Ceinsys Tech Ltd

About the company:

Incorporated in 1998, Ceinsys Tech Ltd provides Enterprise Geospatial & Engineering Services and sale of software and electricity.

- Core Expertise: Ceinsys Tech is a leading technology solution provider in the IT-enabled sector, renowned for its expertise in geospatial engineering and other engineering services and solutions.

- Geospatial Services: They offer a broad range of geospatial intelligence services, including data creation, data analytics, decision support systems, and enterprise web solutions.

- Strategic Expansions (Acquisitions):

In 2022, the company strategically expanded into the mobility sector by acquiring Eniggro Technologies, enhancing capabilities in manufacturing technology and mobility engineering solutions across the entire product development process and industrial automation for diverse sectors (e.g., two and three-wheelers, passenger cars, commercial vehicles, off-highway equipment).

In 2024, they acquired the geospatial business of VTS in USA, primarily operating in the telecom domain.

They are currently identifying more targets for inorganic growth to expand into geospatial and engineering services, having mobilized almost US$28 million for this purpose. Both current M&A opportunities are in the due diligence stage and are moving well, though timelines can shift. These acquisitions are expected to be in geospatial but will incorporate newer technologies not currently at CST.

- Global Presence & Clientele: The company serves prestigious global clientele including large corporates, OEMs, asset management companies, and government bodies. They have offices in India, the United States, the United Kingdom, and Germany, combining local expertise with international reach.

- New Vertical: Ceinsys Tech is venturing into software product development and emerging technologies through a new vertical focused on Artificial Intelligence (AI), Machine Learning (ML), and embedded electronics. This vertical emphasizes the development of AI and ML-enabled applications and solutions to enhance delivery for existing domains, reflecting a commitment to innovation.

About the company:

Incorporated in 1998, Ceinsys Tech Ltd provides Enterprise Geospatial & Engineering Services and sale of software and electricity.

- Core Expertise: Ceinsys Tech is a leading technology solution provider in the IT-enabled sector, renowned for its expertise in geospatial engineering and other engineering services and solutions.

- Geospatial Services: They offer a broad range of geospatial intelligence services, including data creation, data analytics, decision support systems, and enterprise web solutions.

- Strategic Expansions (Acquisitions):

In 2022, the company strategically expanded into the mobility sector by acquiring Eniggro Technologies, enhancing capabilities in manufacturing technology and mobility engineering solutions across the entire product development process and industrial automation for diverse sectors (e.g., two and three-wheelers, passenger cars, commercial vehicles, off-highway equipment).

In 2024, they acquired the geospatial business of VTS in USA, primarily operating in the telecom domain.

They are currently identifying more targets for inorganic growth to expand into geospatial and engineering services, having mobilized almost US$28 million for this purpose. Both current M&A opportunities are in the due diligence stage and are moving well, though timelines can shift. These acquisitions are expected to be in geospatial but will incorporate newer technologies not currently at CST.

- Global Presence & Clientele: The company serves prestigious global clientele including large corporates, OEMs, asset management companies, and government bodies. They have offices in India, the United States, the United Kingdom, and Germany, combining local expertise with international reach.

- New Vertical: Ceinsys Tech is venturing into software product development and emerging technologies through a new vertical focused on Artificial Intelligence (AI), Machine Learning (ML), and embedded electronics. This vertical emphasizes the development of AI and ML-enabled applications and solutions to enhance delivery for existing domains, reflecting a commitment to innovation.

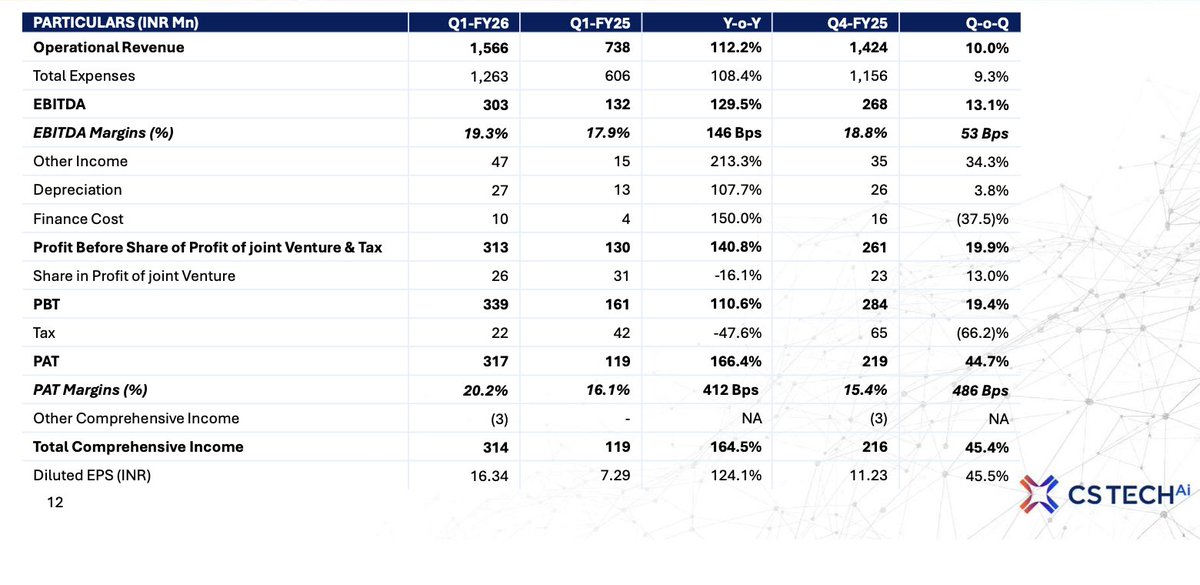

📌 Q1 FY26 Financial & Operational Highlights (Ended June 30, 2025)

➤ Operational Revenue: ₹157 crore, up 112% YoY

➤ EBITDA: ₹30 crore, up 130% YoY

➤ EBITDA Margin: 19.35%, an increase of ~140 bps

➤ Net Profit (PAT): ₹32 crore, up 166% YoY

➤ PAT Margin: 20.18%

📌 Key Drivers of Growth

➤ Strong project execution and operational efficiency improvements

➤ Higher volumes managed with existing tech infrastructure

➤ EBITDA margin expansion due to cost optimization

📌 Strategic Developments

➤ Merger with Algro Technologies (100% subsidiary) effective April 1, 2024 — streamlined reporting and financial consolidation

➤ US Market Expansion: ₹10 crore invested this quarter for business development — led to 20% QoQ revenue growth from the US

📌 Cash & Order Book Position

➤ Operational Cash Surplus: ₹127 crore as of quarter-end

➤ Cash Flow Accretion: ~₹27 crore from ₹30 crore EBITDA

➤ Total Order Book: ₹1,209 crore as of June 25

▫️ ₹765 crore in geospatial

▫️ ₹445 crore in technology solutions

📌 Segment Performance

➤ Technology Solutions Revenue: ₹84 crore in Q1 FY26 vs ₹31 crore in Q1 FY25 — 2.7x growth

➤ Contribution to turnover: 54% in Q1 FY26 (vs 51% in Q4 FY25)

📌 Operational Efficiency

➤ Employee Cost: Reduced to 23% of revenue from 35% YoY — driven by scalability and execution using existing tech infrastructure

📌 Major Contracts Secured

➤ ₹115 crore MMRDA system integrator contract

➤ ₹11.5 crore project management consultancy

➤ ₹5.5 crore Autodesk software development contract from MMRDA

📌 Milestone Achievement

➤ Highest-ever quarterly performance in revenue and EBITDA in company history

➤ Operational Revenue: ₹157 crore, up 112% YoY

➤ EBITDA: ₹30 crore, up 130% YoY

➤ EBITDA Margin: 19.35%, an increase of ~140 bps

➤ Net Profit (PAT): ₹32 crore, up 166% YoY

➤ PAT Margin: 20.18%

📌 Key Drivers of Growth

➤ Strong project execution and operational efficiency improvements

➤ Higher volumes managed with existing tech infrastructure

➤ EBITDA margin expansion due to cost optimization

📌 Strategic Developments

➤ Merger with Algro Technologies (100% subsidiary) effective April 1, 2024 — streamlined reporting and financial consolidation

➤ US Market Expansion: ₹10 crore invested this quarter for business development — led to 20% QoQ revenue growth from the US

📌 Cash & Order Book Position

➤ Operational Cash Surplus: ₹127 crore as of quarter-end

➤ Cash Flow Accretion: ~₹27 crore from ₹30 crore EBITDA

➤ Total Order Book: ₹1,209 crore as of June 25

▫️ ₹765 crore in geospatial

▫️ ₹445 crore in technology solutions

📌 Segment Performance

➤ Technology Solutions Revenue: ₹84 crore in Q1 FY26 vs ₹31 crore in Q1 FY25 — 2.7x growth

➤ Contribution to turnover: 54% in Q1 FY26 (vs 51% in Q4 FY25)

📌 Operational Efficiency

➤ Employee Cost: Reduced to 23% of revenue from 35% YoY — driven by scalability and execution using existing tech infrastructure

📌 Major Contracts Secured

➤ ₹115 crore MMRDA system integrator contract

➤ ₹11.5 crore project management consultancy

➤ ₹5.5 crore Autodesk software development contract from MMRDA

📌 Milestone Achievement

➤ Highest-ever quarterly performance in revenue and EBITDA in company history

📌 Strategic Focus & Growth Drivers – Q1 FY26

➤ Margin Enhancement

▫️ Focused on boosting margins, especially in the technology solutions segment

▫️ Technology margins stood at ~30%, compared to 15–16% in geospatial engineering

▫️ Strategy: Increase tech deliveries while maintaining geospatial margins

➤ Sustainable Margins Outlook

▫️ Margin strength expected to sustain, driven by high-margin tech solutions pipeline and execution efficiency

➤ International Expansion Strategy

▫️ Continued focus on organic + inorganic growth to expand international revenue share

▫️ CEO-designate Suraj KP’s core mandate is to grow the international business

▫️ Long-term mix target: shift from current 70% India / 30% International to 60:40 or 70:30 in favor of International within 3 years

➤ Diversification from Government Business

▫️ Government orders backed by assured funding; not viewed as a financial risk

▫️ Risks exist in execution delays

▫️ Plan: Maintain government revenue in absolute terms, but reduce its overall share via international and private-sector growth

➤ Acquisition Roadmap

▫️ Eyeing acquisitions in geospatial verticals with new-age technologies: AI, IoT, control systems

▫️ Focus geographies: United States and Europe

▫️ Strategic aim: Tech integration + market access

➤ Cash Flow & Revenue Realization

▫️ Maintains a strong cash surplus

▫️ Unbilled revenue accounts for ~50–51% of Q1 revenue

▫️ These are milestone-based and expected to convert smoothly, no cash flow stress expected

➤ River Linking Project Update

▫️ Execution underway but progress slower than planned due to government procedural delays

▫️ ₹30–35 crore executed in Q1 FY26

▫️ Bulk of the remaining execution expected in the upcoming quarters

➤ Margin Enhancement

▫️ Focused on boosting margins, especially in the technology solutions segment

▫️ Technology margins stood at ~30%, compared to 15–16% in geospatial engineering

▫️ Strategy: Increase tech deliveries while maintaining geospatial margins

➤ Sustainable Margins Outlook

▫️ Margin strength expected to sustain, driven by high-margin tech solutions pipeline and execution efficiency

➤ International Expansion Strategy

▫️ Continued focus on organic + inorganic growth to expand international revenue share

▫️ CEO-designate Suraj KP’s core mandate is to grow the international business

▫️ Long-term mix target: shift from current 70% India / 30% International to 60:40 or 70:30 in favor of International within 3 years

➤ Diversification from Government Business

▫️ Government orders backed by assured funding; not viewed as a financial risk

▫️ Risks exist in execution delays

▫️ Plan: Maintain government revenue in absolute terms, but reduce its overall share via international and private-sector growth

➤ Acquisition Roadmap

▫️ Eyeing acquisitions in geospatial verticals with new-age technologies: AI, IoT, control systems

▫️ Focus geographies: United States and Europe

▫️ Strategic aim: Tech integration + market access

➤ Cash Flow & Revenue Realization

▫️ Maintains a strong cash surplus

▫️ Unbilled revenue accounts for ~50–51% of Q1 revenue

▫️ These are milestone-based and expected to convert smoothly, no cash flow stress expected

➤ River Linking Project Update

▫️ Execution underway but progress slower than planned due to government procedural delays

▫️ ₹30–35 crore executed in Q1 FY26

▫️ Bulk of the remaining execution expected in the upcoming quarters

📌 Order Book & Pipeline – Q1 FY26 Update

➤ Current Order Book

▫️ Stands at ₹1,209 crore

▫️ Represents ~18 months of visibility based on current execution pace and growth outlook

➤ Temporary Slowdown in Order Booking

▫️ Caused by Jal Jeevan Mission (JJM) audits leading to a pause in new orders

▫️ Audit phase is nearing completion

▫️ Order pipeline is expected to resume shortly

➤ JJM Opportunity & Winning Probability

▫️ 80% win probability for JJM-related tenders

▫️ Strong track record and familiarity with the scope boost win chances

➤ Order Flow Target for FY26

▫️ Targeting ₹800–900 crore in new orders for Q2–Q4 FY26

▫️ Of this, ₹400 crore expected from JJM opportunities (already tendered or in pipeline)

➤ Pipeline Beyond JJM

▫️ Remaining ₹400–500 crore target expected from:

🔹 Technology solutions, including solution replication

🔹 3D BIM, AC (Asset Condition) use cases in geospatial

🔹 Projects enabled by new tech platforms, likely carrying higher margins

➤ L1 Order Book

▫️ Company policy: Does not disclose size of L1 orders (lowest bidder stage)

➤ Current Order Book

▫️ Stands at ₹1,209 crore

▫️ Represents ~18 months of visibility based on current execution pace and growth outlook

➤ Temporary Slowdown in Order Booking

▫️ Caused by Jal Jeevan Mission (JJM) audits leading to a pause in new orders

▫️ Audit phase is nearing completion

▫️ Order pipeline is expected to resume shortly

➤ JJM Opportunity & Winning Probability

▫️ 80% win probability for JJM-related tenders

▫️ Strong track record and familiarity with the scope boost win chances

➤ Order Flow Target for FY26

▫️ Targeting ₹800–900 crore in new orders for Q2–Q4 FY26

▫️ Of this, ₹400 crore expected from JJM opportunities (already tendered or in pipeline)

➤ Pipeline Beyond JJM

▫️ Remaining ₹400–500 crore target expected from:

🔹 Technology solutions, including solution replication

🔹 3D BIM, AC (Asset Condition) use cases in geospatial

🔹 Projects enabled by new tech platforms, likely carrying higher margins

➤ L1 Order Book

▫️ Company policy: Does not disclose size of L1 orders (lowest bidder stage)

📌 Leadership & Management – Q1 FY26 Update

➤ Mr. Suraj KP – CEO Designate

▫️ Set to officially assume the role of CEO from January 1, 2026

▫️ Currently overseeing daily operations, strategic planning, and directly spearheading acquisition-related efforts

▫️ Core mandate: Drive international expansion, both organically and inorganically

➤ Management Bandwidth Expansion

▫️ Actively strengthening the leadership team to support:

🔹 Rapid business growth

🔹 Strategic acquisitions

🔹 Global market expansion initiatives

➤ Mr. Suraj KP – CEO Designate

▫️ Set to officially assume the role of CEO from January 1, 2026

▫️ Currently overseeing daily operations, strategic planning, and directly spearheading acquisition-related efforts

▫️ Core mandate: Drive international expansion, both organically and inorganically

➤ Management Bandwidth Expansion

▫️ Actively strengthening the leadership team to support:

🔹 Rapid business growth

🔹 Strategic acquisitions

🔹 Global market expansion initiatives

📌 Operational Efficiency & Cost Management – Q1 FY26

➤ Employee Cost Optimization

▫️ Decline in employee cost (as % of revenue) is due to increased operational efficiency, not cost-cutting

▫️ Company is executing more projects with existing talent and tech infrastructure

➤ Other Operational Costs

▫️ Vary based on project structure

▫️ Cost intensity depends on whether delivery is outsourced or in-house (tech-driven)

➤ Strong Cash Conversion

▫️ Q1 FY26 EBITDA of ₹30 crore translated to ₹27 crore in cash flow, indicating excellent cash conversion

➤ Receivables & Payables Management

▫️ Debtor days: Less than 120 days

▫️ Creditor days: Aligned to project milestones, especially for government contracts

▫️ No negative cash conversion cycle – working capital is efficiently managed

➤ Employee Cost Optimization

▫️ Decline in employee cost (as % of revenue) is due to increased operational efficiency, not cost-cutting

▫️ Company is executing more projects with existing talent and tech infrastructure

➤ Other Operational Costs

▫️ Vary based on project structure

▫️ Cost intensity depends on whether delivery is outsourced or in-house (tech-driven)

