🧵🚨 Bo Hines, Executive Director of the White House Crypto Council, has resigned.

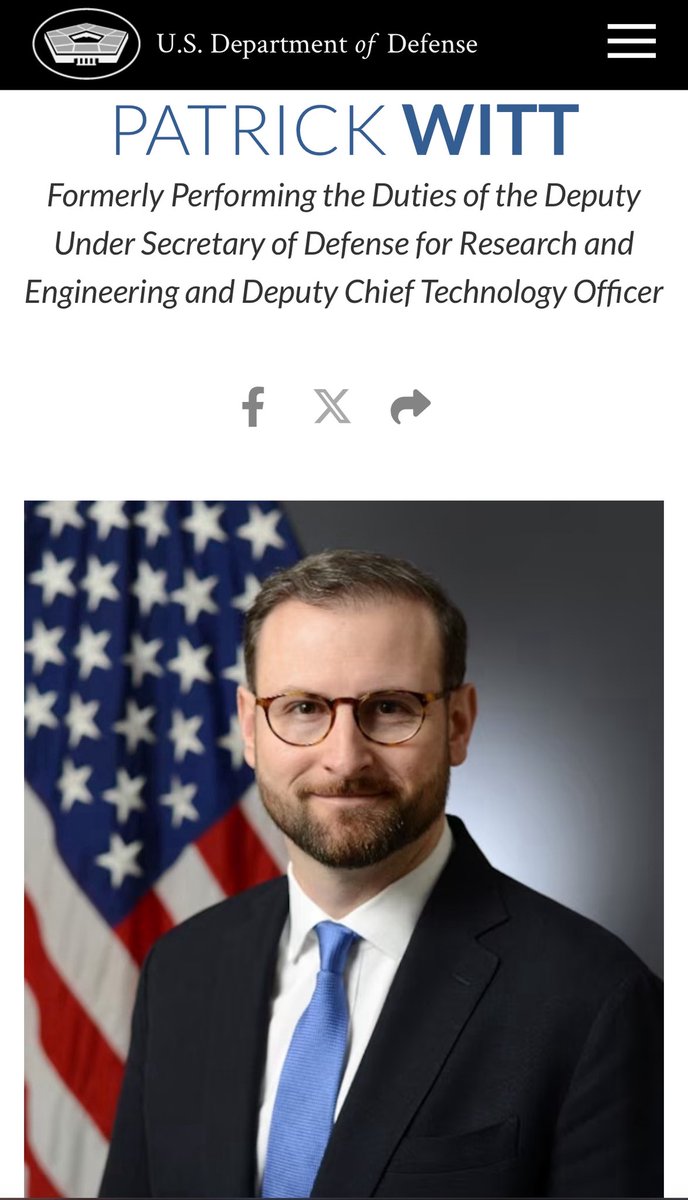

White House quietly replace its crypto chief with a Pentagon-linked money man — Patrick Witt.

This is not a random appointment.

Here’s the full story 🧵👇

White House quietly replace its crypto chief with a Pentagon-linked money man — Patrick Witt.

This is not a random appointment.

Here’s the full story 🧵👇

1/ Bo Hines is out.

Replacing him?

Patrick Witt — his deputy, and the current Acting Director of the Department of Defense’s Office of Strategic Capital.

This isn’t just a staffing change, it’s a blueprint for controlling the entire digital asset space.

Replacing him?

Patrick Witt — his deputy, and the current Acting Director of the Department of Defense’s Office of Strategic Capital.

This isn’t just a staffing change, it’s a blueprint for controlling the entire digital asset space.

2/ Witt’s background:

•Deputy Director of the White House’s digital assets team

•Defense finance experience via the DoD

•Skilled in interagency coordination where money meets national security

He is not a “crypto native.”

•Deputy Director of the White House’s digital assets team

•Defense finance experience via the DoD

•Skilled in interagency coordination where money meets national security

He is not a “crypto native.”

3/ Why does that matter?

Because this role sets the tone for U.S. crypto policy — from stablecoins and tokenization to market infrastructure.

Witt approaches it with a risk-first mindset, not a “number go up” one.

Because this role sets the tone for U.S. crypto policy — from stablecoins and tokenization to market infrastructure.

Witt approaches it with a risk-first mindset, not a “number go up” one.

4/ Expect policy shifts in emphasis:

•Stablecoins framed as critical payment infrastructure

•Tokenization (treasuries, real-world assets) viewed through systemic-risk and national-security filters

•CBDC discussions embedded in defense and treasury strategy

•Stablecoins framed as critical payment infrastructure

•Tokenization (treasuries, real-world assets) viewed through systemic-risk and national-security filters

•CBDC discussions embedded in defense and treasury strategy

5/ This isn’t just leadership continuity — it’s a strategic pivot.

The U.S. crypto blueprint is now being drawn by someone who views blockchain not as an asset class… but as critical infrastructure to be controlled.

The U.S. crypto blueprint is now being drawn by someone who views blockchain not as an asset class… but as critical infrastructure to be controlled.

6/ Bo Hines v/s Patrick Witt.

Bo Hines → Crypto advocate with industry-facing approach, bridging White House policy and market growth.

Patrick Witt → Defense & finance strategist, viewing blockchain as critical infrastructure under national-security oversight.

Different backgrounds. Same chair. Entirely different playbook.

Bo Hines → Crypto advocate with industry-facing approach, bridging White House policy and market growth.

Patrick Witt → Defense & finance strategist, viewing blockchain as critical infrastructure under national-security oversight.

Different backgrounds. Same chair. Entirely different playbook.

7/ For the markets:

•Speculative traders may see fewer surprise policy “green lights”

•Institutions may feel more confident in deploying capital into compliant rails

•Projects with enterprise and payments focus — like XRP — could benefit from a stable, rules-driven environment and government clarity.

•Speculative traders may see fewer surprise policy “green lights”

•Institutions may feel more confident in deploying capital into compliant rails

•Projects with enterprise and payments focus — like XRP — could benefit from a stable, rules-driven environment and government clarity.

8/ During his tenure, Bo Hines was once asked “How much Bitcoin does the U.S. government hold?”

His answer? “Can’t say that.”

Now he’s out… replaced by a Pentagon-linked strategist.

Makes you wonder — was the real game always about control of the rails AND the reserves?

His answer? “Can’t say that.”

Now he’s out… replaced by a Pentagon-linked strategist.

Makes you wonder — was the real game always about control of the rails AND the reserves?

9/ Bottom line:

Watch Patrick Witt’s tenure closely.

It could quietly set the framework for

U.S. dominance in digital assets over the next decade — not by market hype, but by regulatory architecture.

Watch Patrick Witt’s tenure closely.

It could quietly set the framework for

U.S. dominance in digital assets over the next decade — not by market hype, but by regulatory architecture.

10/10 Follow for real-time policy shifts, insider insights, and deep dives into how power, finance, and crypto truly connect.

• • •

Missing some Tweet in this thread? You can try to

force a refresh