Everyday I get asked "How do you find winning stocks to trade?"

I found $AAPL before it made a 12% move in 3 days, by doing something most traders refuse to do 🧵

I found $AAPL before it made a 12% move in 3 days, by doing something most traders refuse to do 🧵

1/ Stop looking for the needles in a hay stack

Most traders scan through 1000s of stocks looking for that "perfect setup." That setup that will FINALLY save their blown account. Meanwhile I focus on options friendly (good liquidity) names. Quality over quantity.

Most traders scan through 1000s of stocks looking for that "perfect setup." That setup that will FINALLY save their blown account. Meanwhile I focus on options friendly (good liquidity) names. Quality over quantity.

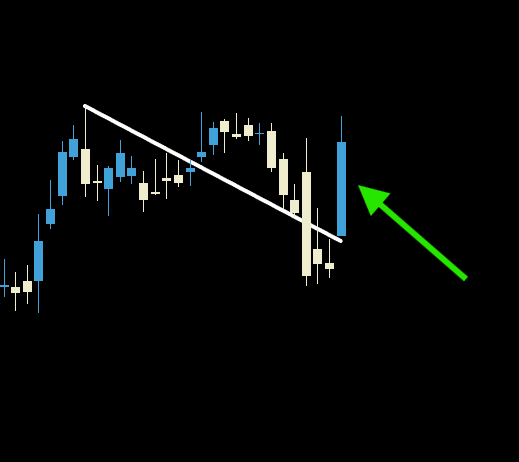

2/ News moves markets

Stocks only make a move when there's fear or greed due to news.

Fear = people selling

Greed = people buying

No move = people waiting.

Stocks only make a move when there's fear or greed due to news.

Fear = people selling

Greed = people buying

No move = people waiting.

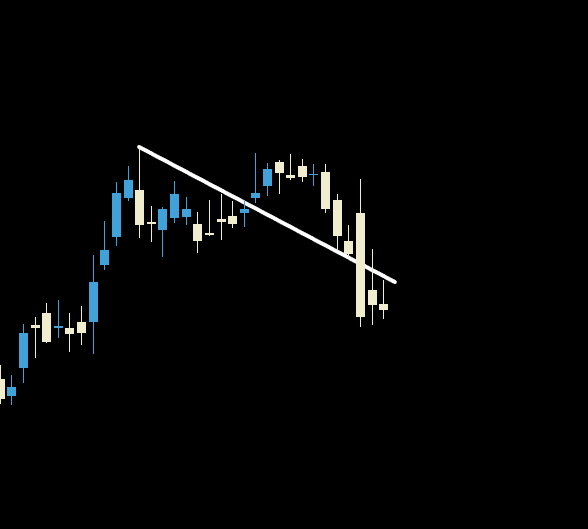

3/ The daily chart told the story

$AAPL broke down after ER as people were fearful that the stock hasn't done anything innovative since the Iphone. People see stocks like $NVDA 10xd in months and are realizing the opportunity cost of their money sitting in a POS. But want happens when that sentiment shifts, and there's hope?

$AAPL broke down after ER as people were fearful that the stock hasn't done anything innovative since the Iphone. People see stocks like $NVDA 10xd in months and are realizing the opportunity cost of their money sitting in a POS. But want happens when that sentiment shifts, and there's hope?

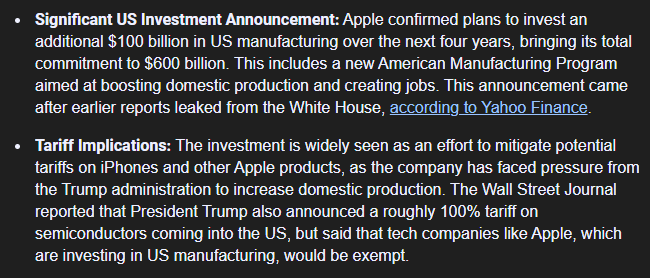

4/ When the boat gets rocked

Everyone was talking smack on $AAPL about how it was a POS (myself included.) But then the story changed $AAPL dropped a tactical nuke. $AAPL announced it plans to invest $100 billion in US manufacturing over the next 4 years. $AAPL decided to play chess with Trump while everyone else is playing go fish.

Everyone was talking smack on $AAPL about how it was a POS (myself included.) But then the story changed $AAPL dropped a tactical nuke. $AAPL announced it plans to invest $100 billion in US manufacturing over the next 4 years. $AAPL decided to play chess with Trump while everyone else is playing go fish.

