According to @thecryptobasic article

Can 5,000 XRP Make You a Multi-Millionaire? Bold $3,380 Forecast Sparks Debate

A viral prediction by @FutureXRP has reignited the conversation around XRP’s long-term potential, claiming that 5,000 XRP could one day be worth over $16 million. The forecast is based on a valuation model placing XRP’s future price at $3,380, driven by the assumption that global financial infrastructure will eventually migrate to the XRP Ledger.

The tweet, which quickly spread through the XRP community, outlines a scenario where XRP becomes the backbone of international settlement systems, overtaking legacy networks like SWIFT, the DTCC, and potentially integrating with platforms like Amazon and the FX markets.

Can 5,000 XRP Make You a Multi-Millionaire? Bold $3,380 Forecast Sparks Debate

A viral prediction by @FutureXRP has reignited the conversation around XRP’s long-term potential, claiming that 5,000 XRP could one day be worth over $16 million. The forecast is based on a valuation model placing XRP’s future price at $3,380, driven by the assumption that global financial infrastructure will eventually migrate to the XRP Ledger.

The tweet, which quickly spread through the XRP community, outlines a scenario where XRP becomes the backbone of international settlement systems, overtaking legacy networks like SWIFT, the DTCC, and potentially integrating with platforms like Amazon and the FX markets.

The $3,380 Valuation Model Explained

According to @FutureXRP, XRP’s current price near $3.00 and a circulating supply of 60 billion tokens allow the network to handle approximately $1.3 trillion in annual on-chain volume—assuming a velocity of 10.

However, if XRP were to support a significantly larger share of the global economy—ranging from $100 trillion to $2 quadrillion in annual transactions—the price per token would need to rise by 1,538x to accommodate the additional demand, assuming supply and velocity stay constant. This leads to the model’s headline estimate of $3,380 per XRP.

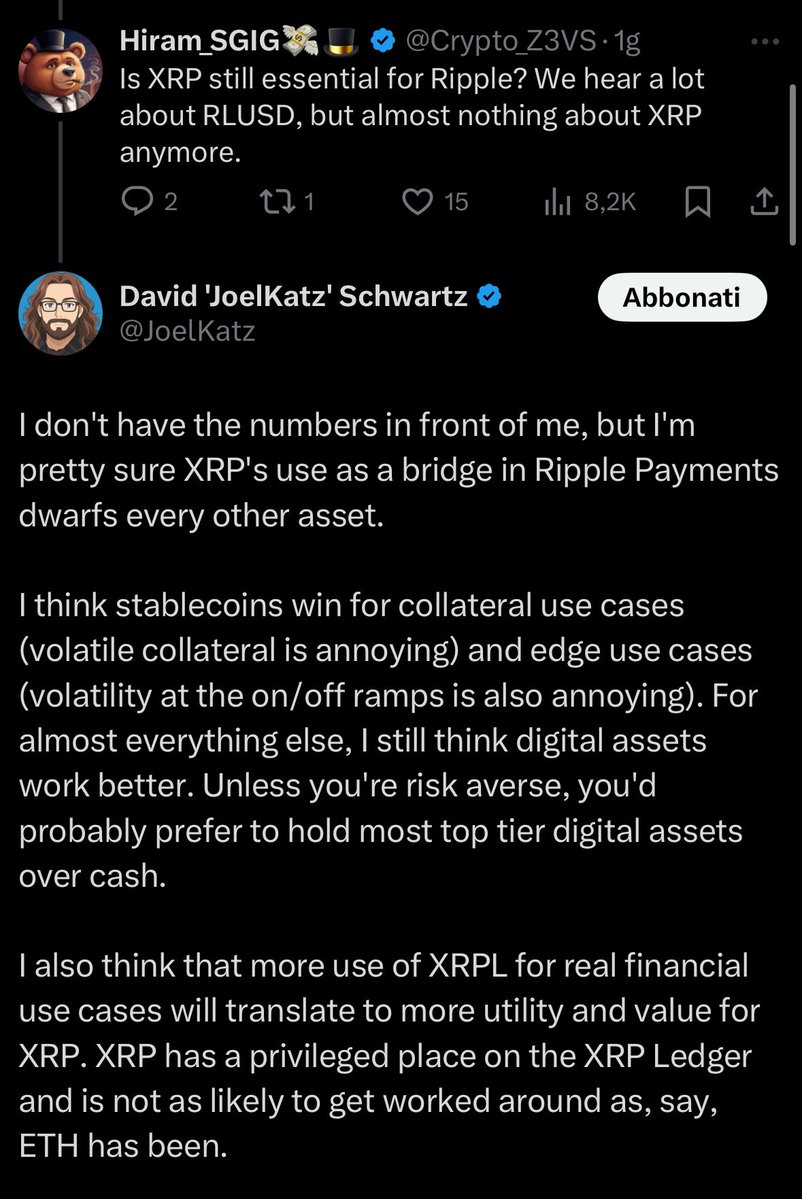

Fueling this vision are recent moves by @Ripple. CEO @bgarlinghouse stated in June that the XRP Ledger could absorb 14% of SWIFT’s volume within five years. Meanwhile, Ripple’s acquisition of Hidden Road, which has ties to the DTCC, adds weight to the notion that XRP may soon operate within legacy financial rails that process over $11 trillion per day.

According to @FutureXRP, XRP’s current price near $3.00 and a circulating supply of 60 billion tokens allow the network to handle approximately $1.3 trillion in annual on-chain volume—assuming a velocity of 10.

However, if XRP were to support a significantly larger share of the global economy—ranging from $100 trillion to $2 quadrillion in annual transactions—the price per token would need to rise by 1,538x to accommodate the additional demand, assuming supply and velocity stay constant. This leads to the model’s headline estimate of $3,380 per XRP.

Fueling this vision are recent moves by @Ripple. CEO @bgarlinghouse stated in June that the XRP Ledger could absorb 14% of SWIFT’s volume within five years. Meanwhile, Ripple’s acquisition of Hidden Road, which has ties to the DTCC, adds weight to the notion that XRP may soon operate within legacy financial rails that process over $11 trillion per day.

XRP as a Gateway to Generational Wealth?

If the price projection proves accurate, the implications for XRP holders are extraordinary. According to the same model:

•1,000 XRP could be worth $3.38 million

•5,000 XRP could reach $16.9 million

•10,000 XRP would be valued at $33.8 million

•50,000 XRP could be worth a staggering $169 million

These figures paint XRP not just as a speculative asset, but as a potential gateway to generational wealth, provided the necessary macro shifts take place in finance and regulation.

If the price projection proves accurate, the implications for XRP holders are extraordinary. According to the same model:

•1,000 XRP could be worth $3.38 million

•5,000 XRP could reach $16.9 million

•10,000 XRP would be valued at $33.8 million

•50,000 XRP could be worth a staggering $169 million

These figures paint XRP not just as a speculative asset, but as a potential gateway to generational wealth, provided the necessary macro shifts take place in finance and regulation.

Criticism Emerges Over Assumptions

Predictably, the model has drawn skepticism. Critics argue that the velocity assumption of 10 is unrealistically low. Traditional financial systems like SWIFT often operate with turnover rates of up to 200x annually. If XRP functioned under such high-velocity conditions, the price required to support $2 quadrillion in volume would fall to around $166, not $3,380.

Others challenged the idea that XRP could dominate this space alone. Competing technologies from @StellarOrg, @circle’s USDC, and Ethereum-based infrastructure are also positioning themselves as viable solutions for global payments and settlement.

Predictably, the model has drawn skepticism. Critics argue that the velocity assumption of 10 is unrealistically low. Traditional financial systems like SWIFT often operate with turnover rates of up to 200x annually. If XRP functioned under such high-velocity conditions, the price required to support $2 quadrillion in volume would fall to around $166, not $3,380.

Others challenged the idea that XRP could dominate this space alone. Competing technologies from @StellarOrg, @circle’s USDC, and Ethereum-based infrastructure are also positioning themselves as viable solutions for global payments and settlement.

Grok AI’s Analysis: Bullish but Cautious

Adding an AI perspective to the debate, @FutureXRP consulted Grok 3, the large language model developed by @xAI. Grok summarized the model and leaned moderately bullish, suggesting that an XRP price between $200 and $1,000 is realistic if the ledger plays a central role in a tokenized financial system.

However, Grok also cautioned that reaching the $3,000+ range would likely require a major systemic shift—such as a collapse of fiat reserves or a rapid move away from dollar-dominated trade settlements.

Adding an AI perspective to the debate, @FutureXRP consulted Grok 3, the large language model developed by @xAI. Grok summarized the model and leaned moderately bullish, suggesting that an XRP price between $200 and $1,000 is realistic if the ledger plays a central role in a tokenized financial system.

However, Grok also cautioned that reaching the $3,000+ range would likely require a major systemic shift—such as a collapse of fiat reserves or a rapid move away from dollar-dominated trade settlements.

Conclusion: Model or Myth?

Whether the $3,380 price target is visionary or far-fetched, it has certainly reignited investor interest. As @Ripple expands its institutional integrations and regulatory clarity edges closer, XRP’s future may lie somewhere between modest gains and a full-scale redefinition of global value transfer.

Whether the $3,380 price target is visionary or far-fetched, it has certainly reignited investor interest. As @Ripple expands its institutional integrations and regulatory clarity edges closer, XRP’s future may lie somewhere between modest gains and a full-scale redefinition of global value transfer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh