1/ H1 crypto hiring was wild.

Macro rocked the market, record jobs were pulled, and companies reacted faster & harder than at any point in 3 years.

👇 From market data + 1000s of convos: what candidates want & what downturns teach us (...because it ain’t always a bull market).

Macro rocked the market, record jobs were pulled, and companies reacted faster & harder than at any point in 3 years.

👇 From market data + 1000s of convos: what candidates want & what downturns teach us (...because it ain’t always a bull market).

2/ Remember: Even in rough macro, crypto’s fundamentals are stronger than ever.

Those fundamentals were on full display at the start of the year.

Those fundamentals were on full display at the start of the year.

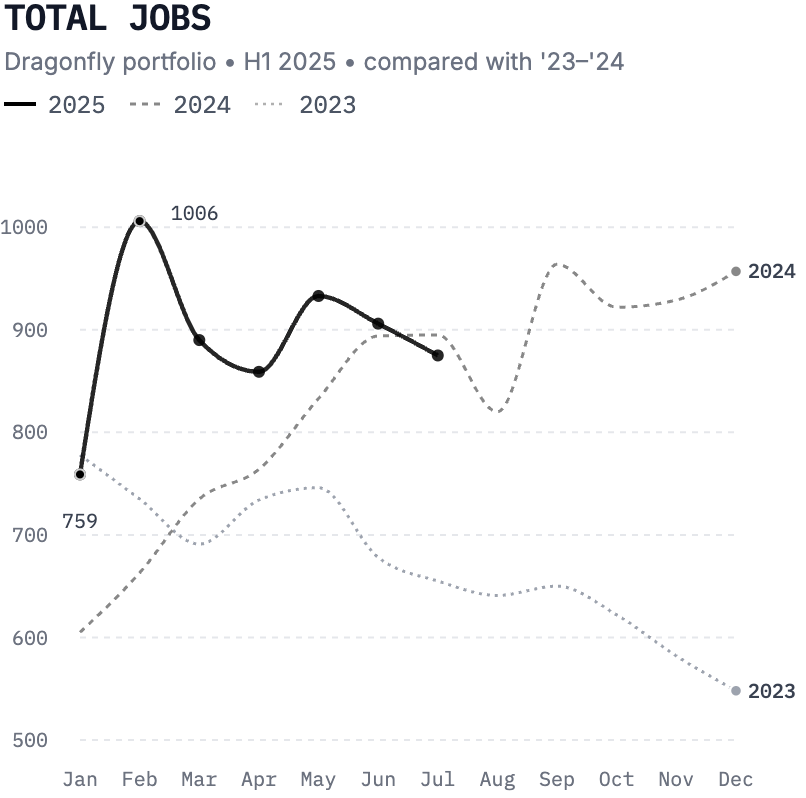

3/ January 2025: Crypto hiring was ripping.

• +60% jobs vs Dec (301 new roles)

• Sales/BD +75% H1 YoY — chasing the bull cycle

• Candidate energy was at full tilt

• +60% jobs vs Dec (301 new roles)

• Sales/BD +75% H1 YoY — chasing the bull cycle

• Candidate energy was at full tilt

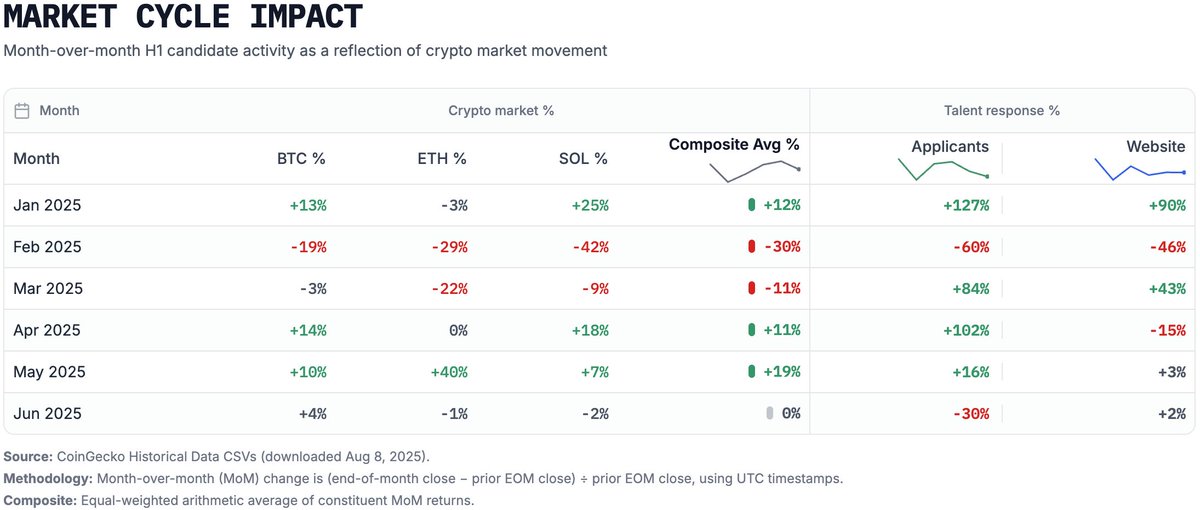

4/ Come February, one macro headline killed the party.

Early tariffs →

• Applications -60% MoM

• Site traffic -46%

Candidate risk appetite evaporated overnight.

Early tariffs →

• Applications -60% MoM

• Site traffic -46%

Candidate risk appetite evaporated overnight.

5/ Then, March brought the cull.

• 750 roles cut (+132% MoM, record high). Massive

• Even with 411 new jobs posted, net growth went negative

...The biggest single-month correction we’ve ever seen, by far.

• 750 roles cut (+132% MoM, record high). Massive

• Even with 411 new jobs posted, net growth went negative

...The biggest single-month correction we’ve ever seen, by far.

6/ But here’s the twist: Candidates came back before companies did, while many teams hadn’t broadly reopened roles yet.

Also by March:

• Applications +84%

• Traffic +43%

Also by March:

• Applications +84%

• Traffic +43%

7/ Market pricing shows it clearly:

• Prices tanked in Feb (~-30% composite) and applications fell -60% instantly

• With April’s rebound (+11%), applicants surged +102% MoM while postings lagged, suggesting net hiring stayed negative through Q2

• Prices tanked in Feb (~-30% composite) and applications fell -60% instantly

• With April’s rebound (+11%), applicants surged +102% MoM while postings lagged, suggesting net hiring stayed negative through Q2

8/ That 4-6 week lag is the window few use.

Smart teams planned headcount and stuck to it. They weren’t overly fearful or reactive, and they won through the rift.

By mid-year, things looked to be stabilizing, overall.

Smart teams planned headcount and stuck to it. They weren’t overly fearful or reactive, and they won through the rift.

By mid-year, things looked to be stabilizing, overall.

9/ Ultimately, H1 analysis revealed 3 key signals:

1️⃣ Market moved first, companies cut hard

2️⃣ Talent revived ~4-6 weeks later

3️⃣ Companies recovered last

If you wait for #3, you’ve already lost the best candidates.

1️⃣ Market moved first, companies cut hard

2️⃣ Talent revived ~4-6 weeks later

3️⃣ Companies recovered last

If you wait for #3, you’ve already lost the best candidates.

10/ Roles that generally stay steady:

• Engineering +17% H1 YoY (+21% Q4→Q1, -9% Q1→Q2)

• Data Science +107% (+43% Q4→Q1, -3% Q1→Q2)

Even when sentiment shifts, these markets hold demand across cycles — always competitive, bull or bear.

• Engineering +17% H1 YoY (+21% Q4→Q1, -9% Q1→Q2)

• Data Science +107% (+43% Q4→Q1, -3% Q1→Q2)

Even when sentiment shifts, these markets hold demand across cycles — always competitive, bull or bear.

11/ Roles that whiplash with the market:

• Sales/BD +75% H1 YoY (+19% → -24%)

• Customer Service +60% (+43% → -29%)

• Marketing +4% (+38% → -22%)

Surged in Q1 then pulled back hard in Q2, showing GTM chasing market cycles.

• Sales/BD +75% H1 YoY (+19% → -24%)

• Customer Service +60% (+43% → -29%)

• Marketing +4% (+38% → -22%)

Surged in Q1 then pulled back hard in Q2, showing GTM chasing market cycles.