5/ The greed factor

This caused the $AAPL daily chart to reverse all of the losses from the post ER sell off. All the bears who thought $AAPL was a POS going to 0 dollars got the squeeze and $AAPL went on a massive run.

This caused the $AAPL daily chart to reverse all of the losses from the post ER sell off. All the bears who thought $AAPL was a POS going to 0 dollars got the squeeze and $AAPL went on a massive run.

6/ The psychology behind the trade

You don't need to read more than a sentence of that headline and know this is huge news. It opens up a lot of questions. How many back scratches will $AAPL get now? More back scratches = multi day run.

You don't need to read more than a sentence of that headline and know this is huge news. It opens up a lot of questions. How many back scratches will $AAPL get now? More back scratches = multi day run.

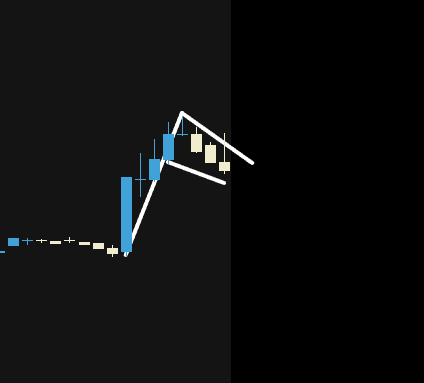

7/ Spotting the trade

I saw the news early PM Wednesday morning and notice it was flagging. This was my top setup because the news caused MOVEMENT premarket. It was a top gainer for large caps at the open.

I saw the news early PM Wednesday morning and notice it was flagging. This was my top setup because the news caused MOVEMENT premarket. It was a top gainer for large caps at the open.

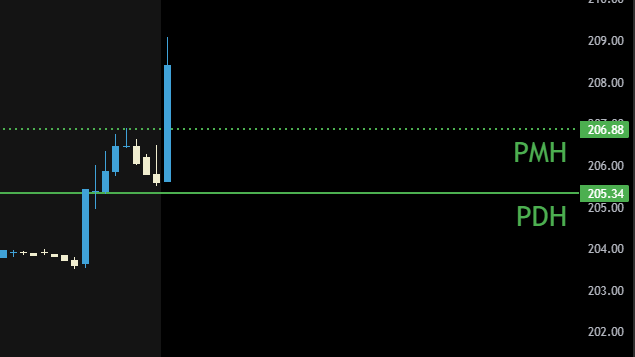

8/ The trade plan

It doesn't matter the news my trade plan is ALWAYS the same. I follow the LE Model. I will wait for the stock to Break the PMH to trigger confirmation to go long. It was already retesting the PDH during the PM. Once we break PMH to confirm no chop its party time.

It doesn't matter the news my trade plan is ALWAYS the same. I follow the LE Model. I will wait for the stock to Break the PMH to trigger confirmation to go long. It was already retesting the PDH during the PM. Once we break PMH to confirm no chop its party time.

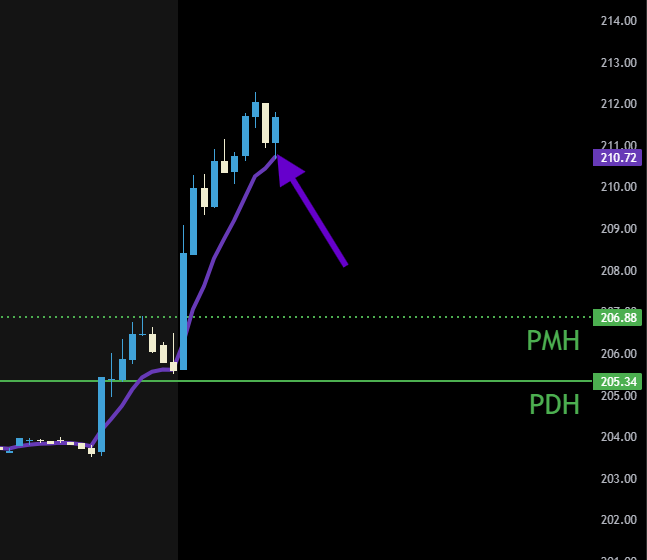

9/ The Entry

I will wait for either a Level Retest or an EMA whichever comes first. There was no level retest so I will not rob myself of the free money breakout. So i waited patiently for a 10m 8ema retest (price coming down to touch the 8ema not break.)

