Most traders completely missed the free money layup last week.

I made 360% on $SPY while you were busy figuring out WTF just happened.

Here is the ridiculously simple setup that hid in plain sight 🧵

I made 360% on $SPY while you were busy figuring out WTF just happened.

Here is the ridiculously simple setup that hid in plain sight 🧵

1/ Friday was a masterclass in simplicity

While most people are studying 10 indicators and drawing Fair Value SMTs DD PoS 3.0. The market handed us the most obvious breakdown setup. The market wanted us to take advantage, but 90% of you didn't.

While most people are studying 10 indicators and drawing Fair Value SMTs DD PoS 3.0. The market handed us the most obvious breakdown setup. The market wanted us to take advantage, but 90% of you didn't.

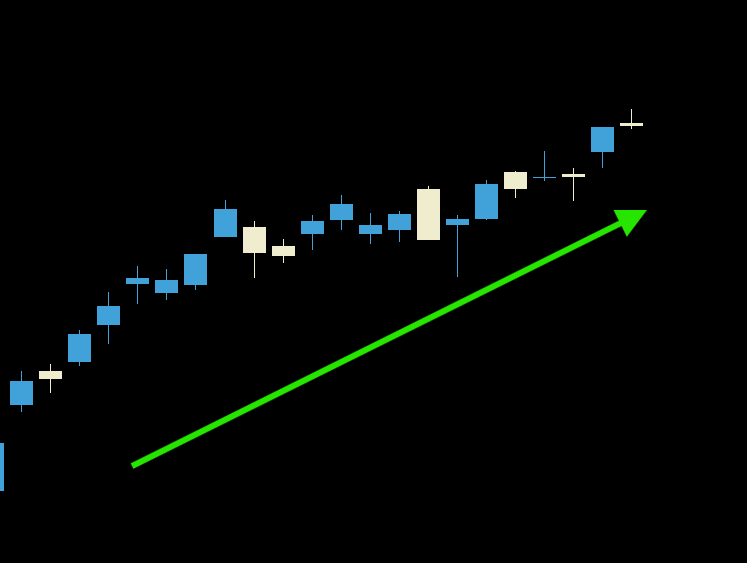

2/ Lets understand how price moves

Stock goes up and to the right = Buyers/Bullish

Stock goes down and to the right = Sellers/bearish

But what happens when price reverses what does that signal?

Stock goes up and to the right = Buyers/Bullish

Stock goes down and to the right = Sellers/bearish

But what happens when price reverses what does that signal?

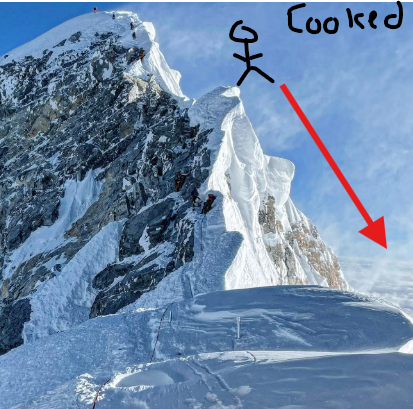

3/ Reversals are like a mountain

Imagine climbing to the top of Mt. Everest. Once you get to the top you're exhausted, but you get some sick pictures. Its similar to how FURUs flex their gains when the market goes up 30% in 90 days. Everyone is a genius, until reality hits!

Imagine climbing to the top of Mt. Everest. Once you get to the top you're exhausted, but you get some sick pictures. Its similar to how FURUs flex their gains when the market goes up 30% in 90 days. Everyone is a genius, until reality hits!

4/ You're exhausted and make a wrong step

You slip and fall off a cliff on Mt. Everest and mid free fall you say to yourself "I'm cooked." Now think of that in terms of price action. What does it mean when price goes quick from high to lows?

You slip and fall off a cliff on Mt. Everest and mid free fall you say to yourself "I'm cooked." Now think of that in terms of price action. What does it mean when price goes quick from high to lows?

