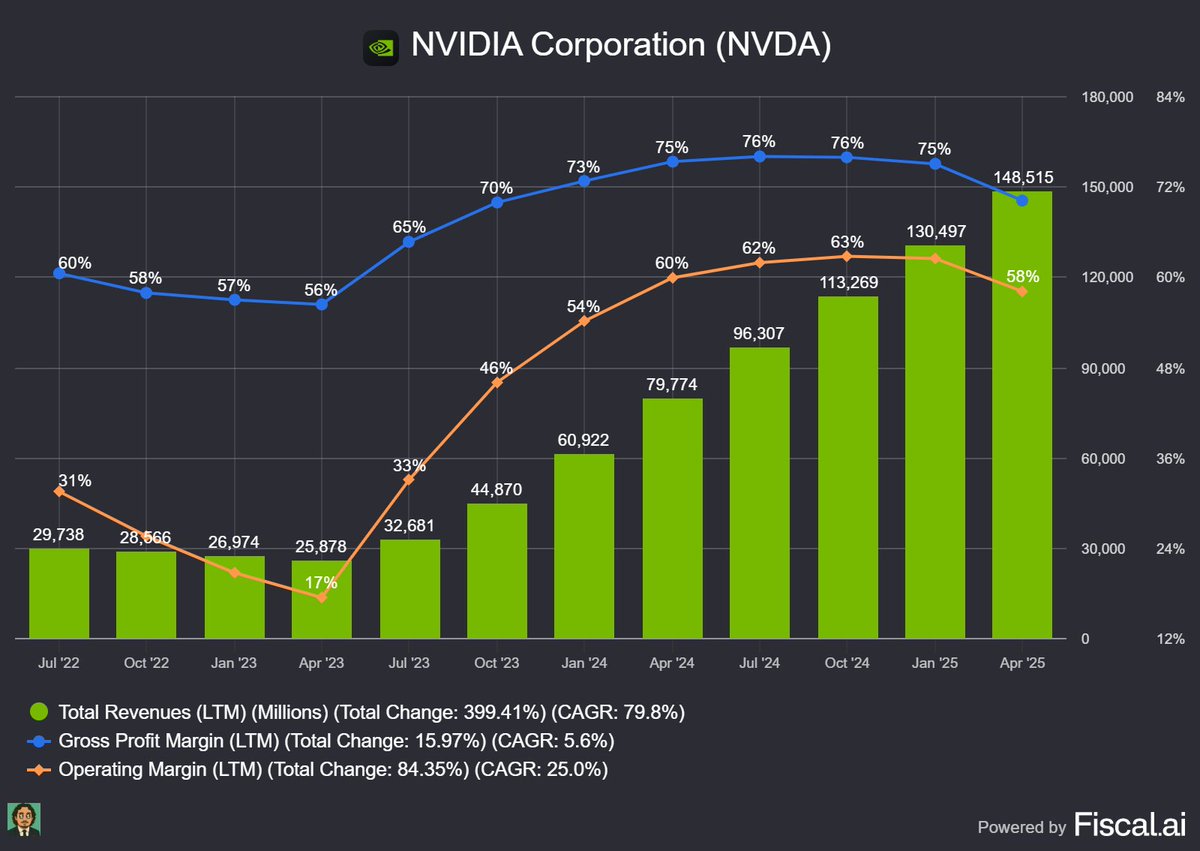

1/ MEGA CAP: $NVDA

CUDA is a textbook example of a true advantage.

They effectively monopolized AI training.

It has turned them from a hardware company into a software enabled platform with significant switching costs.

Nvidia is essentially the "picks and shovels" of the AI gold rush.

They continue to leverage this software edge across AI, networking, and automotive computing.

This one is hard to miss.

Here are 15 companies, from mega caps to smaller players, that hold a CLEAR EDGE over their competition:

1/ MEGA CAP: $NVDA

CUDA is a textbook example of a true advantage.

They effectively monopolized AI training.

It has turned them from a hardware company into a software enabled platform with significant switching costs.

Nvidia is essentially the "picks and shovels" of the AI gold rush.

They continue to leverage this software edge across AI, networking, and automotive computing.

This one is hard to miss.

2/ MEGA CAP: $NFLX

Not talked about enough, but $NFLX has a powerful global dataset on viewing habits.

This allows them to create content at scale.

As the last few years have shown, they know what to produce, and how to maximize engagement while minimizing risk.

They operate with one of the highest ROIs in visual media.

Not talked about enough, but $NFLX has a powerful global dataset on viewing habits.

This allows them to create content at scale.

As the last few years have shown, they know what to produce, and how to maximize engagement while minimizing risk.

They operate with one of the highest ROIs in visual media.

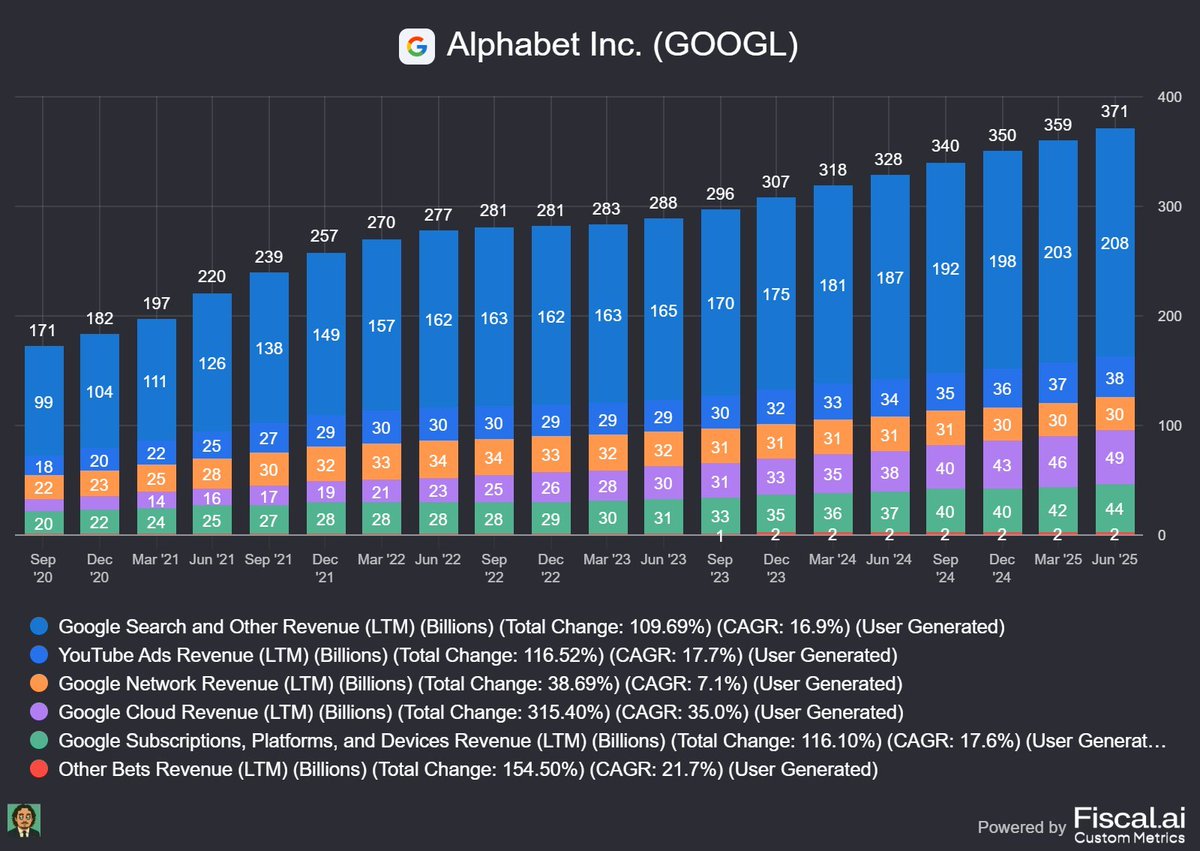

3/ MEGA CAP: $GOOG

It all comes down to data.

