Parag Parikh Flexi Cap becomes the 1st actively managed scheme to cross ₹1L Cr AUM! 🔥

Known for its consistency & outperformance

🟩 Returns (vs Benchmark):

• 1Y: 14.65% vs 6.37%

• 5Y: 31.5% vs 26.27%

• 10Y: 17.95% vs 13.08%

• Since inception: 19.89% vs 14.93%

(1/5)

Known for its consistency & outperformance

🟩 Returns (vs Benchmark):

• 1Y: 14.65% vs 6.37%

• 5Y: 31.5% vs 26.27%

• 10Y: 17.95% vs 13.08%

• Since inception: 19.89% vs 14.93%

(1/5)

🟩 About PPFAS:

It runs 6 schemes, but >95% of its AUM is in just one - the Flexi Cap Fund.

A true investor favourite and the flagship performer.🔥

Schemes:

1. Flexi Cap

2. Liquid

3. ELSS Tax Saver

4. Conservative Hybrid

5. Arbitrage

6. Dynamic Asset Allocation

(2/5)

It runs 6 schemes, but >95% of its AUM is in just one - the Flexi Cap Fund.

A true investor favourite and the flagship performer.🔥

Schemes:

1. Flexi Cap

2. Liquid

3. ELSS Tax Saver

4. Conservative Hybrid

5. Arbitrage

6. Dynamic Asset Allocation

(2/5)

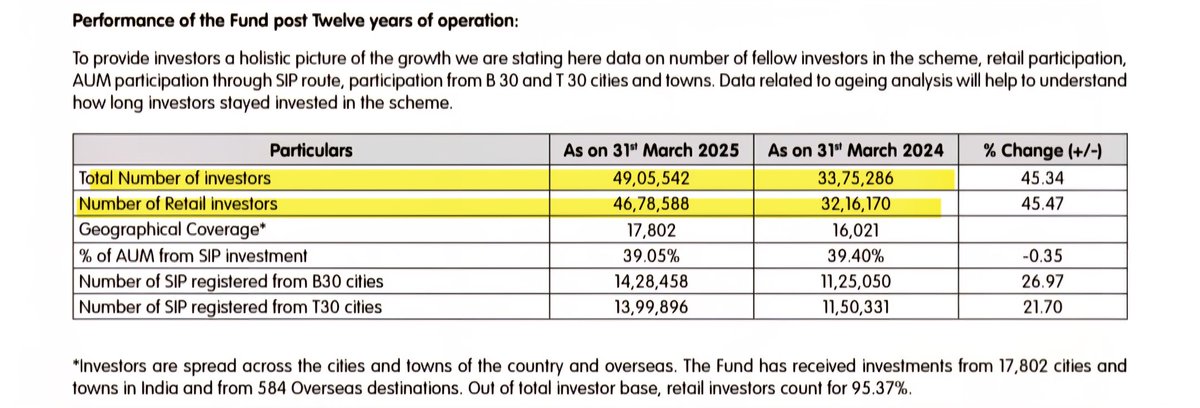

🟩 PPFAS Investors' Growth:

Investor count jumped from 33.7L in FY24 to 49L in FY25 — a solid 45% growth 🔥

With 95% being retail investors, signs of a rising equity culture in India 📈

Also, ~22–23% cash holding in both equity funds shows caution.

(3/5)

Investor count jumped from 33.7L in FY24 to 49L in FY25 — a solid 45% growth 🔥

With 95% being retail investors, signs of a rising equity culture in India 📈

Also, ~22–23% cash holding in both equity funds shows caution.

(3/5)

