🚨Why Selling in August is a Big Mistake🚨

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.

Here’s why I’m staying patient and what I’m doing instead 🧵👇

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.

Here’s why I’m staying patient and what I’m doing instead 🧵👇

1/x The fear is real:

🔸 Tariff headlines

🔸 Weak job data

🔸 Liquidity dip

🔸 ETF outflows

But zoom out, none of this changes the bigger picture. In fact, it’s setting up a perfect Q4 storm.

Let’s break it down.

🔸 Tariff headlines

🔸 Weak job data

🔸 Liquidity dip

🔸 ETF outflows

But zoom out, none of this changes the bigger picture. In fact, it’s setting up a perfect Q4 storm.

Let’s break it down.

2/x Tariffs are just noise. Trump’s tariff pause now ends August 7. But he always uses tariffs as leverage, this is the same China playbook.

Markets might wobble short-term, but once the news is out, the uncertainty fades. Don’t panic sell on headlines.

Markets might wobble short-term, but once the news is out, the uncertainty fades. Don’t panic sell on headlines.

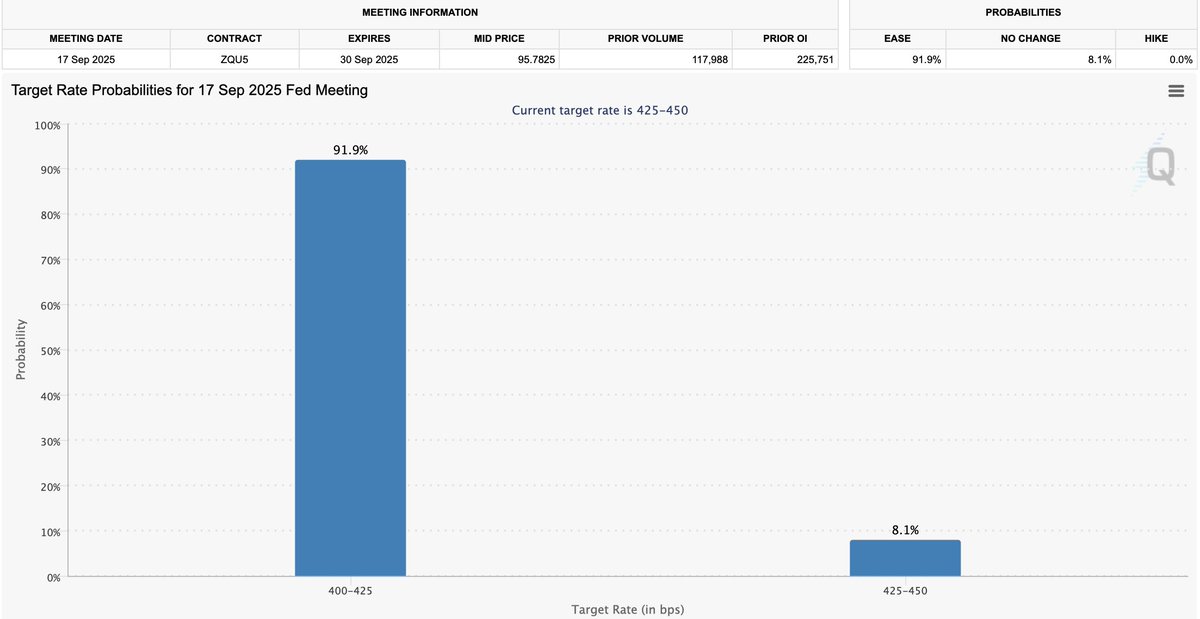

3/x The recent weak jobs report actually boosts the odds of Fed cuts.

May & June job growth was revised down by 258K. That’s massive.

Markets went from 39% to 86% odds of a September rate cut. Easing is back on the table.

May & June job growth was revised down by 258K. That’s massive.

Markets went from 39% to 86% odds of a September rate cut. Easing is back on the table.

4/x The Treasury might pull $500B to refill its General Account, and yes, that could cause short-term chop.

But it’s not a liquidity collapse. It would still form a higher low on global liquidity charts.

But by Q4, we could get:

🔹 Rate cuts

🔹 QT pause

🔹 SLR exemption

August is the shakeout. September is the setup.

But it’s not a liquidity collapse. It would still form a higher low on global liquidity charts.