Google owns the largest and most diverse dataset on human intent anywhere in the world. And it's constantly being fed into a self improving intelligence engine.

This is the single most important input for building and refining AI systems.

They’re literally in court for monopolizing it - so it’s fair to say the advantage is massive.

It all comes down to data.

Google owns the largest and most diverse dataset on human intent anywhere in the world. And it's constantly being fed into a self improving intelligence engine.

This is the single most important input for building and refining AI systems.

They’re literally in court for monopolizing it - so it’s fair to say the advantage is massive.

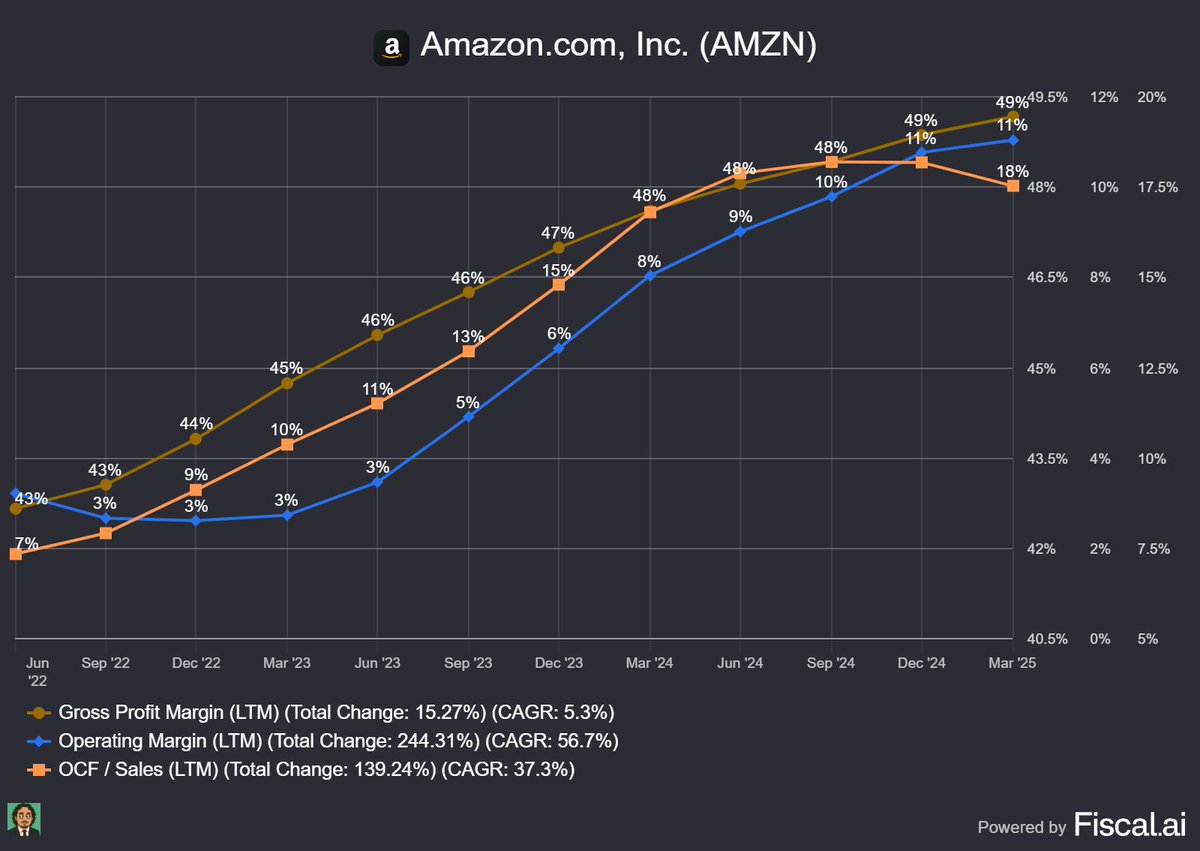

4/ MEGA CAP: $AMZN

A generational structural advantage at massive scale.

Amazon runs the world’s largest physical fulfillment network alongside one of the most dominant cloud computing platforms.

These are two capital intensive moats that reinforce each other, creating unmatched scale and operational efficiency.

Over a 5 year horizon, this is one of the safest businesses to bet on.

When a company has over 1 million robots in operation, it’s hard to argue they don’t have a real structural edge.

A generational structural advantage at massive scale.

Amazon runs the world’s largest physical fulfillment network alongside one of the most dominant cloud computing platforms.

These are two capital intensive moats that reinforce each other, creating unmatched scale and operational efficiency.

Over a 5 year horizon, this is one of the safest businesses to bet on.

When a company has over 1 million robots in operation, it’s hard to argue they don’t have a real structural edge.

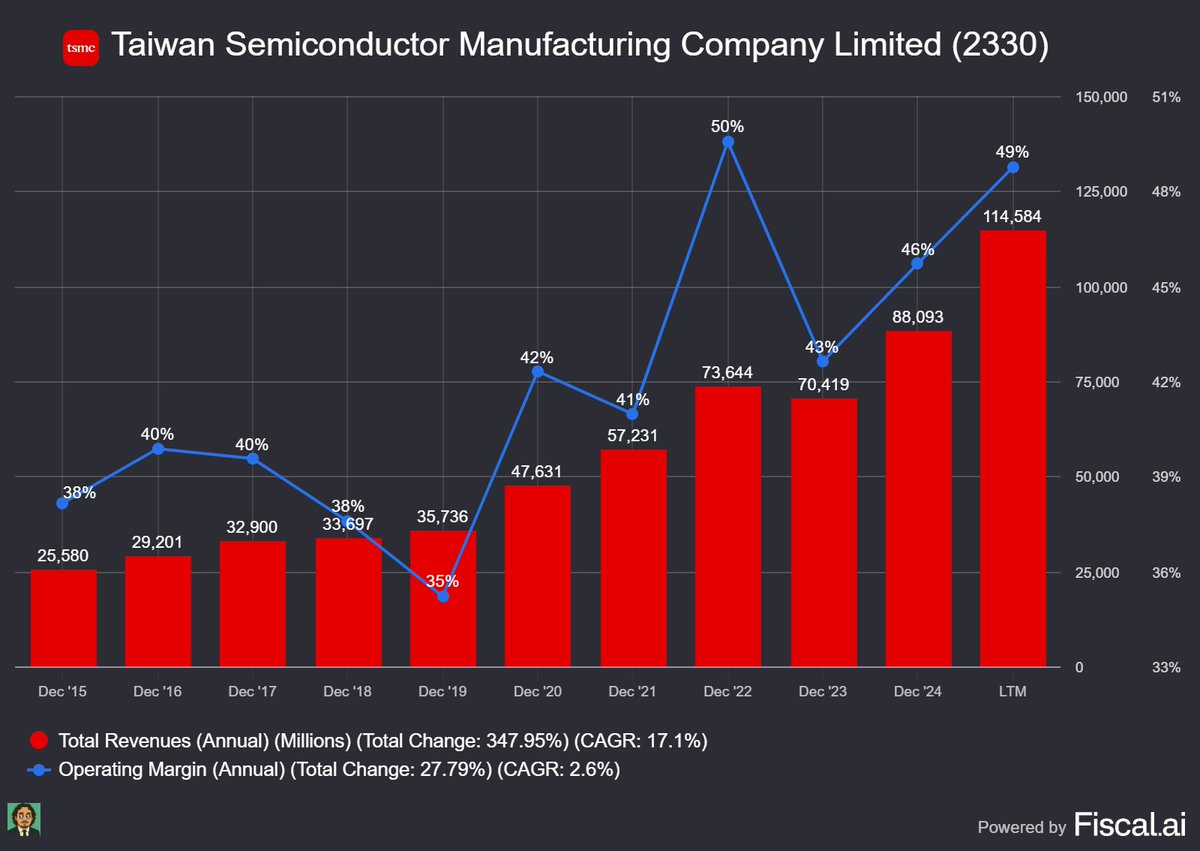

5/ MEGA CAP: $TSMC

Taiwan Semiconductors has a profound geopolitical risk but there is no doubting they also have the same profound operational advantage.

They have a multiyear technology lead which makes them the sole manufacturer capable of producing the most powerful chips for innovators like apple and Nvidia.

They hold over 90% market share, proving they are critical global infrastructure.

Taiwan Semiconductors has a profound geopolitical risk but there is no doubting they also have the same profound operational advantage.

They have a multiyear technology lead which makes them the sole manufacturer capable of producing the most powerful chips for innovators like apple and Nvidia.

They hold over 90% market share, proving they are critical global infrastructure.

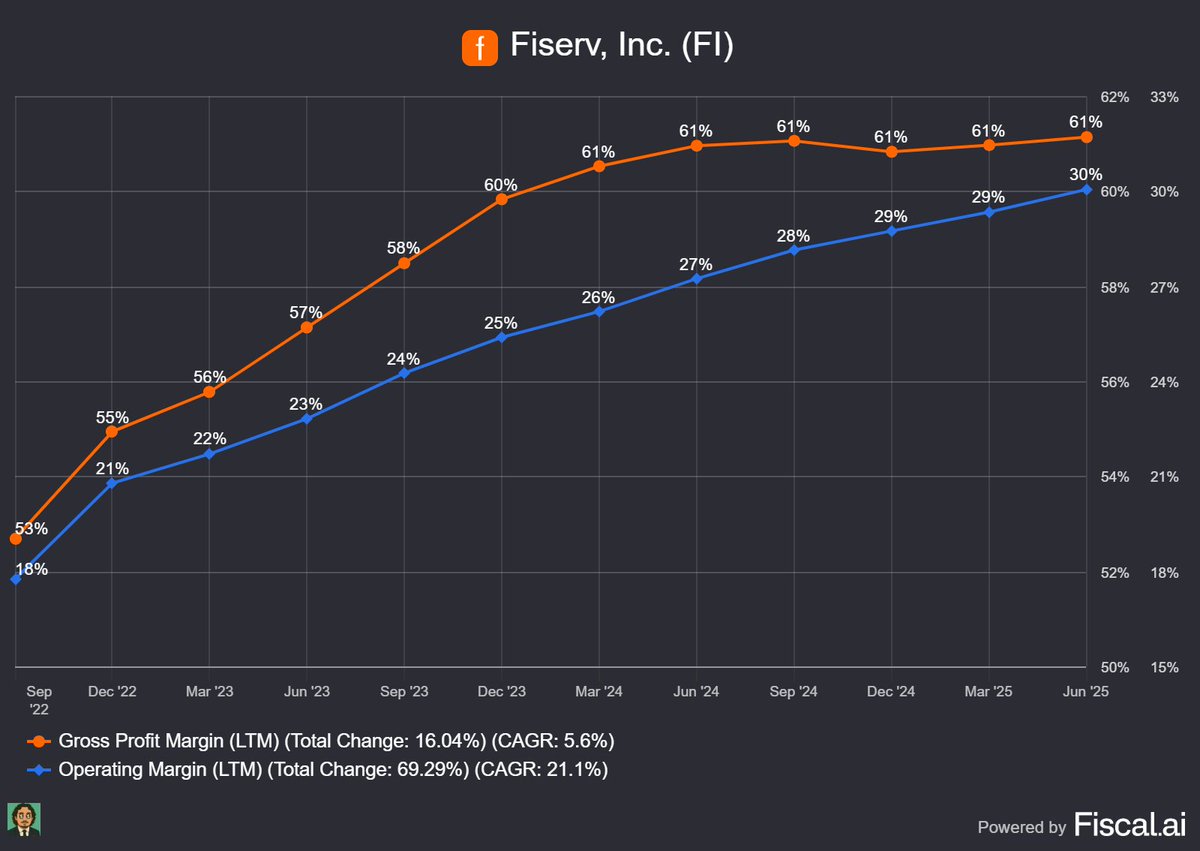

6/ LARGE CAP: $FI

Running a bank’s core transaction system is both complex and risky.

Fiserv solves this by offering a deeply integrated software platform that is proven, reliable, and hard to replace.

The combination of high switching costs and mission critical functionality creates a significant operational advantage. It also builds customer loyalty over time.

This one stays on my add list.

Running a bank’s core transaction system is both complex and risky.

Fiserv solves this by offering a deeply integrated software platform that is proven, reliable, and hard to replace.

The combination of high switching costs and mission critical functionality creates a significant operational advantage. It also builds customer loyalty over time.

This one stays on my add list.

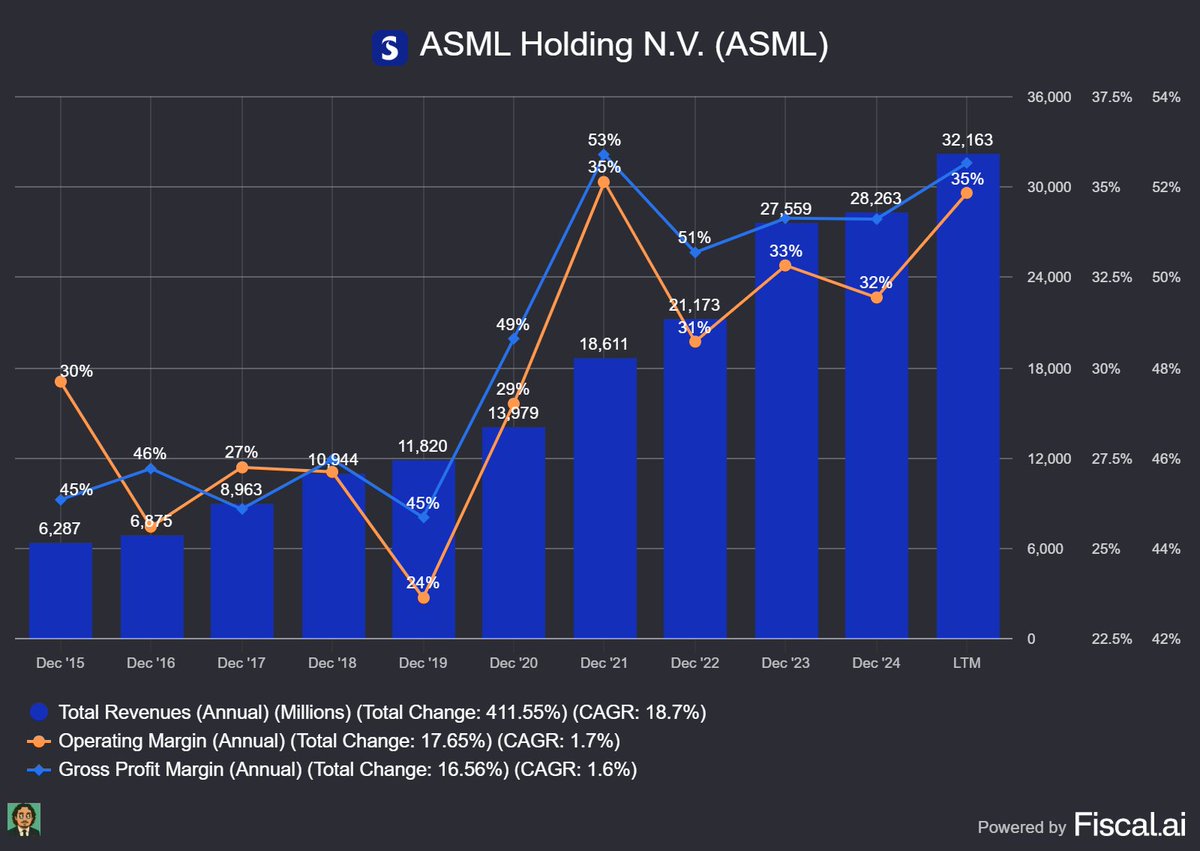

7/ LARGE CAP: $ASML

It’s hard to find a stronger advantage than what ASML holds. They’ve built a technological chokepoint.

The most advanced chips require EUV machines for patterning - and ASML is the only company that makes them.

That exclusivity gives them immense pricing power and long term durability in the semiconductor supply chain.

Currently, the stock looks fairly priced in my view.

It’s hard to find a stronger advantage than what ASML holds. They’ve built a technological chokepoint.

The most advanced chips require EUV machines for patterning - and ASML is the only company that makes them.

That exclusivity gives them immense pricing power and long term durability in the semiconductor supply chain.

Currently, the stock looks fairly priced in my view.

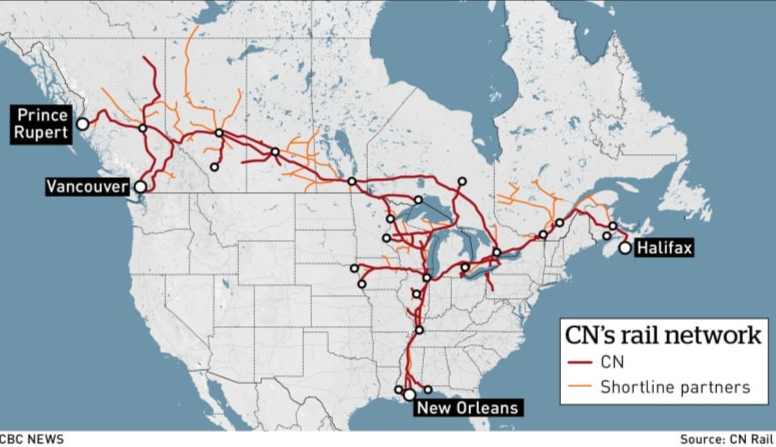

8/ LARGE CAP: $CNI

CNI operates a rare three coast railway network, which is a major structural advantage.

It’s the only railroad in North America that connects the Atlantic, Pacific, and Gulf coasts.

This gives it a unique position in continental logistics, offering a lower cost alternative to traditional freight trucking over long distances.

CNI operates a rare three coast railway network, which is a major structural advantage.

It’s the only railroad in North America that connects the Atlantic, Pacific, and Gulf coasts.

This gives it a unique position in continental logistics, offering a lower cost alternative to traditional freight trucking over long distances.