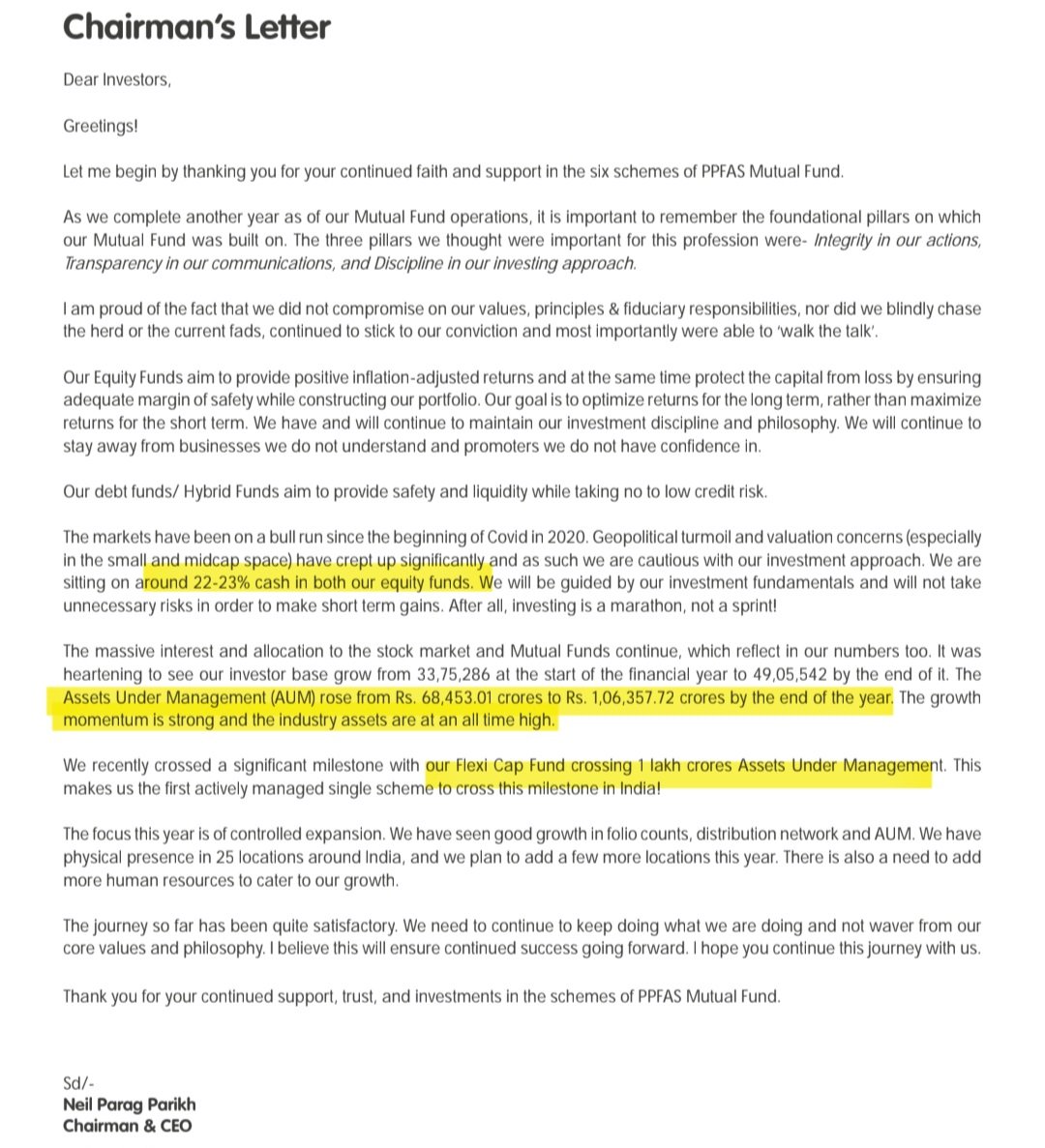

🟩 Let's talk about PPFAS AUM -

🗓️ Inception: 2013 (12 yrs ago)

• Last 1Y: ₹36,207 Cr (34%)

• Last 3Y: ₹77,845 Cr (73%)

• Last 5Y: ₹1,00,123 Cr (94%)

• Total AUM: ₹1,06,358 Cr

Bulk of the money came after years of trust-building. Classic case of compounding! 🚀

(4/5)

🗓️ Inception: 2013 (12 yrs ago)

• Last 1Y: ₹36,207 Cr (34%)

• Last 3Y: ₹77,845 Cr (73%)

• Last 5Y: ₹1,00,123 Cr (94%)

• Total AUM: ₹1,06,358 Cr

Bulk of the money came after years of trust-building. Classic case of compounding! 🚀

(4/5)

Slowly and steadily, Parag Parikh Flexi Cap has delivered industry-best returns - all by staying true to value investing principles. 💯

Trust, patience & discipline paying off in style! 💪🔥

(5/5)

Trust, patience & discipline paying off in style! 💪🔥

(5/5)

Follow @vishan_khadke for more updates..

• • •

Missing some Tweet in this thread? You can try to

force a refresh