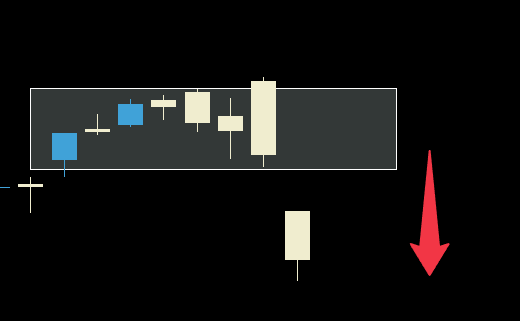

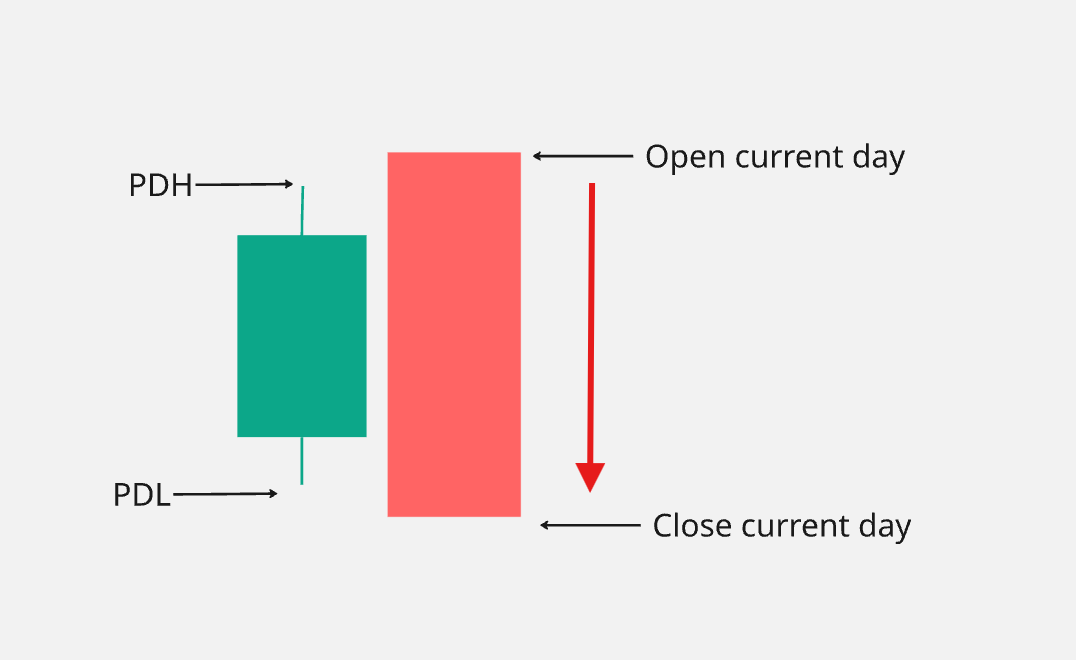

5/ What is a reversal

When price starts are the extreme highs and give back all of days gain and more that is a reversal. Let's think what does the candle look like on a day like this? Let's say we start at the PDH reverse break the PDL and close at LODs.

When price starts are the extreme highs and give back all of days gain and more that is a reversal. Let's think what does the candle look like on a day like this? Let's say we start at the PDH reverse break the PDL and close at LODs.

6/ What do reversals tell us?

Reversal like this tell us that people are taking profits and sellers are in full control. Everyone is exiting stage left due to the recent run. Our job as a trader to spot this type of action and take full advantage.

Reversal like this tell us that people are taking profits and sellers are in full control. Everyone is exiting stage left due to the recent run. Our job as a trader to spot this type of action and take full advantage.

