Deep Dive into the Next Generation of DeFi || @Aave V4

Aave V4 will introduce a new architecture and innovative concepts that will fundamentally change DeFi lending.

In this thread, we’ll explore in detail how it works, what it changes, and the benefits it brings ↓

Aave V4 will introduce a new architecture and innovative concepts that will fundamentally change DeFi lending.

In this thread, we’ll explore in detail how it works, what it changes, and the benefits it brings ↓

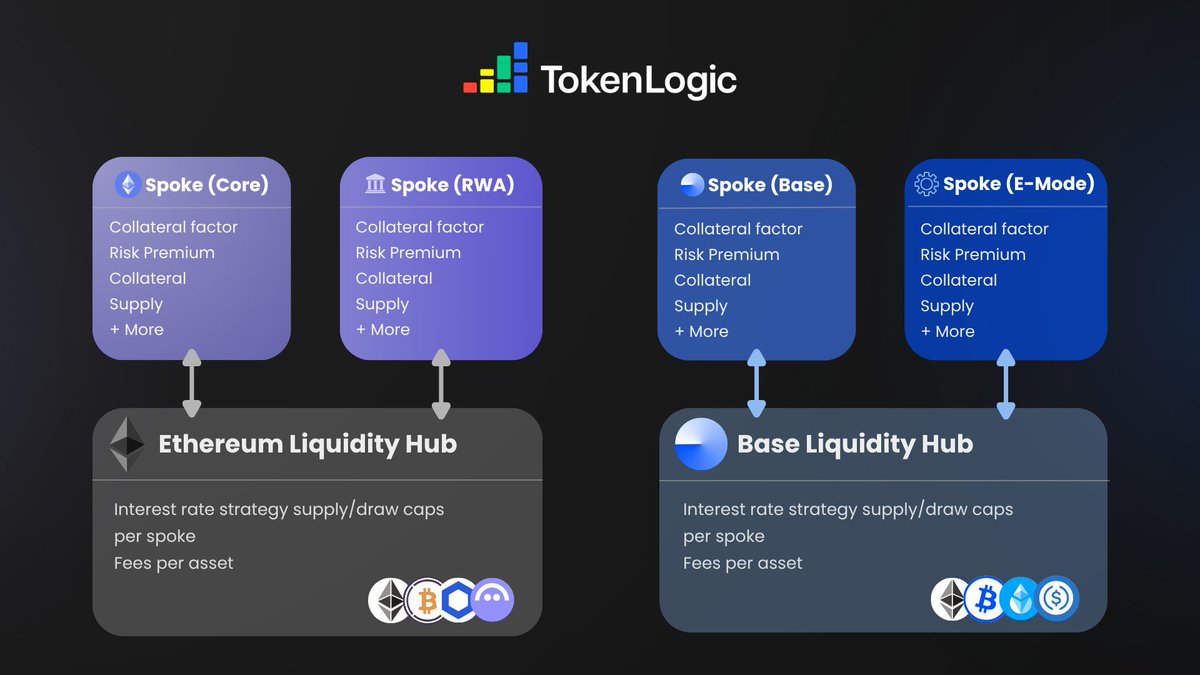

One of the biggest architectural changes is the introduction of Liquidity Hubs.

A Liquidity Hub can be seen as a Unified Liquidity Layer — the core of the new Aave architecture.

This means liquidity will no longer be fragmented by market, but unified per network.

The hub will manage supply and borrow caps, interest rates, supported assets, and incentives.

► The major advantage: other modules will be able to draw (=borrow) liquidity from it.

This solves the liquidity fragmentation problem of Aave V3, as multiple “spokes” will be able to interact with the same shared liquidity source.

A Liquidity Hub can be seen as a Unified Liquidity Layer — the core of the new Aave architecture.

This means liquidity will no longer be fragmented by market, but unified per network.

The hub will manage supply and borrow caps, interest rates, supported assets, and incentives.

► The major advantage: other modules will be able to draw (=borrow) liquidity from it.

This solves the liquidity fragmentation problem of Aave V3, as multiple “spokes” will be able to interact with the same shared liquidity source.

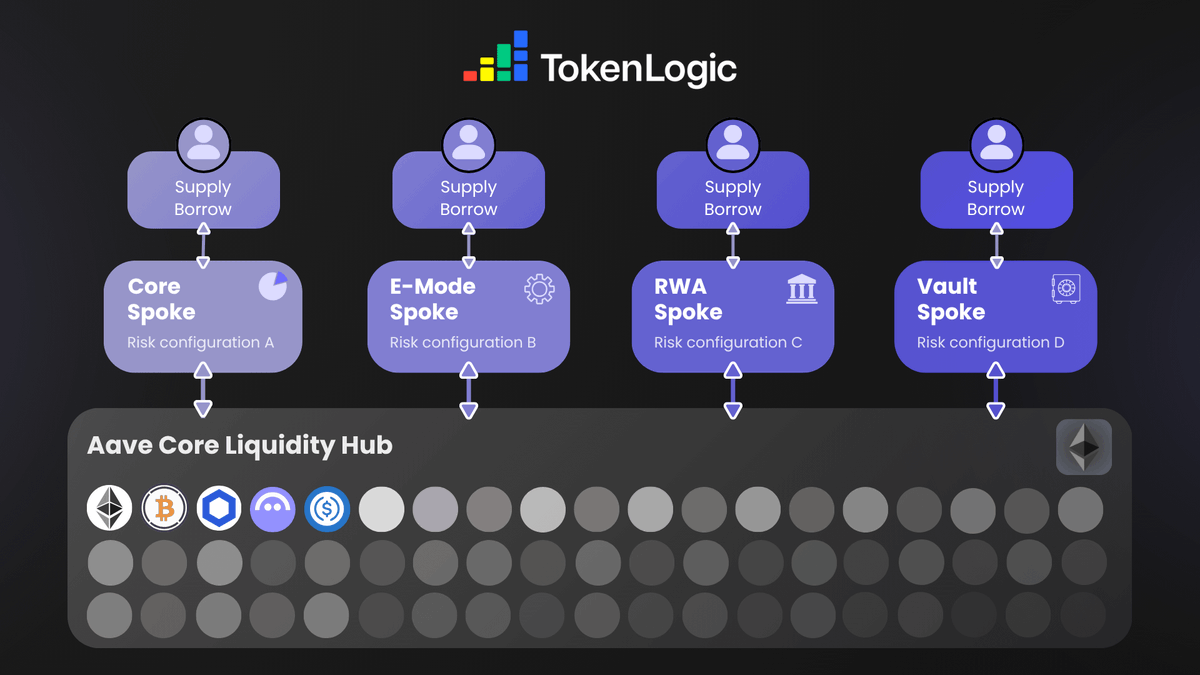

To interact with these Liquidity Hubs, Aave V4 introduces "Spokes".

In simple terms, a Spoke is a configurable borrowing strategy.

Instead of having separate instances like in Aave V3, for example the Core instance and the Prime instance, Aave V4 will have a Core Spoke and a Prime Spoke, both drawing liquidity from the Ethereum Liquidity Hub.

Each Spoke will cater to a different risk profile, with distinct risk parameters such as higher LTVs or different interest rate strategies, and potentially different sets of listed assets.

► In other words, risks are isolated within each Spoke. If one Spoke is affected by an issue, the risk cannot contaminate the others.

Spokes will serve different needs. For example, one Spoke could serve users holding $ETH who want to borrow stablecoins, while another could serve users depositing LSTs using E-Mode to enter a recursive yield trade.

These are two different profiles, so the risks they bring to the protocol shouldn’t be handled within the same Spoke.

In simple terms, a Spoke is a configurable borrowing strategy.

Instead of having separate instances like in Aave V3, for example the Core instance and the Prime instance, Aave V4 will have a Core Spoke and a Prime Spoke, both drawing liquidity from the Ethereum Liquidity Hub.

Each Spoke will cater to a different risk profile, with distinct risk parameters such as higher LTVs or different interest rate strategies, and potentially different sets of listed assets.

► In other words, risks are isolated within each Spoke. If one Spoke is affected by an issue, the risk cannot contaminate the others.

Spokes will serve different needs. For example, one Spoke could serve users holding $ETH who want to borrow stablecoins, while another could serve users depositing LSTs using E-Mode to enter a recursive yield trade.

These are two different profiles, so the risks they bring to the protocol shouldn’t be handled within the same Spoke.

Together, Hubs and Spokes create a modular approach that contrasts with the monolithic structure of Aave V3.

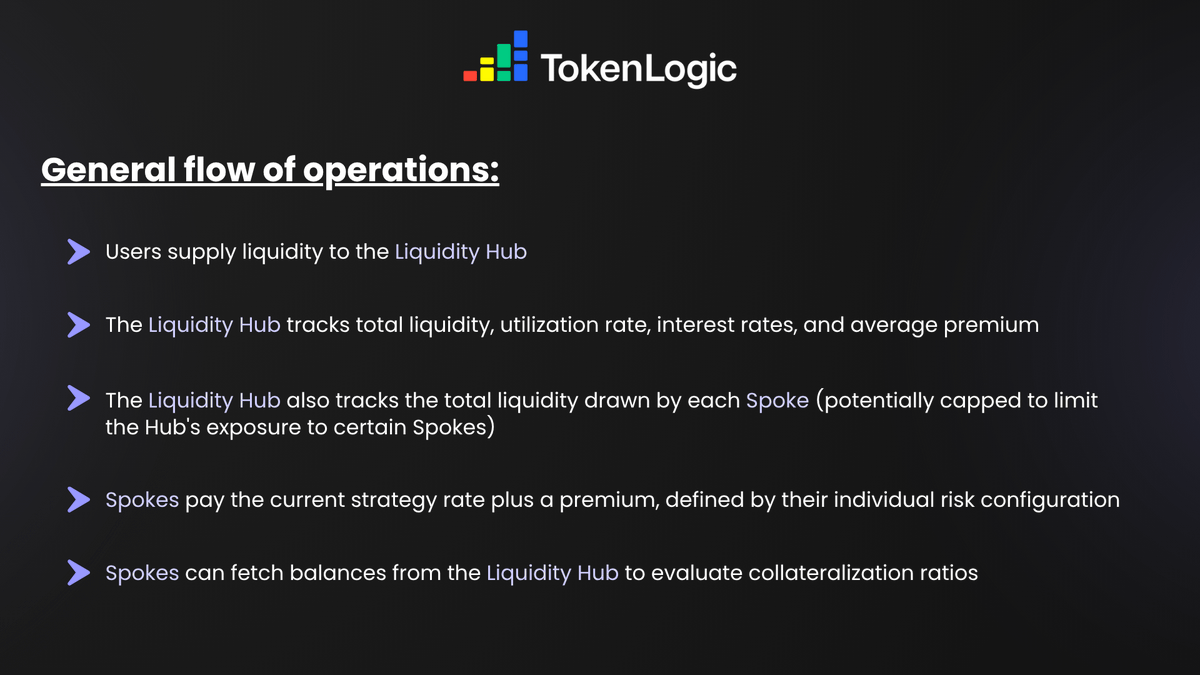

To better understand how it works in practice, here’s a general flow of operations:

→ Users supply liquidity to the Liquidity Hub

→ The Liquidity Hub tracks total liquidity, utilization rate, interest rates, and average premium

→ The Liquidity Hub also tracks the total liquidity drawn by each Spoke (potentially capped to limit the Hub's exposure to certain Spokes)

→ Spokes pay the current strategy rate plus a premium, defined by their individual risk configuration

→ Spokes can fetch balances from the Liquidity Hub to evaluate collateralization ratios

The introduction of smart accounts will help enhance the UX, as users will be able to create as many smart accounts as needed using only one wallet instead of using separate wallets to manage positions.

This is especially useful in cases where a user is borrowing using E-Mode or isolated assets.

To better understand how it works in practice, here’s a general flow of operations:

→ Users supply liquidity to the Liquidity Hub

→ The Liquidity Hub tracks total liquidity, utilization rate, interest rates, and average premium

→ The Liquidity Hub also tracks the total liquidity drawn by each Spoke (potentially capped to limit the Hub's exposure to certain Spokes)

→ Spokes pay the current strategy rate plus a premium, defined by their individual risk configuration

→ Spokes can fetch balances from the Liquidity Hub to evaluate collateralization ratios

The introduction of smart accounts will help enhance the UX, as users will be able to create as many smart accounts as needed using only one wallet instead of using separate wallets to manage positions.

This is especially useful in cases where a user is borrowing using E-Mode or isolated assets.

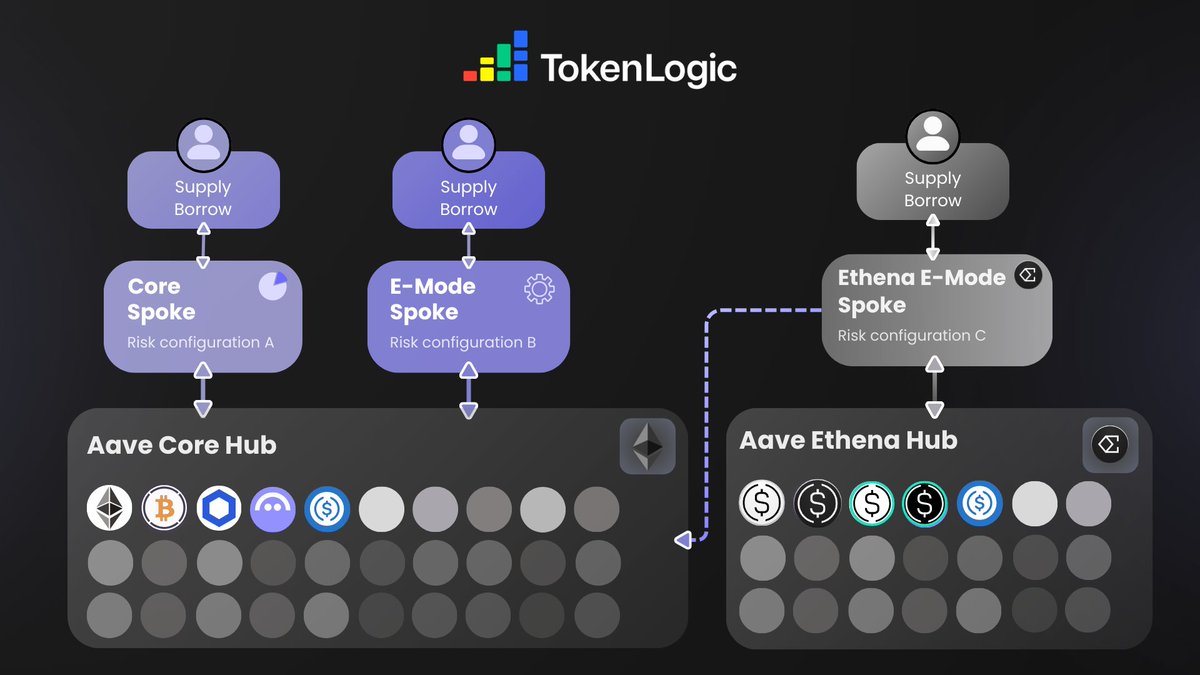

Thanks to this modular approach, it will be easier to innovate with new types of borrowing configurations.

Any future innovation can be plugged into the Liquidity Hub and immediately benefit from its shared liquidity.

Also, instead of having a single rate for all users, different Spokes will offer different rates for the same asset, depending on the level of risk involved.

►It comes down to one sentence: if you take on more risk, you should pay more.

Every borrowable asset will have a base rate, and each Spoke will add a premium based on its specific risk profile.

For example, @ethena_labs yield-bearing stablecoins are in high demand on Aave, but they often carry higher risk since they’re frequently used for recursive yield trades.

A dedicated Hub could be created for them, enabling better control and isolation of that exposure, along with a dedicated E-Mode Spoke built on top.

As a result, the USDC lending yield would be significantly higher for users lending it in an Aave Ethena Hub where borrowing demand is stronger compared to users lending it in the Aave Core Hub.

Same asset, different risk exposure, different yield.

Any future innovation can be plugged into the Liquidity Hub and immediately benefit from its shared liquidity.

Also, instead of having a single rate for all users, different Spokes will offer different rates for the same asset, depending on the level of risk involved.

►It comes down to one sentence: if you take on more risk, you should pay more.

Every borrowable asset will have a base rate, and each Spoke will add a premium based on its specific risk profile.

For example, @ethena_labs yield-bearing stablecoins are in high demand on Aave, but they often carry higher risk since they’re frequently used for recursive yield trades.

A dedicated Hub could be created for them, enabling better control and isolation of that exposure, along with a dedicated E-Mode Spoke built on top.

As a result, the USDC lending yield would be significantly higher for users lending it in an Aave Ethena Hub where borrowing demand is stronger compared to users lending it in the Aave Core Hub.

Same asset, different risk exposure, different yield.

This new architecture is cool and more efficient, but what new features can it really bring?

Here is a non-exhaustive list of new features that we might see in the future:

✦ Fixed rate

Lend and borrow at a fixed rate, with maximum predictability on your moves.

✦ RWA

Using specific Real World Assets as collateral to borrow against them.

✦ LP shares as Collateral

Deposit LP position and borrow against it, with a risk configuration tailored for these markets.

✦ Permissioning for institutional use cases

Lending for verified users with KYC, tailored for institutions and tradfi firms.

Here is a non-exhaustive list of new features that we might see in the future:

✦ Fixed rate

Lend and borrow at a fixed rate, with maximum predictability on your moves.

✦ RWA

Using specific Real World Assets as collateral to borrow against them.

✦ LP shares as Collateral

Deposit LP position and borrow against it, with a risk configuration tailored for these markets.

✦ Permissioning for institutional use cases

Lending for verified users with KYC, tailored for institutions and tradfi firms.

Of course, Aave V4 is still under development, and some aspects may change and evolve over time.

We hope you enjoyed this thread and now have a clearer idea of what’s coming with Aave V4!

We hope you enjoyed this thread and now have a clearer idea of what’s coming with Aave V4!

• • •

Missing some Tweet in this thread? You can try to

force a refresh