(2/9)

The housing market is cooling fast. Are you ready?

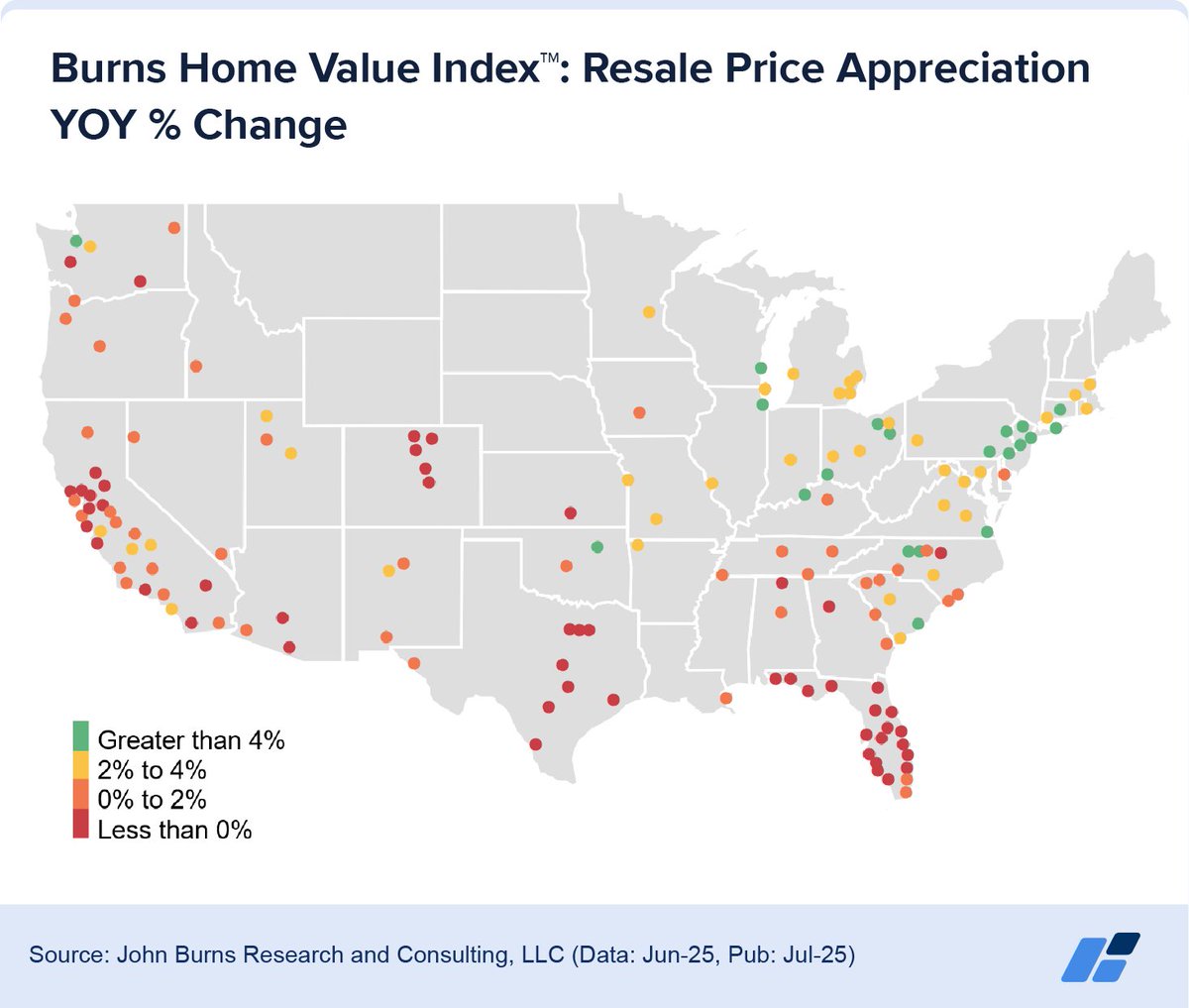

-Resale prices are down compared to one year ago in 53 of 150 markets we track, with declines spreading beyond Texas and Florida.

-New home prices, including builder concessions and incentives, have fallen -1.5% versus last year as builders have been caught with too many completed, unsold homes for the first time in many years.

-Resale prices have risen in 65% of the country over the last year, so pay attention to local dynamics. For our clients, we produce 70-page reports and have user-friendly dashboards with just about every stat we can think of on 100+ metro areas every month.

The housing market is cooling fast. Are you ready?

-Resale prices are down compared to one year ago in 53 of 150 markets we track, with declines spreading beyond Texas and Florida.

-New home prices, including builder concessions and incentives, have fallen -1.5% versus last year as builders have been caught with too many completed, unsold homes for the first time in many years.

-Resale prices have risen in 65% of the country over the last year, so pay attention to local dynamics. For our clients, we produce 70-page reports and have user-friendly dashboards with just about every stat we can think of on 100+ metro areas every month.

(3/9)

Price drops spreading

With new home construction exceeding job creation in most areas, the supply of newly built homes is outpacing new demand. Homebuilders are lowering prices and payments to find demand.

Price weakness has expanded across the Southeast, Southwest, and West Coast. Even some markets in the Midwest and Northeast, where tight supply previously supported strong pricing power, are seeing price appreciation slow rapidly. This geographic spread signals a widespread shift in pricing power.

Price drops spreading

With new home construction exceeding job creation in most areas, the supply of newly built homes is outpacing new demand. Homebuilders are lowering prices and payments to find demand.

Price weakness has expanded across the Southeast, Southwest, and West Coast. Even some markets in the Midwest and Northeast, where tight supply previously supported strong pricing power, are seeing price appreciation slow rapidly. This geographic spread signals a widespread shift in pricing power.

(4/9)

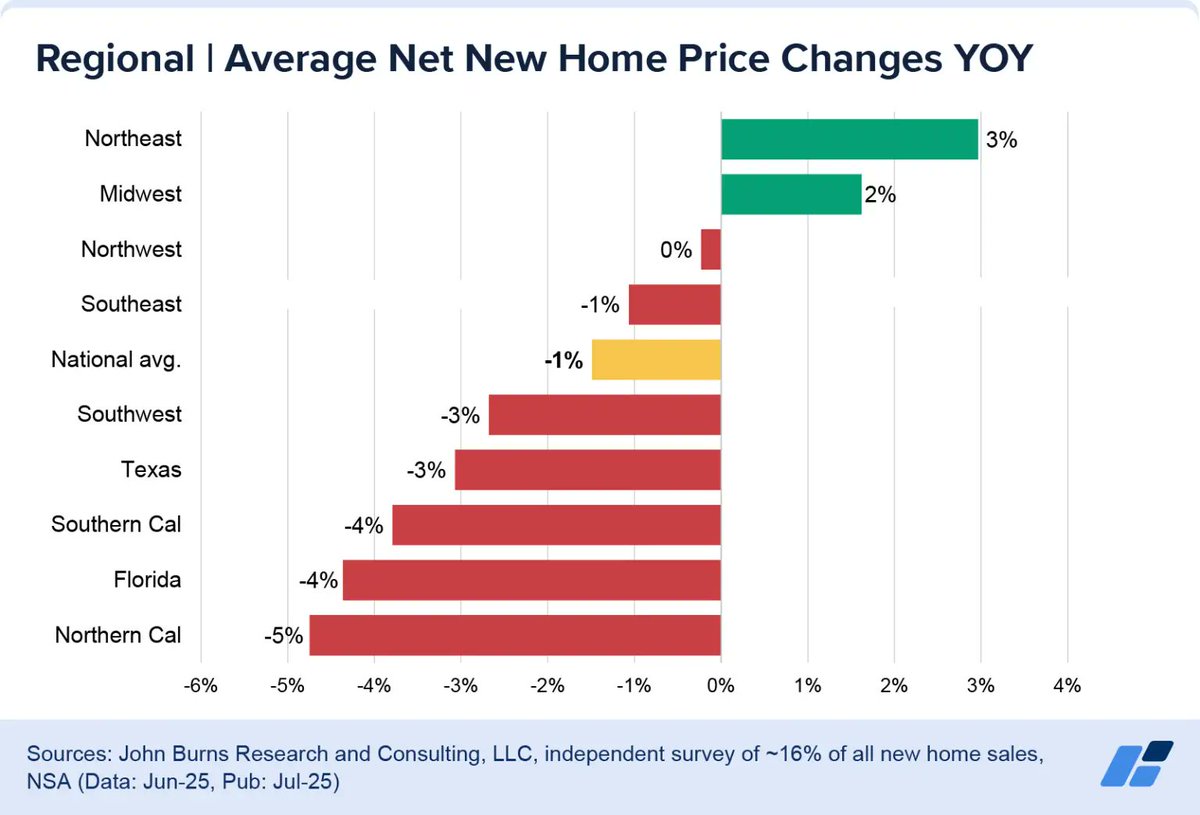

The following chart shows what has happened to new home prices, net of incentives, by region of the country in the last year.

We are releasing our proprietary Homebuilder Survey to our clients this week, which will include updated new home prices for July.

The following chart shows what has happened to new home prices, net of incentives, by region of the country in the last year.

We are releasing our proprietary Homebuilder Survey to our clients this week, which will include updated new home prices for July.

(5/9)

Fewer jobs mean fewer homebuyers and more renters

The job market—a crucial driver of homebuying—is weakening across the country.

Employment growth has slowed, and some markets are losing jobs compared to last year.

Where jobs are still growing (but slower than before):

Charlotte: +2.2% job growth YOY

San Antonio: +2.0% job growth YOY

Salt Lake City: +2.0% job growth YOY

Fewer jobs mean fewer homebuyers and more renters

The job market—a crucial driver of homebuying—is weakening across the country.

Employment growth has slowed, and some markets are losing jobs compared to last year.

Where jobs are still growing (but slower than before):

Charlotte: +2.2% job growth YOY

San Antonio: +2.0% job growth YOY

Salt Lake City: +2.0% job growth YOY

(6/9)

Where jobs are declining:

Bay Area and other coastal markets are seeing YOY job losses.

The high-income sectors that typically drive new home purchases (Information, Financial Activities, and Professional and Business Services) are experiencing the steepest losses. When high-income workers lose jobs or face uncertainty, they’re less likely to buy homes.

Our analysis shows that rental market leasing through June was strong, despite the slowing economy and job growth. We believe most of the demand right now is for rental homes.

Where jobs are declining:

Bay Area and other coastal markets are seeing YOY job losses.

The high-income sectors that typically drive new home purchases (Information, Financial Activities, and Professional and Business Services) are experiencing the steepest losses. When high-income workers lose jobs or face uncertainty, they’re less likely to buy homes.

Our analysis shows that rental market leasing through June was strong, despite the slowing economy and job growth. We believe most of the demand right now is for rental homes.

(7/9)

What this means for you

For homebuyers: This shift creates opportunities for those with stable jobs. More inventory and motivated sellers mean better negotiating power and potentially lower prices. Those registered with homebuilders receive regular emails with incentives to purchase.

What this means for you

For homebuyers: This shift creates opportunities for those with stable jobs. More inventory and motivated sellers mean better negotiating power and potentially lower prices. Those registered with homebuilders receive regular emails with incentives to purchase.

(8/9)

For home sellers: The days of quick sales at a high asking price have ended in most markets. Realistic pricing and patience will be essential.

Entry-level home sellers must meet the payment requirements of first-time homebuyers.

Move-up and luxury home sellers must consider their buyers’ need to sell their current home.

For home sellers: The days of quick sales at a high asking price have ended in most markets. Realistic pricing and patience will be essential.

Entry-level home sellers must meet the payment requirements of first-time homebuyers.

Move-up and luxury home sellers must consider their buyers’ need to sell their current home.

(9/9)

For investors: Market conditions have created challenges for those looking to make a quick buck or earn a high rental yield, as well as opportunities for those who see homeownership as an important part of their asset diversification strategy or an opportunity to grow their rental home portfolio.

The housing market is entering a new phase after years of explosive growth. Understanding these trends can help you make better decisions, whether you’re buying, selling, or simply planning for the future. We are having great conversations with our clients as they navigate the back half of 2025 and plan for 2026. If you would like to be part of this insight, fill out this form.

For investors: Market conditions have created challenges for those looking to make a quick buck or earn a high rental yield, as well as opportunities for those who see homeownership as an important part of their asset diversification strategy or an opportunity to grow their rental home portfolio.

The housing market is entering a new phase after years of explosive growth. Understanding these trends can help you make better decisions, whether you’re buying, selling, or simply planning for the future. We are having great conversations with our clients as they navigate the back half of 2025 and plan for 2026. If you would like to be part of this insight, fill out this form.

• • •

Missing some Tweet in this thread? You can try to

force a refresh