I will wait for either a Level Retest or an EMA whichever comes first. There was no level retest so I will not rob myself of the free money breakout. So i waited patiently for a 10m 8ema retest (price coming down to touch the 8ema not break.)

10/ The question you have

No I am not scared the "stock is too high" or it will "reserve on me and I lose money." A breakout is a breakout there is >75% chance I make money. If i lose 20% I don't care. The stock ripped right afterwards.

No I am not scared the "stock is too high" or it will "reserve on me and I lose money." A breakout is a breakout there is >75% chance I make money. If i lose 20% I don't care. The stock ripped right afterwards.

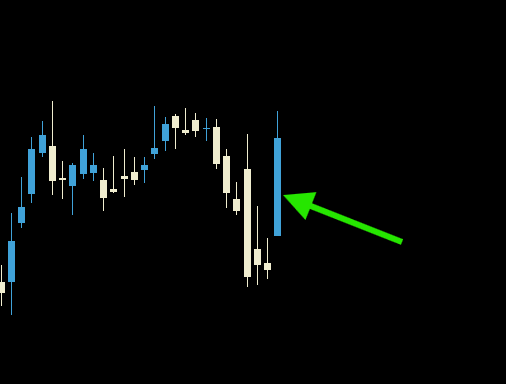

11/ Stop hesitating

The number one problem that is DESTROYING new traders is hesitation. You all wait for someone to spoon feed you plays. By the time someone tells you the play the stock is at HOD and you get bagged. Look at the daily its a big bullish candle, its a long don't be scared.

The number one problem that is DESTROYING new traders is hesitation. You all wait for someone to spoon feed you plays. By the time someone tells you the play the stock is at HOD and you get bagged. Look at the daily its a big bullish candle, its a long don't be scared.

12/ How to fix hesitation

The best way to fix hesitation it to practice. Everyone is scared the first time they do something, its called being human. Its a good thing it means you're probably not a serial killer. The best way to fix this is to create flash cards and burn these setups into your mind.

The best way to fix hesitation it to practice. Everyone is scared the first time they do something, its called being human. Its a good thing it means you're probably not a serial killer. The best way to fix this is to create flash cards and burn these setups into your mind.

13/ Your homework for tomorrow

Every morning finding the stocks making a large move in the PM session and focus on those setups for the day. They have already proved there are ready to run. You don't have to figure out if they WILL move.

Every morning finding the stocks making a large move in the PM session and focus on those setups for the day. They have already proved there are ready to run. You don't have to figure out if they WILL move.

14/ The real secret

99% of my setups come to me. The best trade of the day will announce themselves and make it obvious they want to make you money. Stocks that are quiet are dead money for a reason. Similar to how my ex wife doesn't care about me (call me back please if you're reading this I definitely don't miss you.)

99% of my setups come to me. The best trade of the day will announce themselves and make it obvious they want to make you money. Stocks that are quiet are dead money for a reason. Similar to how my ex wife doesn't care about me (call me back please if you're reading this I definitely don't miss you.)

15/ Stop destroying your small account on trash can setups

Stop incinerating your buying power on stocks no one cares about. Focus on those big trades that will 10x your small account. Those 20-30% scalps might boost your win rate, but they won't change your life forever. You need big wins.

Stop incinerating your buying power on stocks no one cares about. Focus on those big trades that will 10x your small account. Those 20-30% scalps might boost your win rate, but they won't change your life forever. You need big wins.

16/ Your mind set shift for tomorrow

Stop asking "what stocks should I trade?" and start asking "What stocks are moving and shaking this morning because I am trying to move and shake some dollars into my pocket." With practice anyone can master this.

Stop asking "what stocks should I trade?" and start asking "What stocks are moving and shaking this morning because I am trying to move and shake some dollars into my pocket." With practice anyone can master this.

17/ Learning more

Over the last few months I have been 100% committed on teaching everything I know about trading for FREE. I post everything on my YT. I recently posted a video on the one setup I used to double my account. You can watch it here:

Over the last few months I have been 100% committed on teaching everything I know about trading for FREE. I post everything on my YT. I recently posted a video on the one setup I used to double my account. You can watch it here:

18/ Summary

If you found this thread helpful please like and repost this lets me know you found this thread helpful.

If you found this thread helpful please like and repost this lets me know you found this thread helpful.

https://x.com/EllyDtrades/status/1955418555169566837

• • •

Missing some Tweet in this thread? You can try to

force a refresh