But by Q4, we could get:

🔹 Rate cuts

🔹 QT pause

🔹 SLR exemption

August is the shakeout. September is the setup.

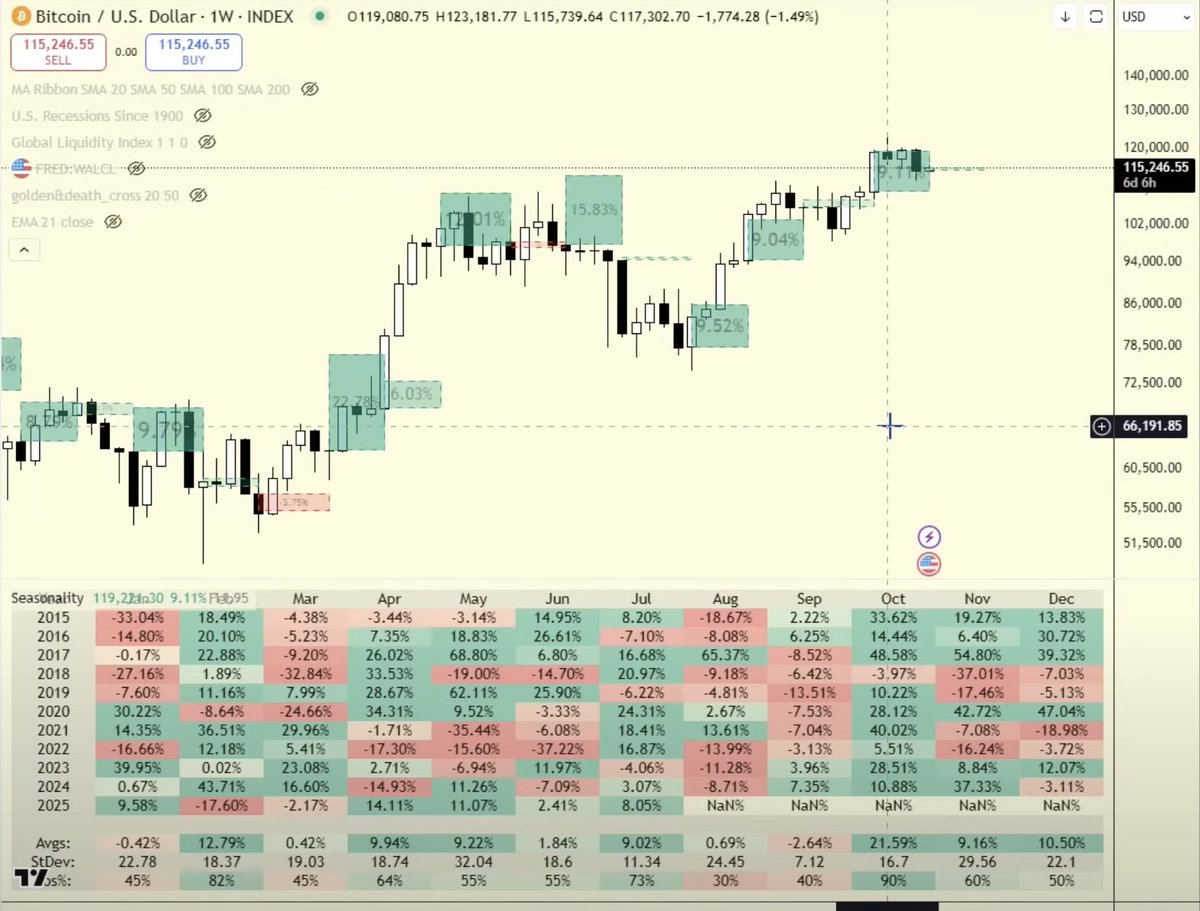

5/x Historically, August is #Bitcoin’s weakest month.

TradFi slows down. Volumes drop. Chop increases.

But seasonality isn't the same as bearish trend. A slow August doesn’t mean a bearish cycle, just a pause before a potential Q4 breakout.

TradFi slows down. Volumes drop. Chop increases.

But seasonality isn't the same as bearish trend. A slow August doesn’t mean a bearish cycle, just a pause before a potential Q4 breakout.

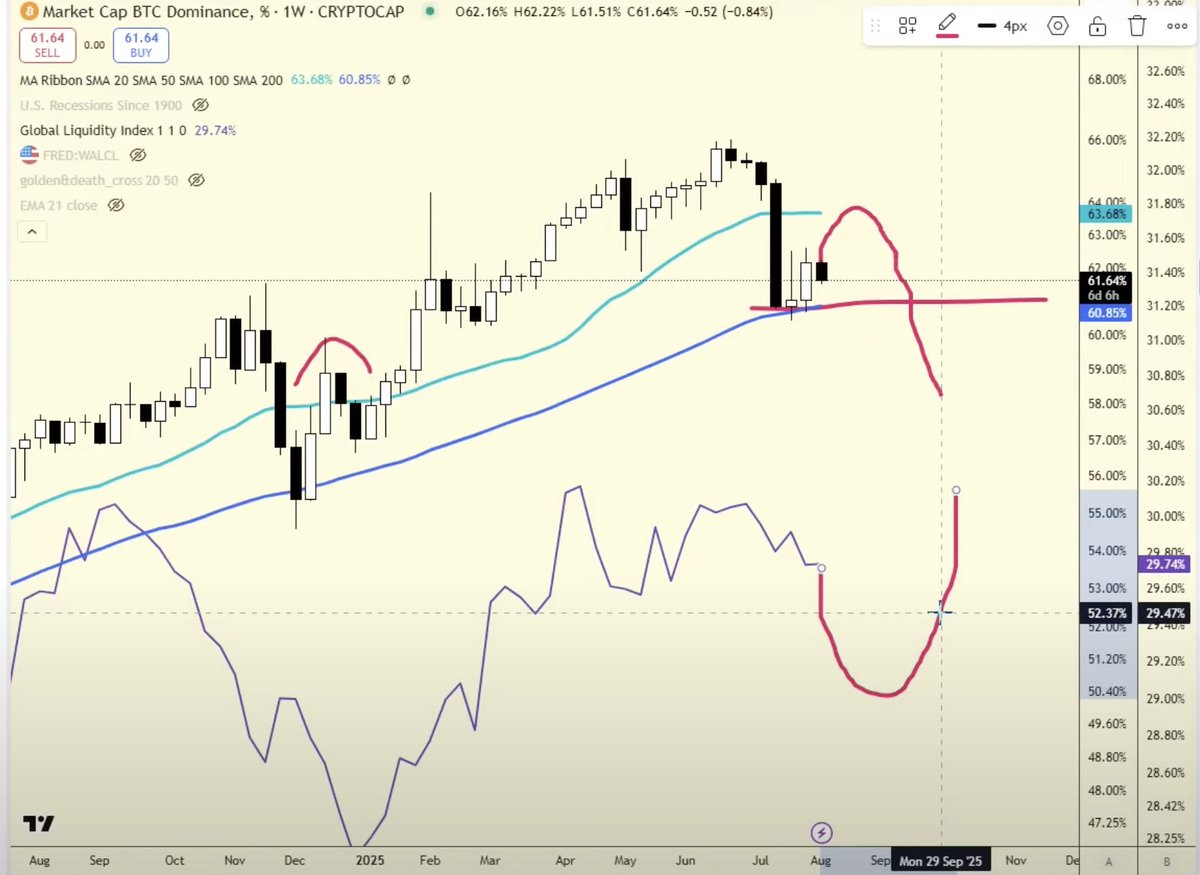

6/x #Bitcoin dominance bounced off its 50-week moving average, just like in prior cycles.

If it climbs to 66%, altcoins will bleed.

But more likely, we get a lower high followed by a breakdown. Until we see that breakdown, low caps stay risky.

If it climbs to 66%, altcoins will bleed.

But more likely, we get a lower high followed by a breakdown. Until we see that breakdown, low caps stay risky.

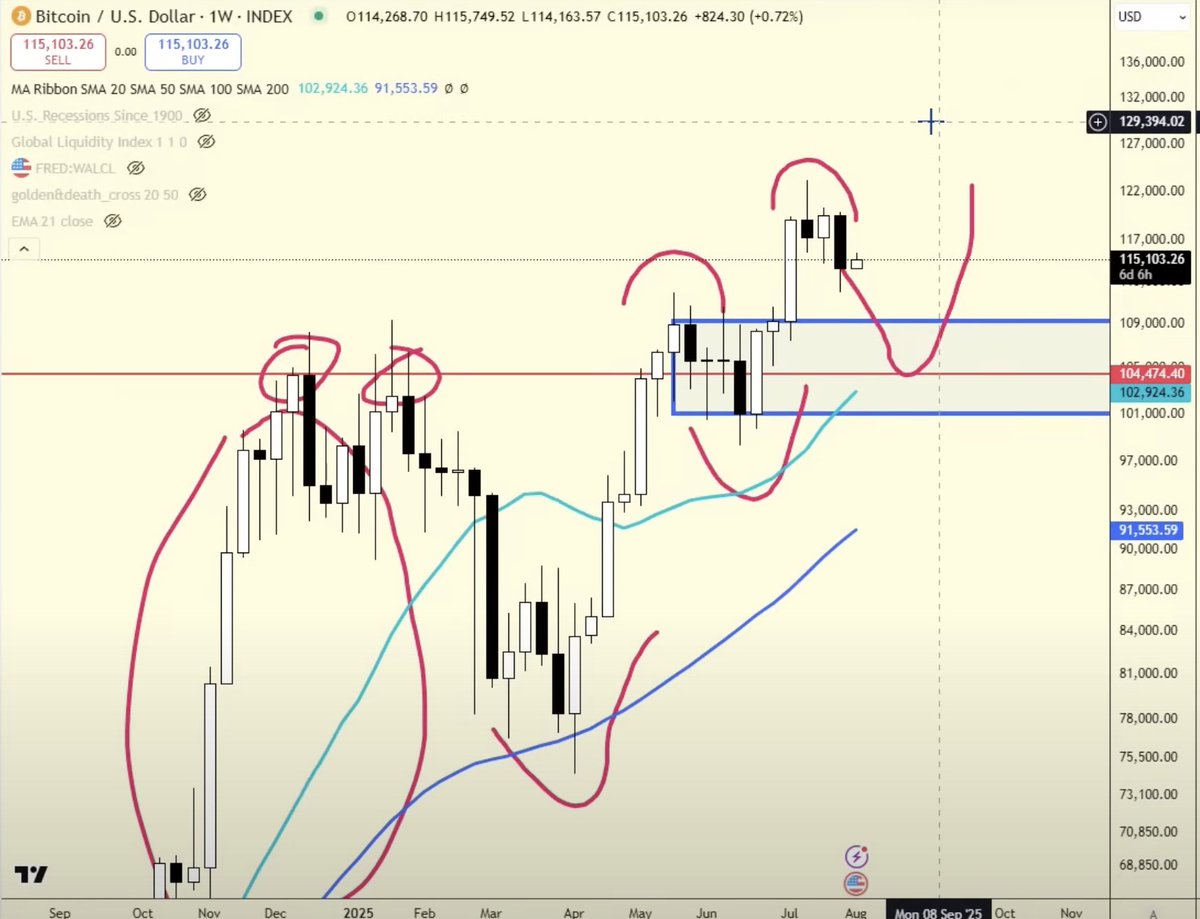

7/x Let's take a look at $BTC:

🔹 Still far above $91.5K support.

🔹 $103K-$104K = healthy buy zone.

🔹 $140K-$150K target still intact.

A small dip today isn’t worth exiting. This is a market to buy, not sell.

🔹 Still far above $91.5K support.

🔹 $103K-$104K = healthy buy zone.

🔹 $140K-$150K target still intact.

A small dip today isn’t worth exiting. This is a market to buy, not sell.