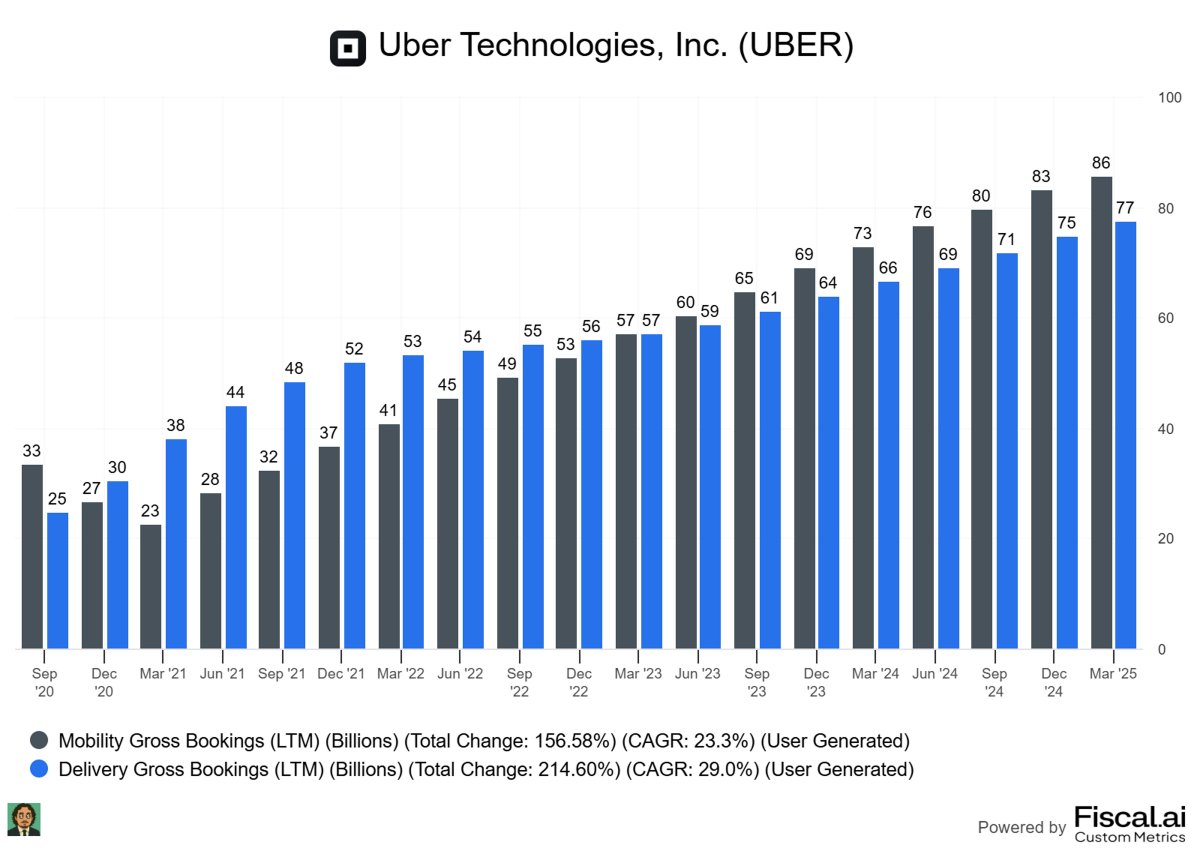

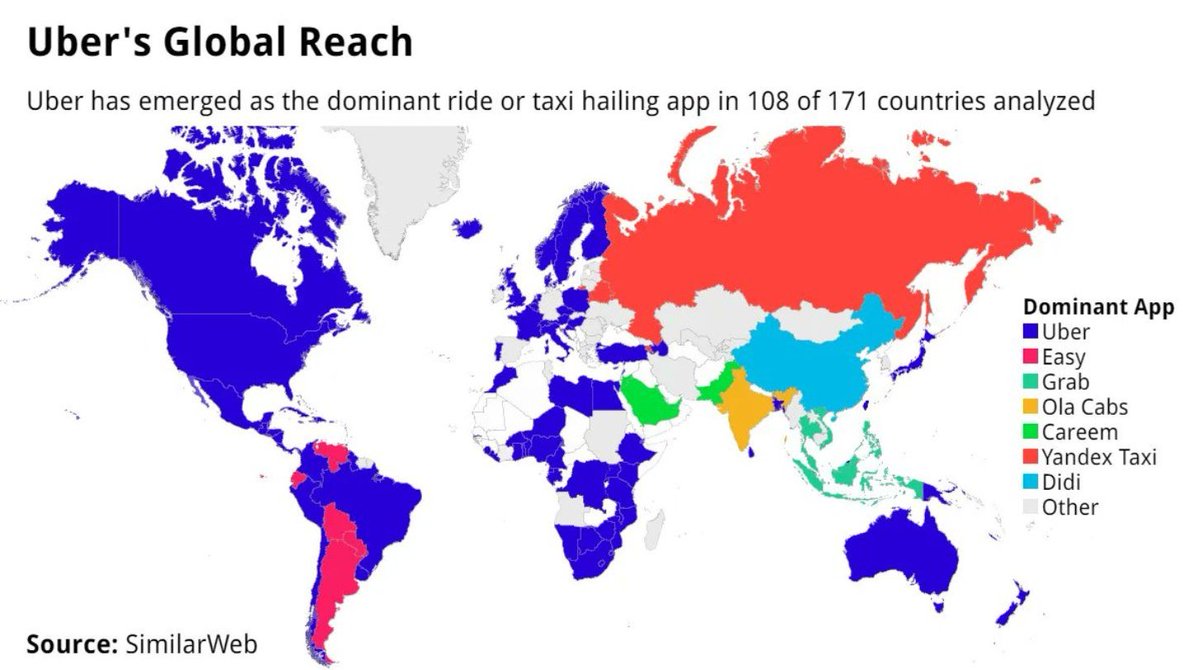

9/ LARGE CAP: $UBER

Uber’s core advantage lies in its strong network effects across both mobility and delivery.

More drivers lead to shorter wait times, which attracts more riders, which in turn brings in more drivers. This self reinforcing loop strengthens their position in each city.

It’s further enhanced by their advanced algorithmic engine that balances supply and demand across the platform.

It’s not impenetrable, but Uber holds a clear network advantage in nearly every major city around the world.

Uber’s core advantage lies in its strong network effects across both mobility and delivery.

More drivers lead to shorter wait times, which attracts more riders, which in turn brings in more drivers. This self reinforcing loop strengthens their position in each city.

It’s further enhanced by their advanced algorithmic engine that balances supply and demand across the platform.

It’s not impenetrable, but Uber holds a clear network advantage in nearly every major city around the world.

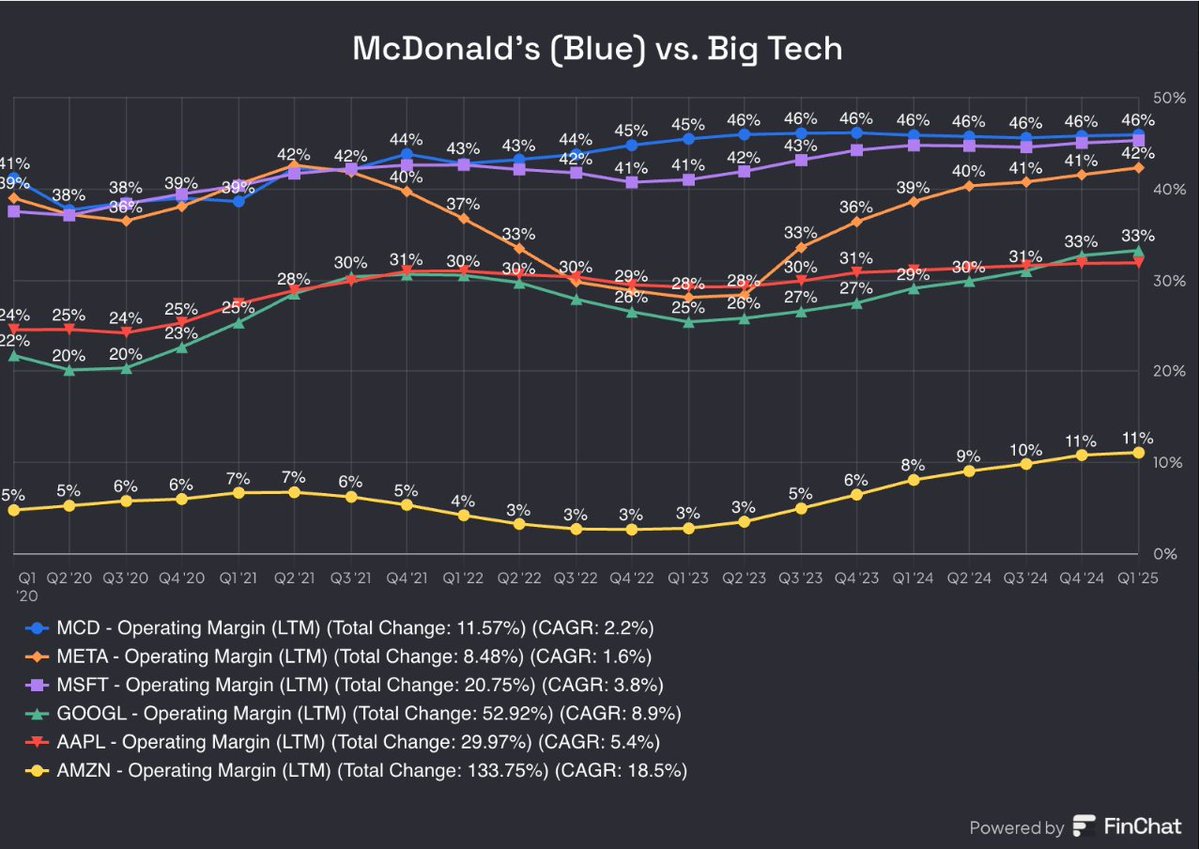

10/ LARGE CAP: $MCD

McDonald’s is a masterclass in operational design.

It effectively blends two powerful businesses into one system: a highly scalable, refined franchise model and one of the largest strategic real estate portfolios in the world.

This synergy allows them to control quality, drive efficiency, and generate consistent, capital light returns.

The chart below highlights just how strong their operational advantage really is.

CC: @QualityInvest5

McDonald’s is a masterclass in operational design.

It effectively blends two powerful businesses into one system: a highly scalable, refined franchise model and one of the largest strategic real estate portfolios in the world.

This synergy allows them to control quality, drive efficiency, and generate consistent, capital light returns.

The chart below highlights just how strong their operational advantage really is.

CC: @QualityInvest5

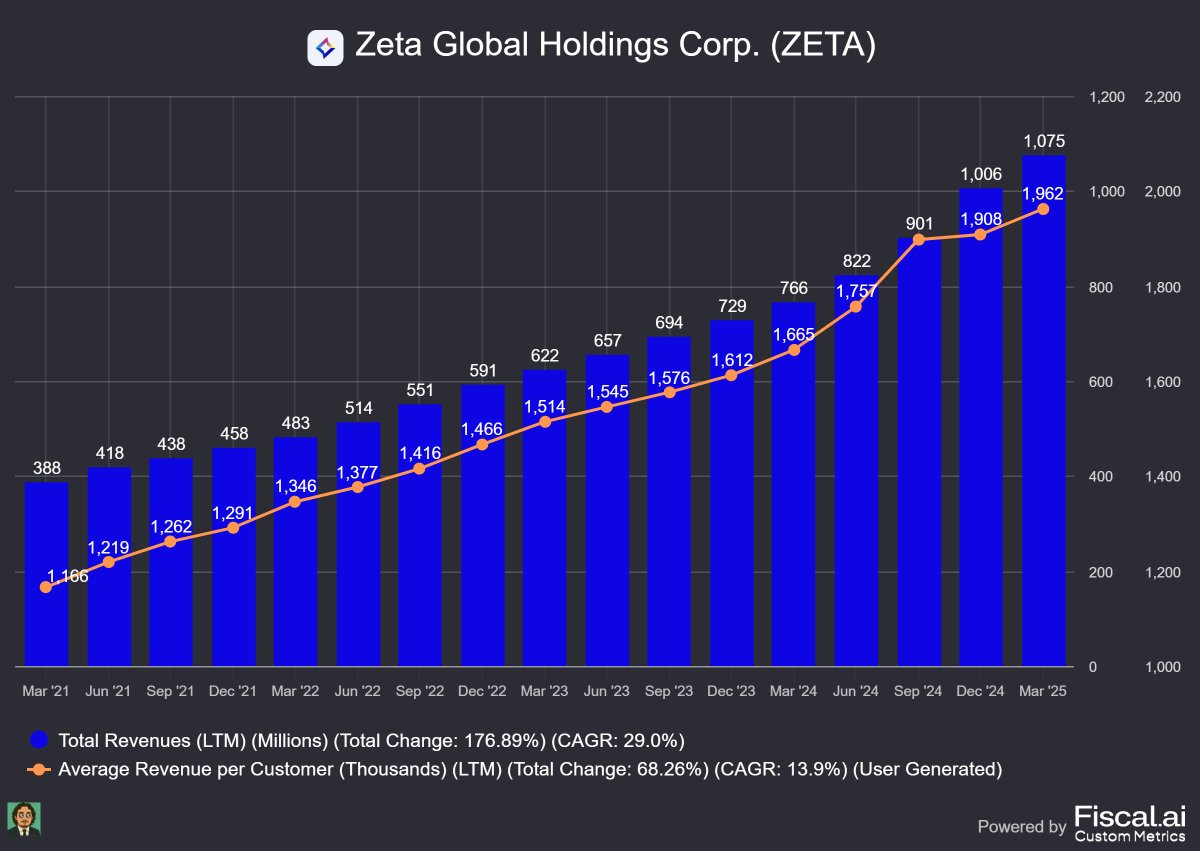

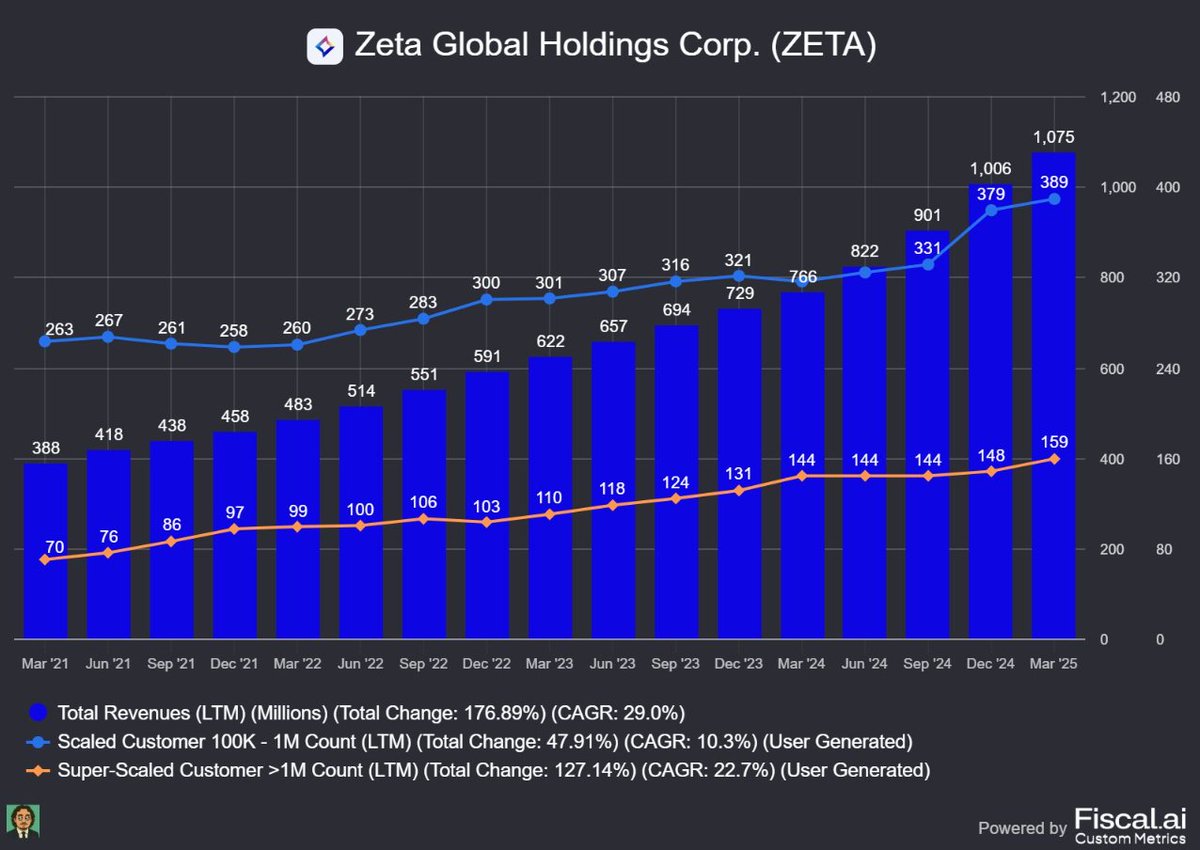

11/ MID - SMALL CAP: $ZETA

The operational advantage at Zeta is one they built in anticipation of an industry shift.

About 7 years ago, they transformed their business to focus on building a massive, permissioned consumer database. On top of that, they layered an AI engine to extract insights from the data.

They now have 2.4 billion identity profiles in that system.

The advantage is clear when you look at their revenue retention, consistently over 110%

The operational advantage at Zeta is one they built in anticipation of an industry shift.

About 7 years ago, they transformed their business to focus on building a massive, permissioned consumer database. On top of that, they layered an AI engine to extract insights from the data.

They now have 2.4 billion identity profiles in that system.

The advantage is clear when you look at their revenue retention, consistently over 110%

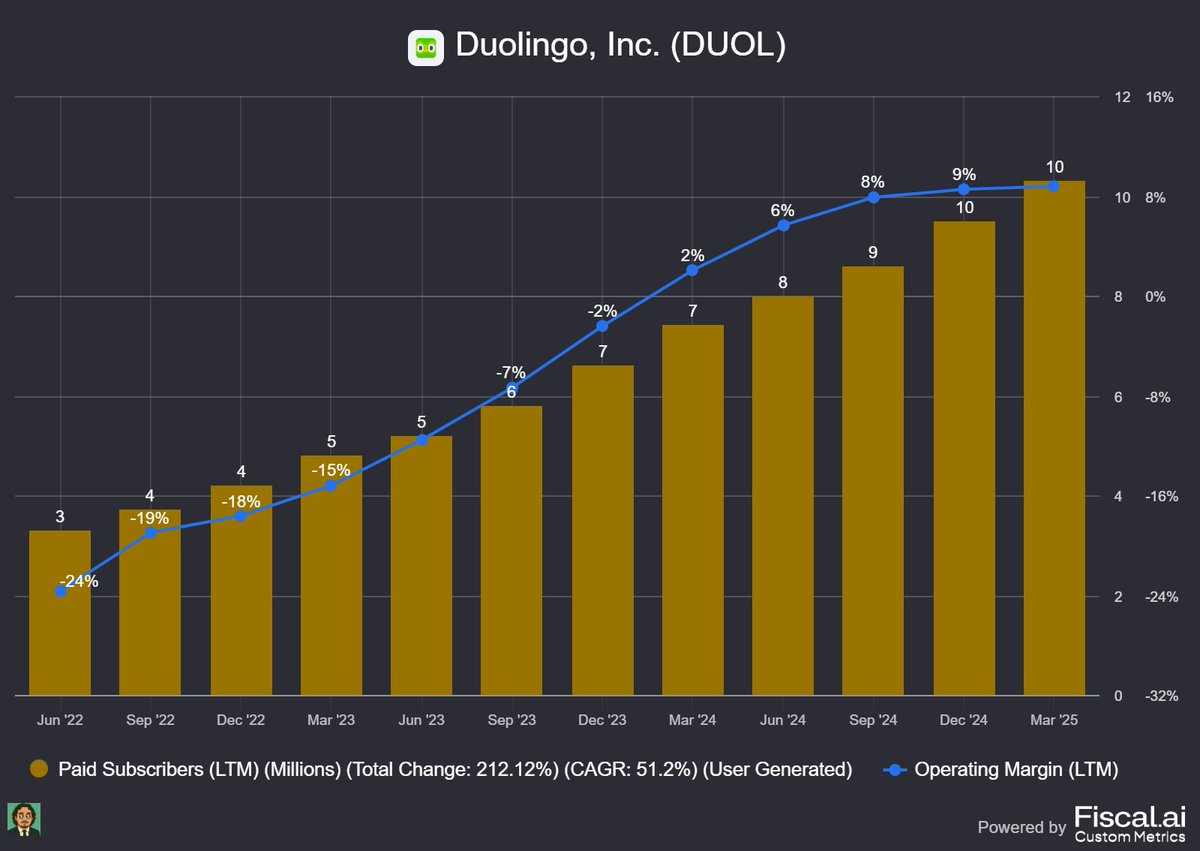

12/ MID - SMALL CAP: $DUOL

What makes Duolingo’s educational model so effective is its data analysis engine.

Every correct or incorrect answer from millions of users becomes a data point.

That data is used to build personalized learning paths for each user. Combine that with gamification, and you get a highly efficient way to keep users engaged.

ChatGPT isn’t going to replace them. They’re successful because it’s fun.

What makes Duolingo’s educational model so effective is its data analysis engine.

Every correct or incorrect answer from millions of users becomes a data point.

That data is used to build personalized learning paths for each user. Combine that with gamification, and you get a highly efficient way to keep users engaged.

ChatGPT isn’t going to replace them. They’re successful because it’s fun.

13/ MID - SMALL CAP: $ELF

E.l.f.'s primary advantage lies in its speed.

The company has developed a supply chain capable of moving a product from concept to retail in just six months.

This rapid turnaround contrasts sharply with legacy brands, which typically operate on multi year cycles.

This fast fashion approach allows e.l.f. to capitalize quickly on emerging trends, giving them a significant time to market operational advantage.

E.l.f.'s primary advantage lies in its speed.

The company has developed a supply chain capable of moving a product from concept to retail in just six months.

This rapid turnaround contrasts sharply with legacy brands, which typically operate on multi year cycles.

This fast fashion approach allows e.l.f. to capitalize quickly on emerging trends, giving them a significant time to market operational advantage.

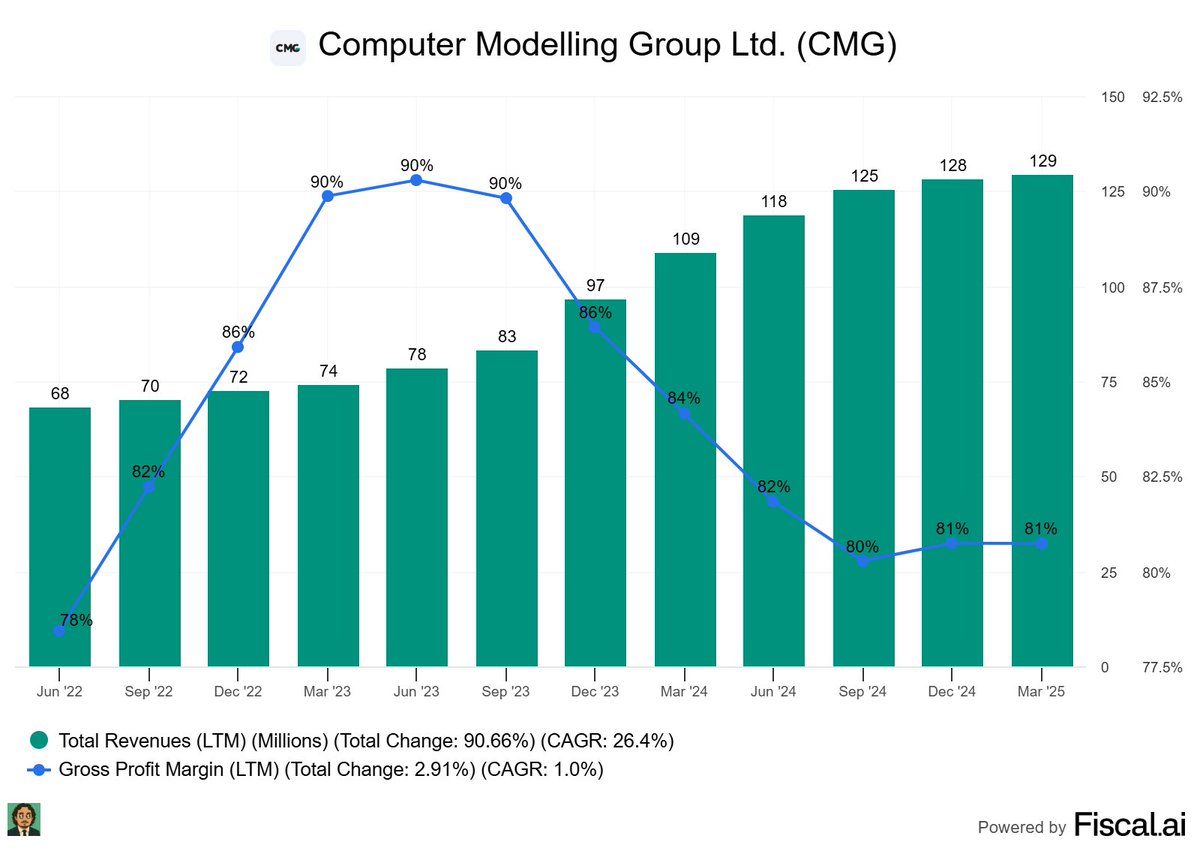

14/ MID - SMALL CAP: $CMG.TO

For energy companies, more accurate underground reservoir modeling leads to optimized, multi million dollar drilling decisions.

Computer Modelling Group excels at this type of reservoir modeling.

As a result, they benefit from extreme customer stickiness.

Once a reservoir model is built using CMG's software, the cost, time, and risk associated with migrating to another solution are prohibitive.

For energy companies, more accurate underground reservoir modeling leads to optimized, multi million dollar drilling decisions.

Computer Modelling Group excels at this type of reservoir modeling.

As a result, they benefit from extreme customer stickiness.

Once a reservoir model is built using CMG's software, the cost, time, and risk associated with migrating to another solution are prohibitive.

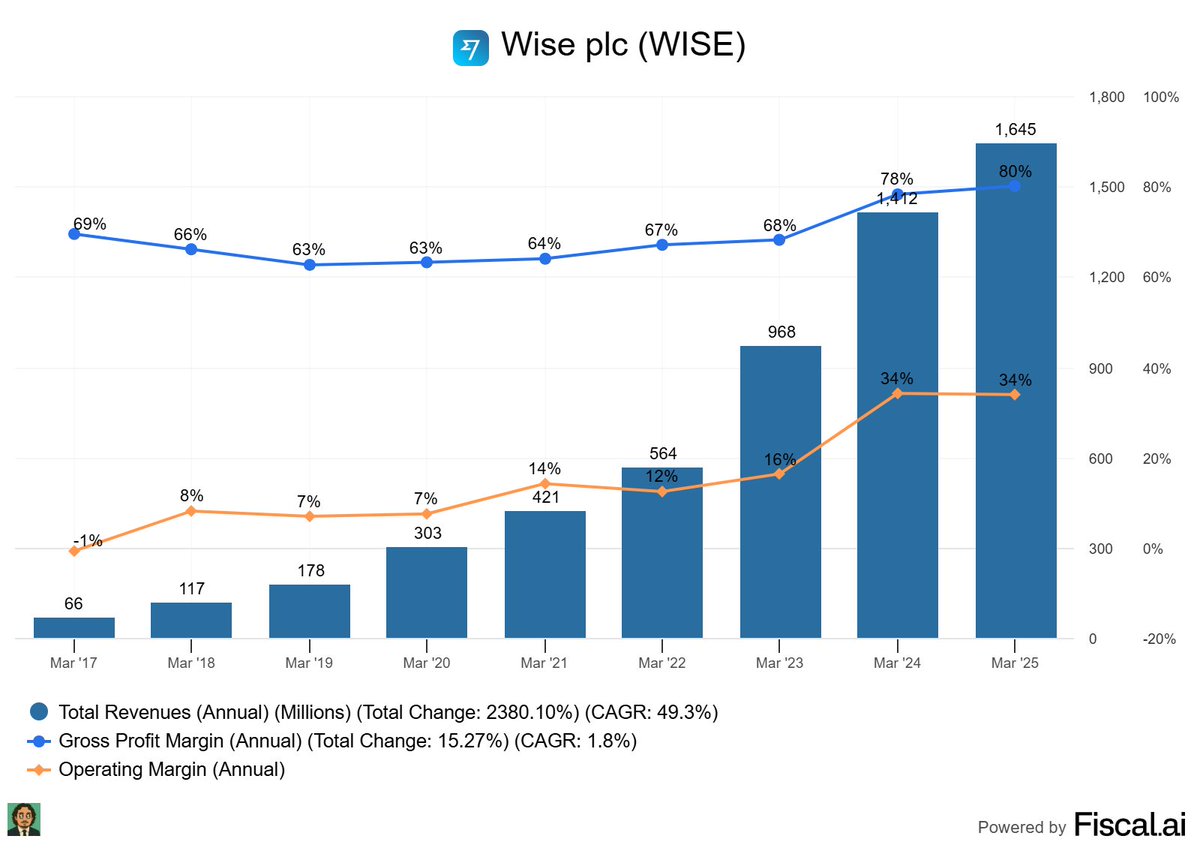

15/ MID - SMALL CAP: $WISE

International payments were historically slow and expensive.

Wise's operational solution addresses this by utilizing a proprietary payments network that bypasses the traditional banking system entirely.

They achieve this by maintaining bank accounts with local currency balances in almost every country. When you send money, your cash doesn't actually leave your country. Wise collects your currency in Canada and then pays out the recipient using their own local bank account in the other country.

This system provides a very obvious advantage.

International payments were historically slow and expensive.

Wise's operational solution addresses this by utilizing a proprietary payments network that bypasses the traditional banking system entirely.

They achieve this by maintaining bank accounts with local currency balances in almost every country. When you send money, your cash doesn't actually leave your country. Wise collects your currency in Canada and then pays out the recipient using their own local bank account in the other country.

This system provides a very obvious advantage.

What companies do you think have a clear operational advantage?

Hope you enjoyed the thread! If you did, please like and follow!

Have a great day :)

Try fiscal for free!! Very clearly the best research platform in the game.

fiscal.ai/?via=MFM

Hope you enjoyed the thread! If you did, please like and follow!

Have a great day :)

Try fiscal for free!! Very clearly the best research platform in the game.

fiscal.ai/?via=MFM

• • •

Missing some Tweet in this thread? You can try to

force a refresh