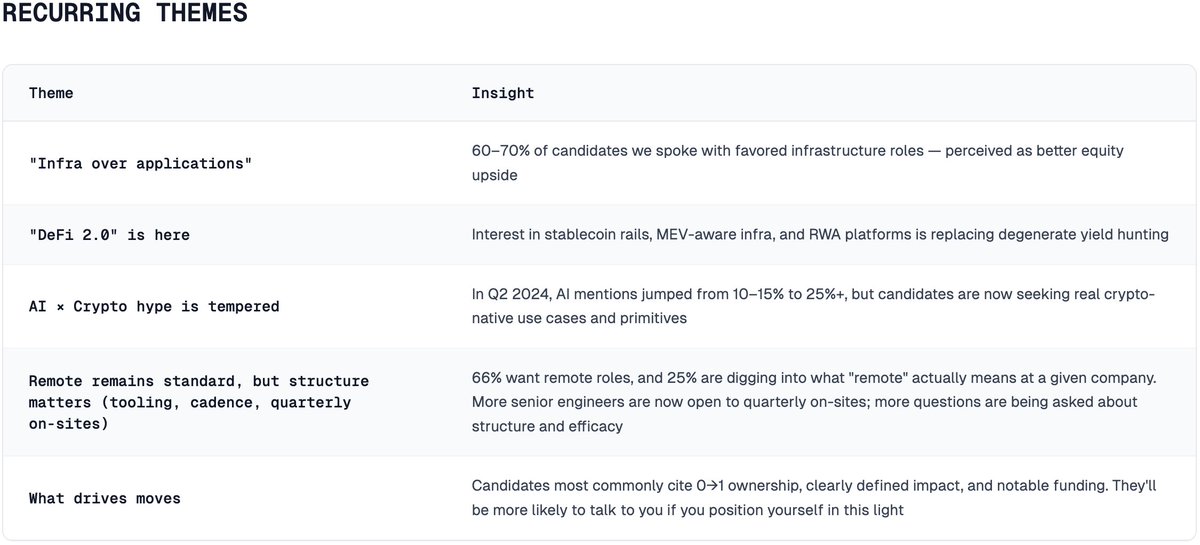

12/ What candidates actually want:

• 60-70% favor infra for perceived equity upside

• Stablecoins, MEV-aware infra, RWAs = “DeFi 2.0”

• AI×Crypto hype cooled — demand is now for crypto-native AI use cases

• 60-70% favor infra for perceived equity upside

• Stablecoins, MEV-aware infra, RWAs = “DeFi 2.0”

• AI×Crypto hype cooled — demand is now for crypto-native AI use cases

13/ It’s not just the perks that win:

• Remote is default, but 25% now probe how it’s run

• Liquidity & comp diligence up to 38%, asked earlier

• 43% judge company quality by interviewer quality

• Remote is default, but 25% now probe how it’s run

• Liquidity & comp diligence up to 38%, asked earlier

• 43% judge company quality by interviewer quality

14/ Geo trends:

• NYC = GTM/BD hotspot (40%+ of commercial talent)

• NYC candidates talk stablecoins/payments more regularly

• ZK talent: Berlin, Lisbon, Eastern Europe (mentions 1.4x NYC)

• NYC = GTM/BD hotspot (40%+ of commercial talent)

• NYC candidates talk stablecoins/payments more regularly

• ZK talent: Berlin, Lisbon, Eastern Europe (mentions 1.4x NYC)

15/ Late-Q3 rebound looks plausible:

• Planning windows line up

• GENIUS Act passed in June (law in July)

• Compliance/legal being staffed earlier than past cycles

Signs of a maturing hiring rhythm.

• Planning windows line up

• GENIUS Act passed in June (law in July)

• Compliance/legal being staffed earlier than past cycles

Signs of a maturing hiring rhythm.

16/ Also, the market’s looking a little different now, yeah?

If you’re hiring in Q4, your advantage starts now. A deeper H1 report with an actionable H2 playbook is available to the Dragonfly portfolio.

Buckle up. :)

If you’re hiring in Q4, your advantage starts now. A deeper H1 report with an actionable H2 playbook is available to the Dragonfly portfolio.

Buckle up. :)

... Also, special thanks to the rest of the Dragonfly talent team — @chris_ahsing, @Rodairos, and @cjwilsonsr — for their hard work and contributions to this report and beyond

• • •

Missing some Tweet in this thread? You can try to

force a refresh