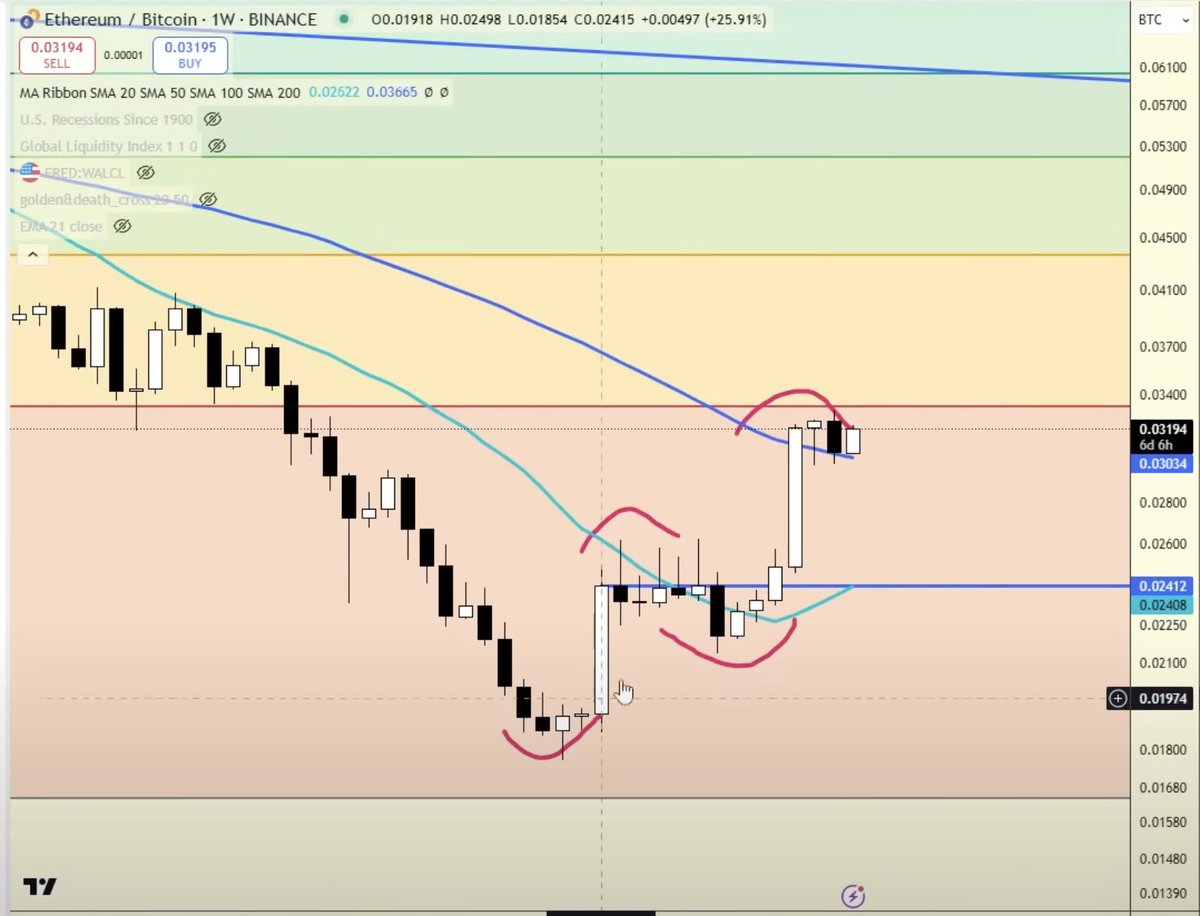

8/x $ETH, $XRP, $SOL outlook:

🔹 $ETH looks solid as long as we stay above $2.7K.

🔹 $XRP needs to hold 0.000022 BTC and is still a buy between $2–$3.

🔹 $SOL has a must-hold $BTC ratio is 0.0012. That gives a USD floor around $110–$130. Still early on all three.

🔹 $ETH looks solid as long as we stay above $2.7K.

🔹 $XRP needs to hold 0.000022 BTC and is still a buy between $2–$3.

🔹 $SOL has a must-hold $BTC ratio is 0.0012. That gives a USD floor around $110–$130. Still early on all three.

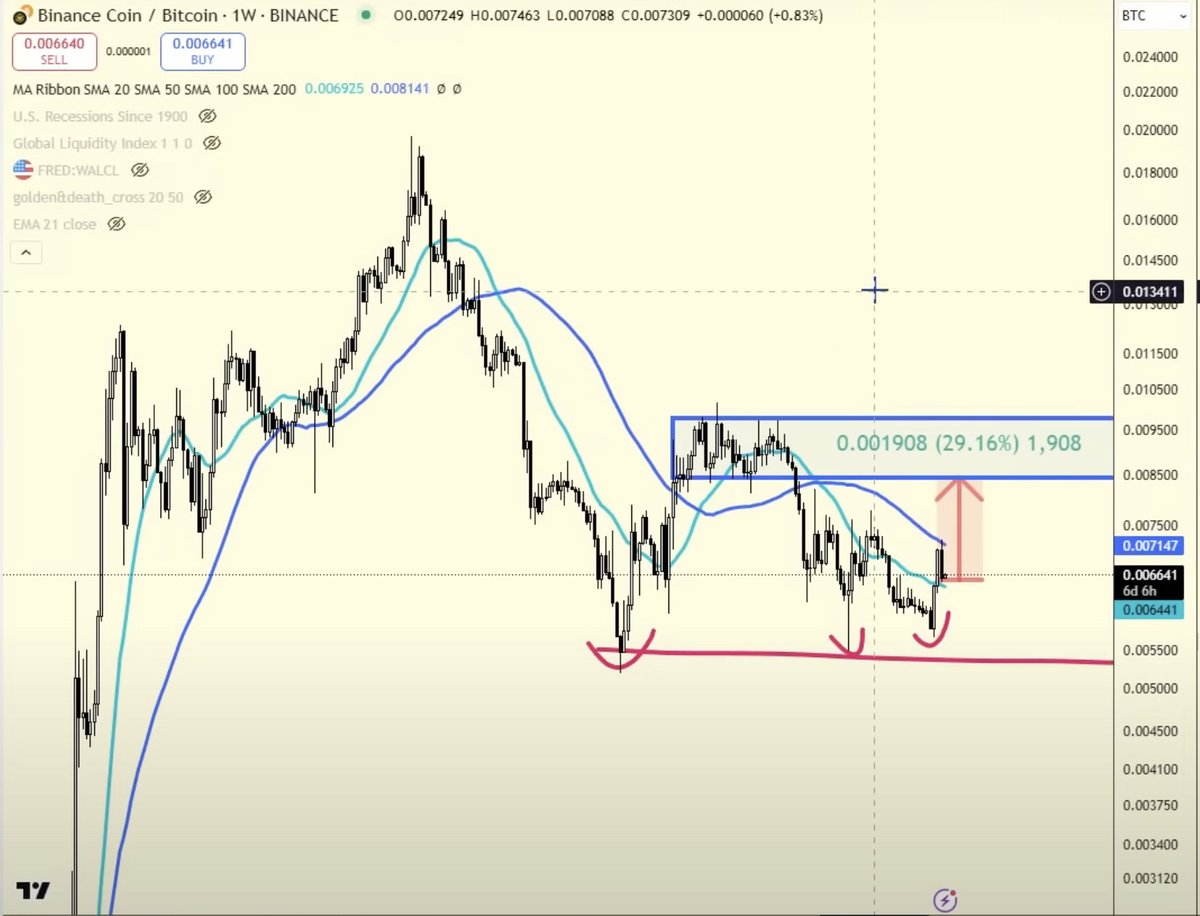

9/x The large caps are holding up and this is where I’m focused.

🔹 $BNB (undervalued + benefits from Project Crypto).

🔹 $ADA (regulatory clarity as a commodity).

🔹 $DOGE, $TRX, $HYPE (near support).

Focus on safer names first. Rotation always starts here.

🔹 $BNB (undervalued + benefits from Project Crypto).

🔹 $ADA (regulatory clarity as a commodity).

🔹 $DOGE, $TRX, $HYPE (near support).

Focus on safer names first. Rotation always starts here.

10/x My strategy right now is simple:

🔹 Stack $BTC, $ETH, $XRP, $SOL, $ADA.

🔹 Rotating into large caps near support.

🔹 Use grid bots to auto-buy dips and take profits.

No need to trade every move, let the bots work the chop while you position for Q4.

🔹 Stack $BTC, $ETH, $XRP, $SOL, $ADA.

🔹 Rotating into large caps near support.

🔹 Use grid bots to auto-buy dips and take profits.

No need to trade every move, let the bots work the chop while you position for Q4.

11/x Don’t get shaken out now.

Rate cuts, QT pause, and SLR easing are all on the horizon.

Stay focused, stay patient and if you want to automate your dip buys and sell targets:

Copy all my trading bots here 👉

What are you buying this month? Drop your choices below!👇bacon.link/all-bots

Rate cuts, QT pause, and SLR easing are all on the horizon.

Stay focused, stay patient and if you want to automate your dip buys and sell targets:

Copy all my trading bots here 👉

What are you buying this month? Drop your choices below!👇bacon.link/all-bots

• • •

Missing some Tweet in this thread? You can try to

force a refresh