🧵BITCOIN TORQUE: THE ULTIMATE METAPLANET BULL CASE

None of you are ready for the next decade of Metaplanet.

This is the GREATEST INVESTMENT I have ever come across👇

None of you are ready for the next decade of Metaplanet.

This is the GREATEST INVESTMENT I have ever come across👇

Alright, kids. STRAP IN.

Time for some quick education before you see the numbers that BREAK your BRAIN:

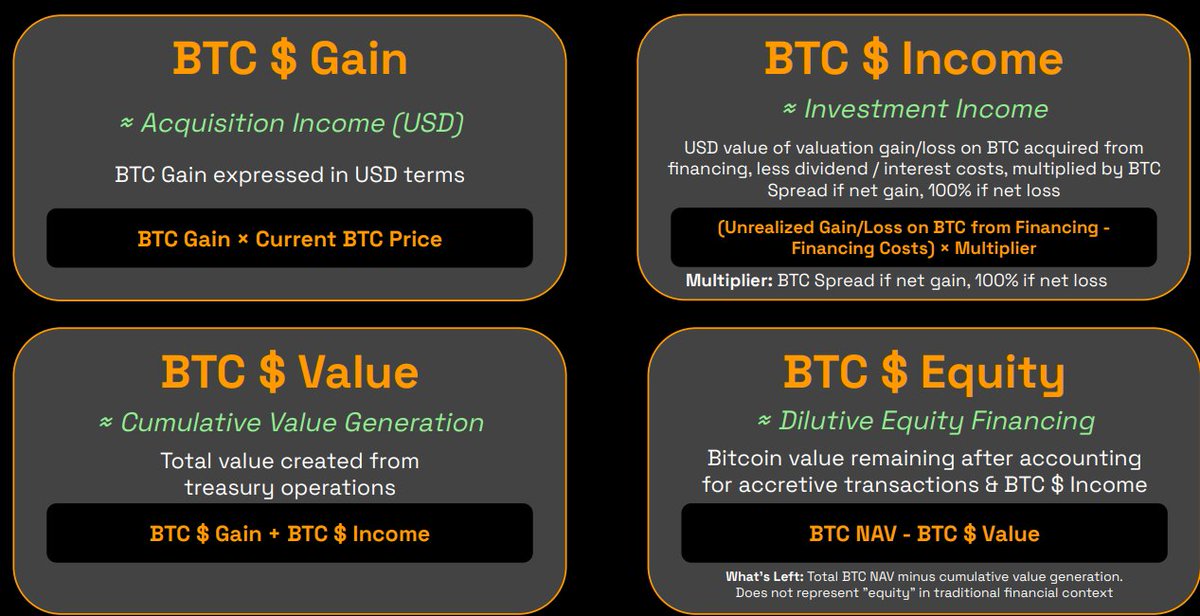

What “BTC Torque” means:

BTC Torque = BTC $ Value ÷ BTC Capital

Bitcoin Torque is the return on invested capital (ROIC) for a Bitcoin treasury.

Higher torque means every dollar raised to buy BTC produces many more dollars of BTC value over time.

Time for some quick education before you see the numbers that BREAK your BRAIN:

What “BTC Torque” means:

BTC Torque = BTC $ Value ÷ BTC Capital

Bitcoin Torque is the return on invested capital (ROIC) for a Bitcoin treasury.

Higher torque means every dollar raised to buy BTC produces many more dollars of BTC value over time.

Related info before your brain breaks:

BTC $ Value = BTC $ Gain + BTC $ Income.

BTC $ Income is the UNREALIZED gain on the specific BTC financed, minus financing costs, multiplied by an efficiency factor.

mNAV = Enterprise Value ÷ BTC NAV. This is the “premium to NAV.”

BTC $ Value = BTC $ Gain + BTC $ Income.

BTC $ Income is the UNREALIZED gain on the specific BTC financed, minus financing costs, multiplied by an efficiency factor.

mNAV = Enterprise Value ÷ BTC NAV. This is the “premium to NAV.”

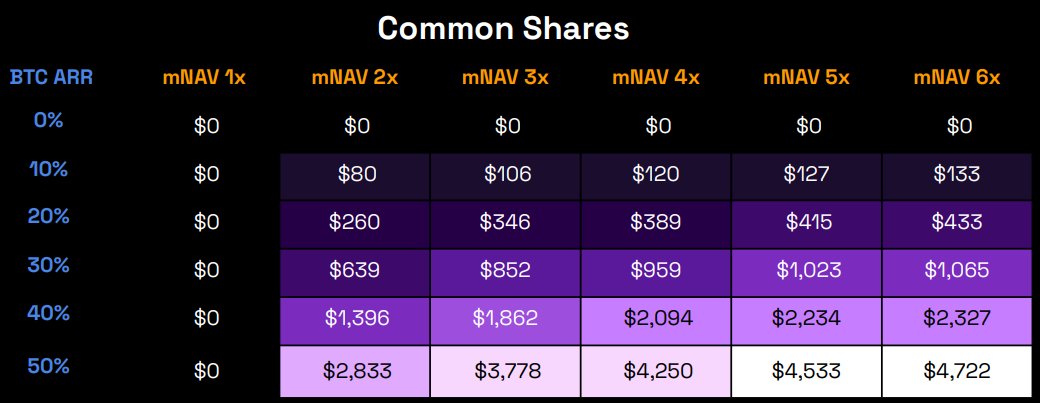

WHAT THE SENSITIVITY TABLES ARE SAYING:

With common stock funding, torque only rises when the equity trades at a premium.

At a 30% Bitcoin ARR over the next 10 years, examples below show torque stepping high at very high mNAV setups.

Translation: common stock issuance is very accretive only when the premium is already rich.

With common stock funding, torque only rises when the equity trades at a premium.

At a 30% Bitcoin ARR over the next 10 years, examples below show torque stepping high at very high mNAV setups.

Translation: common stock issuance is very accretive only when the premium is already rich.

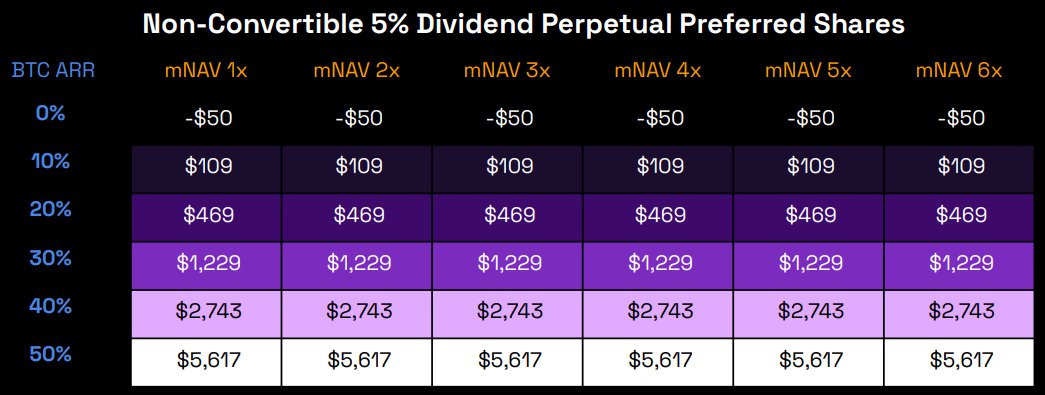

The story is different for the incoming preferred stock:

With a fixed dividend assumption of 5% and a 10-year horizon, torque is mNAV agnostic.

At 30% Bitcoin ARR (conservative IMHO) - there is a 13.3x torque on $100m of preferreds regardless of the mNAV.

All the values are the same regardless of mNAV level.

Massive torque potential on ALL preferred offerings, without worrying about current valuation of the common stock!

With a fixed dividend assumption of 5% and a 10-year horizon, torque is mNAV agnostic.

