JUST IN 🚨

Ripple CTO Explains Why Billions Not Moving On XRP Ledger Yet Despite Partnerships with 300+ Banks

Read more 👇🏼

Ripple CTO Explains Why Billions Not Moving On XRP Ledger Yet Despite Partnerships with 300+ Banks

Read more 👇🏼

According to @TimesTabloid1 article

Why XRPL On-Chain Activity Remains Low Despite Ripple’s Global Reach

Despite @Ripple’s extensive network of over 300 global banking and financial partners, the XRP Ledger (XRPL) has yet to demonstrate the kind of on-chain volume expected from such a wide-reaching institutional ecosystem. This disconnect has led many in the crypto community to question why billions in daily volume have not materialized.

@JoelKatz, also known as David Schwartz, Ripple’s Chief Technology Officer, offered a detailed explanation in a recent post on X. His insights clarify the regulatory, technical, and strategic barriers still limiting XRPL’s direct on-chain utility—despite the company’s global success in building partnerships.

Why XRPL On-Chain Activity Remains Low Despite Ripple’s Global Reach

Despite @Ripple’s extensive network of over 300 global banking and financial partners, the XRP Ledger (XRPL) has yet to demonstrate the kind of on-chain volume expected from such a wide-reaching institutional ecosystem. This disconnect has led many in the crypto community to question why billions in daily volume have not materialized.

@JoelKatz, also known as David Schwartz, Ripple’s Chief Technology Officer, offered a detailed explanation in a recent post on X. His insights clarify the regulatory, technical, and strategic barriers still limiting XRPL’s direct on-chain utility—despite the company’s global success in building partnerships.

The Regulatory Bottleneck and Institutional Reluctance

According to @JoelKatz, regulatory compliance is the key reason institutional players remain hesitant to transact directly on-chain. Many institutions continue to handle digital assets off-chain due to the inability to verify the identity and legitimacy of decentralized liquidity providers.

Even @Ripple itself cannot currently use the XRPL’s decentralized exchange (DEX) for payments, as Schwartz candidly admitted: “We can’t be sure a terrorist won’t provide the liquidity for payment.” The lack of KYC-compliant infrastructure on the DEX side makes it legally risky for regulated actors.

To solve this, @Ripple is actively developing “permissioned domains”—tools that allow parties to confirm they’re interacting only with verified, compliant entities. “We’re close to changing that,” Schwartz noted, emphasizing that institutions are starting to understand the benefits of on-chain settlement.

⸻

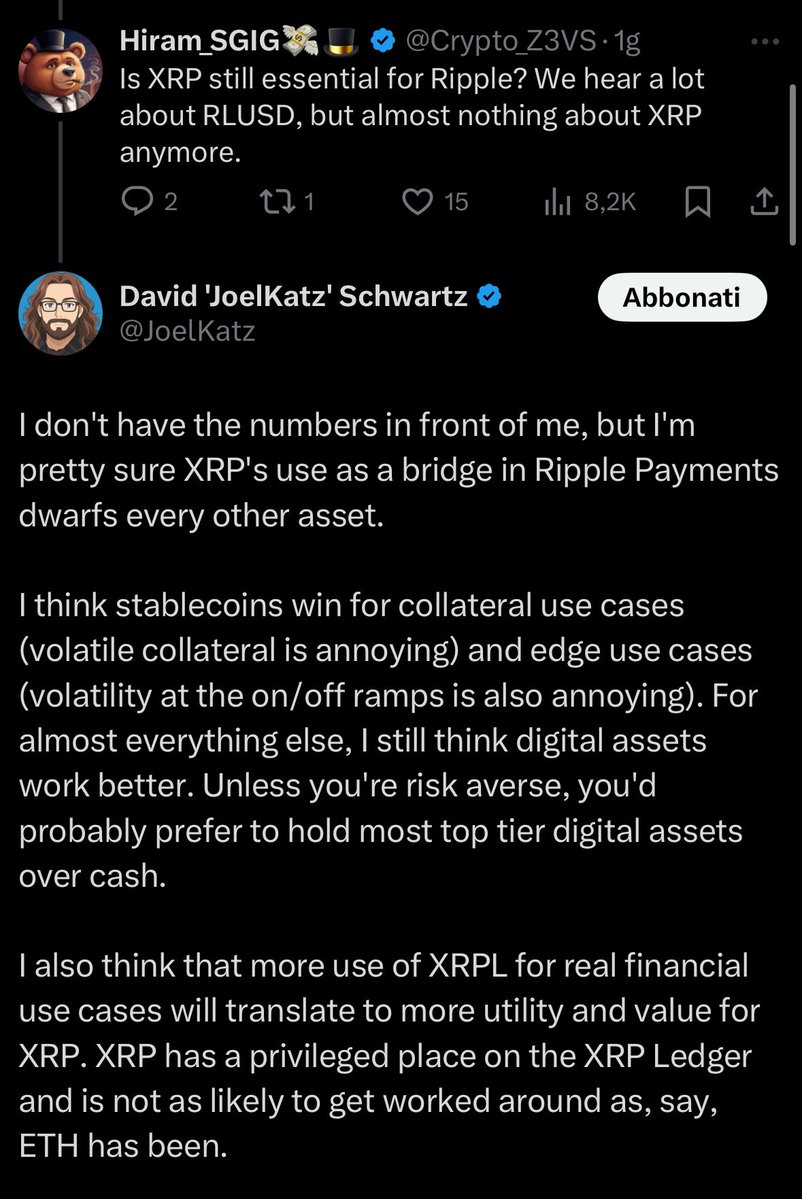

Volatility as a Feature, Not a Bug

Another frequent objection raised is XRP’s price volatility, often compared unfavorably to stablecoins. But @JoelKatz pushed back, arguing that volatility can sometimes be a strategic advantage. “As long as you aren’t very risk-averse, holding it is not a disadvantage,” he said.

Importantly, XRP’s role as a bridge currency requires it to be held by someone—ready to be deployed precisely when needed. In Schwartz’s view, holding XRP avoids the operational inefficiencies of managing multiple less liquid assets in a multi-currency environment.

x.com/joelkatz/statu…

According to @JoelKatz, regulatory compliance is the key reason institutional players remain hesitant to transact directly on-chain. Many institutions continue to handle digital assets off-chain due to the inability to verify the identity and legitimacy of decentralized liquidity providers.

Even @Ripple itself cannot currently use the XRPL’s decentralized exchange (DEX) for payments, as Schwartz candidly admitted: “We can’t be sure a terrorist won’t provide the liquidity for payment.” The lack of KYC-compliant infrastructure on the DEX side makes it legally risky for regulated actors.

To solve this, @Ripple is actively developing “permissioned domains”—tools that allow parties to confirm they’re interacting only with verified, compliant entities. “We’re close to changing that,” Schwartz noted, emphasizing that institutions are starting to understand the benefits of on-chain settlement.

⸻

Volatility as a Feature, Not a Bug

Another frequent objection raised is XRP’s price volatility, often compared unfavorably to stablecoins. But @JoelKatz pushed back, arguing that volatility can sometimes be a strategic advantage. “As long as you aren’t very risk-averse, holding it is not a disadvantage,” he said.

Importantly, XRP’s role as a bridge currency requires it to be held by someone—ready to be deployed precisely when needed. In Schwartz’s view, holding XRP avoids the operational inefficiencies of managing multiple less liquid assets in a multi-currency environment.

x.com/joelkatz/statu…

Stablecoins and XRP: Complementary, Not Redundant

Some argue that stablecoins will eliminate the need for bridge assets like XRP. Schwartz disagrees—at least under current global conditions. “If one stablecoin wins, then no,” he acknowledged. But in a world where many fiat-backed stablecoins coexist, each with jurisdictional constraints, XRP’s neutrality and liquidity give it lasting relevance.

This becomes especially true for tokenizing complex financial instruments such as securities or loan portfolios, where cross-border liquidity and interoperability are critical. In such contexts, XRP retains strategic value as a universal bridge.

Some argue that stablecoins will eliminate the need for bridge assets like XRP. Schwartz disagrees—at least under current global conditions. “If one stablecoin wins, then no,” he acknowledged. But in a world where many fiat-backed stablecoins coexist, each with jurisdictional constraints, XRP’s neutrality and liquidity give it lasting relevance.

This becomes especially true for tokenizing complex financial instruments such as securities or loan portfolios, where cross-border liquidity and interoperability are critical. In such contexts, XRP retains strategic value as a universal bridge.

Why Build on XRPL Instead of Private Chains?

When asked why institutions like BlackRock wouldn’t simply build their own blockchains, @JoelKatz responded by pointing to the power of interoperability. “As long as we have interoperability and asset portability, I’m not sure how much that will matter.”

He compared the scenario to @circle, issuer of USDC. “Why don’t they launch USDC only on their blockchain?” he asked. The answer is that closed systems limit liquidity and adoption. Similarly, financial institutions are unlikely to constrain themselves to proprietary chains, instead favoring open, liquid networks like XRPL.

When asked why institutions like BlackRock wouldn’t simply build their own blockchains, @JoelKatz responded by pointing to the power of interoperability. “As long as we have interoperability and asset portability, I’m not sure how much that will matter.”

He compared the scenario to @circle, issuer of USDC. “Why don’t they launch USDC only on their blockchain?” he asked. The answer is that closed systems limit liquidity and adoption. Similarly, financial institutions are unlikely to constrain themselves to proprietary chains, instead favoring open, liquid networks like XRPL.

Jurisdictional Trust and Geopolitical Tensions

A deeper issue is geopolitical trust. Why would non-U.S. governments or corporations use a blockchain associated with a U.S.-based company like @Ripple? Schwartz emphasized that XRPL itself is not U.S.-controlled, nor has it ever discriminated against any participant.

Still, he acknowledged that certain jurisdictions—such as North Korea or Cuba—will remain off-limits due to international sanctions. And even between U.S. allies, some friction may remain. “There might be, in some cases, pushback to a U.S. company having some control over, say, payments between Pakistan and Saudi Arabia,” Schwartz noted.

Despite this, Ripple’s approach is to earn trust through transparency and compliance, while continuing to expand in regions open to innovation. “We build trust and we make hay where the sun shines,” he said.

A deeper issue is geopolitical trust. Why would non-U.S. governments or corporations use a blockchain associated with a U.S.-based company like @Ripple? Schwartz emphasized that XRPL itself is not U.S.-controlled, nor has it ever discriminated against any participant.

Still, he acknowledged that certain jurisdictions—such as North Korea or Cuba—will remain off-limits due to international sanctions. And even between U.S. allies, some friction may remain. “There might be, in some cases, pushback to a U.S. company having some control over, say, payments between Pakistan and Saudi Arabia,” Schwartz noted.

Despite this, Ripple’s approach is to earn trust through transparency and compliance, while continuing to expand in regions open to innovation. “We build trust and we make hay where the sun shines,” he said.

Outlook: A Ledger Waiting for Its Institutional Moment

In summary, David Schwartz’s remarks help explain why XRPL has not yet reached mass-scale on-chain adoption—even with @Ripple’s formidable global presence. The technical infrastructure is ready, but legal, compliance, and strategic concerns continue to hold institutions back.

With new solutions like permissioned domains on the horizon, and a growing institutional appetite for public blockchain infrastructure, @JoelKatz believes that shift is now accelerating. When it comes, XRP may finally fulfill its long-held promise: becoming the neutral bridge asset that enables seamless value transfer in the global financial system.

In summary, David Schwartz’s remarks help explain why XRPL has not yet reached mass-scale on-chain adoption—even with @Ripple’s formidable global presence. The technical infrastructure is ready, but legal, compliance, and strategic concerns continue to hold institutions back.

With new solutions like permissioned domains on the horizon, and a growing institutional appetite for public blockchain infrastructure, @JoelKatz believes that shift is now accelerating. When it comes, XRP may finally fulfill its long-held promise: becoming the neutral bridge asset that enables seamless value transfer in the global financial system.

• • •

Missing some Tweet in this thread? You can try to

force a refresh