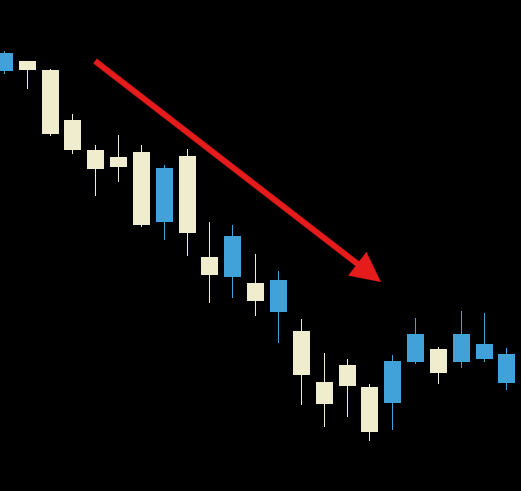

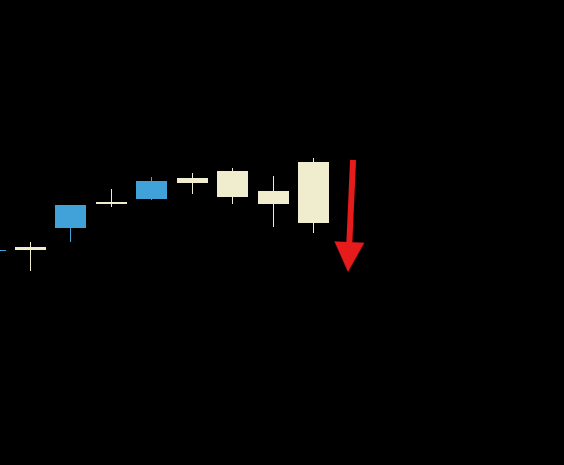

7/ The Signal

On Thursday $SPY once again round tripped all of its gains for the day. I had traders dming me "We are going to $700 off $META ER!" Cool story bro can you explain to me why we sold off? I can. Its because the market is tired. Remember the mountain? Look at the free fall.

On Thursday $SPY once again round tripped all of its gains for the day. I had traders dming me "We are going to $700 off $META ER!" Cool story bro can you explain to me why we sold off? I can. Its because the market is tired. Remember the mountain? Look at the free fall.

8/ The Overnight Entry

I noticed this profit taking in the afternoon and figure there is no way price is bullish. No good ER can save the bearishess. Even if we gapped up they would sell it off anyway, just like they did on Thursday. I took $SPY 625p off the LH/8ema tap for an overnight position.

I noticed this profit taking in the afternoon and figure there is no way price is bullish. No good ER can save the bearishess. Even if we gapped up they would sell it off anyway, just like they did on Thursday. I took $SPY 625p off the LH/8ema tap for an overnight position.

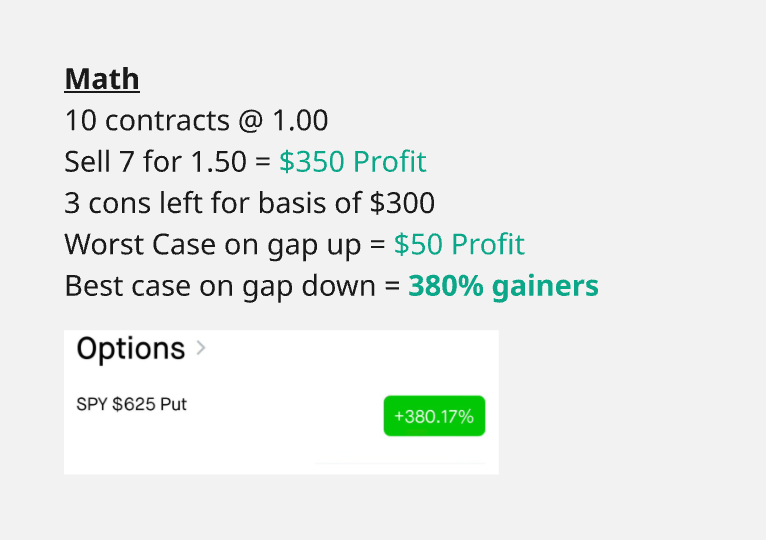

9/ The House Money Concept

The contracts went well over 50% before the close, so instead of risking my entire position like a greedy gambler. I trimmed 70% of position so the rest of the contracts were just profits. It was easy if we sell off I get paid if we gap up I ONLY lose profits and the trade is still green.

The contracts went well over 50% before the close, so instead of risking my entire position like a greedy gambler. I trimmed 70% of position so the rest of the contracts were just profits. It was easy if we sell off I get paid if we gap up I ONLY lose profits and the trade is still green.

10/ The math of trading

If someone told you that you could risk negative $50 dollars, aka some one is paying you to take a risk, to make $5,000 would you do it? Of course not because its likely a ponzi scheme however in trading, we get paid off taking a RISK.

If someone told you that you could risk negative $50 dollars, aka some one is paying you to take a risk, to make $5,000 would you do it? Of course not because its likely a ponzi scheme however in trading, we get paid off taking a RISK.

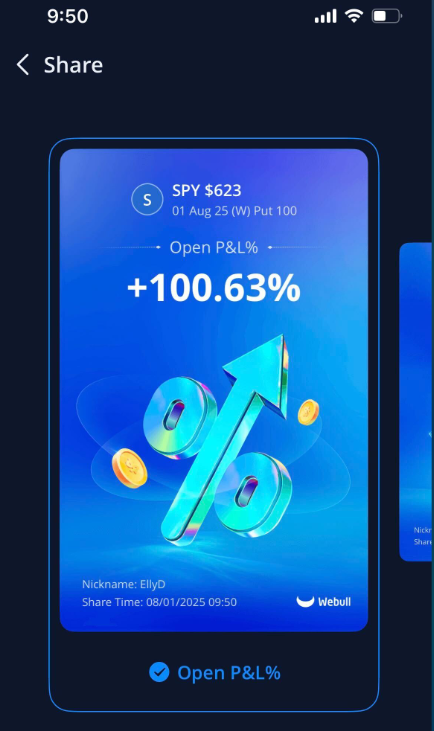

11/ For the haters

Some will say I got lucky or it was just a yolo. Than please explain to me how I made 100.63% in 20 minutes using the exact LE Model I teach for free? If you haven't heard of the LE Model, today is your lucky day let me explain.

Some will say I got lucky or it was just a yolo. Than please explain to me how I made 100.63% in 20 minutes using the exact LE Model I teach for free? If you haven't heard of the LE Model, today is your lucky day let me explain.

12/ My favorite short setup

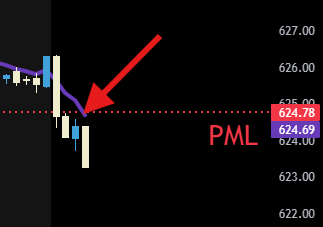

When a stock opens below the PDL I know the stock is bearish. But I need an entry trigger. I need one more reason why I should load up on puts and become a bear. If we look at the chart what would our trigger be? We only have one option: PML

When a stock opens below the PDL I know the stock is bearish. But I need an entry trigger. I need one more reason why I should load up on puts and become a bear. If we look at the chart what would our trigger be? We only have one option: PML

13/ Where are the other levels?

Ask yourself when looking at the chart, is there a level we can use to confirm our thesis? Remember Levels first then EMAs. You need to break a level first before even looking at the EMAs. The only level is the Pre Market Low, keep it simple you don't need 500 levels.

Ask yourself when looking at the chart, is there a level we can use to confirm our thesis? Remember Levels first then EMAs. You need to break a level first before even looking at the EMAs. The only level is the Pre Market Low, keep it simple you don't need 500 levels.

14/ While others were paralyzed I was already in getting paid

I entered on the tap to the PML with no hesitation. The system says short so I short. I don't look for longs I just follow the price. Lots of traders missed this setup it was picture perfect and clean. You have to ask yourself why did you hesitate? Did the red candles scare you?

I entered on the tap to the PML with no hesitation. The system says short so I short. I don't look for longs I just follow the price. Lots of traders missed this setup it was picture perfect and clean. You have to ask yourself why did you hesitate? Did the red candles scare you?

15/ Your biggest enemy isn't the market its your need for overcomplication

I've missed out on 6 figures due to hesitation and overthinking. You need to reprogram your brain to see simple setups as a wealth cheat code, not traps. Cut out all the BS you have learned over the years its all noise. Focus on the BASCIS of trading.

I've missed out on 6 figures due to hesitation and overthinking. You need to reprogram your brain to see simple setups as a wealth cheat code, not traps. Cut out all the BS you have learned over the years its all noise. Focus on the BASCIS of trading.

16/ The basics

Focus on what the daily is doing, is todays candle an inside day or outside day? What is the story telling you? Nothing in the stock market is new as the algos are programed on prior data. You should program your mind the same way.

Focus on what the daily is doing, is todays candle an inside day or outside day? What is the story telling you? Nothing in the stock market is new as the algos are programed on prior data. You should program your mind the same way.

17/ August Assignment

Delete all those garbage indicators from your charts. MASTER the basics first, because if you have a solid trading foundation, we can start building your dream life, and then we can achieve what you set out to do. The lambo/retiring is waiting, but learn to drive first. Don't quit, you're closer than you think.

Delete all those garbage indicators from your charts. MASTER the basics first, because if you have a solid trading foundation, we can start building your dream life, and then we can achieve what you set out to do. The lambo/retiring is waiting, but learn to drive first. Don't quit, you're closer than you think.

18/ Summary

I hope you enjoyed this thread. I tried to paint a story to explain how price works in normal people terms.

If you think this thread was helpful Like and Retweet

I hope you enjoyed this thread. I tried to paint a story to explain how price works in normal people terms.

If you think this thread was helpful Like and Retweet

https://x.com/EllyDtrades/status/1952885095620092107

• • •

Missing some Tweet in this thread? You can try to

force a refresh