At 30% Bitcoin ARR (conservative IMHO) - there is a 13.3x torque on $100m of preferreds regardless of the mNAV.

All the values are the same regardless of mNAV level.

Massive torque potential on ALL preferred offerings, without worrying about current valuation of the common stock!

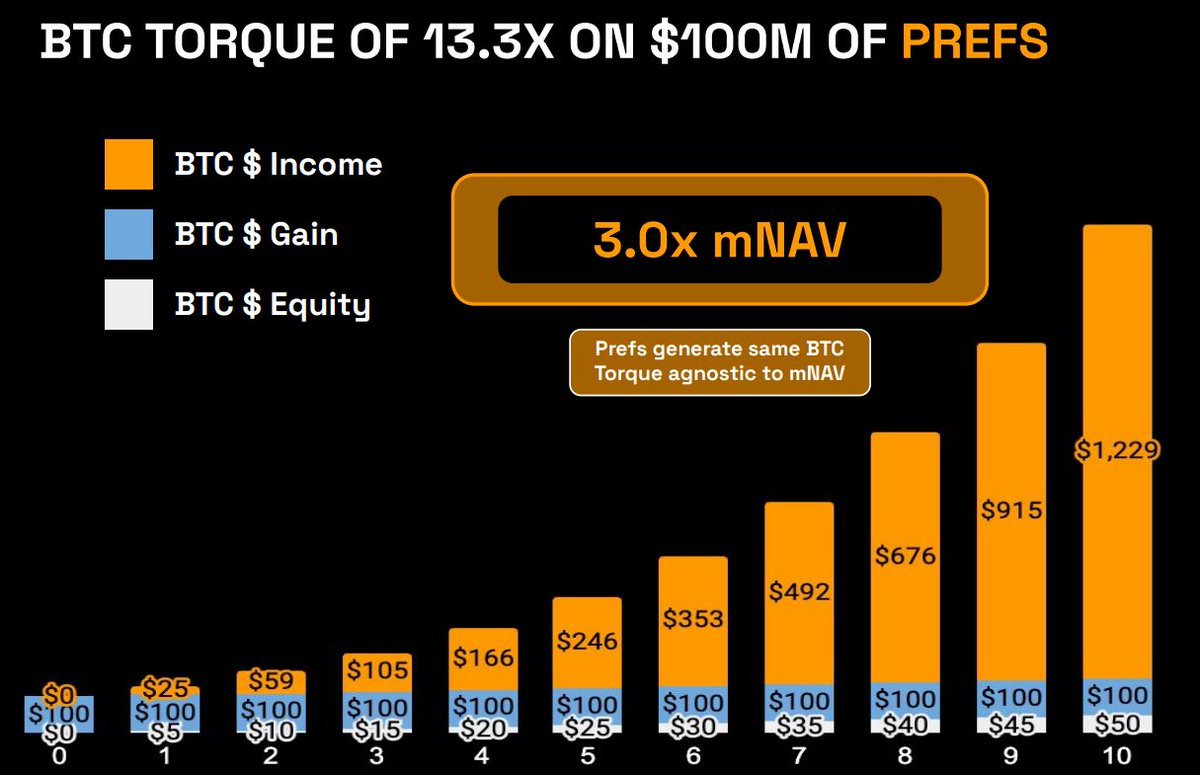

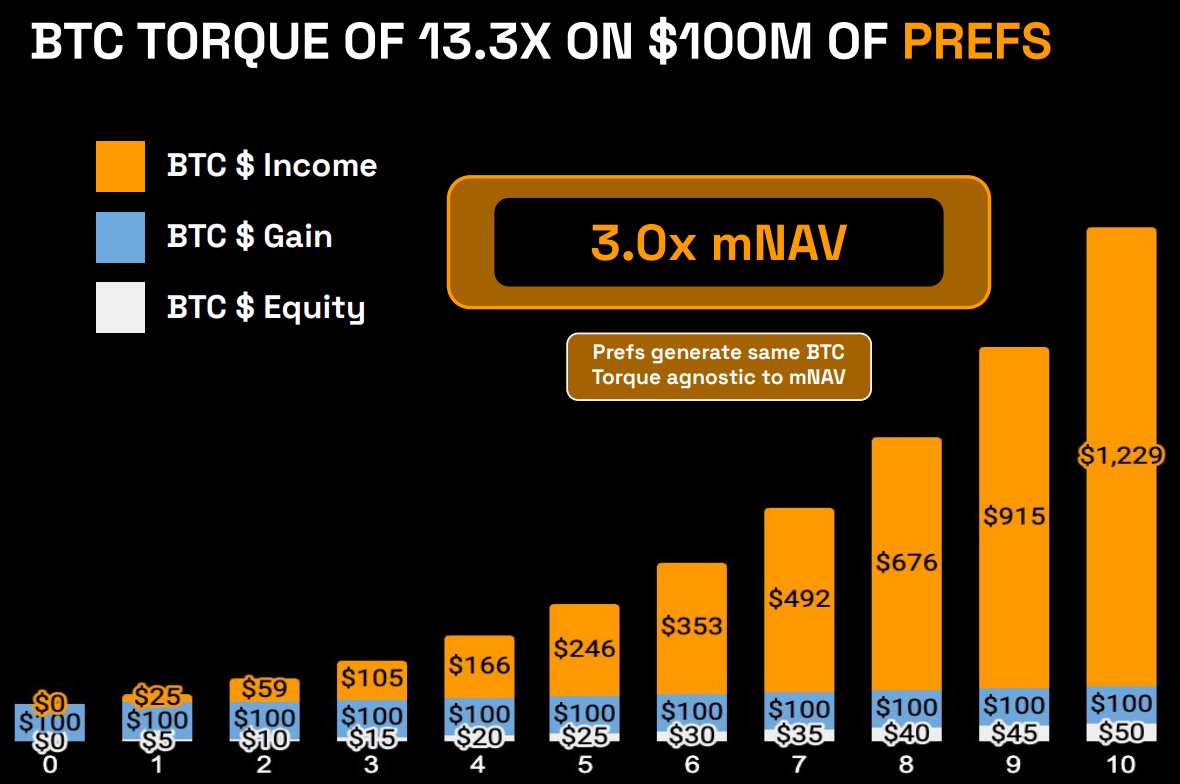

Example of a DOLLAR result:

A 10-year, 30% BTC ARR scenario on $100m of preferred issuance produces $1.22 BILLION of BTC $ Income, and 13.3x torque.

Remember: TOTALLY INDEPENDENT OF mNAV.

By contrast, $100m raised via common delivers a wide range of outcomes that rely on sustaining a high valuation multiple.

Remember the, the issuance of $100m of preferreds is a FRACTION of the planned plan of $3.76 BILLION (¥555 billion).

A 10-year, 30% BTC ARR scenario on $100m of preferred issuance produces $1.22 BILLION of BTC $ Income, and 13.3x torque.

Remember: TOTALLY INDEPENDENT OF mNAV.

By contrast, $100m raised via common delivers a wide range of outcomes that rely on sustaining a high valuation multiple.

Remember the, the issuance of $100m of preferreds is a FRACTION of the planned plan of $3.76 BILLION (¥555 billion).

Why this is INCREDIBLY BULLISH for Metaplanet over the next decade:

1. PREMIUM AGNOSTIC COMPOUNDING

Preferreds clearly create high, repeatable torque without needing the fat equity premium.

This means the treasury can compound through bullish, neutral, or corrective equity tape, rather than waiting for windows of high mNAV to issue stock.

This keeps BTC per share and BTC $ Value compounding on schedule.

1. PREMIUM AGNOSTIC COMPOUNDING

Preferreds clearly create high, repeatable torque without needing the fat equity premium.

This means the treasury can compound through bullish, neutral, or corrective equity tape, rather than waiting for windows of high mNAV to issue stock.

This keeps BTC per share and BTC $ Value compounding on schedule.

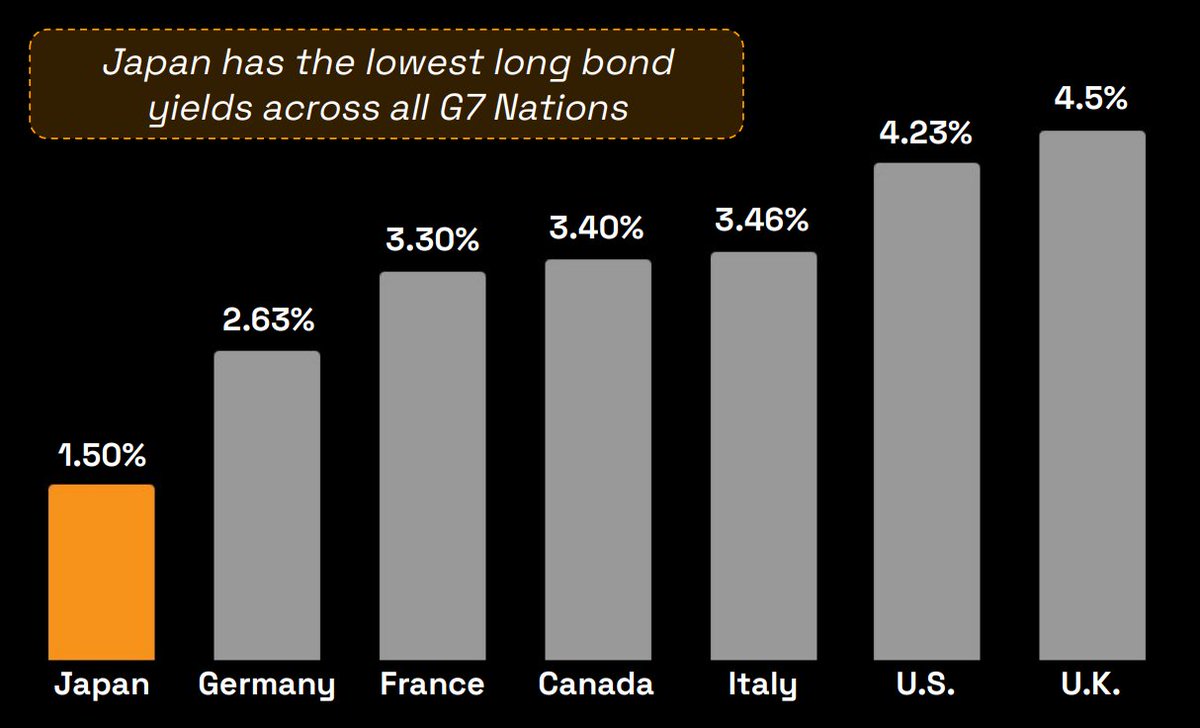

2. Japan's Cost of Capital Advantage

Japan has the lowest long bond yields in the G7.

A lower domestic yield base means preferred dividends can be set at attractive coupons for investors while remaining far below expected multi-year BTC ARR.

This widens the spread that fuels BTC $ Income, which is the engine behind torque.

Japan has the lowest long bond yields in the G7.

A lower domestic yield base means preferred dividends can be set at attractive coupons for investors while remaining far below expected multi-year BTC ARR.

This widens the spread that fuels BTC $ Income, which is the engine behind torque.

3. Metaplanet's risk discipline BAKES IN survivability.

Aggregate preferred issuance is capped at ≤25% of BTC Net Asset Value in the framework, and the deck shows coverage even under severe BTC drawdowns.

This reduces the probability that financing costs overwhelm BTC appreciation in bad years, so the 10-year math has more chances to play out.

Survivability is a torque multiplier.

Aggregate preferred issuance is capped at ≤25% of BTC Net Asset Value in the framework, and the deck shows coverage even under severe BTC drawdowns.

This reduces the probability that financing costs overwhelm BTC appreciation in bad years, so the 10-year math has more chances to play out.

Survivability is a torque multiplier.

4. The mNAV now has DEFENSE.

Because preferreds are accretive regardless of mNAV, they defend the premium when it is soft, and when the premium is rich the company can opportunistically use common as well.

This two-engine approach reduces dependence on any single market condition and stabilizes the path to the 210k BTC aspiration.

Because preferreds are accretive regardless of mNAV, they defend the premium when it is soft, and when the premium is rich the company can opportunistically use common as well.

This two-engine approach reduces dependence on any single market condition and stabilizes the path to the 210k BTC aspiration.

5. Flywheel with BTC Income Generation

Preferred proceeds go to BTC purchases and to a recurring options premium business.

Those cash flows help support dividends and working capital, which sustains the preferred program, which finances more BTC, which enlarges BTC NAV, which deepens over-collateralization, which attracts more capital.

A reinforcing loop is exactly what a decade-long torque story needs.

Preferred proceeds go to BTC purchases and to a recurring options premium business.

Those cash flows help support dividends and working capital, which sustains the preferred program, which finances more BTC, which enlarges BTC NAV, which deepens over-collateralization, which attracts more capital.

A reinforcing loop is exactly what a decade-long torque story needs.

6. THE GIGA-BULLISH MATH

The math points to OUTSIZED VALUE CREATION for shareholders.

If BTC’s ARR averages 20 to 40 percent, preferred-funded torque spans 5.7x to 28.4x.

Even at 10 percent ARR, torque is 2.1x.

Over a decade this stacks with BTC $ Income compounding...

Which quantifies in the hundreds of millions to billions per $100M tranche.

How many tranches will they be able to offer with fixed income products paying FOUR TIMES what Japanese government bonds do?

The math points to OUTSIZED VALUE CREATION for shareholders.

If BTC’s ARR averages 20 to 40 percent, preferred-funded torque spans 5.7x to 28.4x.

Even at 10 percent ARR, torque is 2.1x.

Over a decade this stacks with BTC $ Income compounding...

Which quantifies in the hundreds of millions to billions per $100M tranche.

How many tranches will they be able to offer with fixed income products paying FOUR TIMES what Japanese government bonds do?

The Bottom Line:

BTC Torque reframes capital raising as a compounding engine rather than a one-off dilution event.

The preferred blueprint shifts success dependence away from fickle equity premiums and toward multi-year BTC appreciation and time in the market.

With permanent, low-cost capital in a low-yield jurisdiction, risk caps tied to BTC NAV, and explicit 10-year math that stays accretive across mNAV regimes...

The setup is structurally, RIDICULOUSLY bullish for Metaplanet through the next decade.

You are not prepared for a LEVERAGED BET on a CERTAINTY.

You know Bitcoin is inevitable.

Are you gonna place your bet with the team that knows this the most, in the best economic situation for arbitrage IN THE WORLD?

It's go time.

If you don't like the stock, check your pulse.

BTC Torque reframes capital raising as a compounding engine rather than a one-off dilution event.

The preferred blueprint shifts success dependence away from fickle equity premiums and toward multi-year BTC appreciation and time in the market.

With permanent, low-cost capital in a low-yield jurisdiction, risk caps tied to BTC NAV, and explicit 10-year math that stays accretive across mNAV regimes...

The setup is structurally, RIDICULOUSLY bullish for Metaplanet through the next decade.

You are not prepared for a LEVERAGED BET on a CERTAINTY.

You know Bitcoin is inevitable.

Are you gonna place your bet with the team that knows this the most, in the best economic situation for arbitrage IN THE WORLD?

It's go time.

If you don't like the stock, check your pulse.

If you'd like the video version where I break down Metaplanet's BITCOIN-BACKED PREFERRED STOCK CAPITAL SUPERWEAPON...

Here you go :)

Here you go :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh