Stanford just let an AI pick stocks for 30 years.

First study of its kind in finance history.

The outperformance vs. humans was so extreme, researchers spent 12 months trying to prove themselves wrong.

Here's what happens when you let AI manage your money: 🧵

First study of its kind in finance history.

The outperformance vs. humans was so extreme, researchers spent 12 months trying to prove themselves wrong.

Here's what happens when you let AI manage your money: 🧵

When Stanford professor Ed deHaan first saw the results last year, he couldn't believe them:

"We spent the past 12 months scouring every inch of the data trying to find where we'd done something wrong."

They found 0 errors.

The AI was genuinely superior at capital allocation.

"We spent the past 12 months scouring every inch of the data trying to find where we'd done something wrong."

They found 0 errors.

The AI was genuinely superior at capital allocation.

The methodology was surprisingly straightforward:

Researchers fed their "Terminator" AI (as they nicknamed it) market data from 1980-1990 to establish baseline patterns.

Everything was public information that any fund manager could access.

Then came the real test.

Researchers fed their "Terminator" AI (as they nicknamed it) market data from 1980-1990 to establish baseline patterns.

Everything was public information that any fund manager could access.

Then came the real test.

Terminator analyzed portfolio data from 3,300 actively managed U.S. equity funds between 1990-2020.

But it didn't have the benefit of hindsight.

The AI made decisions quarter-by-quarter, using ONLY the public data that was available at the time.

Just like a real fund manager.

But it didn't have the benefit of hindsight.

The AI made decisions quarter-by-quarter, using ONLY the public data that was available at the time.

Just like a real fund manager.

Over 3 decades of simulation, the results were stunning:

93% of the AI-modified portfolios beat the human managers.

The AI outperformed by 600% - averaging $17.1M/quarter vs humans' $2.8M/quarter.

On identical portfolios. With the same exact data human fund managers had.

93% of the AI-modified portfolios beat the human managers.

The AI outperformed by 600% - averaging $17.1M/quarter vs humans' $2.8M/quarter.

On identical portfolios. With the same exact data human fund managers had.

What surprised the researchers the most wasn't just the AI's success, but the simplicity of its approach.

They expected complex variables and strategies.

Instead?

The AI focused on basic metrics like firm size and dollar trading volume.

They expected complex variables and strategies.

Instead?

The AI focused on basic metrics like firm size and dollar trading volume.

The difference was execution: using advanced techniques to extract maximum signal from simple data.

The AI didn't win because it had better information...

It won because it could process vast amounts of public data without cognitive limitations.

The AI didn't win because it had better information...

It won because it could process vast amounts of public data without cognitive limitations.

No fatigue from monitoring hundreds of positions.

No emotional bias toward familiar companies.

No anchoring to previous decisions.

Just systematic pattern recognition across datasets too large for human analysis.

This exposes a critical market inefficiency:

No emotional bias toward familiar companies.

No anchoring to previous decisions.

Just systematic pattern recognition across datasets too large for human analysis.

This exposes a critical market inefficiency:

Enormous alpha lies hidden in publicly available information, but human cognitive constraints prevent us from capturing it.

The Stanford team calls these "processing frictions":

The cost of extracting insights from freely available data.

AI removes these frictions entirely.

The Stanford team calls these "processing frictions":

The cost of extracting insights from freely available data.

AI removes these frictions entirely.

Professor deHaan believes this technology will transform finance jobs:

"I don't think sitting around, crunching Excel spreadsheets is a job that will exist in a material sense in five years."

Junior analysts jobs especially? Probably on the chopping block.

"I don't think sitting around, crunching Excel spreadsheets is a job that will exist in a material sense in five years."

Junior analysts jobs especially? Probably on the chopping block.

The implications extend far beyond academic research:

If AI can systematically outperform professional fund managers using only public information, we're looking at a fundamental shift in capital allocation.

And we're seeing the early stages of this transition right now.

If AI can systematically outperform professional fund managers using only public information, we're looking at a fundamental shift in capital allocation.

And we're seeing the early stages of this transition right now.

Markets have evolved beyond human cognitive capabilities.

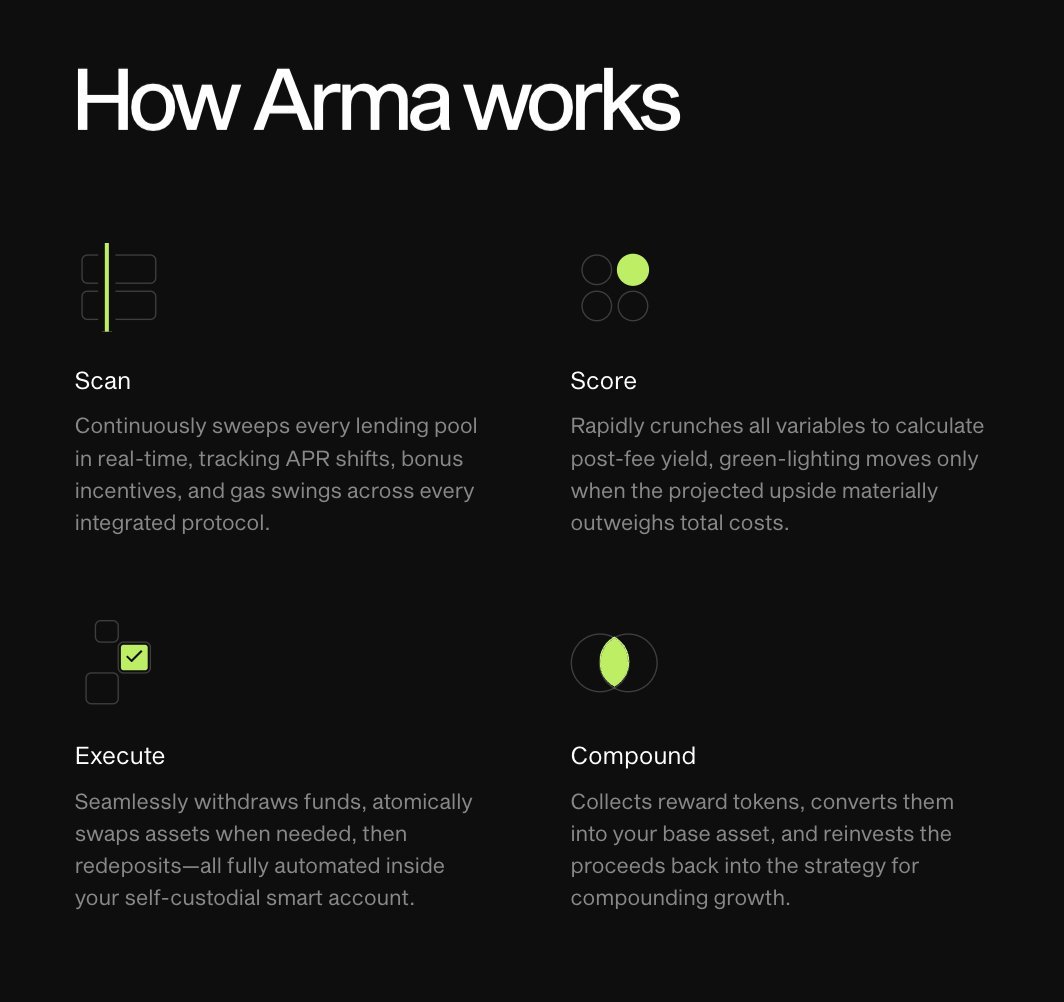

While Stanford's Terminator AI worked quarterly, we built ARMA to work continuously.

ARMA is an autonomous agent that optimizes stablecoin yields 24/7 by moving your capital to wherever yields are highest.

While Stanford's Terminator AI worked quarterly, we built ARMA to work continuously.

ARMA is an autonomous agent that optimizes stablecoin yields 24/7 by moving your capital to wherever yields are highest.

Just like Stanford's AI crushed human fund managers by processing more data without fatigue or bias...

ARMA crushes manual yield farming by:

Never sleeping.

Never missing opportunities.

Always finding the optimal allocation across DeFi protocols.

ARMA crushes manual yield farming by:

Never sleeping.

Never missing opportunities.

Always finding the optimal allocation across DeFi protocols.

It moves your USDC between the highest-yielding protocols while you keep full custody of your assets.

Currently delivering 15% APR with 100% positive P&L rate.

We've processed over $800M in agentic volume, proving this approach works in live markets (not just academic testing).

Currently delivering 15% APR with 100% positive P&L rate.

We've processed over $800M in agentic volume, proving this approach works in live markets (not just academic testing).

The Stanford study shows what's possible.

We're making it reality for stablecoin holders today.

Your money deserve to work as hard as AI.

Park them in ARMA, the #1 place to earn yield on your stables: arma.xyz

We're making it reality for stablecoin holders today.

Your money deserve to work as hard as AI.

Park them in ARMA, the #1 place to earn yield on your stables: arma.xyz

Thanks for the read!

As CEO of @gizatechxyz - we build personalized agents that work 24/7 so your money never stops growing.

Follow me @renckorzay for more on AI x DeFi, and the future of autonomous finance.

As CEO of @gizatechxyz - we build personalized agents that work 24/7 so your money never stops growing.

Follow me @renckorzay for more on AI x DeFi, and the future of autonomous finance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh