🧵🚨 Ripple just acquired “Rail” for $200M.

They just swallowed an entire backend layer of global stablecoin infrastructure.

It’s the quietest, most strategic takeover of modern financial rails we’ve seen.

Let’s decode what Rail is and why this is huge👇🧵

They just swallowed an entire backend layer of global stablecoin infrastructure.

It’s the quietest, most strategic takeover of modern financial rails we’ve seen.

Let’s decode what Rail is and why this is huge👇🧵

(1/🧵) What is Rail?

Rail is a financial plumbing company powering stablecoin settlement, virtual accounts, compliance automation, and global fintech rails.

It processes 10% of all global stablecoin volume.

Yes, 10% of the entire stablecoin economy flows through Rail.

Let that sink in.

Rail is a financial plumbing company powering stablecoin settlement, virtual accounts, compliance automation, and global fintech rails.

It processes 10% of all global stablecoin volume.

Yes, 10% of the entire stablecoin economy flows through Rail.

Let that sink in.

(2/🧵) So what exactly does Rail do?

▪️ Virtual accounts in 180+ countries

▪️ Multi-asset settlement

▪️ Embedded compliance logic (KYC/AML)

▪️ Instant fiat on/off ramps

▪️ End-to-end automation for fintechs and Web3

Basically, Rail is the invisible backbone behind hundreds of fintech platforms.

▪️ Virtual accounts in 180+ countries

▪️ Multi-asset settlement

▪️ Embedded compliance logic (KYC/AML)

▪️ Instant fiat on/off ramps

▪️ End-to-end automation for fintechs and Web3

Basically, Rail is the invisible backbone behind hundreds of fintech platforms.

(3/🧵) Now ask: why would Ripple, a blockchain company buy something like this?

Because Rail already does what CBDCs, stablecoins, and banks are trying to figure out.

It gives Ripple:

→ Global banking access

→ Settlement logic

→ Institutional-grade automation

→ And immediate infrastructure for RLUSD

Because Rail already does what CBDCs, stablecoins, and banks are trying to figure out.

It gives Ripple:

→ Global banking access

→ Settlement logic

→ Institutional-grade automation

→ And immediate infrastructure for RLUSD

(4/🧵) Here’s the kicker:

Ripple’s not just building a stablecoin.

They’re building the operating system for programmable finance.

Think SWIFT + Plaid + Stripe + USDC.

All fused together and settled via XRP and RLUSD.

And with Rail… it’s already live.

Ripple’s not just building a stablecoin.

They’re building the operating system for programmable finance.

Think SWIFT + Plaid + Stripe + USDC.

All fused together and settled via XRP and RLUSD.

And with Rail… it’s already live.

(5/🧵) Don’t forget the timing:

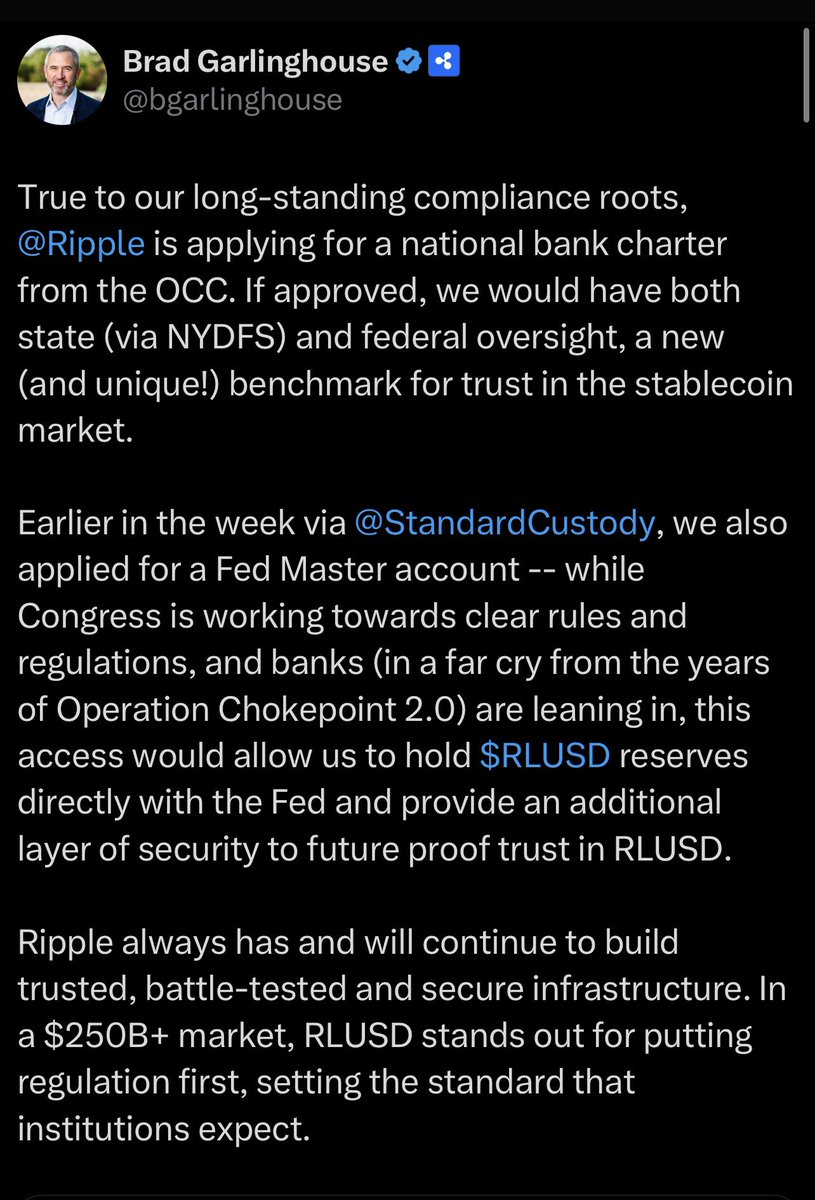

✅ Ripple filed for a banking charter

✅ Filed for a Fed master account

✅ RLUSD just launched

✅ OpenPayd + Amina Bank already support it

✅ BlackRock, IMF, BIS are all shouting “Tokenize the world”

And now… Ripple owns a major piece of the plumbing.

✅ Ripple filed for a banking charter

✅ Filed for a Fed master account

✅ RLUSD just launched

✅ OpenPayd + Amina Bank already support it

✅ BlackRock, IMF, BIS are all shouting “Tokenize the world”

And now… Ripple owns a major piece of the plumbing.

(6/🧵) What does this mean for XRP?

Ripple now has complete control over:

→ The ledger (XRPL)

→ The stablecoin (RLUSD)

→ The pipes (Rail)

→ The compliance (OpenPayd/Amina)

→ And soon… the bank account (Fed access)

This isn’t a payment company.

It’s the new financial grid.

Ripple now has complete control over:

→ The ledger (XRPL)

→ The stablecoin (RLUSD)

→ The pipes (Rail)

→ The compliance (OpenPayd/Amina)

→ And soon… the bank account (Fed access)

This isn’t a payment company.

It’s the new financial grid.

(7/🧵) Bullish consequences of this deal?

▪️ Massive boost to RLUSD adoption

▪️ Institutional clients onboarded instantly

▪️ XRP becomes the native settlement option for stablecoin flows

▪️ Ripple can now route capital without touching legacy banking at all

They just built the rails that others will have to use.

▪️ Massive boost to RLUSD adoption

▪️ Institutional clients onboarded instantly

▪️ XRP becomes the native settlement option for stablecoin flows

▪️ Ripple can now route capital without touching legacy banking at all

They just built the rails that others will have to use.

(8/🧵) First it was Hidden Road, the shadow prime broker for Wall Street giants.

Next, it was the OCC charter and Fed Master Account Applications.

Now it’s Rail, the infrastructure backbone for digital payments.

🔁 Ripple isn’t playing checkers, it’s building the new monetary matrix.

One piece at a time, the old financial system is being replaced… quietly.

Next, it was the OCC charter and Fed Master Account Applications.

Now it’s Rail, the infrastructure backbone for digital payments.

🔁 Ripple isn’t playing checkers, it’s building the new monetary matrix.

One piece at a time, the old financial system is being replaced… quietly.

(9/9) For deeper insights, exclusive breakdowns, and early access to my research:

📲 Join my official Telegram channel:

t.me/ripplercult

📲 Join my official Telegram channel:

t.me/ripplercult

• • •

Missing some Tweet in this thread? You can try to

force a refresh