What a quarter, @MPMaterials! Stock is current up 9% after hours. This report was a glimpse at the future of $MP - a future that is insulated from the volatility of commodity prices while delivering robust and consistent EBITDA margins.

Thoughts below:

1/n

Thoughts below:

1/n

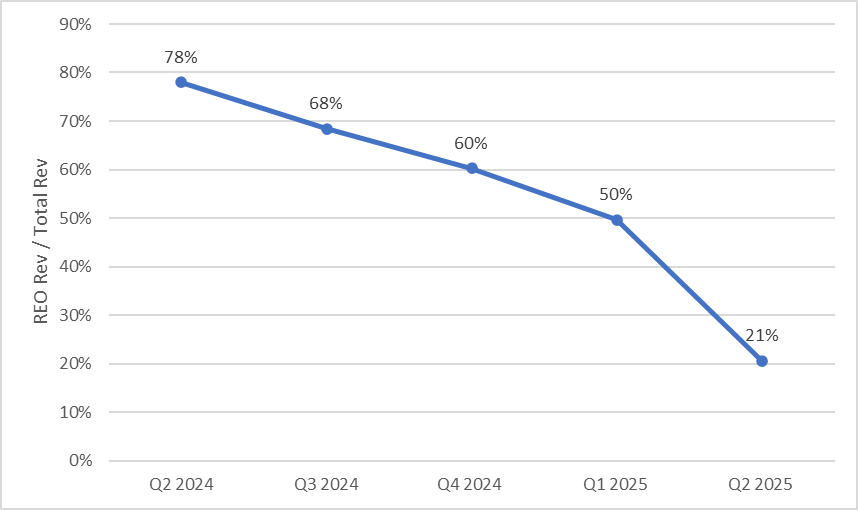

Upstream: 13145 MTs despite planned outages. Second highest upstream production ever in the history of the company. Amazing. 2658 MTs of upstream product sold at 4468 $/MT. REO revenue / total revenue continues to fall off a cliff. Great work $MP team.

2/n

2/n

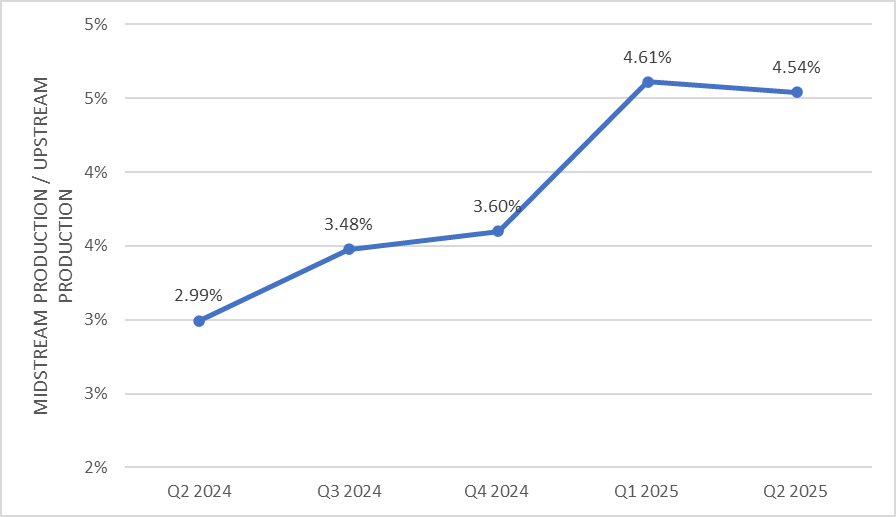

Midstream: Despite planned outages, $MP executed. Highest ever quarterly production at 597 MTs, up 220% YoY. SVs came in lower than I expected at 443 MTs, due to $MP pushing more product through their pipeline. Realized prices per MT were 57$/kg - will move to 110$/kg next Q

3/n

3/n

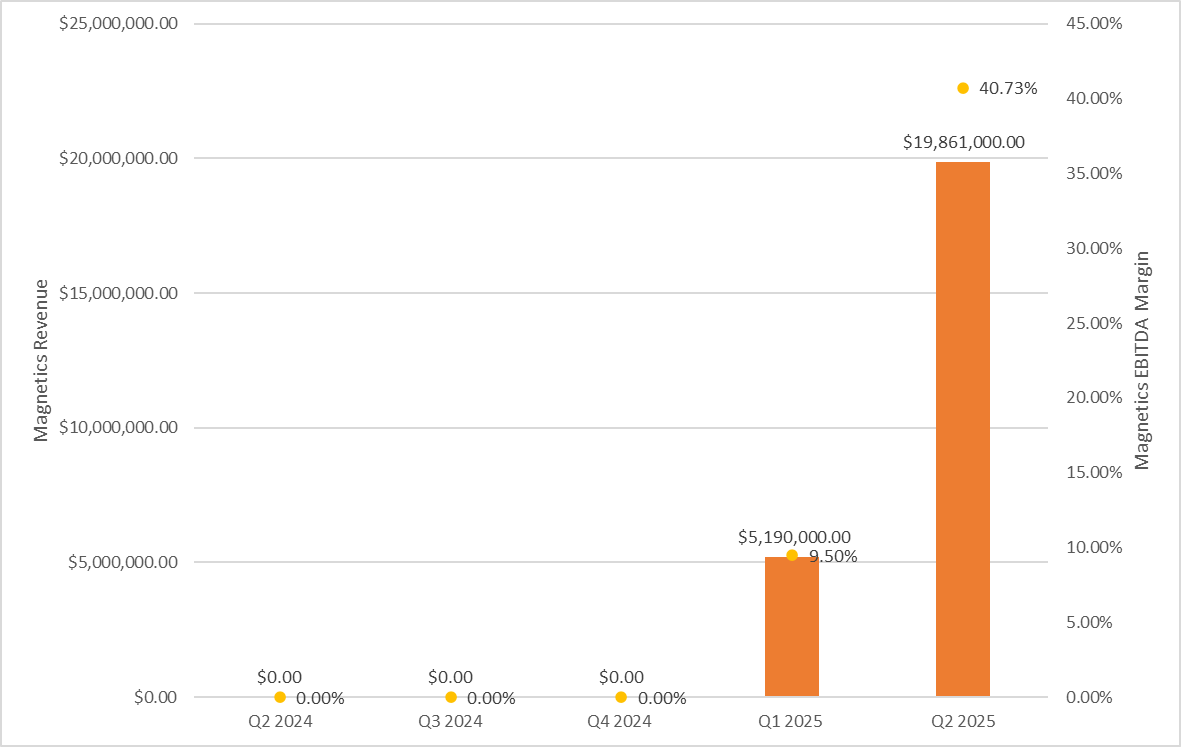

Downstream: The star of the show. 19.861M of revenue with a 40.73% EBITDA margin. QoQ Revenue & EBITDA up 383% & 1640% respectively. Both were well in excess of my predictions and should be rewarded by the market greatly. This is the future of $MP.

4/n

4/n

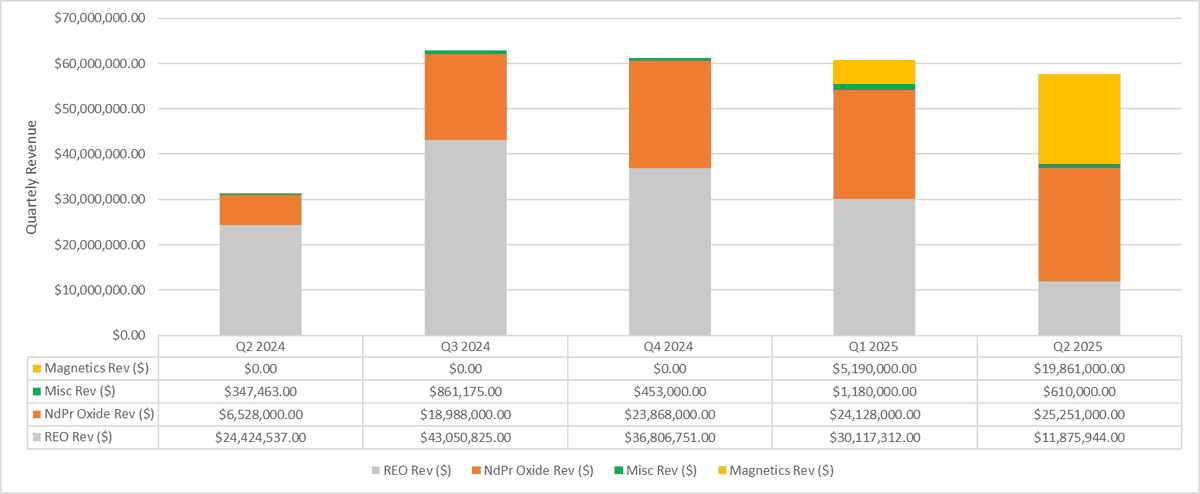

Taking a look at the whole picture now. $MP is in the midst of a transition - one that will end in high margin, high visibility revenue for years to come. The team is executing on both midstream + downstream flawlessly. The momentum is here & the deals should keep rolling.

5/n

5/n

I don't have much to add other than that I remain firmly bullish. The magnetics opportunity remains too attractive with physical AI on the horizon to consider selling $MP. The thesis has been confirmed & validated, now we sit back & enjoy the ride. Cheers!

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh