An easy way to understand @boros_fi :

You are paying a fixed rate for anything.

🔹Bull Market:

Longing in bull market with a positive funding mean longs are paying funding to shorts.

To hedge, you can buy a long YU for a fixed rate to avoid getting busted by even higher positive funding.

Vice versa for shorting in bear market, where you can short YU to protect against a more negative funding environment .

🔹 Basis Trade:

Basis trade means you hold a spot with a short. Short collecting funding when it is positive. Good at bull market.

If funding is looking good now and you think there is no room for better rate (Or bear coming), you can short YU to keep the current rate.

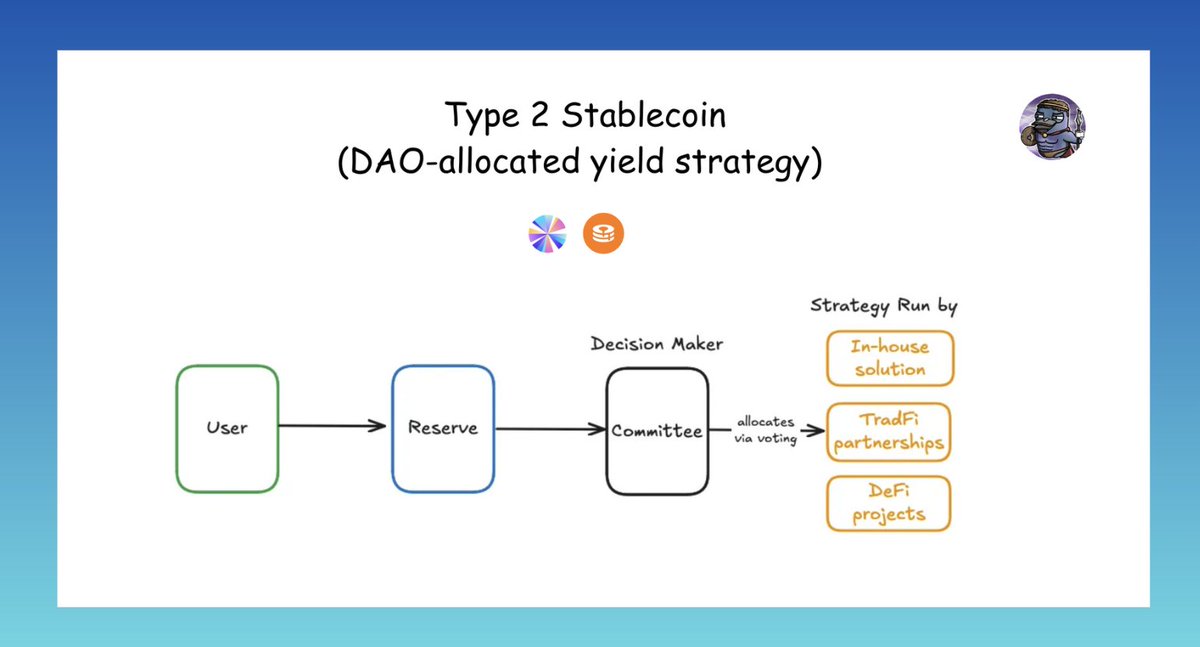

Can see potential demand from yield bearing stable such as @ethena_labs to take profit without unwinding the position.

🧠 Thought:

Boros is clearly still in its exploration phase. Expecting to see an imbalanced amount of short YU on boros as traders / protocols use it to hedge their basis trades.

But IMO it's a smart move by @tn_pendle to tap into the growing perp market and re-engineering yield in the landscape.

Since it's still quite difficult to understand, we defin need more education to drive more adoption.

You are paying a fixed rate for anything.

🔹Bull Market:

Longing in bull market with a positive funding mean longs are paying funding to shorts.

To hedge, you can buy a long YU for a fixed rate to avoid getting busted by even higher positive funding.

Vice versa for shorting in bear market, where you can short YU to protect against a more negative funding environment .

🔹 Basis Trade:

Basis trade means you hold a spot with a short. Short collecting funding when it is positive. Good at bull market.

If funding is looking good now and you think there is no room for better rate (Or bear coming), you can short YU to keep the current rate.

Can see potential demand from yield bearing stable such as @ethena_labs to take profit without unwinding the position.

🧠 Thought:

Boros is clearly still in its exploration phase. Expecting to see an imbalanced amount of short YU on boros as traders / protocols use it to hedge their basis trades.

But IMO it's a smart move by @tn_pendle to tap into the growing perp market and re-engineering yield in the landscape.

Since it's still quite difficult to understand, we defin need more education to drive more adoption.

• • •

Missing some Tweet in this thread? You can try to

force a refresh