➤ Strong Cash Conversion

▫️ Q1 FY26 EBITDA of ₹30 crore translated to ₹27 crore in cash flow, indicating excellent cash conversion

➤ Receivables & Payables Management

▫️ Debtor days: Less than 120 days

▫️ Creditor days: Aligned to project milestones, especially for government contracts

▫️ No negative cash conversion cycle – working capital is efficiently managed

📌 Specific Project & Initiative Updates

➤ Jal Jeevan Mission (JJM)

▫️ Major orders temporarily paused due to government audit

▫️ Audit is nearly complete; order pipeline expected to reopen in Q2 FY26

▫️ Timelines subject to government approvals

➤ US Market Expansion

▫️ Investment has yielded 20% QoQ revenue growth

▫️ Focus areas: Private players & utilities (energy, telecom, road assets)

▫️ Delivering AI-enabled solutions for faster and more accurate data cleaning and segmentation

➤ Chennai Development Center

▫️ Fully operational and fully occupied

▫️ Opened at the request of customer (Caterpillar) to enable nearshore engagement

▫️ Open to launching more centers in tier 2/3 cities based on client needs and resource pools

➤ Jal Jeevan Mission (JJM)

▫️ Major orders temporarily paused due to government audit

▫️ Audit is nearly complete; order pipeline expected to reopen in Q2 FY26

▫️ Timelines subject to government approvals

➤ US Market Expansion

▫️ Investment has yielded 20% QoQ revenue growth

▫️ Focus areas: Private players & utilities (energy, telecom, road assets)

▫️ Delivering AI-enabled solutions for faster and more accurate data cleaning and segmentation

➤ Chennai Development Center

▫️ Fully operational and fully occupied

▫️ Opened at the request of customer (Caterpillar) to enable nearshore engagement

▫️ Open to launching more centers in tier 2/3 cities based on client needs and resource pools

📌 Closing Remarks – Q1 FY26

➤ Outperformance

▫️ The company has outperformed both the industry and market in Q1 FY26

▫️ Reflects strong execution, strategic alignment, and market adaptability

➤ Q1 vs Q4 Performance Shift

▫️ Traditionally, Q1 lagged behind Q4

▫️ In FY26, Q1 has outpaced Q4, signaling robust business momentum and effective strategy implementation

➤ Technology-Led Differentiation

▫️ Actively investing in technology enablers

▫️ Leveraging AI and other advanced technologies to lead in:

🔹 Speed of execution

🔹 Quality of delivery

🔹 Offering alternative, future-ready solutions

▫️ Well-positioned for continued outperformance in upcoming quarters

➤ Forward-Looking Guidance

▫️ The company has clearly stated it does not issue forward-looking statements regarding future revenue or PAT margins

➤ Outperformance

▫️ The company has outperformed both the industry and market in Q1 FY26

▫️ Reflects strong execution, strategic alignment, and market adaptability

➤ Q1 vs Q4 Performance Shift

▫️ Traditionally, Q1 lagged behind Q4

▫️ In FY26, Q1 has outpaced Q4, signaling robust business momentum and effective strategy implementation

➤ Technology-Led Differentiation

▫️ Actively investing in technology enablers

▫️ Leveraging AI and other advanced technologies to lead in:

🔹 Speed of execution

🔹 Quality of delivery

🔹 Offering alternative, future-ready solutions

▫️ Well-positioned for continued outperformance in upcoming quarters

➤ Forward-Looking Guidance

▫️ The company has clearly stated it does not issue forward-looking statements regarding future revenue or PAT margins

📢 Stay Connected with LNPR Capital🚀

🔹 WhatsApp Group: chat.whatsapp.com/GCqOsrfWZDiFOK…

🔹 WhatsApp Channel: whatsapp.com/channel/0029Vb…

🔹 Telegram: t.me/LNPRCap

🔹 Follow on Twitter for Updates:📈 @LnprCapital | @Rahul_Invest | @Rakesh_Invest

🔹 WhatsApp Group: chat.whatsapp.com/GCqOsrfWZDiFOK…

🔹 WhatsApp Channel: whatsapp.com/channel/0029Vb…

🔹 Telegram: t.me/LNPRCap

🔹 Follow on Twitter for Updates:📈 @LnprCapital | @Rahul_Invest | @Rakesh_Invest

• • •

Missing some Tweet in this thread? You can try to

force a refresh