Congress green-lit a $3.4 trillion spending package through the Big Beautiful Bill.

What does that mean for Americans?

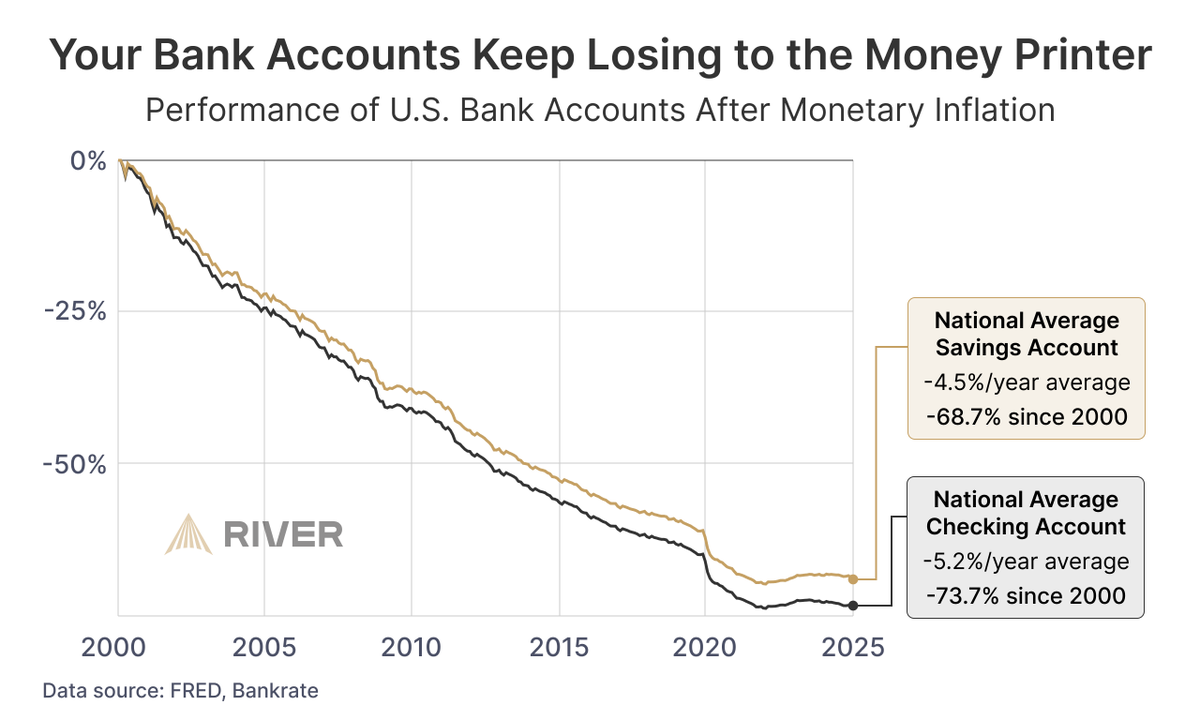

Your dollars are on the path to devaluation, unless you learn their SIX ways to print money, and how to opt out👇

What does that mean for Americans?

Your dollars are on the path to devaluation, unless you learn their SIX ways to print money, and how to opt out👇

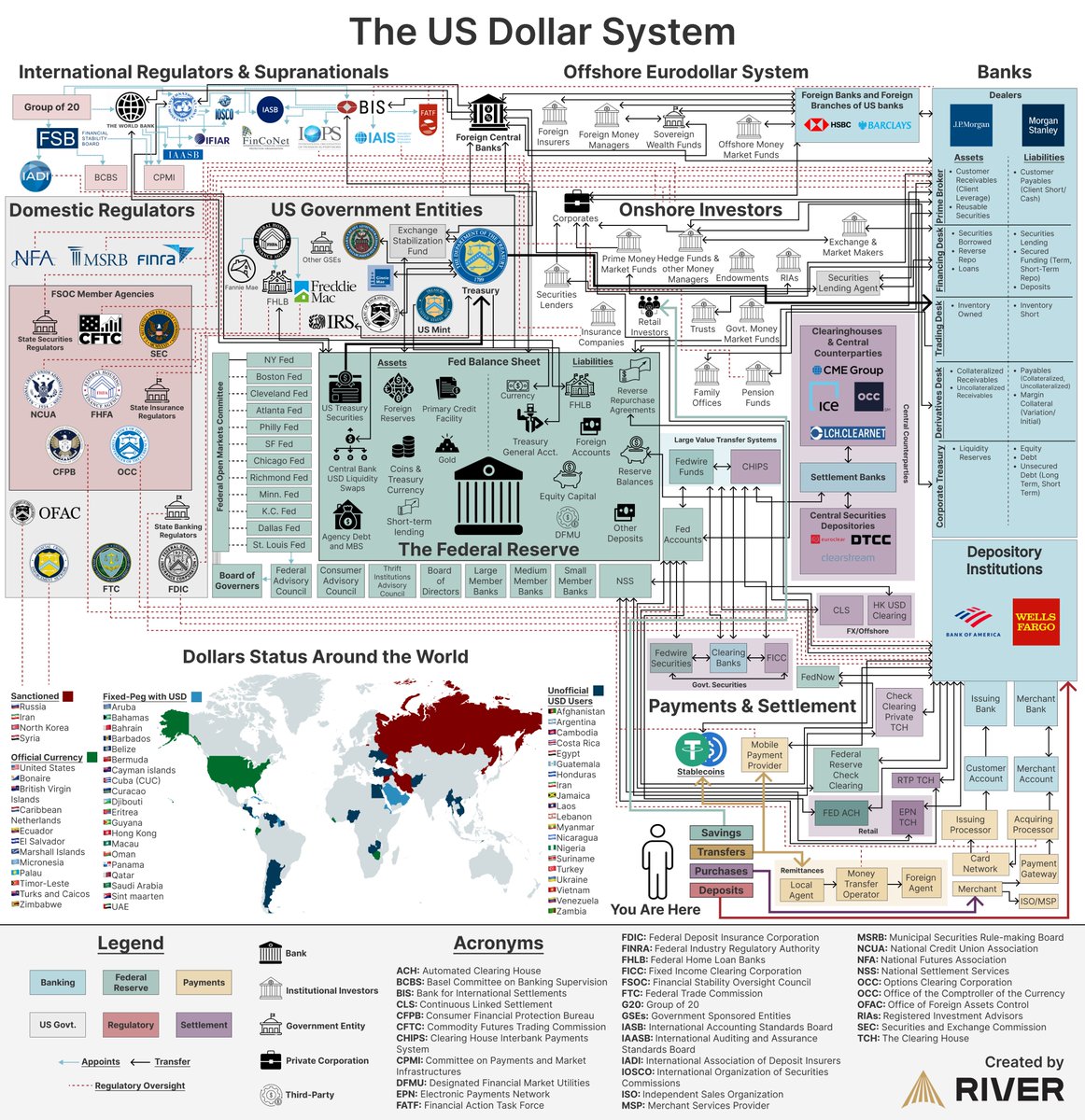

The money supply is commonly measured in 2 ways:

1. M2 money supply ($22 trillion)

-> Dollars in the economy for spending/saving.

2. Monetary base ($5.7 trillion)

-> Cash & bank reserves, controlled by the Federal Reserve.

80%+ of this supply was created after the year 2000

1. M2 money supply ($22 trillion)

-> Dollars in the economy for spending/saving.

2. Monetary base ($5.7 trillion)

-> Cash & bank reserves, controlled by the Federal Reserve.

80%+ of this supply was created after the year 2000

Money creation happens in 2 categories:

M2 supply is increased in 2 ways through credit expansion by the private sector (banks) and fiscal government policies.

The monetary base is increased in 4 ways through monetary stimulus by the Federal Reserve.

Let's get to those 6

M2 supply is increased in 2 ways through credit expansion by the private sector (banks) and fiscal government policies.

The monetary base is increased in 4 ways through monetary stimulus by the Federal Reserve.

Let's get to those 6

1️⃣ Private sector lending causes credit expansion.

When a bank issues a loan it creates new money, which circulates through the economy and gets deposited in a bank and lent out again.

Does that sound dangerous to you? It is, and it makes it seem like there is more money.

When a bank issues a loan it creates new money, which circulates through the economy and gets deposited in a bank and lent out again.

Does that sound dangerous to you? It is, and it makes it seem like there is more money.

2️⃣ Government deficits cause credit expansion.

Most governments spend more than they collect in taxes.

They create bonds and sell those to make up the difference, except most people don't want to buy them. So the central bank creates new money to buy them. $6.6T worth today.

Most governments spend more than they collect in taxes.

They create bonds and sell those to make up the difference, except most people don't want to buy them. So the central bank creates new money to buy them. $6.6T worth today.

3️⃣ Open market operations can be a form of monetary stimulus.

The Federal Reserve sets interest rates by buying or selling securities, which can increase the money supply.

The Federal Reserve sets interest rates by buying or selling securities, which can increase the money supply.

4️⃣ Loans to financial institutions are a form of monetary stimulus.

Remember Silicon Valley Bank? After the banking crisis of 2023, the Fed lent over $100 billion to banks on the verge of collapse.

Where does that money come from? Taxes? Nope, it is newly created.

Remember Silicon Valley Bank? After the banking crisis of 2023, the Fed lent over $100 billion to banks on the verge of collapse.

Where does that money come from? Taxes? Nope, it is newly created.

5️⃣ Foreign exchange intervention can serve as a form of monetary stimulus.

In May 2020, the Fed provided up to $448 billion to foreign central banks through swap lines to stabilize foreign exchange markets.

In May 2020, the Fed provided up to $448 billion to foreign central banks through swap lines to stabilize foreign exchange markets.

6️⃣ Printing currency is a form of monetary stimulus.

Finally we get back to the image people think about. This is the only physical way in which money is printed.

Physical printing happens regularly based on demand forecasts.

Finally we get back to the image people think about. This is the only physical way in which money is printed.

Physical printing happens regularly based on demand forecasts.

There you have it: 6 ways to print new money.

1️⃣ Private sector lending

2️⃣ Government deficits

3️⃣ Open market operations

4️⃣ Loans to financial institutions

5️⃣ Foreign exchange intervention

6️⃣ Printing currency

Most people can not keep track of the maze of the dollar system.

1️⃣ Private sector lending

2️⃣ Government deficits

3️⃣ Open market operations

4️⃣ Loans to financial institutions

5️⃣ Foreign exchange intervention

6️⃣ Printing currency

Most people can not keep track of the maze of the dollar system.

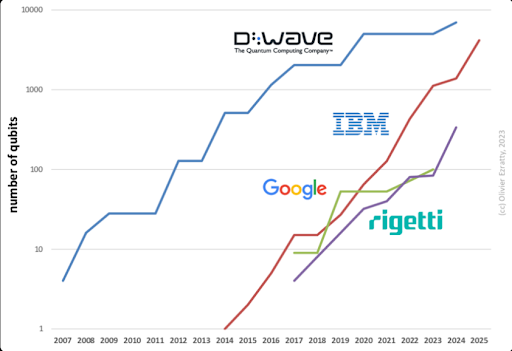

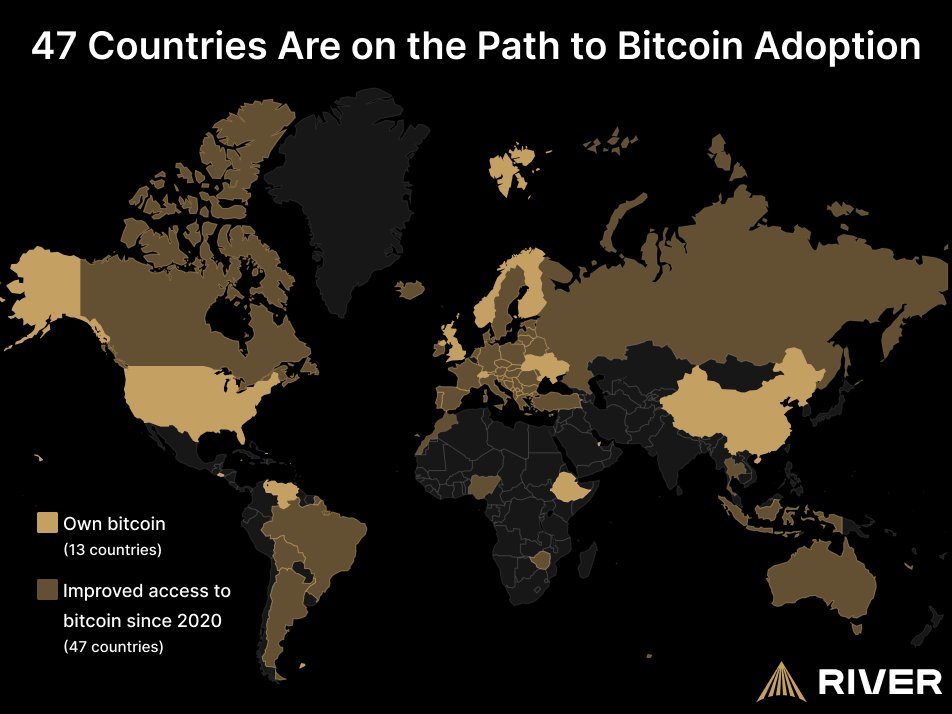

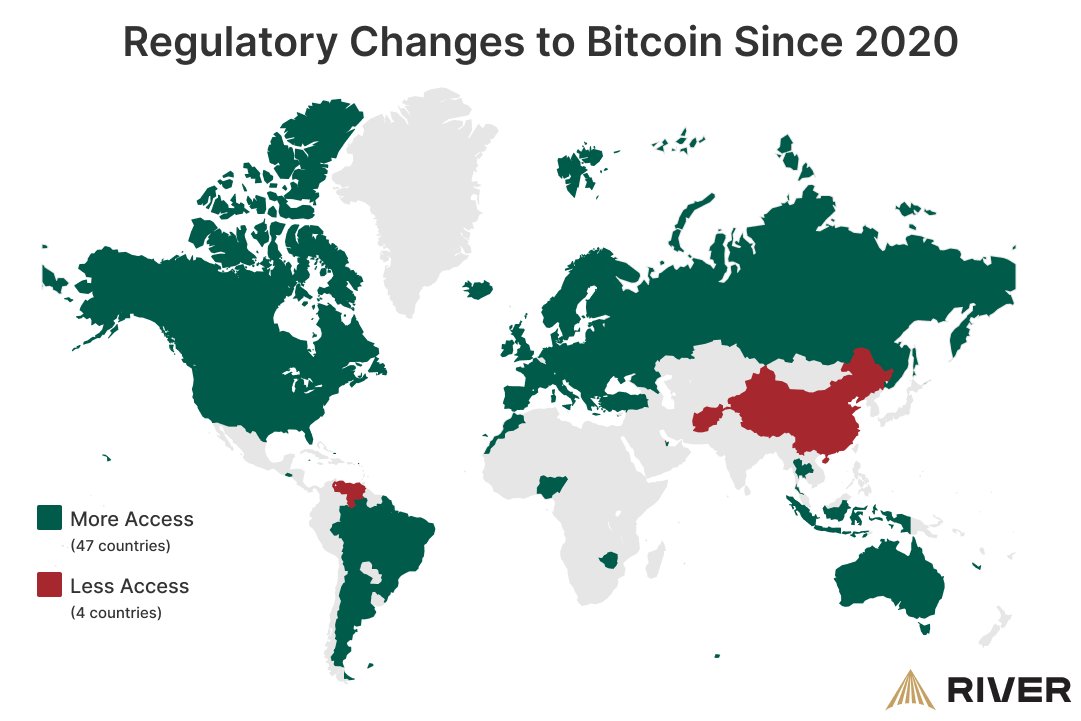

In #Bitcoin, money is created in ONE way and only once:

For each new block that is added to the blockchain, there is a reward for the miner who successfully mined the block.

Over Bitcoin's lifespan, these rewards add up to a max of 21 million BTC.

For each new block that is added to the blockchain, there is a reward for the miner who successfully mined the block.

Over Bitcoin's lifespan, these rewards add up to a max of 21 million BTC.

Bitcoin's monetary policy is completely predictable and can't be changed.

It's what makes it so valuable in the eyes of many people.

No backroom deals, no mistaken decisions, and no small group of people deciding how much your money will be worth in the near future.

It's what makes it so valuable in the eyes of many people.

No backroom deals, no mistaken decisions, and no small group of people deciding how much your money will be worth in the near future.

If you want to learn more about money printing, check out our article on River Learn. river.com/learn/how-does…

If you enjoyed this thread, please give it a like, a retweet, or bookmark it for the next time you need a reminder 👇x.com/River/status/1…

If you enjoyed this thread, please give it a like, a retweet, or bookmark it for the next time you need a reminder 👇x.com/River/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh